-

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

Financial Fortress with TradeSmart University

1 × $6.00

Financial Fortress with TradeSmart University

1 × $6.00 -

×

Catching the Bounce

1 × $6.00

Catching the Bounce

1 × $6.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

Strategic Swing Trader with Sami Abusaad

1 × $6.00

Strategic Swing Trader with Sami Abusaad

1 × $6.00 -

×

A Complete Beginner to Advanced Trading Mentorship Program with Habby Forex Trading Academy

1 × $5.00

A Complete Beginner to Advanced Trading Mentorship Program with Habby Forex Trading Academy

1 × $5.00 -

×

Secrets of the Darvas Trading System

1 × $6.00

Secrets of the Darvas Trading System

1 × $6.00 -

×

Currency Trading for Dummies with Mark Galant

1 × $6.00

Currency Trading for Dummies with Mark Galant

1 × $6.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Essential Stock Picking Strategies with Daniel Strachman

1 × $6.00

Essential Stock Picking Strategies with Daniel Strachman

1 × $6.00 -

×

Artificial Neural Networks Technology with Dave Anderson, George McNeill

1 × $6.00

Artificial Neural Networks Technology with Dave Anderson, George McNeill

1 × $6.00 -

×

MACD Divergence Fully Automatic Indicator for ThinkOrSwim TOS

1 × $6.00

MACD Divergence Fully Automatic Indicator for ThinkOrSwim TOS

1 × $6.00 -

×

The Adventures of the Cycle Hunter. The Trader with Craig Bttlc

1 × $6.00

The Adventures of the Cycle Hunter. The Trader with Craig Bttlc

1 × $6.00 -

×

The Reducing Risk and Maximizing Returns Blueprint (Atomic Hedge Strategy) with Don Kaufman

1 × $6.00

The Reducing Risk and Maximizing Returns Blueprint (Atomic Hedge Strategy) with Don Kaufman

1 × $6.00 -

×

Forex Retracement Theory with CopperChips

1 × $6.00

Forex Retracement Theory with CopperChips

1 × $6.00 -

×

Trading a Living Thing (Article) with David Bowden

1 × $6.00

Trading a Living Thing (Article) with David Bowden

1 × $6.00 -

×

How to Buy Stocks Before They Skyrocket

1 × $6.00

How to Buy Stocks Before They Skyrocket

1 × $6.00 -

×

Your Next Great Stock: How to Screen the Market for Tomorrow's Top Performers with Jack Hough

1 × $6.00

Your Next Great Stock: How to Screen the Market for Tomorrow's Top Performers with Jack Hough

1 × $6.00 -

×

Trading Hub 4.0 with Mr. Khan

1 × $27.00

Trading Hub 4.0 with Mr. Khan

1 × $27.00 -

×

Simpler Options - Double Diagonals Class

1 × $6.00

Simpler Options - Double Diagonals Class

1 × $6.00 -

×

Day Trading For 50 Years PDF with Michael Jenkins

1 × $6.00

Day Trading For 50 Years PDF with Michael Jenkins

1 × $6.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

The Instagram DM Automation Playbook with Natasha Takahashi

1 × $6.00

The Instagram DM Automation Playbook with Natasha Takahashi

1 × $6.00 -

×

3 Day Master Advanced Workshop Seminar (Video & Manuals 8.48 GB)

1 × $6.00

3 Day Master Advanced Workshop Seminar (Video & Manuals 8.48 GB)

1 × $6.00 -

×

Fast Start Barter System with Bob Meyer

1 × $31.00

Fast Start Barter System with Bob Meyer

1 × $31.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Fibonacci Mastery Course: Complete Guide to Trading with Fib By Todd Gordon

1 × $62.00

Fibonacci Mastery Course: Complete Guide to Trading with Fib By Todd Gordon

1 × $62.00 -

×

Get to know the VIX Index (aka The Fear Index)

1 × $15.00

Get to know the VIX Index (aka The Fear Index)

1 × $15.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

5 Steps to Investment Success with Tyler Bolhorn

1 × $6.00

5 Steps to Investment Success with Tyler Bolhorn

1 × $6.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Candlestick Patterns to Master Forex Trading Price Action with Federico Sellitti

1 × $6.00

Candlestick Patterns to Master Forex Trading Price Action with Federico Sellitti

1 × $6.00 -

×

Timing the Market with Unique Indicators with Sherman McCellan

1 × $6.00

Timing the Market with Unique Indicators with Sherman McCellan

1 × $6.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

Forex Trading Course. Turn $1,260 Into $12,300 In 30 Days with David Arena

1 × $6.00

Forex Trading Course. Turn $1,260 Into $12,300 In 30 Days with David Arena

1 × $6.00 -

×

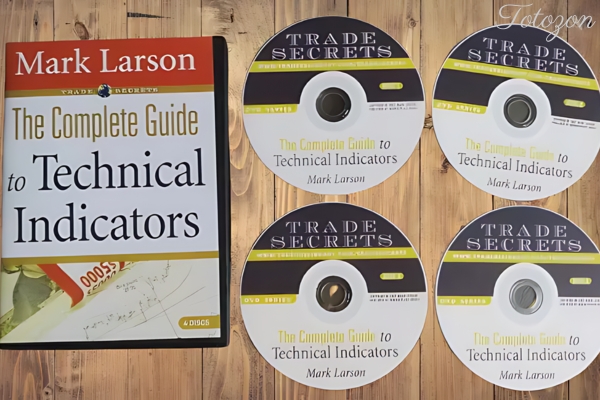

The Complete Guide to Technical Indicators with Mark Larson

1 × $6.00

The Complete Guide to Technical Indicators with Mark Larson

1 × $6.00 -

×

Professor Jeff Bierman's 15 Class Bundle (The Professor's Package)

1 × $6.00

Professor Jeff Bierman's 15 Class Bundle (The Professor's Package)

1 × $6.00 -

×

How to Manage a $25,000 Portfolio with Dan Sheridan - Sheridan Options Mentoring

1 × $6.00

How to Manage a $25,000 Portfolio with Dan Sheridan - Sheridan Options Mentoring

1 × $6.00 -

×

Advanced Options Trading with Lucas Downey

1 × $15.00

Advanced Options Trading with Lucas Downey

1 × $15.00 -

×

Advanced Forex Trading Momentum vs Reversals with Indicators Webinar - Mark Whistler

1 × $6.00

Advanced Forex Trading Momentum vs Reversals with Indicators Webinar - Mark Whistler

1 × $6.00 -

×

Cyber Trading University - Power Trading 7 CD

1 × $8.00

Cyber Trading University - Power Trading 7 CD

1 × $8.00 -

×

Million Dollar Stock Market Idea with Larry Williams

1 × $6.00

Million Dollar Stock Market Idea with Larry Williams

1 × $6.00 -

×

Trading with MORE Special Set-ups - Recorded Webinar

1 × $15.00

Trading with MORE Special Set-ups - Recorded Webinar

1 × $15.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Mapping the Markets: A Guide to Stock Market Analysis with Deborah Owen & Robin Griffiths

1 × $6.00

Mapping the Markets: A Guide to Stock Market Analysis with Deborah Owen & Robin Griffiths

1 × $6.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

Math Trading Course 2023

1 × $34.00

Math Trading Course 2023

1 × $34.00 -

×

An Empirical Ananlysis of Stock Market Sentiment (Article) with Andrea Terzi

1 × $6.00

An Empirical Ananlysis of Stock Market Sentiment (Article) with Andrea Terzi

1 × $6.00 -

×

Option Trading: Pricing and Volatility Strategies and Techniques with Euan Sinclair

1 × $6.00

Option Trading: Pricing and Volatility Strategies and Techniques with Euan Sinclair

1 × $6.00 -

×

Renko Profits Accelerator

1 × $15.00

Renko Profits Accelerator

1 × $15.00 -

×

Master Trader with InvestingSimple

1 × $15.00

Master Trader with InvestingSimple

1 × $15.00 -

×

Gillen Predicts with Jack Gillen

1 × $6.00

Gillen Predicts with Jack Gillen

1 × $6.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

Confidence to Hypnotize

1 × $6.00

Confidence to Hypnotize

1 × $6.00 -

×

Activedaytrader - Mastering Technicals

1 × $15.00

Activedaytrader - Mastering Technicals

1 × $15.00 -

×

Spyglass LSS Day Trading Workshop

1 × $15.00

Spyglass LSS Day Trading Workshop

1 × $15.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

Superstructure Trading - 5 DVDs + Manual + 1 BONUS DVD 2010 Live Trading Webinars with Ken Chow

1 × $6.00

Superstructure Trading - 5 DVDs + Manual + 1 BONUS DVD 2010 Live Trading Webinars with Ken Chow

1 × $6.00 -

×

Fibonacci Trading & Dynamic Profit Targeting with Base Camp Trading

1 × $15.00

Fibonacci Trading & Dynamic Profit Targeting with Base Camp Trading

1 × $15.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

Larry Williams Newsletters (1994-1997)

1 × $6.00

Larry Williams Newsletters (1994-1997)

1 × $6.00 -

×

London Close Trade 2.0 with Shirley Hudson & Vic Noble - Forex Mentor

1 × $5.00

London Close Trade 2.0 with Shirley Hudson & Vic Noble - Forex Mentor

1 × $5.00 -

×

Profiting In Bull Or Bear Markets with George Dagnino

1 × $6.00

Profiting In Bull Or Bear Markets with George Dagnino

1 × $6.00 -

×

AG Trading Journal with Ace Gazette

1 × $6.00

AG Trading Journal with Ace Gazette

1 × $6.00 -

×

Divorcing the Dow: Using Revolutionary Market Indicators to Profit from the Stealth Boom Ahead - Jim Troup & Sharon Michalsky

1 × $6.00

Divorcing the Dow: Using Revolutionary Market Indicators to Profit from the Stealth Boom Ahead - Jim Troup & Sharon Michalsky

1 × $6.00 -

×

Proven Swing Trading Strat & Multiple Time Frame Analysis - Robert Krausz & Thom Hartle

1 × $6.00

Proven Swing Trading Strat & Multiple Time Frame Analysis - Robert Krausz & Thom Hartle

1 × $6.00 -

×

Follow the Leader Trading System with Anthony Gibson

1 × $6.00

Follow the Leader Trading System with Anthony Gibson

1 × $6.00 -

×

The Crypto Code with Joel Peterson - Adam Short

1 × $15.00

The Crypto Code with Joel Peterson - Adam Short

1 × $15.00 -

×

Power FX Xtreme BuySell EA

1 × $23.00

Power FX Xtreme BuySell EA

1 × $23.00 -

×

Advanced Trading Techniques 2 CDs with Sammy Chua

1 × $6.00

Advanced Trading Techniques 2 CDs with Sammy Chua

1 × $6.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Ron Wagner - Creating a Profitable Trading & Investing Plan + Techniques to Perfect Your Intraday GAP

1 × $6.00

Ron Wagner - Creating a Profitable Trading & Investing Plan + Techniques to Perfect Your Intraday GAP

1 × $6.00 -

×

Small Account Options Trading Workshop Package with Doc Severson

1 × $6.00

Small Account Options Trading Workshop Package with Doc Severson

1 × $6.00 -

×

Trade Options Like a DPM with The Admiral Webinar Series with Hamzei Analytics

1 × $6.00

Trade Options Like a DPM with The Admiral Webinar Series with Hamzei Analytics

1 × $6.00 -

×

Advanced Course with Dimitri Wallace - Gold Minds Global

1 × $6.00

Advanced Course with Dimitri Wallace - Gold Minds Global

1 × $6.00 -

×

Practical Speculation with Victor Niederhoffer, Laurel Kenner

1 × $6.00

Practical Speculation with Victor Niederhoffer, Laurel Kenner

1 × $6.00 -

×

Day Trading Insight with Al Brooks

1 × $10.00

Day Trading Insight with Al Brooks

1 × $10.00 -

×

Nora Bystra Legacy International Complete Course

1 × $6.00

Nora Bystra Legacy International Complete Course

1 × $6.00 -

×

Sang Lucci Master Course 2021 with Sang Lucci

1 × $6.00

Sang Lucci Master Course 2021 with Sang Lucci

1 × $6.00 -

×

Day Trading with Volume Profile and Orderflow - Price Action Volume Trader

1 × $6.00

Day Trading with Volume Profile and Orderflow - Price Action Volume Trader

1 × $6.00 -

×

Big Boy Volume Spread Analysis + Advanced Price Action Mastery Course with Kai Sheng Chew

1 × $15.00

Big Boy Volume Spread Analysis + Advanced Price Action Mastery Course with Kai Sheng Chew

1 × $15.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

More on the Short Cycles of Interest Rates (Article) with Arie Melnik, Alan Kraus

1 × $6.00

More on the Short Cycles of Interest Rates (Article) with Arie Melnik, Alan Kraus

1 × $6.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

Become A Quant Trader Bundle with Lachezar Haralampiev & Radoslav Haralampiev - Quant Factory

1 × $17.00

Become A Quant Trader Bundle with Lachezar Haralampiev & Radoslav Haralampiev - Quant Factory

1 × $17.00 -

×

Relationship of the StockMarket Fluctuations to the Lunarcycle with Frank J.Guarino

1 × $6.00

Relationship of the StockMarket Fluctuations to the Lunarcycle with Frank J.Guarino

1 × $6.00 -

×

All About Market Timing with Leslie N.Masonson

1 × $6.00

All About Market Timing with Leslie N.Masonson

1 × $6.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00

SWING TRADING WITH CONFIDENCE

$499.00 Original price was: $499.00.$31.00Current price is: $31.00.

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Swing Trading with Confidence

Swing trading is a popular trading strategy that focuses on capturing short- to medium-term gains in financial instruments over a period of days to weeks. This article will provide a comprehensive guide to swing trading, helping you develop the skills and confidence needed to succeed in this dynamic market.

Introduction to Swing Trading

What is Swing Trading?

Swing trading aims to capitalize on price swings within a trend. Traders look for opportunities to enter trades at the beginning of a price movement and exit before it reverses.

Why Choose Swing Trading?

Swing trading offers a balance between the rapid pace of day trading and the long-term approach of buy-and-hold investing. It allows traders to take advantage of market volatility without the need for constant monitoring.

Key Principles of Swing Trading

1. Understanding Market Cycles

Market cycles consist of four phases: accumulation, uptrend, distribution, and downtrend. Recognizing these phases can help identify profitable swing trading opportunities.

2. Technical Analysis

Swing traders rely heavily on technical analysis to make informed decisions. This includes studying price charts, identifying patterns, and using technical indicators.

3. Risk Management

Effective risk management is crucial for swing trading success. This involves setting stop-loss orders, determining position sizes, and diversifying your trades.

Essential Tools for Swing Trading

1. Price Charts

Price charts provide a visual representation of an asset’s price movement over time. They are fundamental to technical analysis.

2. Technical Indicators

Indicators such as moving averages, relative strength index (RSI), and MACD help traders identify trends and potential entry and exit points.

3. Trading Platforms

A reliable trading platform with real-time data, charting tools, and execution capabilities is essential for swing trading.

Popular Swing Trading Strategies

1. Trend Following

This strategy involves identifying and following the current trend until it shows signs of reversing. Traders enter trades in the direction of the trend.

2. Breakout Trading

Breakout traders look for assets that break through key resistance or support levels, indicating a strong price movement.

3. Reversal Trading

Reversal trading aims to identify points where a trend is likely to reverse, allowing traders to buy low and sell high (or vice versa).

4. Moving Average Crossovers

This strategy uses moving averages to identify changes in trend direction. For example, a crossover of a shorter-term moving average above a longer-term moving average can signal a buy.

5. Swing Trading with Fibonacci Retracements

Fibonacci retracements help identify potential support and resistance levels, guiding traders on where to enter or exit trades.

How to Get Started with Swing Trading

1. Educate Yourself

Before diving into swing trading, it’s important to educate yourself. Read books, take online courses, and follow financial news to understand the basics.

2. Choose a Broker

Select a broker that offers low commissions, a robust trading platform, and access to the tools you need for swing trading.

3. Develop a Trading Plan

A solid trading plan outlines your strategy, risk management rules, and goals. Stick to your plan to maintain discipline.

4. Start with a Demo Account

Practice with a demo account to build confidence and refine your strategies without risking real money.

5. Begin Trading

Once you’re comfortable, start trading with real money. Begin with small positions and gradually increase your exposure as you gain experience.

Tips for Successful Swing Trading

1. Stay Disciplined

Discipline is key to successful trading. Stick to your plan and avoid emotional decisions.

2. Keep Learning

The market is always changing, and continuous learning is essential. Stay updated with new strategies and market trends.

3. Monitor Your Trades

Regularly review your trades to identify what worked and what didn’t. Use this information to improve your strategies.

4. Manage Your Risk

Never risk more than you can afford to lose. Use stop-loss orders and position sizing to manage your risk.

5. Be Patient

Successful swing trading requires patience. Wait for the right opportunities and don’t rush into trades.

Common Mistakes to Avoid

1. Overtrading

Avoid the temptation to trade too frequently. Focus on quality trades rather than quantity.

2. Ignoring Risk Management

Proper risk management is crucial. Always use stop-loss orders and don’t risk too much on a single trade.

3. Following the Crowd

Make your own decisions based on analysis rather than following the crowd or market hype.

4. Lack of a Trading Plan

Trading without a plan can lead to inconsistent results. Develop and stick to a well-thought-out trading plan.

5. Impatience

Swing trading requires patience. Avoid making impulsive decisions based on short-term market movements.

Conclusion

Swing trading can be a highly rewarding strategy if approached with the right knowledge and discipline. By understanding market cycles, using technical analysis, and managing risk effectively, you can swing trade with confidence. Remember to continuously educate yourself, stay disciplined, and refine your strategies to improve your trading performance.

Commonly Asked Questions:

- Business Model Innovation: Accept the truth of a legitimate business! Our strategy is organising a group buy in which participants share the costs. We use these cash to acquire popular courses from sale pages and make them available to people with limited financial resources. Despite the authors’ worries, our clients love the cost and accessibility we give.

- The Legal Environment: Yes or No The legality of our activity is ambiguous. While we don’t have specific permission from the course authors to resell the material, there is a technicality at work. The author did not specify any limits on resale when purchasing the course. This legal intricacy is both an opportunity for us and a boon for individuals looking for low-cost access.

- Quality Control: Uncovering the Truth

Getting to the heart of the issue – quality. Purchasing the course straight from the sale page guarantees that all documents and resources are the same as those obtained through traditional channels.

However, we distinguish ourselves by going beyond personal research and resale. It is crucial to note that we are not the official course providers, which means that the following premium services are not included in our package:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not permitted.

- No access to the author’s private membership forum.

- There is no direct email support available from the author or their team.

We operate independently, with the goal of bridging the pricing gap without the extra services provided by official course channels. Your comprehension of our distinct approach is much appreciated.

Be the first to review “SWING TRADING WITH CONFIDENCE” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.