-

×

HYDRA 3 Day Bootcamp

1 × $5.00

HYDRA 3 Day Bootcamp

1 × $5.00 -

×

Short Skirt Trading, the Most Bang for the Buck with Linda Raschke

1 × $6.00

Short Skirt Trading, the Most Bang for the Buck with Linda Raschke

1 × $6.00 -

×

Quantitative Technical Analysis: An integrated approach to trading system development and trading management

1 × $6.00

Quantitative Technical Analysis: An integrated approach to trading system development and trading management

1 × $6.00 -

×

Trading Mindset, and Three Steps To Profitable Trading with Bruce Banks

1 × $6.00

Trading Mindset, and Three Steps To Profitable Trading with Bruce Banks

1 × $6.00 -

×

The New Goldrush Of 2021 with Keith Dougherty

1 × $46.00

The New Goldrush Of 2021 with Keith Dougherty

1 × $46.00 -

×

Advanced Trading Course with John Person

1 × $6.00

Advanced Trading Course with John Person

1 × $6.00 -

×

Compound Stock Earnings Advanced Charting (Video 1.19 GB)

1 × $15.00

Compound Stock Earnings Advanced Charting (Video 1.19 GB)

1 × $15.00 -

×

Fx Engine Trading Course with Adeh Mirzakhani

1 × $6.00

Fx Engine Trading Course with Adeh Mirzakhani

1 × $6.00 -

×

Timing Techniques for Commodity Futures Markets with Colin Alexander

1 × $6.00

Timing Techniques for Commodity Futures Markets with Colin Alexander

1 × $6.00 -

×

Objective Evaluation of Indicators with Constance Brown

1 × $6.00

Objective Evaluation of Indicators with Constance Brown

1 × $6.00 -

×

The Compleat Day Trader with Jake Bernstein

1 × $6.00

The Compleat Day Trader with Jake Bernstein

1 × $6.00 -

×

Definitive Guide to Order Execution Class with Don Kaufman

1 × $6.00

Definitive Guide to Order Execution Class with Don Kaufman

1 × $6.00 -

×

Order Flow Mastery Course with OrderFlowForex

1 × $6.00

Order Flow Mastery Course with OrderFlowForex

1 × $6.00 -

×

Tradingmarkets - Introduction to AmiBroker Programming

1 × $15.00

Tradingmarkets - Introduction to AmiBroker Programming

1 × $15.00 -

×

Advanced Daytrading Seminar with Ken Calhoun

1 × $155.00

Advanced Daytrading Seminar with Ken Calhoun

1 × $155.00 -

×

The Hidden Order Within Stock Prices with Clay Allen

1 × $6.00

The Hidden Order Within Stock Prices with Clay Allen

1 × $6.00 -

×

Coulda, woulda, shoulda with Charles Cottle

1 × $6.00

Coulda, woulda, shoulda with Charles Cottle

1 × $6.00 -

×

Forex Breakthrough Academy

1 × $31.00

Forex Breakthrough Academy

1 × $31.00 -

×

Stock Market Winners with Maria Crawford Scott, John Bajkowski

1 × $6.00

Stock Market Winners with Maria Crawford Scott, John Bajkowski

1 × $6.00 -

×

SI Indicator Course 2023 with Scott Pulcini

1 × $15.00

SI Indicator Course 2023 with Scott Pulcini

1 × $15.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

Frontline Forex Vol 1-3 with Steve Nison - Candle Charts

1 × $54.00

Frontline Forex Vol 1-3 with Steve Nison - Candle Charts

1 × $54.00 -

×

YouAreTheIndicator Online Course 1.0

1 × $6.00

YouAreTheIndicator Online Course 1.0

1 × $6.00 -

×

Using Median Lines as a Trading Tool with Greg Fisher

1 × $6.00

Using Median Lines as a Trading Tool with Greg Fisher

1 × $6.00 -

×

Introduction to Macro Investing with Mike Singleton

1 × $31.00

Introduction to Macro Investing with Mike Singleton

1 × $31.00 -

×

Empirical Market Microstructure

1 × $6.00

Empirical Market Microstructure

1 × $6.00 -

×

Trader BO Divergence System with Aleg A.Bot

1 × $6.00

Trader BO Divergence System with Aleg A.Bot

1 × $6.00 -

×

Mindful Trading e-Workbook with Traders State Of Mind

1 × $6.00

Mindful Trading e-Workbook with Traders State Of Mind

1 × $6.00 -

×

Common Sense on Mutual Funds: Fully Updated 10th Anniversary Edition with John Bogle

1 × $6.00

Common Sense on Mutual Funds: Fully Updated 10th Anniversary Edition with John Bogle

1 × $6.00 -

×

Mesa & Trading Market Cycles (1st Edition) with John Ehlers & Perry Kaufman

1 × $6.00

Mesa & Trading Market Cycles (1st Edition) with John Ehlers & Perry Kaufman

1 × $6.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00

The HV7 Option Trading System with Amy Meissner – Aeromir

$260.00 Original price was: $260.00.$8.00Current price is: $8.00.

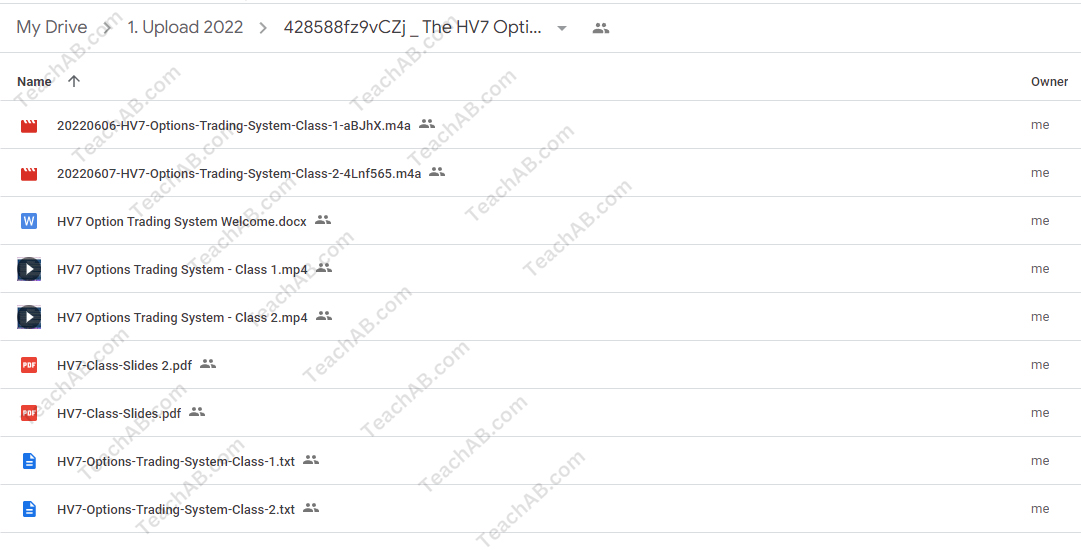

You may check content proof of “The HV7 Option Trading System with Amy Meissner – Aeromirre” below:

Meisner Amy

In the mid-1990s, Amy started dabbling in options trading by trading credit spreads in the SPX while she was still employed in the software and multimedia sectors.

Though it was a hit or miss at the time, Amy was inspired to return in 2005 and give the options initiative another try because she wanted to learn more and get serious about earning a living through trading options.

In 2006, after establishing a consistent revenue stream and consistently enhancing the caliber of her trading methods, she turned her attention to full-time options trading.

She encountered some excellent teachers along the way, who offered her the courage to improve tried-and-true techniques and give them a distinctively her own touch.

Amy’s area of expertise is implementing high probability option techniques to trade options for monthly income. She leads webinars and is a popular figure in the options trading community.

Amy is regarded as a steady, methodical trader in the professional options trading world who coolly controls her risk during the course of the trade, even in erratic market circumstances.

Her unique quality is consistency, yet she will occasionally make tiny alterations to her strategy as the market shifts. Amy has reaped consistent rewards year after year because to her unwavering confidence and sensible approach.

The HV7 Option Trading System: What is it?

Amy’s most recent trading system, the HV7 Option Trading System, looks for particular high volatility events as a signal to place a trade. This is combined with a very short-term weekly plan designed to profit from market volatility when it occurs.

Amy wanted to talk about the difficulties she was having trading in a highly volatile market. She also desired a short-term, high-return approach that could be used for small or large accounts.

Amy is well known for teaching several trading systems including:

- The Asymmetric Iron Condor (aka “the Weirdor”)

- The Nested Iron Condor

- The Timezone Trade

- The 14-Day Asymmetric Iron Condor

- The A14 Weekly Options Strategy

Amy wanted to address challenges with the trading in a high volatility environment. She also wanted a short term strategy that was suitable for small or large account with high returns.

HV7 Option Trading System Benefits

- Specific signal tells you when it’s the best time to enter a trade

- Simple setup with a single order at entry. No need to multiple legs.

- Basic entry

- Low margin entry option

- No adjustments needed

- Uses GTC orders to exit to no need to watch the market all day

- Quick exit with an average of two days in each trade

- Uses SPX index options with are highly liquid with favorable U.S. tax benefits

- Can be used with RUT index options (all examples and performance testing done with SPX)

HV7 Option Trading System Overview

- Standard Entry Planned Capital is $5,000 with $2,800 average margin.

- Low Margin Entry Planned Capital is $1,500 with $1,200 average margin.

- Profit target is 5% of margin.

- Losses average ~8.7%

- Win/Loss Expectancy was 14.1667.

- Profit Factor is 9.8735

What You’ll Get

- HV7 Entry Signal: What is the criteria and how to set alerts so you know exactly when to enter a trade

- How to set up the HV7 trade position step by step. Includes additional set-up for lower margin version and covers the differences and benefits of each

- Exactly when and how to exit the trade including the use of GTC orders

- Examples of multiple trades throughout the extensive 10 year backtest

- Bonus example trades using the lower margin version plus some example trades using the RUT index

The HV7 Course Is Exclusively for Educational Objectives

The HV7 Option Trading System’s goal is to make trading information about Amy available.

The purpose of the class is to provide examples so that you can acquire inspiration for your own trading.

Advance towards achieving mastery in options trading.

Do not let the intricacies of options trading to hinder you from achieving your maximum trading capabilities. Participate in the HV7 Option Trading System developed by Amy Meissner – Aeromir and move closer to attaining your trading objectives. With the assistance of knowledgeable mentors, extensive inclusiveness, and a nurturing collective, the potential outcomes are boundless. Enroll now and begin a profound journey towards achieving proficiency in options trading!

Frequently Asked Questions:

- Business Model Innovation:

Embrace our legitimate business model! We organize group buys, allowing participants to share costs for popular courses, making them accessible to those with limited financial resources. Our approach ensures affordability and accessibility, despite author concerns. - The Legal Environment:

The legality of our activity is uncertain. While we lack specific permission from course authors, there’s a technicality: authors didn’t impose resale limits upon course purchase. This presents both an opportunity for us and a benefit for individuals seeking low-cost access. - Quality Control:

Unveiling the Truth

Quality is paramount. Purchasing courses directly from sales pages ensures consistency with traditionally obtained materials. However, we’re not official course providers and don’t offer premium services:

- No scheduled coaching calls or sessions with the author.

- No access to the author’s private Facebook group or web portal.

- No entry to the author’s private membership forum.

- Direct email support from the author or their team is unavailable.Operating independently, we aim to bridge the pricing gap without additional services provided by official channels. Your understanding of our unique approach is valued.

Be the first to review “The HV7 Option Trading System with Amy Meissner – Aeromir” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.