-

×

Forex Trading Strategies Modules 1-3 Complete Set with Blake Young - Shadow Trader

1 × $54.00

Forex Trading Strategies Modules 1-3 Complete Set with Blake Young - Shadow Trader

1 × $54.00 -

×

Zero to Hero Course with EVO Capital

1 × $13.00

Zero to Hero Course with EVO Capital

1 × $13.00 -

×

MTA Master Trader Academy with Junior Charles

1 × $5.00

MTA Master Trader Academy with Junior Charles

1 × $5.00 -

×

AM Trader - Strategy Training Course

1 × $23.00

AM Trader - Strategy Training Course

1 × $23.00 -

×

A PLAN TO MAKE $4K MONTHLY ON $20K with Dan Sheridan - Sheridan Options Mentoring

1 × $15.00

A PLAN TO MAKE $4K MONTHLY ON $20K with Dan Sheridan - Sheridan Options Mentoring

1 × $15.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Hit and Run Trading Updated Version with Jeff Cooper

1 × $6.00

Hit and Run Trading Updated Version with Jeff Cooper

1 × $6.00 -

×

Stock Market 101 with Sabrina Peterson

1 × $4.00

Stock Market 101 with Sabrina Peterson

1 × $4.00 -

×

ZipTraderU 2023 with ZipTrader

1 × $5.00

ZipTraderU 2023 with ZipTrader

1 × $5.00 -

×

Option Express Plugin

1 × $6.00

Option Express Plugin

1 × $6.00 -

×

Perfecting Execution and Trade Management Online Masterclass with The Trading Framework

1 × $6.00

Perfecting Execution and Trade Management Online Masterclass with The Trading Framework

1 × $6.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

VintagEducation - The Fast Track Forex Bootcamp

1 × $6.00

VintagEducation - The Fast Track Forex Bootcamp

1 × $6.00 -

×

Order Flow With The Power Of Point Of Control Course and The Imbalance

1 × $6.00

Order Flow With The Power Of Point Of Control Course and The Imbalance

1 × $6.00 -

×

Trading to Win (Seminar WorkBook 2003) with Bruce Gilmore

1 × $6.00

Trading to Win (Seminar WorkBook 2003) with Bruce Gilmore

1 × $6.00 -

×

Rob’s Swing Trading Methods with Rob Hoffman

1 × $39.00

Rob’s Swing Trading Methods with Rob Hoffman

1 × $39.00 -

×

Alpha Quant Program with Lucas Inglese - Quantreo

1 × $15.00

Alpha Quant Program with Lucas Inglese - Quantreo

1 × $15.00 -

×

Virtual Intensive Trader Training

1 × $31.00

Virtual Intensive Trader Training

1 × $31.00 -

×

How Big Money Trades A Key Aspect of Systems Thinking - Van Tharp and Chuck Whitman – Van Tharp

1 × $46.00

How Big Money Trades A Key Aspect of Systems Thinking - Van Tharp and Chuck Whitman – Van Tharp

1 × $46.00 -

×

CFA Level 1,2,3 - Study Guides 2006

1 × $6.00

CFA Level 1,2,3 - Study Guides 2006

1 × $6.00 -

×

Module 4 Elliot Wave and Identify Wave Count

1 × $31.00

Module 4 Elliot Wave and Identify Wave Count

1 × $31.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

Newsbeat Master Class Recording

1 × $39.00

Newsbeat Master Class Recording

1 × $39.00 -

×

The Trap Trade Workshop with Doc Severson

1 × $6.00

The Trap Trade Workshop with Doc Severson

1 × $6.00 -

×

Trading Online

1 × $6.00

Trading Online

1 × $6.00 -

×

Mastering Momentum Gaps with Toni Hansen

1 × $6.00

Mastering Momentum Gaps with Toni Hansen

1 × $6.00 -

×

Monthly Newsletter 99-01 with Elliott Wave Theorist

1 × $6.00

Monthly Newsletter 99-01 with Elliott Wave Theorist

1 × $6.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

Pips University

1 × $6.00

Pips University

1 × $6.00 -

×

Trading Spreads and Seasonals (tradingeducators.com)

1 × $6.00

Trading Spreads and Seasonals (tradingeducators.com)

1 × $6.00 -

×

The Hidden Order Within Stock Prices with Clay Allen

1 × $6.00

The Hidden Order Within Stock Prices with Clay Allen

1 × $6.00 -

×

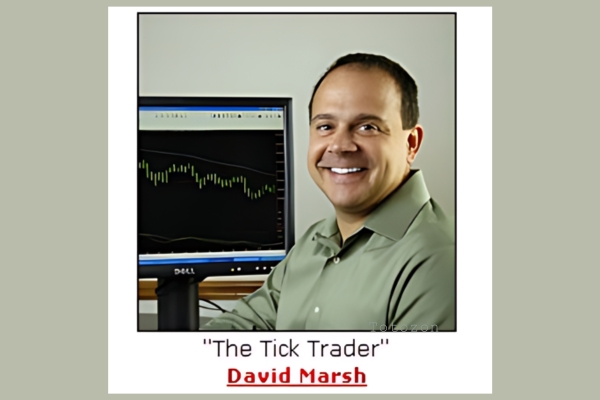

Tick Trader Day Trading Course with David Marsh

1 × $6.00

Tick Trader Day Trading Course with David Marsh

1 × $6.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

NORMAN HALLETT SIMPLE TRADING PLANS

1 × $31.00

NORMAN HALLETT SIMPLE TRADING PLANS

1 × $31.00 -

×

TraderSumo Academy Course

1 × $13.00

TraderSumo Academy Course

1 × $13.00 -

×

Trend Trading Techniques with Rob Hoffman

1 × $6.00

Trend Trading Techniques with Rob Hoffman

1 × $6.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

The Nature of Risk with Justin Mamis

1 × $6.00

The Nature of Risk with Justin Mamis

1 × $6.00 -

×

Time, Price & Pattern with John Crane

1 × $6.00

Time, Price & Pattern with John Crane

1 × $6.00 -

×

Carolyn Boroden Package

1 × $15.00

Carolyn Boroden Package

1 × $15.00 -

×

Activedaytrader - Workshop Options For Income

1 × $15.00

Activedaytrader - Workshop Options For Income

1 × $15.00 -

×

FX GOAT 3.0 (ALL IN ONE) with FX GOAT FOREX TRADING ACADEMY

1 × $5.00

FX GOAT 3.0 (ALL IN ONE) with FX GOAT FOREX TRADING ACADEMY

1 × $5.00 -

×

Mastermind Bootcamp + Core Concepts Mastery with DreamsFX

1 × $6.00

Mastermind Bootcamp + Core Concepts Mastery with DreamsFX

1 × $6.00 -

×

Avoiding Trading Mistakes with Mark D.Cook

1 × $6.00

Avoiding Trading Mistakes with Mark D.Cook

1 × $6.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

The Full EMA Strategy with King Of Forex

1 × $5.00

The Full EMA Strategy with King Of Forex

1 × $5.00 -

×

Low Timeframe Supply and Demand with SMC Gelo

1 × $5.00

Low Timeframe Supply and Demand with SMC Gelo

1 × $5.00 -

×

Online Trading Academy Professional Trader Series (7 Day Complete)

1 × $6.00

Online Trading Academy Professional Trader Series (7 Day Complete)

1 × $6.00 -

×

LBFX Academy Training Course

1 × $5.00

LBFX Academy Training Course

1 × $5.00 -

×

Managing By The Greeks (6 Classes) Sept 2010 [9 Videos(mp4) 11 docs(pdf)] by Dan Sheridan

1 × $6.00

Managing By The Greeks (6 Classes) Sept 2010 [9 Videos(mp4) 11 docs(pdf)] by Dan Sheridan

1 × $6.00 -

×

Inside the House of Money (2006) with Steven Drobny

1 × $6.00

Inside the House of Money (2006) with Steven Drobny

1 × $6.00 -

×

Bear Trap Indicator with Markay Latimer

1 × $5.00

Bear Trap Indicator with Markay Latimer

1 × $5.00 -

×

BGFX Trading Academy

1 × $5.00

BGFX Trading Academy

1 × $5.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

The City Traders Course with Andrew Lockwood

1 × $10.00

The City Traders Course with Andrew Lockwood

1 × $10.00 -

×

Market Stalkers Level 2 - Daytrading College (2020)

1 × $8.00

Market Stalkers Level 2 - Daytrading College (2020)

1 × $8.00 -

×

GANNacci Code Elite + Training Course

1 × $31.00

GANNacci Code Elite + Training Course

1 × $31.00 -

×

The Ultimate Trading Course Elite & Complete Guide with Sean Dekmar

1 × $31.00

The Ultimate Trading Course Elite & Complete Guide with Sean Dekmar

1 × $31.00 -

×

Your Next Great Stock: How to Screen the Market for Tomorrow's Top Performers with Jack Hough

1 × $6.00

Your Next Great Stock: How to Screen the Market for Tomorrow's Top Performers with Jack Hough

1 × $6.00 -

×

Basic Day Trading Techniques with Michael Jenkins

1 × $6.00

Basic Day Trading Techniques with Michael Jenkins

1 × $6.00 -

×

Phantom of the Pit BY Art Simpson

1 × $6.00

Phantom of the Pit BY Art Simpson

1 × $6.00 -

×

Trading The Kaltbaum Seven-Step Methodology with Gary Kaltbaum

1 × $4.00

Trading The Kaltbaum Seven-Step Methodology with Gary Kaltbaum

1 × $4.00 -

×

Price Ladder Training

1 × $15.00

Price Ladder Training

1 × $15.00 -

×

Trading Options as a Professional: Techniques for Market Makers and Experienced Traders with James Bittman

1 × $6.00

Trading Options as a Professional: Techniques for Market Makers and Experienced Traders with James Bittman

1 × $6.00 -

×

Orderflows Gems 2-Private Sessions with Mike Valtos

1 × $20.00

Orderflows Gems 2-Private Sessions with Mike Valtos

1 × $20.00 -

×

The Subtle Trap of Trading with Brian McAboy

1 × $6.00

The Subtle Trap of Trading with Brian McAboy

1 × $6.00 -

×

Leading Indicators

1 × $23.00

Leading Indicators

1 × $23.00 -

×

Cwesi Forex Trading Bootcamp (Algo Trading)

1 × $13.00

Cwesi Forex Trading Bootcamp (Algo Trading)

1 × $13.00 -

×

Practical Speculation with Victor Niederhoffer, Laurel Kenner

1 × $6.00

Practical Speculation with Victor Niederhoffer, Laurel Kenner

1 × $6.00 -

×

Andy’s EMini Bar – 40 Min System with Joe Ross

1 × $6.00

Andy’s EMini Bar – 40 Min System with Joe Ross

1 × $6.00 -

×

The EAP Training Program (Apr 2019)

1 × $6.00

The EAP Training Program (Apr 2019)

1 × $6.00 -

×

Beat The Binaries

1 × $15.00

Beat The Binaries

1 × $15.00 -

×

The Tyler Method For Successful Triangle Trading with Chris Tyler

1 × $6.00

The Tyler Method For Successful Triangle Trading with Chris Tyler

1 × $6.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

Kaizen On-Demand By Candle Charts

1 × $6.00

Kaizen On-Demand By Candle Charts

1 × $6.00 -

×

Masterclass 3.0 with RockzFX Academy

1 × $6.00

Masterclass 3.0 with RockzFX Academy

1 × $6.00 -

×

FX Savages Courses Collection

1 × $7.00

FX Savages Courses Collection

1 × $7.00 -

×

60 Minute Trader with Chris Kobewka

1 × $6.00

60 Minute Trader with Chris Kobewka

1 × $6.00 -

×

Hedged Strategy Series in Volatile Markets All 4 with Dan Sheridan

1 × $15.00

Hedged Strategy Series in Volatile Markets All 4 with Dan Sheridan

1 × $15.00 -

×

MTPredictor RT build 45 for Tradestation, eSignal, NinjaTrader (mtpredictor.com)

1 × $6.00

MTPredictor RT build 45 for Tradestation, eSignal, NinjaTrader (mtpredictor.com)

1 × $6.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00

Ultimate Guide To Swing Trading ETF’s

$590.00 Original price was: $590.00.$23.00Current price is: $23.00.

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Ultimate Guide To Swing Trading ETFs

Introduction

Swing trading Exchange Traded Funds (ETFs) can be a highly profitable strategy for both novice and experienced traders. By capturing short to medium-term gains, swing traders can take advantage of market volatility. This guide provides a comprehensive look at swing trading ETFs, covering everything from the basics to advanced strategies.

What is Swing Trading?

Overview

Swing trading is a strategy that involves holding positions for several days to weeks to capitalize on expected market moves. Unlike day trading, swing trading focuses on short to medium-term gains.

Key Features

- Time Frame: Positions held for days to weeks.

- Objective: Capture gains from market “swings”.

- Tools: Technical analysis and market trends.

What are ETFs?

Definition

ETFs are investment funds that trade on stock exchanges, similar to individual stocks. They hold assets like stocks, commodities, or bonds and typically track an index.

Benefits of Trading ETFs

- Diversification: Access to a broad range of assets.

- Liquidity: ETFs can be bought and sold like stocks.

- Lower Costs: Generally lower expense ratios compared to mutual funds.

Why Swing Trade ETFs?

Advantages

Swing trading ETFs offers several advantages:

- Flexibility: Suitable for part-time traders.

- Leverage: Potential for higher returns through leveraged ETFs.

- Risk Management: Easier to diversify and manage risk.

Market Opportunities

ETFs cover various sectors, commodities, and indices, providing numerous opportunities for swing trading.

Getting Started with Swing Trading ETFs

Choosing the Right ETFs

Factors to Consider

- Liquidity: High trading volume ensures easy entry and exit.

- Volatility: More volatile ETFs provide better swing trading opportunities.

- Trend Analysis: Choose ETFs with clear trends.

Setting Up Your Trading Platform

Ensure your trading platform supports ETF trading and provides necessary tools for technical analysis.

Technical Analysis for Swing Trading ETFs

Key Indicators

Moving Averages

- Simple Moving Average (SMA): Average price over a specific period.

- Exponential Moving Average (EMA): Gives more weight to recent prices.

Relative Strength Index (RSI)

Measures the speed and change of price movements to identify overbought or oversold conditions.

MACD (Moving Average Convergence Divergence)

Shows the relationship between two moving averages to indicate momentum.

Chart Patterns

Identify common chart patterns like head and shoulders, triangles, and flags to predict market movements.

Developing a Swing Trading Strategy

Define Your Goals

Set clear, achievable trading goals to guide your strategy.

Risk Management

Stop-Loss Orders

Protect against significant losses by setting stop-loss orders.

Position Sizing

Determine the size of each trade based on your risk tolerance.

Entry and Exit Points

Use technical indicators and chart patterns to determine optimal entry and exit points.

Executing Swing Trades

Placing Trades

- Market Orders: Buy or sell at the current market price.

- Limit Orders: Buy or sell at a specific price.

Monitoring Your Trades

Keep an eye on market conditions and adjust your positions as needed.

Advanced Swing Trading Techniques

Leveraged ETFs

Use leveraged ETFs to amplify potential gains, but be aware of the increased risk.

Short Selling

Profit from declining markets by short selling ETFs.

Hedging Strategies

Protect your portfolio against adverse market movements with hedging techniques.

Common Mistakes to Avoid

Overtrading

Avoid the temptation to trade too frequently, which can lead to unnecessary losses.

Ignoring Market Trends

Always consider the broader market trends when making trading decisions.

Poor Risk Management

Ensure you have a robust risk management plan in place to protect your capital.

Case Studies

Successful Swing Trades

Analyze successful swing trades to understand effective strategies.

Learning from Failures

Review failed trades to identify and learn from mistakes.

Resources for Swing Traders

Books and Courses

- “Swing Trading for Dummies” by Omar Bassal

- “Mastering the Trade” by John F. Carter

Online Communities

Join online forums and communities to share insights and learn from other traders.

Conclusion

Swing trading ETFs can be a rewarding strategy when done correctly. By understanding the basics, utilizing technical analysis, and developing a solid strategy, you can take advantage of market swings to achieve your trading goals. Start small, stay disciplined, and continually refine your approach to become a successful swing trader.

Commonly Asked Questions:

- Business Model Innovation: Accept the truth of a legitimate business! Our strategy is organising a group buy in which participants share the costs. We use these cash to acquire popular courses from sale pages and make them available to people with limited financial resources. Despite the authors’ worries, our clients love the cost and accessibility we give.

- The Legal Environment: Yes or No The legality of our activity is ambiguous. While we don’t have specific permission from the course authors to resell the material, there is a technicality at work. The author did not specify any limits on resale when purchasing the course. This legal intricacy is both an opportunity for us and a boon for individuals looking for low-cost access.

- Quality Control: Uncovering the Truth

Getting to the heart of the issue – quality. Purchasing the course straight from the sale page guarantees that all documents and resources are the same as those obtained through traditional channels.

However, we distinguish ourselves by going beyond personal research and resale. It is crucial to note that we are not the official course providers, which means that the following premium services are not included in our package:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not permitted.

- No access to the author’s private membership forum.

- There is no direct email support available from the author or their team.

We operate independently, with the goal of bridging the pricing gap without the extra services provided by official course channels. Your comprehension of our distinct approach is much appreciated.

Be the first to review “Ultimate Guide To Swing Trading ETF’s” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Reviews

There are no reviews yet.