-

×

Investment Blunders with John Nofsinger

1 × $6.00

Investment Blunders with John Nofsinger

1 × $6.00 -

×

Fibonacci Mastery Course: Complete Guide to Trading with Fib By Todd Gordon

1 × $62.00

Fibonacci Mastery Course: Complete Guide to Trading with Fib By Todd Gordon

1 × $62.00 -

×

Fractal Markets SFX with Tyson Bieniek

1 × $5.00

Fractal Markets SFX with Tyson Bieniek

1 × $5.00 -

×

Mastering Technical Analysis with Investi Share

1 × $23.00

Mastering Technical Analysis with Investi Share

1 × $23.00 -

×

Deep Market Analysis Volume 1 with Fractal Flow Pro

1 × $6.00

Deep Market Analysis Volume 1 with Fractal Flow Pro

1 × $6.00 -

×

Chart Pattern Profits

1 × $6.00

Chart Pattern Profits

1 × $6.00 -

×

Special Bootcamp with Smart Earners Academy

1 × $5.00

Special Bootcamp with Smart Earners Academy

1 × $5.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

MotiveWave Ultimate v5.1.3 (OFA, OFA AlgoX), (Aug 2017)

1 × $101.00

MotiveWave Ultimate v5.1.3 (OFA, OFA AlgoX), (Aug 2017)

1 × $101.00 -

×

DApp Mastermind (Crypto DApps) – Passive Income with DApps and SMART Contracts with Jason BTO

1 × $6.00

DApp Mastermind (Crypto DApps) – Passive Income with DApps and SMART Contracts with Jason BTO

1 × $6.00 -

×

CFA Level 1,2,3 - Study Guides 2006

1 × $6.00

CFA Level 1,2,3 - Study Guides 2006

1 × $6.00 -

×

Advanced Elliott Wave Analysis : Complex Patterns, Intermarket Relationships, and Global Cash Flow Analysis

1 × $6.00

Advanced Elliott Wave Analysis : Complex Patterns, Intermarket Relationships, and Global Cash Flow Analysis

1 × $6.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Ichimoku Cloud Trading System Class with Jeff Bierman

1 × $6.00

Ichimoku Cloud Trading System Class with Jeff Bierman

1 × $6.00 -

×

Tick By Tick By Alphonso Esposito - TradeSmart

1 × $6.00

Tick By Tick By Alphonso Esposito - TradeSmart

1 × $6.00 -

×

Active Trading Course Notes with Alan Hull

1 × $6.00

Active Trading Course Notes with Alan Hull

1 × $6.00 -

×

THE ART OF ADJUSTING IN 2017

1 × $6.00

THE ART OF ADJUSTING IN 2017

1 × $6.00 -

×

Level II Profit System with Sammy Chua

1 × $6.00

Level II Profit System with Sammy Chua

1 × $6.00 -

×

Game Plan of a Winning Trader with Mike Podwojski & Vic Noble

1 × $6.00

Game Plan of a Winning Trader with Mike Podwojski & Vic Noble

1 × $6.00 -

×

Spotting Solid Short-Term Opportunities

1 × $6.00

Spotting Solid Short-Term Opportunities

1 × $6.00 -

×

SO FX Educational Course with SO FX

1 × $5.00

SO FX Educational Course with SO FX

1 × $5.00 -

×

Stock Trading Using Planetary Time Cycles – The Gann Method Volume I,II + Gann Astro Vol III Horoscopes and Trading Methods By Michael S. Jenkins – Stock Cycles Forecast

1 × $6.00

Stock Trading Using Planetary Time Cycles – The Gann Method Volume I,II + Gann Astro Vol III Horoscopes and Trading Methods By Michael S. Jenkins – Stock Cycles Forecast

1 × $6.00 -

×

Corruption and Reform: Lessons from America's Economic History with Edward Glaeser & Claudia Goldin

1 × $6.00

Corruption and Reform: Lessons from America's Economic History with Edward Glaeser & Claudia Goldin

1 × $6.00 -

×

Basic Astrotech

1 × $6.00

Basic Astrotech

1 × $6.00 -

×

MorningSwing Method with Austin Passamonte

1 × $6.00

MorningSwing Method with Austin Passamonte

1 × $6.00 -

×

Wyckoff Analytics Courses Collection

1 × $27.00

Wyckoff Analytics Courses Collection

1 × $27.00 -

×

Lessons 1-30 & Tradestation Code with Charles Drummond

1 × $6.00

Lessons 1-30 & Tradestation Code with Charles Drummond

1 × $6.00 -

×

Credit Spreads Deep Dive with Jay Bailey - Sheridan Options Mentoring

1 × $31.00

Credit Spreads Deep Dive with Jay Bailey - Sheridan Options Mentoring

1 × $31.00 -

×

Forex Time Machine with Bill Poulos

1 × $6.00

Forex Time Machine with Bill Poulos

1 × $6.00 -

×

Cyber Trading University - Power Trading 7 CD

1 × $8.00

Cyber Trading University - Power Trading 7 CD

1 × $8.00 -

×

Charting the Major Forex Pairs: Focus on Major Currencies with James Bickford

1 × $6.00

Charting the Major Forex Pairs: Focus on Major Currencies with James Bickford

1 × $6.00 -

×

Trade Like Warren Buffett with James Altucher

1 × $6.00

Trade Like Warren Buffett with James Altucher

1 × $6.00 -

×

Evidence Based Technical Analysis with David Aronson

1 × $6.00

Evidence Based Technical Analysis with David Aronson

1 × $6.00 -

×

Earnings Power Play with Dave Aquino

1 × $15.00

Earnings Power Play with Dave Aquino

1 × $15.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

PPC Lead Pro Training Program

1 × $31.00

PPC Lead Pro Training Program

1 × $31.00 -

×

Newtonian Trading Strategy Video Course with Fractal Flow Pro

1 × $6.00

Newtonian Trading Strategy Video Course with Fractal Flow Pro

1 × $6.00 -

×

Advanced Options Concepts - Probability, Greeks, Simulation

1 × $6.00

Advanced Options Concepts - Probability, Greeks, Simulation

1 × $6.00 -

×

Levines Guide to Spss for Analysis of Variance with Melanie Page, Sanford Braver & David Mackinnon

1 × $6.00

Levines Guide to Spss for Analysis of Variance with Melanie Page, Sanford Braver & David Mackinnon

1 × $6.00 -

×

Learn Plan Profit 2.0 with Ricky Gutierrez

1 × $39.00

Learn Plan Profit 2.0 with Ricky Gutierrez

1 × $39.00 -

×

Forecast 2012 Report with Larry Williams

1 × $6.00

Forecast 2012 Report with Larry Williams

1 × $6.00 -

×

Forex Courses Collection

1 × $55.00

Forex Courses Collection

1 × $55.00 -

×

The Liquidity Theory of Asset Prices with Gordon Pepper & Michael Oliver

1 × $6.00

The Liquidity Theory of Asset Prices with Gordon Pepper & Michael Oliver

1 × $6.00 -

×

The Art And Science Of Trading with Adam Grimes

1 × $6.00

The Art And Science Of Trading with Adam Grimes

1 × $6.00 -

×

Euro Error with Jean-Jacques Rosa

1 × $6.00

Euro Error with Jean-Jacques Rosa

1 × $6.00 -

×

VSA Advanced Mentorship Course

1 × $31.00

VSA Advanced Mentorship Course

1 × $31.00 -

×

INVESTOPEDIA - BECOME A DAY TRADER

1 × $15.00

INVESTOPEDIA - BECOME A DAY TRADER

1 × $15.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

KP Trading Room w/ Paladin and JadeCapFX

1 × $5.00

KP Trading Room w/ Paladin and JadeCapFX

1 × $5.00 -

×

Trading The Kaltbaum Seven-Step Methodology with Gary Kaltbaum

1 × $4.00

Trading The Kaltbaum Seven-Step Methodology with Gary Kaltbaum

1 × $4.00 -

×

The Traders Battle Plan

1 × $6.00

The Traders Battle Plan

1 × $6.00 -

×

FX Funding Mate Course

1 × $5.00

FX Funding Mate Course

1 × $5.00 -

×

Field of Vision Program – Digital Download

1 × $31.00

Field of Vision Program – Digital Download

1 × $31.00 -

×

Micro Bull Run Mentorship Program (Autumn 2023) with Brendan Viehman

1 × $23.00

Micro Bull Run Mentorship Program (Autumn 2023) with Brendan Viehman

1 × $23.00 -

×

Options Wizardry from A to Z (Video 2.80 GB) with Don Fishback

1 × $6.00

Options Wizardry from A to Z (Video 2.80 GB) with Don Fishback

1 × $6.00 -

×

Forex Fortune Factory with Nehemiah Douglass & Cottrell Phillip

1 × $5.00

Forex Fortune Factory with Nehemiah Douglass & Cottrell Phillip

1 × $5.00 -

×

High Probability Trading with Marcel Link

1 × $6.00

High Probability Trading with Marcel Link

1 × $6.00 -

×

Secrets of An Electronic Futures Trader with Larry Levin

1 × $6.00

Secrets of An Electronic Futures Trader with Larry Levin

1 × $6.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

Candle Charting Essentials & Beyond Volume 1 & 2 with Steve Nison - Candle Charts

1 × $15.00

Candle Charting Essentials & Beyond Volume 1 & 2 with Steve Nison - Candle Charts

1 × $15.00 -

×

Killmex Academy Education Course

1 × $5.00

Killmex Academy Education Course

1 × $5.00 -

×

Trade for Life 7-day Intensive Training Course - Oliver Velez & Dan Gibby

1 × $6.00

Trade for Life 7-day Intensive Training Course - Oliver Velez & Dan Gibby

1 × $6.00 -

×

Market Maps. High Probability Trading Techniques with Timothy Morge

1 × $6.00

Market Maps. High Probability Trading Techniques with Timothy Morge

1 × $6.00 -

×

An Ultimate Guide to Successful Investing with Trading Tuitions

1 × $23.00

An Ultimate Guide to Successful Investing with Trading Tuitions

1 × $23.00 -

×

Stocks and Bonds with Elaine Scott

1 × $6.00

Stocks and Bonds with Elaine Scott

1 × $6.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

NodeTrader (+ open code) (Nov 2014)

1 × $6.00

NodeTrader (+ open code) (Nov 2014)

1 × $6.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Neural Networks in Trading with Dr. Ernest P. Chan

1 × $31.00

Neural Networks in Trading with Dr. Ernest P. Chan

1 × $31.00 -

×

High Probability Option Trading - Covered Calls and Credit Spreads

1 × $6.00

High Probability Option Trading - Covered Calls and Credit Spreads

1 × $6.00 -

×

You can be a Stock Market Genious with Joel Greenblaat

1 × $6.00

You can be a Stock Market Genious with Joel Greenblaat

1 × $6.00 -

×

Trading Using Ocean Theory with Pat Raffolovich

1 × $4.00

Trading Using Ocean Theory with Pat Raffolovich

1 × $4.00 -

×

Wyckoff Unleashed Official Online Course (2018) with Wyckoffsmi

1 × $23.00

Wyckoff Unleashed Official Online Course (2018) with Wyckoffsmi

1 × $23.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Simpler Options - Insider’s Guide to Generating Income using Options Strategies Course (Oct 2014)

1 × $6.00

Simpler Options - Insider’s Guide to Generating Income using Options Strategies Course (Oct 2014)

1 × $6.00 -

×

Dan Sheridan Options Mentoring Weekly Webinars

1 × $6.00

Dan Sheridan Options Mentoring Weekly Webinars

1 × $6.00 -

×

Options on Futures Trading Course

1 × $15.00

Options on Futures Trading Course

1 × $15.00 -

×

Forex Profit Formula System with Jason Fielder

1 × $6.00

Forex Profit Formula System with Jason Fielder

1 × $6.00 -

×

The New Options Market with Max Ansbacher

1 × $6.00

The New Options Market with Max Ansbacher

1 × $6.00 -

×

The MissionFX Compounding Course with Nick Shawn

1 × $5.00

The MissionFX Compounding Course with Nick Shawn

1 × $5.00 -

×

Fisher Investments on Telecom with Dan Sinton, Andrew S.Teufel

1 × $6.00

Fisher Investments on Telecom with Dan Sinton, Andrew S.Teufel

1 × $6.00 -

×

The STRAT Execution Basics with Jermaine McGruder

1 × $31.00

The STRAT Execution Basics with Jermaine McGruder

1 × $31.00 -

×

Baby Blue Trading Technique for the E-Minis with Dave Wright

1 × $6.00

Baby Blue Trading Technique for the E-Minis with Dave Wright

1 × $6.00 -

×

Project Gorilla

1 × $5.00

Project Gorilla

1 × $5.00 -

×

Exploring MetaStock Basic with Martin Pring

1 × $6.00

Exploring MetaStock Basic with Martin Pring

1 × $6.00 -

×

Simple Methods for Detecting Buying and Selling Points in Securities with James Liveright

1 × $6.00

Simple Methods for Detecting Buying and Selling Points in Securities with James Liveright

1 × $6.00 -

×

VWAP Trading course with Trade With Trend

1 × $6.00

VWAP Trading course with Trade With Trend

1 × $6.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

Gold & Silver Profit System with Bill Poulos

1 × $6.00

Gold & Silver Profit System with Bill Poulos

1 × $6.00 -

×

Trade Options Like a DPM with The Admiral Webinar Series with Hamzei Analytics

1 × $6.00

Trade Options Like a DPM with The Admiral Webinar Series with Hamzei Analytics

1 × $6.00 -

×

Secrets to Succesful Forex Trading Course with Jose Soto

1 × $6.00

Secrets to Succesful Forex Trading Course with Jose Soto

1 × $6.00 -

×

The Insider's Guide to 52 Homes in 52 Weeks: Acquire Your Real Estate Fortune Today with Dolf De Roos

1 × $6.00

The Insider's Guide to 52 Homes in 52 Weeks: Acquire Your Real Estate Fortune Today with Dolf De Roos

1 × $6.00 -

×

High Powered Investing with Amine Bouchentouf

1 × $6.00

High Powered Investing with Amine Bouchentouf

1 × $6.00 -

×

The Great Reflation with Anthony Boeckh

1 × $6.00

The Great Reflation with Anthony Boeckh

1 × $6.00 -

×

Capital Flows and Crises with Barry Eichengreen

1 × $6.00

Capital Flows and Crises with Barry Eichengreen

1 × $6.00 -

×

Investing Classroom 2022 with Danny Devan

1 × $15.00

Investing Classroom 2022 with Danny Devan

1 × $15.00 -

×

Market Energy Trader with Top Trade Tools

1 × $5.00

Market Energy Trader with Top Trade Tools

1 × $5.00 -

×

Power FX Xtreme BuySell EA

1 × $23.00

Power FX Xtreme BuySell EA

1 × $23.00 -

×

Precision Timing Your Options Trades Using Fibonacci with Trading Analysis

1 × $15.00

Precision Timing Your Options Trades Using Fibonacci with Trading Analysis

1 × $15.00 -

×

Applying Fibonacci Analysis to Price Action

1 × $6.00

Applying Fibonacci Analysis to Price Action

1 × $6.00 -

×

The Connors Research Volatility Trading Strategy Summit

1 × $85.00

The Connors Research Volatility Trading Strategy Summit

1 × $85.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Advanced Nuances & Exceptions eCourse with Jim Dalton

1 × $15.00

Advanced Nuances & Exceptions eCourse with Jim Dalton

1 × $15.00 -

×

Mastering Momentum Gaps with Toni Hansen

1 × $6.00

Mastering Momentum Gaps with Toni Hansen

1 × $6.00 -

×

Tail Hedging - Learn to Insure Stocks Against Large Declines with James Marsh

1 × $15.00

Tail Hedging - Learn to Insure Stocks Against Large Declines with James Marsh

1 × $15.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

Timing is Everything with Robert M.Barnes

1 × $6.00

Timing is Everything with Robert M.Barnes

1 × $6.00 -

×

Trading Mindset, and Three Steps To Profitable Trading with Bruce Banks

1 × $6.00

Trading Mindset, and Three Steps To Profitable Trading with Bruce Banks

1 × $6.00 -

×

Yield Farming MasterClass Course (2022) with Boss Financial

1 × $5.00

Yield Farming MasterClass Course (2022) with Boss Financial

1 × $5.00 -

×

Tradeguider - Wyckoff VSA eBook Collection

1 × $23.00

Tradeguider - Wyckoff VSA eBook Collection

1 × $23.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Winning on Wall Street (Updated & Revised Ed.) with Martin Zweig

1 × $6.00

Winning on Wall Street (Updated & Revised Ed.) with Martin Zweig

1 × $6.00 -

×

Speculator King 1967 with Jesse Livermore

1 × $6.00

Speculator King 1967 with Jesse Livermore

1 × $6.00 -

×

Stochastic Calculus with Alan Bain

1 × $6.00

Stochastic Calculus with Alan Bain

1 × $6.00 -

×

The Professional Risk Manager Handbook with Carol Alexander

1 × $6.00

The Professional Risk Manager Handbook with Carol Alexander

1 × $6.00 -

×

Price Action Trading Manual 2010

1 × $6.00

Price Action Trading Manual 2010

1 × $6.00 -

×

Sami Abusaad Elite Mentorship

1 × $31.00

Sami Abusaad Elite Mentorship

1 × $31.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

VIP - One on One Coursework with Talkin Options

1 × $15.00

VIP - One on One Coursework with Talkin Options

1 × $15.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

RiskDoctor RD2 – Intermediate Course to Options Trading the RiskDoctor Way - Charles Cottle

1 × $6.00

RiskDoctor RD2 – Intermediate Course to Options Trading the RiskDoctor Way - Charles Cottle

1 × $6.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

Small Account Options Trading Workshop Package with Doc Severson

1 × $6.00

Small Account Options Trading Workshop Package with Doc Severson

1 × $6.00 -

×

Build Your Own Trading System with John Hill

1 × $6.00

Build Your Own Trading System with John Hill

1 × $6.00 -

×

5 Steps to Investment Success with Tyler Bolhorn

1 × $6.00

5 Steps to Investment Success with Tyler Bolhorn

1 × $6.00 -

×

Mutual Funds: Fifty Years of Research Findings by Seth C. Anderson

1 × $6.00

Mutual Funds: Fifty Years of Research Findings by Seth C. Anderson

1 × $6.00 -

×

The Delphi Scalper 4 (delphiscalper.com) with Jason Fielder

1 × $6.00

The Delphi Scalper 4 (delphiscalper.com) with Jason Fielder

1 × $6.00 -

×

Alpha Quant Program with Lucas Inglese - Quantreo

1 × $15.00

Alpha Quant Program with Lucas Inglese - Quantreo

1 × $15.00 -

×

Unsorted Articles about the Psychology of Trading with Brett N.Steenbarger

1 × $6.00

Unsorted Articles about the Psychology of Trading with Brett N.Steenbarger

1 × $6.00 -

×

Simple Trade Strategies

1 × $31.00

Simple Trade Strategies

1 × $31.00 -

×

Butterfly's Guide to Weekly Returns with Don Kaufman

1 × $6.00

Butterfly's Guide to Weekly Returns with Don Kaufman

1 × $6.00 -

×

What Ranks Schema Course with Clint Butler

1 × $23.00

What Ranks Schema Course with Clint Butler

1 × $23.00 -

×

Flipping Cash Rockstar with Lucas Adamski

1 × $6.00

Flipping Cash Rockstar with Lucas Adamski

1 × $6.00 -

×

5 Part Daytrading Course with Kevin Haggerty

1 × $6.00

5 Part Daytrading Course with Kevin Haggerty

1 × $6.00 -

×

Natural Squares Calculator with Lambert-Gann Educators

1 × $6.00

Natural Squares Calculator with Lambert-Gann Educators

1 × $6.00 -

×

Naked Forex: High-Probability Techniques for Trading Without Indicators (2012) with Alex Nekritin & Walter Peters

1 × $6.00

Naked Forex: High-Probability Techniques for Trading Without Indicators (2012) with Alex Nekritin & Walter Peters

1 × $6.00 -

×

Oliver Velez - Core, Swing, Guerrilla, Momentum Trading, Micro Trading Tactics

1 × $23.00

Oliver Velez - Core, Swing, Guerrilla, Momentum Trading, Micro Trading Tactics

1 × $23.00 -

×

Power Cycle Trading - Boot Camp for Swing Trading

1 × $6.00

Power Cycle Trading - Boot Camp for Swing Trading

1 × $6.00 -

×

Selling Options For A Living Class with Don Kaufman

1 × $6.00

Selling Options For A Living Class with Don Kaufman

1 × $6.00 -

×

Toolkit For Thinkorswim with Bigtrends

1 × $54.00

Toolkit For Thinkorswim with Bigtrends

1 × $54.00 -

×

Trading With Venus

1 × $31.00

Trading With Venus

1 × $31.00 -

×

Jim Rickards Intelligence Triggers with Agora Financial

1 × $5.00

Jim Rickards Intelligence Triggers with Agora Financial

1 × $5.00 -

×

Profit in the Futures Markets! with Jack Bernstein

1 × $6.00

Profit in the Futures Markets! with Jack Bernstein

1 × $6.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00

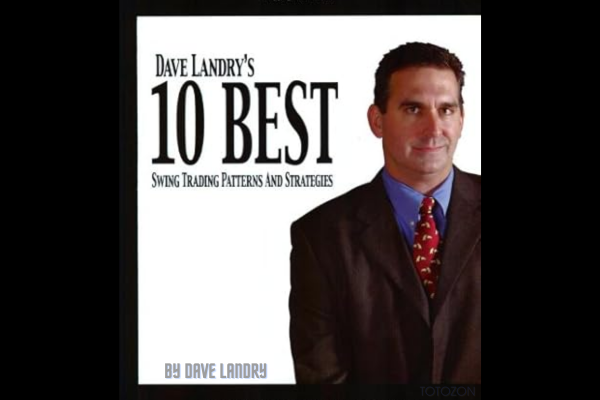

10 Best Swing Trading Patterns & Strategies with Dave Landry

$4.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

10 Best Swing Trading Patterns & Strategies with Dave Landry

Introduction

Swing trading is a popular strategy that capitalizes on short- to medium-term price movements in the stock market. In this article, we delve into the 10 best swing trading patterns and strategies championed by renowned trader Dave Landry. These methods are designed to help traders identify profitable opportunities and maximize their returns.

What is Swing Trading?

Swing trading involves holding positions for several days to weeks, aiming to profit from expected price moves. Unlike day trading, which requires constant monitoring, swing trading offers more flexibility, making it ideal for those with other commitments.

Why Choose Swing Trading?

- Flexibility: Less time-intensive than day trading.

- Potential for High Returns: Captures significant price swings.

- Accessibility: Suitable for beginners and experienced traders alike.

Dave Landry’s Swing Trading Philosophy

Dave Landry is a well-known trader and author with a practical approach to swing trading. His strategies focus on simplicity and effectiveness, making them accessible to traders at all levels.

Core Principles

- Trend Following: Trade in the direction of the prevailing trend.

- Pattern Recognition: Identify repeatable chart patterns.

- Risk Management: Use stop-loss orders to protect capital.

1. The Bowtie Pattern

Identifying the Bowtie Pattern

The Bowtie pattern is a trend reversal signal that occurs when three moving averages converge and then spread out. This pattern can indicate a shift in market sentiment.

Trading the Bowtie Pattern

- Entry Point: Enter when the moving averages start to diverge.

- Exit Point: Set a stop-loss below the recent low (for long positions).

2. The First Thrust Pattern

Understanding the First Thrust Pattern

This pattern signifies the beginning of a new trend following a sharp price movement. It’s characterized by a strong price thrust in the direction of the new trend.

Trading the First Thrust Pattern

- Entry Point: Enter at the close of the first thrust bar.

- Exit Point: Use trailing stops to lock in profits.

3. The Trend Knockout (TKO) Pattern

Spotting the TKO Pattern

The TKO pattern is a continuation signal in an established trend. It occurs when a price pullback “knocks out” weak hands, providing a buying opportunity.

Trading the TKO Pattern

- Entry Point: Enter after the pullback shows signs of reversing.

- Exit Point: Place a stop-loss below the pullback low.

4. The Pullback Strategy

Recognizing Pullbacks

Pullbacks are temporary reversals in a trend, providing opportunities to enter trades at better prices. They are often followed by a continuation of the trend.

Trading Pullbacks

- Entry Point: Enter when the price resumes the trend direction.

- Exit Point: Set a stop-loss just below the pullback low.

5. The Persistent Pullback Strategy

Defining Persistent Pullbacks

A persistent pullback shows a series of small, consecutive price movements against the trend, indicating strong underlying support.

Trading Persistent Pullbacks

- Entry Point: Enter when the pullback loses momentum.

- Exit Point: Use a tight stop-loss to manage risk.

6. The Cup and Handle Pattern

Identifying the Cup and Handle

This bullish continuation pattern resembles a cup with a handle. It indicates a period of consolidation followed by a breakout.

Trading the Cup and Handle

- Entry Point: Enter on the breakout above the handle’s resistance.

- Exit Point: Place a stop-loss below the handle’s low.

7. The Flag Pattern

Understanding Flag Patterns

Flag patterns are short-term continuation patterns that occur after a sharp price movement, indicating a brief consolidation before the trend resumes.

Trading Flag Patterns

- Entry Point: Enter on the breakout from the flag pattern.

- Exit Point: Use a stop-loss below the flag’s low.

8. The Wedge Pattern

Spotting Wedge Patterns

Wedge patterns form when price moves within converging trend lines, signaling a potential reversal or continuation depending on the direction of the breakout.

Trading Wedge Patterns

- Entry Point: Enter on the breakout from the wedge.

- Exit Point: Set a stop-loss below the recent low (for upward breakouts).

9. The Double Bottom Pattern

Recognizing Double Bottoms

A double bottom is a bullish reversal pattern that forms after two unsuccessful attempts to break below a support level.

Trading Double Bottoms

- Entry Point: Enter on the breakout above the pattern’s high.

- Exit Point: Place a stop-loss below the recent low.

10. The Head and Shoulders Pattern

Identifying Head and Shoulders

The head and shoulders pattern is a reversal pattern that indicates a shift from bullish to bearish (or vice versa). It’s composed of a peak (head) flanked by two smaller peaks (shoulders).

Trading Head and Shoulders

- Entry Point: Enter on the breakout below the neckline (for bearish reversals).

- Exit Point: Set a stop-loss above the right shoulder.

Conclusion

Mastering swing trading patterns and strategies with Dave Landry’s guidance can significantly enhance your trading success. By understanding and applying these techniques, you can capitalize on market movements and achieve consistent profitability. Remember, the key to successful swing trading lies in patience, discipline, and continuous learning.

Commonly Asked Questions:

- Business Model Innovation: Accept the truth of a legitimate business! Our strategy is organising a group buy in which participants share the costs. We use these cash to acquire popular courses from sale pages and make them available to people with limited financial resources. Despite the authors’ worries, our clients love the cost and accessibility we give.

- The Legal Environment: Yes or No The legality of our activity is ambiguous. While we don’t have specific permission from the course authors to resell the material, there is a technicality at work. The author did not specify any limits on resale when purchasing the course. This legal intricacy is both an opportunity for us and a boon for individuals looking for low-cost access.

- Quality Control: Uncovering the Truth

Getting to the heart of the issue – quality. Purchasing the course straight from the sale page guarantees that all documents and resources are the same as those obtained through traditional channels.

However, we distinguish ourselves by going beyond personal research and resale. It is crucial to note that we are not the official course providers, which means that the following premium services are not included in our package:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not permitted.

- No access to the author’s private membership forum.

- There is no direct email support available from the author or their team.

We operate independently, with the goal of bridging the pricing gap without the extra services provided by official course channels. Your comprehension of our distinct approach is much appreciated.

Be the first to review “10 Best Swing Trading Patterns & Strategies with Dave Landry” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.