-

×

Advanced Stock Trading Course + Strategies

1 × $15.00

Advanced Stock Trading Course + Strategies

1 × $15.00 -

×

We Fund Traders - The Whale Order

1 × $5.00

We Fund Traders - The Whale Order

1 × $5.00 -

×

All About Dividend Investing with Don Schreiber & Gary Stroik

1 × $6.00

All About Dividend Investing with Don Schreiber & Gary Stroik

1 × $6.00 -

×

Trade Execution & Trade Management with Kam Dhadwar

1 × $6.00

Trade Execution & Trade Management with Kam Dhadwar

1 × $6.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

Advanced Forex Trading Momentum vs Reversals with Indicators Webinar - Mark Whistler

1 × $6.00

Advanced Forex Trading Momentum vs Reversals with Indicators Webinar - Mark Whistler

1 × $6.00 -

×

ValueCharts Ultimate Bundle with Base Camp Trading

1 × $54.00

ValueCharts Ultimate Bundle with Base Camp Trading

1 × $54.00 -

×

Trade Like a Market Maker with James Ramelli - AlphaShark

1 × $15.00

Trade Like a Market Maker with James Ramelli - AlphaShark

1 × $15.00 -

×

Yin Yang Forex Training Program

1 × $85.00

Yin Yang Forex Training Program

1 × $85.00 -

×

XJO Quant - High Probability Trading Setups on ASX 200 Index

1 × $31.00

XJO Quant - High Probability Trading Setups on ASX 200 Index

1 × $31.00 -

×

VSTOPS ProTrader Strategy (Nov 2013)

1 × $6.00

VSTOPS ProTrader Strategy (Nov 2013)

1 × $6.00 -

×

YTC Price Action Trader

1 × $6.00

YTC Price Action Trader

1 × $6.00 -

×

VSA Advanced Mentorship Course

1 × $31.00

VSA Advanced Mentorship Course

1 × $31.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Advanced GET 8.0 EOD

1 × $6.00

Advanced GET 8.0 EOD

1 × $6.00 -

×

5 Part Daytrading Course with Kevin Haggerty

1 × $6.00

5 Part Daytrading Course with Kevin Haggerty

1 × $6.00 -

×

Trading With Market Timing and Intelligence with John Crain

1 × $23.00

Trading With Market Timing and Intelligence with John Crain

1 × $23.00 -

×

Wyckoff Analytics Courses Collection

1 × $27.00

Wyckoff Analytics Courses Collection

1 × $27.00 -

×

Van Tharp Courses Collection

1 × $41.00

Van Tharp Courses Collection

1 × $41.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

Trendfans & Trendline Breaks with Albert Yang

1 × $6.00

Trendfans & Trendline Breaks with Albert Yang

1 × $6.00 -

×

Arjoio’s MMT - Essential Package

1 × $5.00

Arjoio’s MMT - Essential Package

1 × $5.00 -

×

Trading Triggers - The Secrets to Profitable Trading with John Person

1 × $6.00

Trading Triggers - The Secrets to Profitable Trading with John Person

1 × $6.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Ambush Trading Method on Wheat & Corn with Marco Mayer

1 × $4.00

Ambush Trading Method on Wheat & Corn with Marco Mayer

1 × $4.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

Zeus Capital (ZCFX) Full Mentorship Course

1 × $13.00

Zeus Capital (ZCFX) Full Mentorship Course

1 × $13.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

VIP - One on One Coursework with Talkin Options

1 × $15.00

VIP - One on One Coursework with Talkin Options

1 × $15.00 -

×

Unlocking Success in ICT 2022 Mentorship: The Smart Money Guide to The Full ICT Day Trading Model by LumiTraders & Darya Filipenka

1 × $5.00

Unlocking Success in ICT 2022 Mentorship: The Smart Money Guide to The Full ICT Day Trading Model by LumiTraders & Darya Filipenka

1 × $5.00 -

×

Broke: The New American Dream with Michael Covel

1 × $6.00

Broke: The New American Dream with Michael Covel

1 × $6.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Bank Financial Model with Cash Flow Investing Pro

1 × $15.00

Bank Financial Model with Cash Flow Investing Pro

1 × $15.00 -

×

Zap Seminar - David Stendahl – Day Trading the E-Minis

1 × $6.00

Zap Seminar - David Stendahl – Day Trading the E-Minis

1 × $6.00 -

×

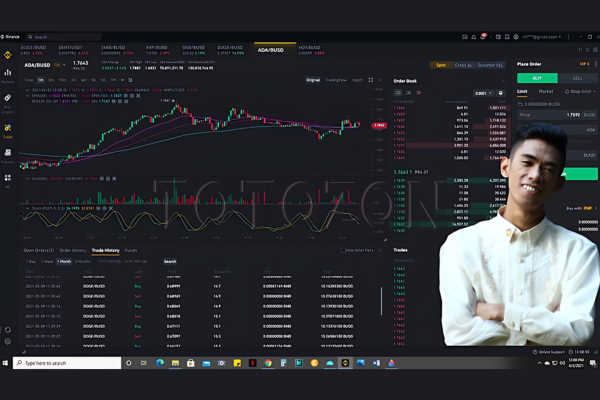

Binance Trading Bots Passive Income with Rhodnnie Jessnor Austria

1 × $5.00

Binance Trading Bots Passive Income with Rhodnnie Jessnor Austria

1 × $5.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

Advanced Calculus with Applications in Statistics

1 × $6.00

Advanced Calculus with Applications in Statistics

1 × $6.00 -

×

Alpha Quant Program with Lucas Inglese - Quantreo

1 × $15.00

Alpha Quant Program with Lucas Inglese - Quantreo

1 × $15.00 -

×

Volatility Trading with Fractal Flow Pro

1 × $15.00

Volatility Trading with Fractal Flow Pro

1 × $15.00 -

×

WealthFRX Trading Mastery 3.0

1 × $5.00

WealthFRX Trading Mastery 3.0

1 × $5.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Advanced Forex Mastery Course with Alpha Forex Global

1 × $5.00

Advanced Forex Mastery Course with Alpha Forex Global

1 × $5.00 -

×

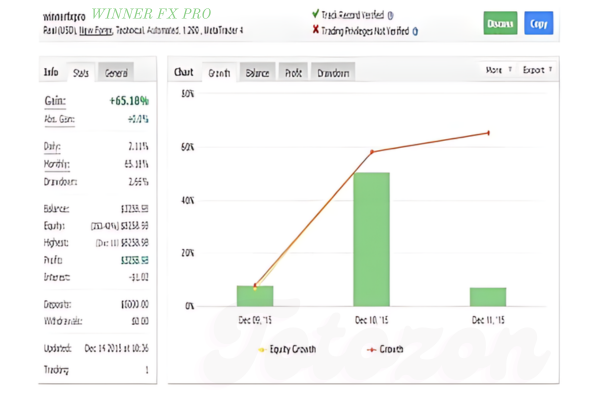

WINNER FX PRO

1 × $15.00

WINNER FX PRO

1 × $15.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

Bubbleology: The New Science of Stock Market Winners and Losers with Kevin Hassett

1 × $6.00

Bubbleology: The New Science of Stock Market Winners and Losers with Kevin Hassett

1 × $6.00 -

×

Advanced Course with Dimitri Wallace - Gold Minds Global

1 × $6.00

Advanced Course with Dimitri Wallace - Gold Minds Global

1 × $6.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

YouAreTheIndicator Online Course 1.0

1 × $6.00

YouAreTheIndicator Online Course 1.0

1 × $6.00 -

×

A-Z Course with InvestiTrade Academy

1 × $5.00

A-Z Course with InvestiTrade Academy

1 × $5.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

90 Minute Cycle withThe Algo Trader

1 × $5.00

90 Minute Cycle withThe Algo Trader

1 × $5.00 -

×

Tradematic Trading Strategy

1 × $31.00

Tradematic Trading Strategy

1 × $31.00 -

×

Trading With DiNapoli Levels

1 × $6.00

Trading With DiNapoli Levels

1 × $6.00 -

×

Wyckoff Stock Market Institute

1 × $5.00

Wyckoff Stock Market Institute

1 × $5.00 -

×

WITS Turbo Seminars with Brian James Sklenka

1 × $6.00

WITS Turbo Seminars with Brian James Sklenka

1 × $6.00 -

×

Trading Price Action Reversals (Kindle) with Al Brooks

1 × $6.00

Trading Price Action Reversals (Kindle) with Al Brooks

1 × $6.00 -

×

5 Basic Elliott Wave Patterns + Technical Tools = Trading Success with Jeffrey Kennedy

1 × $15.00

5 Basic Elliott Wave Patterns + Technical Tools = Trading Success with Jeffrey Kennedy

1 × $15.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

Weekly Power Options Strategies

1 × $6.00

Weekly Power Options Strategies

1 × $6.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

WyseTrade Trading Masterclass Course

1 × $5.00

WyseTrade Trading Masterclass Course

1 × $5.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

Andy’s EMini Bar – 40 Min System with Joe Ross

1 × $6.00

Andy’s EMini Bar – 40 Min System with Joe Ross

1 × $6.00 -

×

War Room Psychology Vol. 4 with Pat Mitchell – Trick Trades

1 × $23.00

War Room Psychology Vol. 4 with Pat Mitchell – Trick Trades

1 × $23.00 -

×

Asset Allocation for the Individual Investor with CFA Institute

1 × $6.00

Asset Allocation for the Individual Investor with CFA Institute

1 × $6.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

XLT - Futures Trading Course

1 × $54.00

XLT - Futures Trading Course

1 × $54.00 -

×

Z4X Long Term Trading System

1 × $6.00

Z4X Long Term Trading System

1 × $6.00 -

×

60 Seconds Sure Shot Strategy with Albert E

1 × $6.00

60 Seconds Sure Shot Strategy with Albert E

1 × $6.00 -

×

Trading Trend Pullbacks - 3-Step Technical Analysis Method with Richard Deutsch

1 × $6.00

Trading Trend Pullbacks - 3-Step Technical Analysis Method with Richard Deutsch

1 × $6.00 -

×

Advanced AmiBroker Coding with Matt Radtke & Connors Research

1 × $23.00

Advanced AmiBroker Coding with Matt Radtke & Connors Research

1 × $23.00 -

×

Ultimate Breakout

1 × $54.00

Ultimate Breakout

1 × $54.00 -

×

Winning – Zodiacal Timing Revised 1980 with Joyce Wehrman

1 × $6.00

Winning – Zodiacal Timing Revised 1980 with Joyce Wehrman

1 × $6.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

Automatic Millionaire (Audio Book) with David Bach

1 × $6.00

Automatic Millionaire (Audio Book) with David Bach

1 × $6.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Breakthrough Strategies for Predicting Any Market: Charting Elliott Wave, Lucas, Fibonacci and Time for Profit - Jeff Greenblatt & Dawn Bolton-Smith

1 × $6.00

Breakthrough Strategies for Predicting Any Market: Charting Elliott Wave, Lucas, Fibonacci and Time for Profit - Jeff Greenblatt & Dawn Bolton-Smith

1 × $6.00 -

×

The Undergroundtrader.com Guide to Electronic Trading with Jea Yu

1 × $6.00

The Undergroundtrader.com Guide to Electronic Trading with Jea Yu

1 × $6.00 -

×

TREND/REV BLOCK AND EA FOREX SYSTEM (No MT4 Indicator) with IFXSuccess

1 × $69.00

TREND/REV BLOCK AND EA FOREX SYSTEM (No MT4 Indicator) with IFXSuccess

1 × $69.00 -

×

What Works in Online Trading with Mark Etzkorn

1 × $6.00

What Works in Online Trading with Mark Etzkorn

1 × $6.00 -

×

Build A Career In Forex Trading - Learn Fundamental Analysis - Luciano Kelly & Learn Forex Mentor

1 × $4.00

Build A Career In Forex Trading - Learn Fundamental Analysis - Luciano Kelly & Learn Forex Mentor

1 × $4.00 -

×

When Buy Means Sell : An Investor's Guide to Investing When It Counts with Eric Shkolnik

1 × $6.00

When Buy Means Sell : An Investor's Guide to Investing When It Counts with Eric Shkolnik

1 × $6.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

Ultimate Options Trading Blueprint

1 × $23.00

Ultimate Options Trading Blueprint

1 × $23.00 -

×

7 DAY INTENSIVE ONLINE TRADER TRAINING PROGRAMME with The Trading Framework

1 × $15.00

7 DAY INTENSIVE ONLINE TRADER TRAINING PROGRAMME with The Trading Framework

1 × $15.00 -

×

TrimTabs Investing with Charles Biderman & David Santschi

1 × $6.00

TrimTabs Investing with Charles Biderman & David Santschi

1 × $6.00 -

×

Volatility and Timing with Jay Kaeppel – The Option Trader’s Guide to Probability

1 × $6.00

Volatility and Timing with Jay Kaeppel – The Option Trader’s Guide to Probability

1 × $6.00 -

×

Value Investing King of Trading Methods in the Commodity Markets - Hal Masover

1 × $6.00

Value Investing King of Trading Methods in the Commodity Markets - Hal Masover

1 × $6.00 -

×

Activedaytrader - Workshop: Unusual Options

1 × $6.00

Activedaytrader - Workshop: Unusual Options

1 × $6.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

Trading to Win (Seminar WorkBook 2003) with Bruce Gilmore

1 × $6.00

Trading to Win (Seminar WorkBook 2003) with Bruce Gilmore

1 × $6.00 -

×

Create A Forex Trading Cash Money Machine

1 × $54.00

Create A Forex Trading Cash Money Machine

1 × $54.00 -

×

7 Things You MUST Know about Forex Candlesticks

1 × $4.00

7 Things You MUST Know about Forex Candlesticks

1 × $4.00 -

×

4 Day Trading Bootcamp

1 × $31.00

4 Day Trading Bootcamp

1 × $31.00 -

×

Winning on Wall Street (Updated & Revised Ed.) with Martin Zweig

1 × $6.00

Winning on Wall Street (Updated & Revised Ed.) with Martin Zweig

1 × $6.00 -

×

Winning System For Trading High-Performance Stocks with Tim Cho

1 × $6.00

Winning System For Trading High-Performance Stocks with Tim Cho

1 × $6.00 -

×

Volume, Trend and Momentum with Philip Roth

1 × $6.00

Volume, Trend and Momentum with Philip Roth

1 × $6.00 -

×

Trading the Moves - Consistent Gains in All Markets with Ed Downs

1 × $6.00

Trading the Moves - Consistent Gains in All Markets with Ed Downs

1 × $6.00

$1,500 to $1 Million In 3 Years

$797.00 Original price was: $797.00.$39.00Current price is: $39.00.

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Tim Grittani: $1,500 to $1 Million in 3 Years

Introduction

Transforming $1,500 into $1 million in just three years might sound like a dream, but Tim Grittani made it a reality. As an inspiring figure in the trading world, Grittani’s story showcases the power of disciplined trading strategies and relentless learning. Let’s delve into the journey of how he achieved this remarkable feat.

Who is Tim Grittani?

Tim Grittani is a self-taught trader who turned a modest starting capital into a substantial fortune through stock trading. His journey is a testament to what can be achieved with dedication and the right approach.

Background and Early Days

- Initial Investment: Grittani started with just $1,500.

- Self-Education: He immersed himself in trading books, online courses, and webinars.

Breakthrough Moment

- First Major Success: Realized significant profits within the first year, setting the stage for his remarkable growth.

Tim Grittani’s Trading Philosophy

Understanding Grittani’s trading philosophy is crucial to grasp how he achieved his success.

Focus on Penny Stocks

- Low-Cost Investments: Grittani focused on low-cost penny stocks with high volatility.

- Short Selling: He often shorted overvalued stocks to capitalize on their price decline.

Disciplined Approach

- Risk Management: Grittani always emphasized the importance of managing risk.

- Consistent Learning: He continuously refined his strategies through learning and practice.

Strategies Used by Tim Grittani

Grittani’s success can be attributed to several key trading strategies.

Momentum Trading

1.1 Identifying Momentum

- Volume Indicators: Used volume spikes to identify potential momentum trades.

- Price Action: Analyzed price movements to make informed decisions.

1.2 Executing Trades

- Quick Entries and Exits: Focused on quick trades to capture short-term price movements.

- Risk-Reward Ratio: Ensured a favorable risk-reward ratio for every trade.

Short Selling

2.1 Spotting Overvalued Stocks

- Fundamental Analysis: Identified stocks with inflated valuations.

- Market Sentiment: Monitored market sentiment to predict price declines.

2.2 Executing Short Sales

- Timing: Entered short positions at optimal times.

- Covering Shorts: Covered short positions to lock in profits.

Dip Buying

3.1 Recognizing Dips

- Chart Patterns: Identified patterns indicating potential dips.

- Support Levels: Used support levels to determine entry points.

3.2 Buying Strategy

- Incremental Buying: Bought in increments to manage risk.

- Profit Targets: Set clear profit targets for each trade.

Risk Management Techniques

Risk management was a cornerstone of Grittani’s trading approach.

Position Sizing

- Small Positions: Started with small positions to minimize potential losses.

- Scaling Up: Gradually increased position sizes as confidence grew.

Stop-Loss Orders

- Setting Stops: Always used stop-loss orders to limit losses.

- Adjusting Stops: Adjusted stop-loss levels based on market conditions.

Diversification

- Varied Trades: Diversified trades across different stocks and strategies.

- Hedging: Used hedging techniques to protect against market downturns.

Tim Grittani’s Learning Process

Continuous learning played a pivotal role in Grittani’s success.

Education Resources

- Books and Courses: Consumed vast amounts of trading literature and online courses.

- Mentorship: Learned from experienced traders and mentors.

Trading Journals

- Detailed Records: Kept detailed records of all trades.

- Performance Analysis: Regularly analyzed performance to identify strengths and weaknesses.

Challenges and Setbacks

Grittani’s journey wasn’t without challenges and setbacks.

Early Losses

- Learning Curve: Experienced significant losses in the early stages.

- Emotional Discipline: Learned to manage emotions and stay disciplined.

Market Volatility

- Adaptability: Developed strategies to adapt to market volatility.

- Risk Mitigation: Focused on risk mitigation techniques during volatile periods.

Key Takeaways from Tim Grittani’s Journey

There are several key takeaways from Grittani’s trading journey.

Patience and Persistence

- Long-Term Focus: Focused on long-term goals rather than short-term gains.

- Continuous Improvement: Always looked for ways to improve trading strategies.

Education and Practice

- Ongoing Learning: Committed to continuous learning and skill development.

- Practical Application: Applied theoretical knowledge through consistent practice.

Conclusion

Tim Grittani’s journey from $1,500 to $1 million in three years is an inspiring example of what can be achieved with the right approach. By focusing on disciplined trading, continuous learning, and effective risk management, Grittani turned a modest investment into a substantial fortune.

Commonly Asked Questions:

- Business Model Innovation: Accept the truth of a legitimate business! Our strategy is organising a group buy in which participants share the costs. We use these cash to acquire popular courses from sale pages and make them available to people with limited financial resources. Despite the authors’ worries, our clients love the cost and accessibility we give.

- The Legal Environment: Yes or No The legality of our activity is ambiguous. While we don’t have specific permission from the course authors to resell the material, there is a technicality at work. The author did not specify any limits on resale when purchasing the course. This legal intricacy is both an opportunity for us and a boon for individuals looking for low-cost access.

- Quality Control: Uncovering the Truth

Getting to the heart of the issue – quality. Purchasing the course straight from the sale page guarantees that all documents and resources are the same as those obtained through traditional channels.

However, we distinguish ourselves by going beyond personal research and resale. It is crucial to note that we are not the official course providers, which means that the following premium services are not included in our package:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not permitted.

- No access to the author’s private membership forum.

- There is no direct email support available from the author or their team.

We operate independently, with the goal of bridging the pricing gap without the extra services provided by official course channels. Your comprehension of our distinct approach is much appreciated.

Be the first to review “$1,500 to $1 Million In 3 Years” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.