-

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

The Adventures of the Cycle Hunter. The Analyst with Craig Bttlc

1 × $6.00

The Adventures of the Cycle Hunter. The Analyst with Craig Bttlc

1 × $6.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Trading Options Effectively with Paul Forchione

1 × $4.00

Trading Options Effectively with Paul Forchione

1 × $4.00 -

×

Hedge Funds for Dummies

1 × $6.00

Hedge Funds for Dummies

1 × $6.00 -

×

Smart Money Trading Course with Prosperity Academy

1 × $5.00

Smart Money Trading Course with Prosperity Academy

1 × $5.00 -

×

The Aftermath + Jack Savage Extras (How To Trade Gold) with FXSavages

1 × $6.00

The Aftermath + Jack Savage Extras (How To Trade Gold) with FXSavages

1 × $6.00 -

×

Sure-thing Options Trading: A Money-Making Guide to the New Listed Stock and Commodity Options Markets - George Angell

1 × $6.00

Sure-thing Options Trading: A Money-Making Guide to the New Listed Stock and Commodity Options Markets - George Angell

1 × $6.00 -

×

Advent Forex Course with Cecil Robles

1 × $6.00

Advent Forex Course with Cecil Robles

1 × $6.00 -

×

ETF Strategies & Tactics: Hedge Your Portfolio in a Changing Marke with Laurence Rosenberg

1 × $6.00

ETF Strategies & Tactics: Hedge Your Portfolio in a Changing Marke with Laurence Rosenberg

1 × $6.00 -

×

Right Line Trading IndicatorSuite (May 2015)

1 × $31.00

Right Line Trading IndicatorSuite (May 2015)

1 × $31.00 -

×

David Landry On Swing Trading

1 × $6.00

David Landry On Swing Trading

1 × $6.00 -

×

Mastering Risk Modeling with Excel by Alastair Day

1 × $6.00

Mastering Risk Modeling with Excel by Alastair Day

1 × $6.00 -

×

Analysis & Interpretation in Qualitative Market Research with Gill Ereaut

1 × $6.00

Analysis & Interpretation in Qualitative Market Research with Gill Ereaut

1 × $6.00 -

×

Opening Bell Income Strategy with Todd Mitchell

1 × $54.00

Opening Bell Income Strategy with Todd Mitchell

1 × $54.00 -

×

ValueCharts Ultimate Bundle with Base Camp Trading

1 × $54.00

ValueCharts Ultimate Bundle with Base Camp Trading

1 × $54.00 -

×

Commodity Speculation for Beginners with Charles Huff, Barbara Marinacci

1 × $6.00

Commodity Speculation for Beginners with Charles Huff, Barbara Marinacci

1 × $6.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

Investment Titans: Investment Insights from the Minds that Move Wall Street with Jonathan Burton

1 × $6.00

Investment Titans: Investment Insights from the Minds that Move Wall Street with Jonathan Burton

1 × $6.00 -

×

Intra-day Solar Trader with George Harrison

1 × $17.00

Intra-day Solar Trader with George Harrison

1 × $17.00 -

×

The Oil Money (open code) (Nov 2013)

1 × $6.00

The Oil Money (open code) (Nov 2013)

1 × $6.00 -

×

The Random Character of Interest Rates with Joseph Murphy

1 × $6.00

The Random Character of Interest Rates with Joseph Murphy

1 × $6.00 -

×

Optionpit - Mastering Iron Condors and Butterflies

1 × $15.00

Optionpit - Mastering Iron Condors and Butterflies

1 × $15.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

Earnings Reaction Gaps Workshop with John Pocorobba

1 × $27.00

Earnings Reaction Gaps Workshop with John Pocorobba

1 × $27.00 -

×

Create Your Own Hedge Fund with Mark Wolfinger

1 × $6.00

Create Your Own Hedge Fund with Mark Wolfinger

1 × $6.00 -

×

How to Trade Diagonal Triangles. Superior Risk Reward Trade Setups

1 × $6.00

How to Trade Diagonal Triangles. Superior Risk Reward Trade Setups

1 × $6.00 -

×

Making Sense of Price Action: Price Action Profits with Scott Foster

1 × $54.00

Making Sense of Price Action: Price Action Profits with Scott Foster

1 × $54.00 -

×

Cryptocurrency Investing Master Class with Stone River eLearning

1 × $6.00

Cryptocurrency Investing Master Class with Stone River eLearning

1 × $6.00 -

×

Astro Cycles with Larry Pesavento

1 × $6.00

Astro Cycles with Larry Pesavento

1 × $6.00 -

×

Futures & Options Course with Talkin Options

1 × $15.00

Futures & Options Course with Talkin Options

1 × $15.00 -

×

Mastering Technical Analysis with Investi Share

1 × $23.00

Mastering Technical Analysis with Investi Share

1 × $23.00 -

×

Foundations of Forex Trading with TradeSmart University

1 × $6.00

Foundations of Forex Trading with TradeSmart University

1 × $6.00 -

×

Day Trade Futures Online with Larry Williams

1 × $6.00

Day Trade Futures Online with Larry Williams

1 × $6.00 -

×

Power Index Method for Profitable Futures Trading with Harold Goldberg

1 × $6.00

Power Index Method for Profitable Futures Trading with Harold Goldberg

1 × $6.00 -

×

The A to Z of Mathematics: A Basic Guide with Thomas Sidebotham

1 × $6.00

The A to Z of Mathematics: A Basic Guide with Thomas Sidebotham

1 × $6.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

Hedge Fund of Funds Investing with Joseph Nicholas

1 × $6.00

Hedge Fund of Funds Investing with Joseph Nicholas

1 × $6.00 -

×

Daily Market Review 2009-2012 (Video 16 GB) with David Vallieres

1 × $6.00

Daily Market Review 2009-2012 (Video 16 GB) with David Vallieres

1 × $6.00 -

×

Forex EURUSD Trader Live Training (2012)

1 × $6.00

Forex EURUSD Trader Live Training (2012)

1 × $6.00 -

×

Ron Wagner - Creating a Profitable Trading & Investing Plan + Techniques to Perfect Your Intraday GAP

1 × $6.00

Ron Wagner - Creating a Profitable Trading & Investing Plan + Techniques to Perfect Your Intraday GAP

1 × $6.00 -

×

Trading For Busy People with Josias Kere

1 × $6.00

Trading For Busy People with Josias Kere

1 × $6.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

Trade Options Like a DPM with The Admiral Webinar Series with Hamzei Analytics

1 × $6.00

Trade Options Like a DPM with The Admiral Webinar Series with Hamzei Analytics

1 × $6.00 -

×

PFAZoneSuite [Trading Indicator] 2017

1 × $109.00

PFAZoneSuite [Trading Indicator] 2017

1 × $109.00 -

×

All About Dividend Investing with Don Schreiber & Gary Stroik

1 × $6.00

All About Dividend Investing with Don Schreiber & Gary Stroik

1 × $6.00 -

×

Learn how to trade Volatility 75 Index Technical Analysis with Patrick Muke

1 × $6.00

Learn how to trade Volatility 75 Index Technical Analysis with Patrick Muke

1 × $6.00 -

×

Learn to Trade Course with Mike Aston

1 × $6.00

Learn to Trade Course with Mike Aston

1 × $6.00 -

×

Full 2 Day Dark Pool And Market Strategy Training

1 × $6.00

Full 2 Day Dark Pool And Market Strategy Training

1 × $6.00 -

×

Acclimation Course with Base Camp Trading

1 × $10.00

Acclimation Course with Base Camp Trading

1 × $10.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

Price Action and Orderflow Course with Young Tilopa

1 × $17.00

Price Action and Orderflow Course with Young Tilopa

1 × $17.00 -

×

9-Pack of TOS Indicators

1 × $6.00

9-Pack of TOS Indicators

1 × $6.00 -

×

How I Get Paid $1,000 Every Friday Trading Options with Jeff Tompkins

1 × $15.00

How I Get Paid $1,000 Every Friday Trading Options with Jeff Tompkins

1 × $15.00 -

×

Profit Trading VIX Options Course with Don Kaufman

1 × $6.00

Profit Trading VIX Options Course with Don Kaufman

1 × $6.00 -

×

The Mathematics of Technical Analysis with Clifford Sherry

1 × $6.00

The Mathematics of Technical Analysis with Clifford Sherry

1 × $6.00 -

×

Connors on Advanced Trading Strategies with Larry Connors

1 × $6.00

Connors on Advanced Trading Strategies with Larry Connors

1 × $6.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

Tape Reading Small Caps with Jtrader

$299.00 Original price was: $299.00.$23.00Current price is: $23.00.

File Size:1.58 GB

Delivery Time: 1–12 hours

Media Type: Online Course

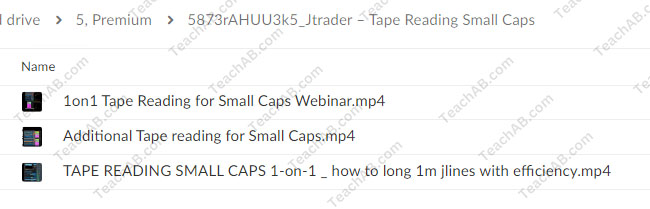

Content Proof: Watch Here!

You may check content proof of “Tape Reading Small Caps with Jtrader” below:

Introduction

Are you looking to enhance your trading skills and gain an edge in the stock market? Tape reading is an essential technique that can help you understand market movements and make informed trading decisions. “Tape Reading Small Caps By Jtrader” is a comprehensive guide that delves into the nuances of tape reading, specifically focusing on small-cap stocks. Let’s explore how this powerful tool can transform your trading approach.

Who is Jtrader?

Background and Expertise

Jtrader is a seasoned trader known for his expertise in small-cap stocks and tape reading. With years of experience in the financial markets, Jtrader has developed a deep understanding of market dynamics and trading strategies.

Contributions to the Trading Community

Through educational content, webinars, and live trading sessions, Jtrader has significantly impacted the trading community. His practical approach and clear teaching style have made him a respected mentor among aspiring traders.

What is Tape Reading?

Definition and Purpose

Tape reading is the practice of analyzing the flow of buy and sell orders, also known as the “tape,” to gain insights into market sentiment and price movements. It involves closely watching the time and sales data to make informed trading decisions.

Historical Context

Tape reading has a rich history, dating back to the early days of stock trading. Traders would use ticker tape machines to monitor stock transactions and make quick decisions based on the information displayed.

Why Focus on Small Caps?

High Volatility

Small-cap stocks are known for their high volatility, which presents both opportunities and risks for traders. Tape reading can help you navigate this volatility effectively.

Potential for Growth

Small-cap stocks often have significant growth potential, making them attractive to traders looking for substantial returns.

Core Principles of Tape Reading

Reading the Tape

Learn to interpret the tape by observing the flow of buy and sell orders. Identify patterns and trends that indicate potential price movements.

Analyzing Order Flow

Understand how to analyze order flow to gauge market sentiment. Large orders, for instance, can indicate the presence of institutional traders and potential price changes.

Techniques for Effective Tape Reading

Identifying Key Levels

Focus on key price levels where significant buying or selling activity occurs. These levels can act as support or resistance, guiding your trading decisions.

Watching for Momentum

Monitor the tape for signs of momentum, such as rapid order execution and increased trading volume. These indicators can signal potential breakout or breakdown scenarios.

Spotting Fakeouts

Learn to spot fakeouts, where price movements initially appear to be significant but quickly reverse. Understanding these patterns can prevent you from making costly mistakes.

Tools and Resources

Time and Sales Data

Utilize time and sales data to track real-time order flow. This information is crucial for effective tape reading.

Level II Quotes

Level II quotes provide deeper insights into the order book, showing the bid and ask prices and the depth of market orders.

Trading Platforms

Choose a trading platform that offers robust tape reading tools and real-time data feeds. Popular platforms include Thinkorswim, Interactive Brokers, and TradeStation.

Developing a Tape Reading Strategy

Setting Goals

Before diving into tape reading, set clear trading goals. Determine what you aim to achieve, whether it’s short-term gains or long-term growth.

Practice and Patience

Tape reading requires practice and patience. Start by paper trading to hone your skills before committing real capital.

Risk Management

Implement risk management strategies to protect your capital. Use stop-loss orders and position sizing to manage risk effectively.

Common Mistakes to Avoid

Overtrading

Avoid overtrading by being selective with your trades. Quality over quantity is a key principle in tape reading.

Ignoring Market Context

Always consider the broader market context. Tape reading is more effective when combined with technical and fundamental analysis.

Emotional Trading

Stay disciplined and avoid letting emotions drive your trading decisions. Stick to your strategy and remain objective.

Benefits of Tape Reading Small Caps

Enhanced Market Insight

Tape reading provides deeper insights into market sentiment and price action, helping you make informed decisions.

Real-Time Decision Making

Make quick, real-time decisions based on the flow of orders and market dynamics.

Increased Trading Accuracy

Improve your trading accuracy by identifying key levels, momentum, and potential reversals through tape reading.

Testimonials from Traders

Alex Brown

“Jtrader’s tape reading techniques have revolutionized my trading. The insights gained from watching the tape have significantly improved my decision-making.”

Samantha Lee

“I used to struggle with understanding market movements, but Jtrader’s course on tape reading has made a huge difference. My trading accuracy has never been better.”

Michael Johnson

“Thanks to Jtrader, I’ve learned to navigate the volatility of small-cap stocks with confidence. Tape reading has become an essential part of my trading strategy.”

Key Takeaways

Mastering the Basics

Understanding the basics of tape reading is crucial for effective trading. Start with the core principles and gradually develop your skills.

Continuous Learning

Tape reading is a skill that requires continuous learning and practice. Stay updated with market trends and refine your strategies regularly.

Combining Techniques

Combine tape reading with other forms of analysis, such as technical and fundamental analysis, to enhance your trading approach.

How to Get Started

Enrollment Process

Enroll in Jtrader’s course on tape reading by visiting his website. Complete the registration form and gain access to comprehensive materials and resources.

Preparation Tips

Prepare yourself by setting clear goals and dedicating time each day to practice tape reading. Start with paper trading to build confidence.

Engage Actively

Participate actively in all live sessions, discussions, and practical assignments. Engaging fully will maximize your learning experience and help you achieve your trading goals.

Conclusion

“Tape Reading Small Caps By Jtrader” is an invaluable resource for traders looking to enhance their skills and achieve consistent profitability. With expert guidance, proven strategies, and a supportive community, this program equips you with the tools and knowledge needed to navigate the complexities of small-cap stocks. Start your journey towards trading mastery today and unlock the potential of tape reading with Jtrader.

Commonly Asked Questions:

- Business Model Innovation: Accept the truth of a legitimate business! Our strategy is organising a group buy in which participants share the costs. We use these cash to acquire popular courses from sale pages and make them available to people with limited financial resources. Despite the authors’ worries, our clients love the cost and accessibility we give.

- The Legal Environment: Yes or No The legality of our activity is ambiguous. While we don’t have specific permission from the course authors to resell the material, there is a technicality at work. The author did not specify any limits on resale when purchasing the course. This legal intricacy is both an opportunity for us and a boon for individuals looking for low-cost access.

- Quality Control: Uncovering the Truth

Getting to the heart of the issue – quality. Purchasing the course straight from the sale page guarantees that all documents and resources are the same as those obtained through traditional channels.

However, we distinguish ourselves by going beyond personal research and resale. It is crucial to note that we are not the official course providers, which means that the following premium services are not included in our package:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not permitted.

- No access to the author’s private membership forum.

- There is no direct email support available from the author or their team.

We operate independently, with the goal of bridging the pricing gap without the extra services provided by official course channels. Your comprehension of our distinct approach is much appreciated.

Be the first to review “Tape Reading Small Caps with Jtrader” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.