-

×

BearProof Investing with Kenneth Little

1 × $6.00

BearProof Investing with Kenneth Little

1 × $6.00 -

×

Evidence Based Technical Analysis with David Aronson

1 × $6.00

Evidence Based Technical Analysis with David Aronson

1 × $6.00 -

×

Volume, Trend and Momentum with Philip Roth

1 × $6.00

Volume, Trend and Momentum with Philip Roth

1 × $6.00 -

×

Chart Pattern Profits

1 × $6.00

Chart Pattern Profits

1 × $6.00 -

×

Complete Trading Course with Sean Dekmar

1 × $5.00

Complete Trading Course with Sean Dekmar

1 × $5.00 -

×

ICT Mentorship 2016-17 with Inner Circle Trading

1 × $6.00

ICT Mentorship 2016-17 with Inner Circle Trading

1 × $6.00 -

×

Trend Trading Techniques with Rob Hoffman

1 × $6.00

Trend Trading Techniques with Rob Hoffman

1 × $6.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

The Best (Public) Trading Methods I’ve Found for Futures & Equities with Perry J.Kaufman

1 × $6.00

The Best (Public) Trading Methods I’ve Found for Futures & Equities with Perry J.Kaufman

1 × $6.00 -

×

Your Next Great Stock: How to Screen the Market for Tomorrow's Top Performers with Jack Hough

1 × $6.00

Your Next Great Stock: How to Screen the Market for Tomorrow's Top Performers with Jack Hough

1 × $6.00 -

×

Rob’s Swing Trading Methods with Rob Hoffman

1 × $39.00

Rob’s Swing Trading Methods with Rob Hoffman

1 × $39.00 -

×

Double Your Capital In 30 Days(2016) with GFA Flips

1 × $5.00

Double Your Capital In 30 Days(2016) with GFA Flips

1 × $5.00 -

×

The Trader’s Book of Volume with Mark Leibovit

1 × $6.00

The Trader’s Book of Volume with Mark Leibovit

1 × $6.00 -

×

The Key to Profits in Tough Times

1 × $6.00

The Key to Profits in Tough Times

1 × $6.00 -

×

Stable Adaptive Control for Nonlinear Systems with Jeffrey Spooner

1 × $6.00

Stable Adaptive Control for Nonlinear Systems with Jeffrey Spooner

1 × $6.00 -

×

Risk Management Toolkit with Peter Bain

1 × $6.00

Risk Management Toolkit with Peter Bain

1 × $6.00 -

×

ABC Waves TOS Indicator & Live Class with Simpler Options

1 × $6.00

ABC Waves TOS Indicator & Live Class with Simpler Options

1 × $6.00 -

×

60 Minute Trader with Chris Kobewka

1 × $6.00

60 Minute Trader with Chris Kobewka

1 × $6.00 -

×

MTA Master Trader Academy with Junior Charles

1 × $5.00

MTA Master Trader Academy with Junior Charles

1 × $5.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

Avoiding Trading Mistakes with Mark D.Cook

1 × $6.00

Avoiding Trading Mistakes with Mark D.Cook

1 × $6.00 -

×

Emini Day Trading Boot Camp - Base Camp Trading

1 × $6.00

Emini Day Trading Boot Camp - Base Camp Trading

1 × $6.00 -

×

Gaining an Edge when you Trade the S&P Futures with Carolyn Boroden

1 × $6.00

Gaining an Edge when you Trade the S&P Futures with Carolyn Boroden

1 × $6.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

Activedaytrader - Bond Trading Bootcamp

1 × $8.00

Activedaytrader - Bond Trading Bootcamp

1 × $8.00 -

×

Beat the Odds in Forex Trading: How to Identify and Profit from High Percentage Market Patterns with Igor Toshchakov

1 × $6.00

Beat the Odds in Forex Trading: How to Identify and Profit from High Percentage Market Patterns with Igor Toshchakov

1 × $6.00 -

×

Applied Quantitative Methods for Trading and Investment with Christian Dunis, Jason Laws & Patrick Na¿m

1 × $6.00

Applied Quantitative Methods for Trading and Investment with Christian Dunis, Jason Laws & Patrick Na¿m

1 × $6.00 -

×

The Kiloby Inquiries Online with Scott Kiloby

1 × $39.00

The Kiloby Inquiries Online with Scott Kiloby

1 × $39.00 -

×

Financial Astrology Course with Brian James Sklenka

1 × $6.00

Financial Astrology Course with Brian James Sklenka

1 × $6.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

Dumb Money: Adventures of a Day Trader with Joey Anuff

1 × $6.00

Dumb Money: Adventures of a Day Trader with Joey Anuff

1 × $6.00 -

×

How the Stock Market Works with Ramon DeGennaro

1 × $5.00

How the Stock Market Works with Ramon DeGennaro

1 × $5.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

Master Commodities Course

1 × $6.00

Master Commodities Course

1 × $6.00 -

×

Trading Floor Training

1 × $6.00

Trading Floor Training

1 × $6.00 -

×

A Non-Random Walk Down Wall Street with Andrew W.Lo

1 × $6.00

A Non-Random Walk Down Wall Street with Andrew W.Lo

1 × $6.00 -

×

Lessons From A Trader’s Camp. Winning Psychology & Tactics with Alexander Elder

1 × $6.00

Lessons From A Trader’s Camp. Winning Psychology & Tactics with Alexander Elder

1 × $6.00 -

×

Altucher’s Top 1% Advisory Newsletter 2016 with James Altucher

1 × $6.00

Altucher’s Top 1% Advisory Newsletter 2016 with James Altucher

1 × $6.00 -

×

QuickBooks 2003 Official Guide

1 × $6.00

QuickBooks 2003 Official Guide

1 × $6.00 -

×

All About Dividend Investing with Don Schreiber & Gary Stroik

1 × $6.00

All About Dividend Investing with Don Schreiber & Gary Stroik

1 × $6.00 -

×

Advanced Ichimoku Kinkō Hyō - Ichimoku Cloud Strategy with Rafał Zuchowicz - TopMasterTrader

1 × $17.00

Advanced Ichimoku Kinkō Hyō - Ichimoku Cloud Strategy with Rafał Zuchowicz - TopMasterTrader

1 × $17.00 -

×

Managing By The Greeks (6 Classes) Sept 2010 [9 Videos(mp4) 11 docs(pdf)] by Dan Sheridan

1 × $6.00

Managing By The Greeks (6 Classes) Sept 2010 [9 Videos(mp4) 11 docs(pdf)] by Dan Sheridan

1 × $6.00 -

×

Tradingmarkets - Introduction to AmiBroker Programming

1 × $15.00

Tradingmarkets - Introduction to AmiBroker Programming

1 × $15.00 -

×

Order Flow Mastery (New 2024) with The Volume Traders

1 × $24.00

Order Flow Mastery (New 2024) with The Volume Traders

1 × $24.00 -

×

Executive Mentoring Elliot Wave Course (Video & Manuals)

1 × $6.00

Executive Mentoring Elliot Wave Course (Video & Manuals)

1 × $6.00 -

×

SOT Intermediate Course (May 2014)

1 × $23.00

SOT Intermediate Course (May 2014)

1 × $23.00 -

×

Fierce 10 with Mandi Rafsendjani

1 × $5.00

Fierce 10 with Mandi Rafsendjani

1 × $5.00 -

×

Foundation & Application of the Market with Jim Dalton - JimDalton Trading

1 × $5.00

Foundation & Application of the Market with Jim Dalton - JimDalton Trading

1 × $5.00 -

×

Self-Destructing Trader with Ryan Jonesc

1 × $6.00

Self-Destructing Trader with Ryan Jonesc

1 × $6.00 -

×

Secret Weapon to Trading Options on ETF's Class with Don Kaufman

1 × $6.00

Secret Weapon to Trading Options on ETF's Class with Don Kaufman

1 × $6.00 -

×

Options On Futures Class By Mark Fenton - Sheridan Options Mentoring

1 × $6.00

Options On Futures Class By Mark Fenton - Sheridan Options Mentoring

1 × $6.00 -

×

Trading For A Living Course with Yvan Byeajee - Trading Composure

1 × $6.00

Trading For A Living Course with Yvan Byeajee - Trading Composure

1 × $6.00 -

×

DAY TRADING OPTIONS For Beginners: Strategies to INVEST and WIN with Dylan Parker

1 × $5.00

DAY TRADING OPTIONS For Beginners: Strategies to INVEST and WIN with Dylan Parker

1 × $5.00 -

×

Optionetics 2007 - Home Study Course, MP3

1 × $6.00

Optionetics 2007 - Home Study Course, MP3

1 × $6.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

$310.00 Original price was: $310.00.$23.00Current price is: $23.00.

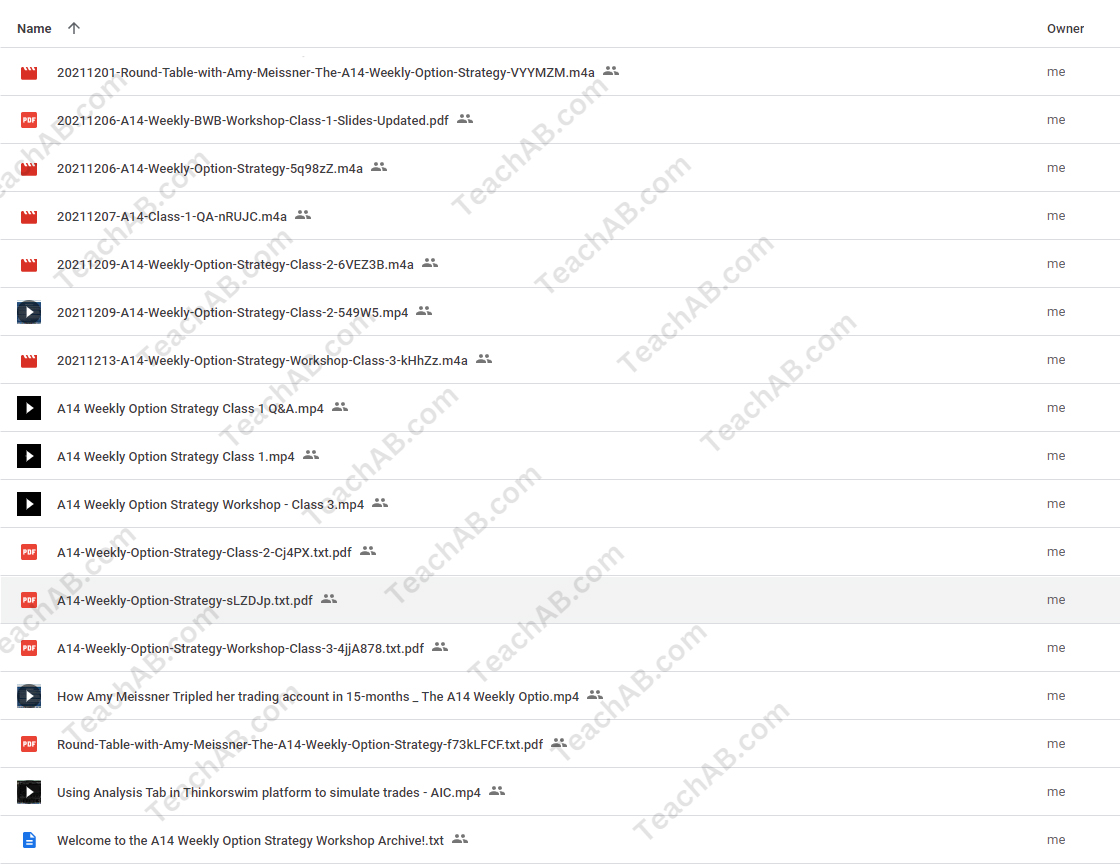

You may check content proof of “The A14 Weekly Option Strategy Workshop with Amy Meissner” below:

Meisner Amy

In the mid-1990s, Amy started dabbling in options trading by trading credit spreads in the SPX while she was still employed in the software and multimedia sectors. Though it was a hit or miss at the time, Amy was inspired to return in 2005 and give the options initiative another try because she wanted to learn more and get serious about earning a living through trading options.

In 2006, after establishing a consistent revenue stream and consistently enhancing the caliber of her trading methods, she turned her attention to full-time options trading. She encountered some excellent teachers along the way, who offered her the courage to improve tried-and-true techniques and give them a distinctively her own touch.

Options trading for monthly income using high probability option techniques is Amy’s area of expertise. She leads webinars and is a popular figure in the options trading community.

Amy is regarded as a steady, methodical trader in the professional options trading world who coolly controls her risk during the course of the trade, even in erratic market circumstances.

Her unique quality is consistency, yet she will occasionally make tiny alterations to her strategy as the market shifts. Year after year, Amy’s consistent self-assurance and sound approach have brought her reliable returns.

What is the A14 Weekly Option Strategy?

The A14 Weekly Option Strategy is Amy’s latest iteration in her trading journey.

Amy is well known for teaching several trading systems including:

- The Asymmetric Iron Condor (aka “the Weirdor”)

- The Nested Iron Condor

- The Timezone Trade

- The 14-Day Asymmetric Iron Condor

Amy wanted to address challenges with the Boxcar and other short term trading strategies. She also wanted a weekly strategy that was suitable for small or large account with high returns.

Since September 2020, Amy started live testing new ideas that combined a variety of trading tactics. The results are fantastic.

How Were Amy’s Live Trading Results?

In a word… Outstanding

Amy started with a $32,447.49 account in September 2020.

In the 15-month period that followed, she deposited another $29,661.02 for a total cash outlay of $62,108.51.

What happened with Amy’s account?

Something extraordinary

Amy’s account today is $204,545.76!

The net profit was $142,437.30 including all fees! That is a 229.336% profit.

Remember that a 100% profit doubles an account.

Amy MORE THAN TRIPLED HER ACCOUNT in 15-months!

We’ve been watching trading systems for a long time. This is the highest yielding market neutral options performance we’ve seen!

This is the type of results directional traders hope for!

The A14 Weekly Option Strategy Was Born!

Amy analyzed her live trades and created a set of rules in order to be capable of getting the same results of her live trading.

The A14 Weekly Option Strategy was the end result.

A14 Weekly Option Strategy Advantages

- No need to pick direction. Don’t have to be a technical analysis guru.

- Single order at entry. No need to multiple legs.

- No need to sit in front of the computer during trading hours.

- Adjustments are simple and only need to be checked once a day.

- Adjustment tactics can be used with other strategies.

A14 Weekly Option Strategy Overview

- Planned Capital is $5,000 to $8,000 for a two-lot trade.

- Minimum account is $10,000 to trade a two-lot.

- Profit target is +5% or more. Amy averaged +6.5% per trade

- Losses average ~6% and generally under -10%.

- Win/Loss Expectancy was 9:1.

What You’ll Get

- Core Concepts of the A14 Weekly BWB tactics used.

- Rules and Guidelines for the A14 Weekly BWB strategy (including: Entry, Adjustments, and Exit).

- Several Step by Step Examples of the A14 in Up, Down, and Choppy markets.

- Additional Adjustment options that can be used.

- Using the A14 Adjustment strategy for the Boxcar.

Frequently Asked Questions:

- Business Model Innovation:

Embrace our legitimate business model! We organize group buys, allowing participants to share costs for popular courses, making them accessible to those with limited financial resources. Our approach ensures affordability and accessibility, despite author concerns. - The Legal Environment:

The legality of our activity is uncertain. While we lack specific permission from course authors, there’s a technicality: authors didn’t impose resale limits upon course purchase. This presents both an opportunity for us and a benefit for individuals seeking low-cost access. - Quality Control:

Unveiling the Truth

Quality is paramount. Purchasing courses directly from sales pages ensures consistency with traditionally obtained materials. However, we’re not official course providers and don’t offer premium services:

- No scheduled coaching calls or sessions with the author.

- No access to the author’s private Facebook group or web portal.

- No entry to the author’s private membership forum.

- Direct email support from the author or their team is unavailable.Operating independently, we aim to bridge the pricing gap without additional services provided by official channels. Your understanding of our unique approach is valued

Be the first to review “The A14 Weekly Option Strategy Workshop with Amy Meissner” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.