-

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

Chaos and order in the Capital Markets with Edgar E.Peters

1 × $6.00

Chaos and order in the Capital Markets with Edgar E.Peters

1 × $6.00 -

×

With All Odds Forex System I & II with Barry Thornton

1 × $6.00

With All Odds Forex System I & II with Barry Thornton

1 × $6.00 -

×

Field of Vision Program – Digital Download

1 × $31.00

Field of Vision Program – Digital Download

1 × $31.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

Wyckoff 2.0: Structures, Volume Profile and Order Flow (Trading and Investing Course: Advanced Technical Analysis) by Rubén Villahermosa

1 × $5.00

Wyckoff 2.0: Structures, Volume Profile and Order Flow (Trading and Investing Course: Advanced Technical Analysis) by Rubén Villahermosa

1 × $5.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

Note Buying Blueprint with Scott Carson - We Close Notes

1 × $6.00

Note Buying Blueprint with Scott Carson - We Close Notes

1 × $6.00 -

×

Rate of Change Indicator with Alphashark

1 × $31.00

Rate of Change Indicator with Alphashark

1 × $31.00 -

×

Forex and Stocks Trading Course - Set and Forget with Alfonso Moreno

1 × $6.00

Forex and Stocks Trading Course - Set and Forget with Alfonso Moreno

1 × $6.00 -

×

Trading to Win (Seminar WorkBook 2003) with Bruce Gilmore

1 × $6.00

Trading to Win (Seminar WorkBook 2003) with Bruce Gilmore

1 × $6.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

MTA - Technically Speaking Newsletters

1 × $6.00

MTA - Technically Speaking Newsletters

1 × $6.00 -

×

Harmonic Patterns for ThinkorSwim Bat, Butterfly, Crab, and Gartley

1 × $6.00

Harmonic Patterns for ThinkorSwim Bat, Butterfly, Crab, and Gartley

1 × $6.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

ICT Charter 2020 with Inner Circle Trader

1 × $13.00

ICT Charter 2020 with Inner Circle Trader

1 × $13.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

Forex Mastermind with FOREX4NOOBS

1 × $5.00

Forex Mastermind with FOREX4NOOBS

1 × $5.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

5 Week Live Web Seminar (Video & WorkBook ) with Larry Connors

1 × $6.00

5 Week Live Web Seminar (Video & WorkBook ) with Larry Connors

1 × $6.00 -

×

Trading System Mastery with Brian McAboy

1 × $6.00

Trading System Mastery with Brian McAboy

1 × $6.00 -

×

WITS Turbo Seminars with Brian James Sklenka

1 × $6.00

WITS Turbo Seminars with Brian James Sklenka

1 × $6.00 -

×

5 Part Daytrading Course with Kevin Haggerty

1 × $6.00

5 Part Daytrading Course with Kevin Haggerty

1 × $6.00 -

×

A- Z Educational Trading Course with InvestiTrade

1 × $39.00

A- Z Educational Trading Course with InvestiTrade

1 × $39.00 -

×

Zen8 Forex Hedging Program with Hugh Kimura - Trading Heroes

1 × $5.00

Zen8 Forex Hedging Program with Hugh Kimura - Trading Heroes

1 × $5.00 -

×

Wyckoff Analysis Series. Module 2. Wyckoff Candle Volume Analysis

1 × $6.00

Wyckoff Analysis Series. Module 2. Wyckoff Candle Volume Analysis

1 × $6.00 -

×

Building Winning Trading Systems

1 × $6.00

Building Winning Trading Systems

1 × $6.00 -

×

30 Days to Market Mastery: A Step-by-Step Guide to Profitable Trading with Jack Bernstein

1 × $6.00

30 Days to Market Mastery: A Step-by-Step Guide to Profitable Trading with Jack Bernstein

1 × $6.00 -

×

Master NFTs in 7 Days with Ben Yu

1 × $23.00

Master NFTs in 7 Days with Ben Yu

1 × $23.00 -

×

FluxOrion By Back To The Future Trading

1 × $6.00

FluxOrion By Back To The Future Trading

1 × $6.00 -

×

Tradacc – The Volume Profile Formula + Futures Masterclass and Rapid Setups Pack + S&P 500 Secrets Bundle - Aaron Korbs

1 × $5.00

Tradacc – The Volume Profile Formula + Futures Masterclass and Rapid Setups Pack + S&P 500 Secrets Bundle - Aaron Korbs

1 × $5.00 -

×

Bennett McDowell – A Trader’s Money Management System

1 × $6.00

Bennett McDowell – A Trader’s Money Management System

1 × $6.00 -

×

High Probability Continuation and Reversal Patterns

1 × $23.00

High Probability Continuation and Reversal Patterns

1 × $23.00 -

×

Train & Trade Academy with Omar Agag

1 × $5.00

Train & Trade Academy with Omar Agag

1 × $5.00 -

×

Trading Trainer - 6 Percent Protocol

1 × $39.00

Trading Trainer - 6 Percent Protocol

1 × $39.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Trading the Moves - Consistent Gains in All Markets with Ed Downs

1 × $6.00

Trading the Moves - Consistent Gains in All Markets with Ed Downs

1 × $6.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

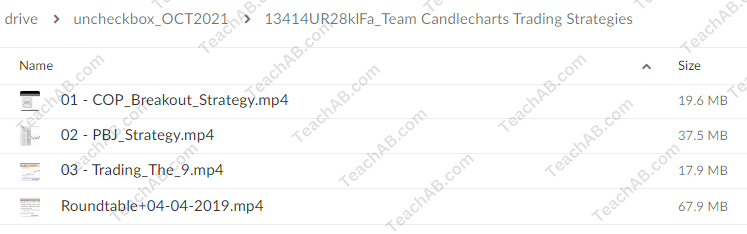

Team Candlecharts Trading Strategies with Candle Charts

$395.00 Original price was: $395.00.$31.00Current price is: $31.00.

File Size: 142.9 MB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Team Candlecharts Trading Strategies with Candle Charts” below:

Team Candlecharts Trading Strategies By Candle Charts

Introduction to Team Candlecharts

Trading in the financial markets requires a blend of knowledge, skill, and strategy. Team Candlecharts Trading Strategies by Candle Charts is designed to equip traders with the tools and insights needed to navigate these markets successfully. By leveraging the power of candlestick charting techniques, traders can make more informed decisions and enhance their trading performance.

Understanding Candlestick Charting

What Are Candlestick Charts?

Candlestick charts are a type of financial chart used to describe price movements of a security, derivative, or currency. Each candlestick typically shows one day, although time periods can vary.

Components of a Candlestick

- Body: Represents the range between the opening and closing prices.

- Wicks: The lines above and below the body, indicating the high and low prices.

- Color: Indicates whether the closing price was higher (usually green or white) or lower (usually red or black) than the opening price.

Why Use Candlestick Charts?

Visual Appeal

Candlestick charts provide a visual representation of price movements, making it easier to spot trends and patterns.

Historical Significance

The use of candlestick charts dates back to 18th century Japan, where they were used by rice traders to predict future price movements. Their historical reliability makes them a trusted tool in modern trading.

Core Strategies by Team Candlecharts

The Power of Reversal Patterns

Engulfing Patterns

- Bullish Engulfing: Indicates a potential reversal in an existing downtrend.

- Bearish Engulfing: Suggests a possible reversal in an existing uptrend.

Doji Patterns

- Gravestone Doji: Signals a possible reversal when found at the top of an uptrend.

- Dragonfly Doji: Indicates potential bullish reversal when found at the bottom of a downtrend.

The Role of Continuation Patterns

Rising Three Methods

A bullish continuation pattern that suggests the uptrend will continue.

Falling Three Methods

A bearish continuation pattern that indicates the downtrend will persist.

Incorporating Technical Indicators

Moving Averages

- Simple Moving Average (SMA): Helps identify the overall trend direction.

- Exponential Moving Average (EMA): Places more weight on recent prices, making it more responsive to new information.

Relative Strength Index (RSI)

Measures the speed and change of price movements, indicating overbought or oversold conditions.

Moving Average Convergence Divergence (MACD)

A trend-following momentum indicator that shows the relationship between two moving averages of a security’s price.

Risk Management in Trading

Importance of Risk Management

Effective risk management is crucial to preserve capital and ensure long-term trading success. Without it, even the best strategies can lead to significant losses.

Risk Management Techniques

- Stop-Loss Orders: Automatically sell a position at a predetermined price to limit losses.

- Position Sizing: Determine the appropriate amount to invest in each trade to manage risk exposure.

- Diversification: Spread investments across various assets to reduce risk.

The Benefits of Team Candlecharts

Expert Guidance

Team Candlecharts provides expert guidance from seasoned traders who have mastered the art of candlestick charting.

Educational Resources

- Webinars and Workshops: Interactive sessions to enhance your understanding of trading strategies.

- Training Videos: Comprehensive video tutorials covering various aspects of trading.

- E-books and Articles: In-depth written materials to support continuous learning.

Community Support

Being part of the Team Candlecharts community offers valuable support and insights from fellow traders. This collaborative environment fosters learning and growth.

Real-World Applications

Success Stories

Numerous traders have benefited from the strategies taught by Team Candlecharts. Here are a few testimonials:

- Alex J.: “Using candlestick patterns, I’ve been able to improve my entry and exit points significantly.”

- Samantha L.: “The strategies taught by Team Candlecharts have transformed my trading approach.”

Case Studies

Detailed case studies demonstrate how traders have applied these strategies to achieve substantial gains in the market.

Getting Started with Team Candlecharts

Enrollment Process

- Visit the Candle Charts Website: Navigate to the official Candle Charts website.

- Select a Program: Choose the trading program that best suits your needs.

- Complete Registration: Fill in the necessary details and complete the registration process.

- Access Materials: Gain immediate access to the educational resources and start learning.

Additional Support

- Customer Service: Contact Candle Charts for any queries or support.

- Online Forums: Engage with other traders to share insights and strategies.

Conclusion

Team Candlecharts Trading Strategies by Candle Charts offers a comprehensive approach to trading using candlestick charting techniques. By understanding and applying these strategies, traders can enhance their decision-making and improve their trading outcomes. Whether you are a beginner or an experienced trader, the resources and community support provided by Team Candlecharts can help you achieve your trading goals.

Frequently Asked Questions

1. What are candlestick charts?

Candlestick charts are a type of financial chart used to describe price movements of a security, derivative, or currency.

2. Why are candlestick charts effective?

Candlestick charts are visually appealing and have a historical significance, making them a reliable tool for predicting price movements.

3. What are some key candlestick patterns?

Key patterns include bullish and bearish engulfing patterns, gravestone and dragonfly doji, and rising and falling three methods.

4. How important is risk management in trading?

Risk management is crucial to preserve capital and ensure long-term success in trading.

5. How can I start learning from Team Candlecharts?

You can start by visiting the Candle Charts website, selecting a program, and completing the registration process.

Be the first to review “Team Candlecharts Trading Strategies with Candle Charts” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.