-

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

How I use Technical Analysis & Orderflow with Adam Webb – Traderskew

$300.00 Original price was: $300.00.$54.00Current price is: $54.00.

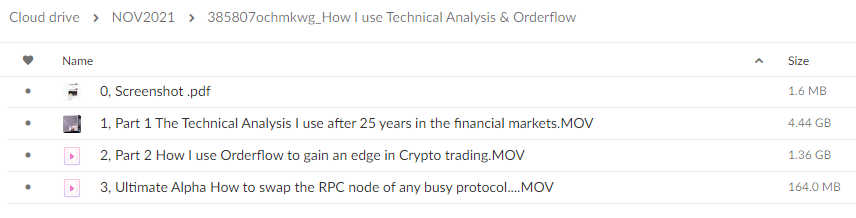

File Size: 5.97 GB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “How I use Technical Analysis & Orderflow with Adam Webb – Traderskew” below:

How I Use Technical Analysis & Orderflow with Adam Webb – Traderskew

Introduction: Embracing Market Insights

When diving into the vast world of financial trading, the arsenal one chooses can heavily dictate their success. Among the diverse strategies available, technical analysis and order flow stand out, especially when utilized by experienced traders like Adam Webb from Traderskew. Today, we delve into how these tools shape decisions and drive success in trading.

Understanding Technical Analysis

What is Technical Analysis?

Technical analysis is a method traders use to evaluate securities by analyzing statistics generated by market activity, such as past prices and volume. It helps traders anticipate what is likely to happen to prices over time.

Key Components of Technical Analysis

- Trend Lines: Simple yet powerful, these lines track the movements of securities and help identify trends.

- Indicators: Tools like Moving Averages and RSI that give insights into market conditions.

- Charts: The canvas where all data converges, providing a visual representation of the market.

The Power of Order Flow

Decoding Order Flow

Order flow isn’t just about counting transactions; it involves understanding the buying and selling pressure behind market moves. It provides a real-time x-ray into market dynamics, offering clues about potential price movements before they happen.

Advantages of Using Order Flow

- Transparency: See beyond price movements to the actual transactions.

- Predictive Power: Gauge future price movements based on real-time data.

- Strategic Execution: Improve entry and exit points for better trading outcomes.

Integrating Strategies: A Dual Approach

Combining Technical Analysis and Order Flow

By integrating technical analysis with order flow, traders like Adam Webb gain a comprehensive view of the market. This synergy allows for more precise predictions and strategic decisions.

Case Studies and Examples

- Example 1: Identifying breakout points through volume spikes and trend analysis.

- Example 2: Using order depth to anticipate price reversals.

Tools and Software

Essential Tools for Modern Traders

To effectively apply these strategies, traders rely on various tools and platforms. Some of the most notable include:

- Charting Software: Tools like TradingView and MetaTrader offer in-depth charting capabilities.

- Order Flow Analyzers: Software like NinjaTrader provides detailed insights into market dynamics.

Real-World Application: Insights from Adam Webb

Adam Webb’s Approach

Adam Webb utilizes a blend of technical analysis and order flow to not only interpret the market but also to make educated predictions about future movements. His approach is methodical and data-driven, focusing on:

- Market Trends

- Volume Analysis

- Price Action

Conclusion: Why It Matters

In the trading arena, the combination of technical analysis and order flow can significantly elevate a trader’s ability to make informed decisions. For those looking to enhance their trading strategies, considering these methods is crucial.

FAQs

What is technical analysis in trading?

Technical analysis involves using historical price and volume data to predict future market behavior.

How does order flow complement technical analysis?

Order flow provides real-time data on buying and selling pressure, enhancing the predictions made with technical analysis.

Can beginners use these strategies?

Yes, with the right tools and education, beginners can effectively use both strategies.

What tools does Adam Webb recommend?

Adam Webb frequently uses advanced charting software and order flow analyzers like NinjaTrader.

Why is the combination of these strategies effective?

This combination offers a holistic view of market dynamics, leading to more precise and strategic trading decisions.

Be the first to review “How I use Technical Analysis & Orderflow with Adam Webb – Traderskew” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.