-

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

Sniper Trading System for Forex with Chris Capre

1 × $4.00

Sniper Trading System for Forex with Chris Capre

1 × $4.00 -

×

The Whale Trade Workshop Plus One Week of Live Trading with Doc Severson

1 × $6.00

The Whale Trade Workshop Plus One Week of Live Trading with Doc Severson

1 × $6.00 -

×

Rob’s Swing Trading Methods with Rob Hoffman

1 × $39.00

Rob’s Swing Trading Methods with Rob Hoffman

1 × $39.00 -

×

Portfolio Optimization & Perfomance Analysis with Jean-Luc Prigent

1 × $6.00

Portfolio Optimization & Perfomance Analysis with Jean-Luc Prigent

1 × $6.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

TradeSafe Mechanical Trading System, Course, and Coaching

1 × $85.00

TradeSafe Mechanical Trading System, Course, and Coaching

1 × $85.00 -

×

BookMap Advanced v6.1

1 × $6.00

BookMap Advanced v6.1

1 × $6.00 -

×

Timing the Market with Curtis Arnold

1 × $6.00

Timing the Market with Curtis Arnold

1 × $6.00 -

×

Textbook Trading DVD with InvestorsLive

1 × $6.00

Textbook Trading DVD with InvestorsLive

1 × $6.00 -

×

Gannline. Total School Package

1 × $6.00

Gannline. Total School Package

1 × $6.00 -

×

Master Trader Technical Strategies with Greg Capra - Master Trader

1 × $5.00

Master Trader Technical Strategies with Greg Capra - Master Trader

1 × $5.00 -

×

Advanced Breakthroughs in Day Trading DVD course with George Angell

1 × $6.00

Advanced Breakthroughs in Day Trading DVD course with George Angell

1 × $6.00 -

×

Cracking The Forex Code with Kevin Adams

1 × $6.00

Cracking The Forex Code with Kevin Adams

1 × $6.00 -

×

Investment Illusions with Martin S.Fridson

1 × $6.00

Investment Illusions with Martin S.Fridson

1 × $6.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

Quantitative Business Valuation with Jay Abrams

1 × $6.00

Quantitative Business Valuation with Jay Abrams

1 × $6.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

The 3 Skills of Top Trading with Hank Pruden

1 × $6.00

The 3 Skills of Top Trading with Hank Pruden

1 × $6.00 -

×

Day Trade to Win E-Course with John Paul

1 × $6.00

Day Trade to Win E-Course with John Paul

1 × $6.00 -

×

6 Dynamic Trader Real Time and End Of Day

1 × $39.00

6 Dynamic Trader Real Time and End Of Day

1 × $39.00 -

×

The Science of Trading with Mark Boucher

1 × $6.00

The Science of Trading with Mark Boucher

1 × $6.00 -

×

The New Electronic Traders with Jonathan R.Aspartore

1 × $6.00

The New Electronic Traders with Jonathan R.Aspartore

1 × $6.00 -

×

Online Course: Forex Trading By Fxtc.co

1 × $5.00

Online Course: Forex Trading By Fxtc.co

1 × $5.00 -

×

Forex Power Strategy Course with Jason Steele

1 × $6.00

Forex Power Strategy Course with Jason Steele

1 × $6.00 -

×

The TC2000 Masterclass Course with Sasha Evdakov - Rise2learn

1 × $23.00

The TC2000 Masterclass Course with Sasha Evdakov - Rise2learn

1 × $23.00 -

×

Adx Mastery Complete Course

1 × $6.00

Adx Mastery Complete Course

1 × $6.00 -

×

Quality FX Academy

1 × $5.00

Quality FX Academy

1 × $5.00 -

×

Short Term Trading. Integrated Pithfork Analysis with Dr. Mircea Dologa

1 × $6.00

Short Term Trading. Integrated Pithfork Analysis with Dr. Mircea Dologa

1 × $6.00 -

×

Technical Analysis 201: From Chart Setups to Trading Execution Methodology Class with Jeff Bierman

1 × $6.00

Technical Analysis 201: From Chart Setups to Trading Execution Methodology Class with Jeff Bierman

1 × $6.00 -

×

Optionetics 2007 - Home Study Course, MP3

1 × $6.00

Optionetics 2007 - Home Study Course, MP3

1 × $6.00 -

×

M3-4u Trading System with John Locke

1 × $5.00

M3-4u Trading System with John Locke

1 × $5.00 -

×

Market Fluidity

1 × $6.00

Market Fluidity

1 × $6.00 -

×

WEBINAR series 5 – EXECUTION: A DETAILED PROCESS with FuturesTrader71

1 × $4.00

WEBINAR series 5 – EXECUTION: A DETAILED PROCESS with FuturesTrader71

1 × $4.00 -

×

Outperforming the Market with John Merrill

1 × $6.00

Outperforming the Market with John Merrill

1 × $6.00 -

×

Advanced Stock Trading Course + Strategies

1 × $15.00

Advanced Stock Trading Course + Strategies

1 × $15.00 -

×

Successful Stock Speculation (1922) with John James

1 × $6.00

Successful Stock Speculation (1922) with John James

1 × $6.00 -

×

Cyclic Analysis. A BreakThrough in Transaction Timing with Cyclitec Services

1 × $6.00

Cyclic Analysis. A BreakThrough in Transaction Timing with Cyclitec Services

1 × $6.00 -

×

Indicator Effectiveness Testing & System Creation with David Vomund

1 × $6.00

Indicator Effectiveness Testing & System Creation with David Vomund

1 × $6.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

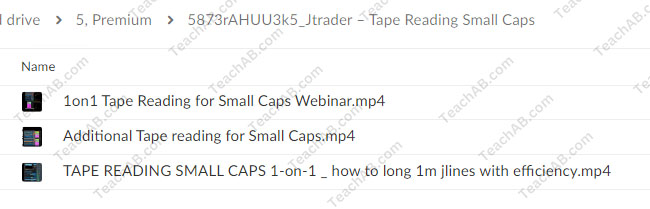

Tape Reading Small Caps with Jtrader

$299.00 Original price was: $299.00.$23.00Current price is: $23.00.

File Size:1.58 GB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Tape Reading Small Caps with Jtrader” below:

Introduction

Are you looking to enhance your trading skills and gain an edge in the stock market? Tape reading is an essential technique that can help you understand market movements and make informed trading decisions. “Tape Reading Small Caps By Jtrader” is a comprehensive guide that delves into the nuances of tape reading, specifically focusing on small-cap stocks. Let’s explore how this powerful tool can transform your trading approach.

Who is Jtrader?

Background and Expertise

Jtrader is a seasoned trader known for his expertise in small-cap stocks and tape reading. With years of experience in the financial markets, Jtrader has developed a deep understanding of market dynamics and trading strategies.

Contributions to the Trading Community

Through educational content, webinars, and live trading sessions, Jtrader has significantly impacted the trading community. His practical approach and clear teaching style have made him a respected mentor among aspiring traders.

What is Tape Reading?

Definition and Purpose

Tape reading is the practice of analyzing the flow of buy and sell orders, also known as the “tape,” to gain insights into market sentiment and price movements. It involves closely watching the time and sales data to make informed trading decisions.

Historical Context

Tape reading has a rich history, dating back to the early days of stock trading. Traders would use ticker tape machines to monitor stock transactions and make quick decisions based on the information displayed.

Why Focus on Small Caps?

High Volatility

Small-cap stocks are known for their high volatility, which presents both opportunities and risks for traders. Tape reading can help you navigate this volatility effectively.

Potential for Growth

Small-cap stocks often have significant growth potential, making them attractive to traders looking for substantial returns.

Core Principles of Tape Reading

Reading the Tape

Learn to interpret the tape by observing the flow of buy and sell orders. Identify patterns and trends that indicate potential price movements.

Analyzing Order Flow

Understand how to analyze order flow to gauge market sentiment. Large orders, for instance, can indicate the presence of institutional traders and potential price changes.

Techniques for Effective Tape Reading

Identifying Key Levels

Focus on key price levels where significant buying or selling activity occurs. These levels can act as support or resistance, guiding your trading decisions.

Watching for Momentum

Monitor the tape for signs of momentum, such as rapid order execution and increased trading volume. These indicators can signal potential breakout or breakdown scenarios.

Spotting Fakeouts

Learn to spot fakeouts, where price movements initially appear to be significant but quickly reverse. Understanding these patterns can prevent you from making costly mistakes.

Tools and Resources

Time and Sales Data

Utilize time and sales data to track real-time order flow. This information is crucial for effective tape reading.

Level II Quotes

Level II quotes provide deeper insights into the order book, showing the bid and ask prices and the depth of market orders.

Trading Platforms

Choose a trading platform that offers robust tape reading tools and real-time data feeds. Popular platforms include Thinkorswim, Interactive Brokers, and TradeStation.

Developing a Tape Reading Strategy

Setting Goals

Before diving into tape reading, set clear trading goals. Determine what you aim to achieve, whether it’s short-term gains or long-term growth.

Practice and Patience

Tape reading requires practice and patience. Start by paper trading to hone your skills before committing real capital.

Risk Management

Implement risk management strategies to protect your capital. Use stop-loss orders and position sizing to manage risk effectively.

Common Mistakes to Avoid

Overtrading

Avoid overtrading by being selective with your trades. Quality over quantity is a key principle in tape reading.

Ignoring Market Context

Always consider the broader market context. Tape reading is more effective when combined with technical and fundamental analysis.

Emotional Trading

Stay disciplined and avoid letting emotions drive your trading decisions. Stick to your strategy and remain objective.

Benefits of Tape Reading Small Caps

Enhanced Market Insight

Tape reading provides deeper insights into market sentiment and price action, helping you make informed decisions.

Real-Time Decision Making

Make quick, real-time decisions based on the flow of orders and market dynamics.

Increased Trading Accuracy

Improve your trading accuracy by identifying key levels, momentum, and potential reversals through tape reading.

Testimonials from Traders

Alex Brown

“Jtrader’s tape reading techniques have revolutionized my trading. The insights gained from watching the tape have significantly improved my decision-making.”

Samantha Lee

“I used to struggle with understanding market movements, but Jtrader’s course on tape reading has made a huge difference. My trading accuracy has never been better.”

Michael Johnson

“Thanks to Jtrader, I’ve learned to navigate the volatility of small-cap stocks with confidence. Tape reading has become an essential part of my trading strategy.”

Key Takeaways

Mastering the Basics

Understanding the basics of tape reading is crucial for effective trading. Start with the core principles and gradually develop your skills.

Continuous Learning

Tape reading is a skill that requires continuous learning and practice. Stay updated with market trends and refine your strategies regularly.

Combining Techniques

Combine tape reading with other forms of analysis, such as technical and fundamental analysis, to enhance your trading approach.

How to Get Started

Enrollment Process

Enroll in Jtrader’s course on tape reading by visiting his website. Complete the registration form and gain access to comprehensive materials and resources.

Preparation Tips

Prepare yourself by setting clear goals and dedicating time each day to practice tape reading. Start with paper trading to build confidence.

Engage Actively

Participate actively in all live sessions, discussions, and practical assignments. Engaging fully will maximize your learning experience and help you achieve your trading goals.

Conclusion

“Tape Reading Small Caps By Jtrader” is an invaluable resource for traders looking to enhance their skills and achieve consistent profitability. With expert guidance, proven strategies, and a supportive community, this program equips you with the tools and knowledge needed to navigate the complexities of small-cap stocks. Start your journey towards trading mastery today and unlock the potential of tape reading with Jtrader.

Commonly Asked Questions:

- Business Model Innovation: Accept the truth of a legitimate business! Our strategy is organising a group buy in which participants share the costs. We use these cash to acquire popular courses from sale pages and make them available to people with limited financial resources. Despite the authors’ worries, our clients love the cost and accessibility we give.

- The Legal Environment: Yes or No The legality of our activity is ambiguous. While we don’t have specific permission from the course authors to resell the material, there is a technicality at work. The author did not specify any limits on resale when purchasing the course. This legal intricacy is both an opportunity for us and a boon for individuals looking for low-cost access.

- Quality Control: Uncovering the Truth

Getting to the heart of the issue – quality. Purchasing the course straight from the sale page guarantees that all documents and resources are the same as those obtained through traditional channels.

However, we distinguish ourselves by going beyond personal research and resale. It is crucial to note that we are not the official course providers, which means that the following premium services are not included in our package:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not permitted.

- No access to the author’s private membership forum.

- There is no direct email support available from the author or their team.

We operate independently, with the goal of bridging the pricing gap without the extra services provided by official course channels. Your comprehension of our distinct approach is much appreciated.

Be the first to review “Tape Reading Small Caps with Jtrader” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.