-

×

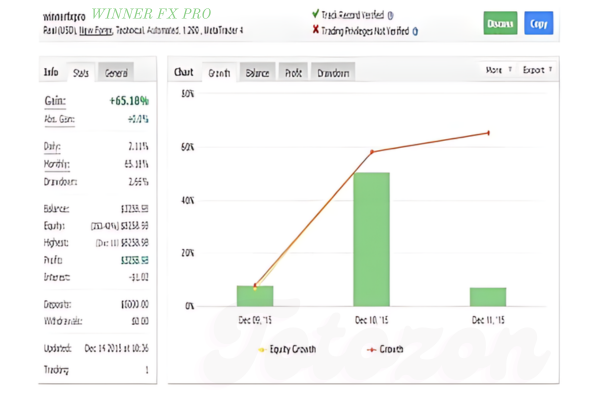

WINNER FX PRO

1 × $15.00

WINNER FX PRO

1 × $15.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

Trading Pro System

1 × $31.00

Trading Pro System

1 × $31.00 -

×

The Oxford Handbook of Political Theory with John Dryzek, Bonnie Honig & Anne Phillips

1 × $6.00

The Oxford Handbook of Political Theory with John Dryzek, Bonnie Honig & Anne Phillips

1 × $6.00 -

×

Trading Psychology, Day-trading & Swing Trading with Alexander Elder

1 × $31.00

Trading Psychology, Day-trading & Swing Trading with Alexander Elder

1 × $31.00 -

×

Schooloftrade - SOT Beginners Course (May 2014)

1 × $23.00

Schooloftrade - SOT Beginners Course (May 2014)

1 × $23.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

The Order Flow Edge Trading Course with Michael Valtos

1 × $20.00

The Order Flow Edge Trading Course with Michael Valtos

1 × $20.00 -

×

INSIDER HEDGE FUND FORMULA (IHFF)

1 × $6.00

INSIDER HEDGE FUND FORMULA (IHFF)

1 × $6.00 -

×

Trading Markets Swing Trading College 2019 with Larry Connor

1 × $5.00

Trading Markets Swing Trading College 2019 with Larry Connor

1 × $5.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Instant Forex Profits Home Study Course

1 × $23.00

Instant Forex Profits Home Study Course

1 × $23.00 -

×

Ultimate Scalping Masterclass 4.0 with RockzFX Academy

1 × $6.00

Ultimate Scalping Masterclass 4.0 with RockzFX Academy

1 × $6.00 -

×

Ultimate Options Trading with Cash Flow Academy

1 × $34.00

Ultimate Options Trading with Cash Flow Academy

1 × $34.00 -

×

Mastering Level 2 with ClayTrader

1 × $197.00

Mastering Level 2 with ClayTrader

1 × $197.00 -

×

The Viper Advanced Program

1 × $13.00

The Viper Advanced Program

1 × $13.00 -

×

Trading The Curran 3-Line Break Method A Professional Strategy For Daytrading The Eminis By Chris Curran

1 × $4.00

Trading The Curran 3-Line Break Method A Professional Strategy For Daytrading The Eminis By Chris Curran

1 × $4.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Trading the Pristine Method 2008 (Videos & Workbooks) with Pristine

1 × $4.00

Trading the Pristine Method 2008 (Videos & Workbooks) with Pristine

1 × $4.00 -

×

InterMarket Analysis (Ed.2004) with John J.Murphy

1 × $6.00

InterMarket Analysis (Ed.2004) with John J.Murphy

1 × $6.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

Big Morning Profits with Base Camp Trading

1 × $4.00

Big Morning Profits with Base Camp Trading

1 × $4.00 -

×

Trading With Market Timing and Intelligence with John Crain

1 × $23.00

Trading With Market Timing and Intelligence with John Crain

1 × $23.00 -

×

Momentum Explained. Vol.2 with Martin Pring

1 × $4.00

Momentum Explained. Vol.2 with Martin Pring

1 × $4.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

TTM Indicators Package for eSignal

1 × $6.00

TTM Indicators Package for eSignal

1 × $6.00 -

×

The FOREX Blueprint with The Swag Academy

1 × $5.00

The FOREX Blueprint with The Swag Academy

1 × $5.00 -

×

Technical Analysis of the Currency Market Classic Techniques for Profiting from Market Swings and Trader Sentiment with Boris Schlossberg

1 × $6.00

Technical Analysis of the Currency Market Classic Techniques for Profiting from Market Swings and Trader Sentiment with Boris Schlossberg

1 × $6.00 -

×

Quick Scalp Trader (Unlocked)

1 × $31.00

Quick Scalp Trader (Unlocked)

1 × $31.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

Total Fibonacci Trading with TradeSmart University

1 × $31.00

Total Fibonacci Trading with TradeSmart University

1 × $31.00 -

×

Tunnel Through the Air (1994 Conference of Astro-Timing Techniques) with Bonnie Lee Hill

1 × $4.00

Tunnel Through the Air (1994 Conference of Astro-Timing Techniques) with Bonnie Lee Hill

1 × $4.00 -

×

The Stock Market Mastery Program with Ryan Hildreth

1 × $12.00

The Stock Market Mastery Program with Ryan Hildreth

1 × $12.00 -

×

Stock Options Mastery with Jeremy Lefebvre

1 × $23.00

Stock Options Mastery with Jeremy Lefebvre

1 × $23.00 -

×

TRADER SMILE MANAGEMENT TRAINING COURSE

1 × $31.00

TRADER SMILE MANAGEMENT TRAINING COURSE

1 × $31.00 -

×

Sports Trading Journey with Jack Birkhead

1 × $23.00

Sports Trading Journey with Jack Birkhead

1 × $23.00 -

×

Tick Trader Bundle with Top Trade Tools

1 × $54.00

Tick Trader Bundle with Top Trade Tools

1 × $54.00 -

×

Trend Following Stocks - Complete Breakout System with Joe Marwood

1 × $6.00

Trend Following Stocks - Complete Breakout System with Joe Marwood

1 × $6.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

How To Trade Weeklys Using The Ichimoku Cloud with Alphashark

1 × $31.00

How To Trade Weeklys Using The Ichimoku Cloud with Alphashark

1 × $31.00 -

×

The Secret To Making 7 Figures In A Year with Steven Dux

1 × $31.00

The Secret To Making 7 Figures In A Year with Steven Dux

1 × $31.00 -

×

Scalping Betfair For Daily Profits

1 × $6.00

Scalping Betfair For Daily Profits

1 × $6.00 -

×

Wifxa - INSTITUTIONAL SCALPING

1 × $23.00

Wifxa - INSTITUTIONAL SCALPING

1 × $23.00 -

×

The Forex Trading Course: A Self-Study Guide To Becoming a Successful Currency Trader with Abe Cofnas

1 × $6.00

The Forex Trading Course: A Self-Study Guide To Becoming a Successful Currency Trader with Abe Cofnas

1 × $6.00 -

×

Van Tharp Courses Collection

1 × $41.00

Van Tharp Courses Collection

1 × $41.00 -

×

TTM Bricks, Trend & BB Squeeze for TS

1 × $6.00

TTM Bricks, Trend & BB Squeeze for TS

1 × $6.00 -

×

Strategy Class + Indicators

1 × $31.00

Strategy Class + Indicators

1 × $31.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

P&L Accumulation Distribution with Charles Drummond

1 × $4.00

P&L Accumulation Distribution with Charles Drummond

1 × $4.00 -

×

Understanding Price Action: practical analysis of the 5-minute time frame with Bob Volman

1 × $5.00

Understanding Price Action: practical analysis of the 5-minute time frame with Bob Volman

1 × $5.00 -

×

MAM EA (Unlocked) with Christopher Wilson

1 × $6.00

MAM EA (Unlocked) with Christopher Wilson

1 × $6.00 -

×

BookMap Advanced v6.1

1 × $6.00

BookMap Advanced v6.1

1 × $6.00 -

×

The Situational Order Flow Trading Course with Mike Valtos

1 × $20.00

The Situational Order Flow Trading Course with Mike Valtos

1 × $20.00 -

×

Understanding Electronic DayTrading with Carol Troy

1 × $6.00

Understanding Electronic DayTrading with Carol Troy

1 × $6.00 -

×

Winning Market Systems. 83 Ways to Beat the Market

1 × $6.00

Winning Market Systems. 83 Ways to Beat the Market

1 × $6.00 -

×

Market Geometry Mentoring Sessions with Timothy Morge

1 × $69.00

Market Geometry Mentoring Sessions with Timothy Morge

1 × $69.00 -

×

Options on Futures Trading Course

1 × $15.00

Options on Futures Trading Course

1 × $15.00 -

×

www Trading System Ezine with Alex Krzhechevsky

1 × $6.00

www Trading System Ezine with Alex Krzhechevsky

1 × $6.00 -

×

Ultimate Gann Trading

1 × $15.00

Ultimate Gann Trading

1 × $15.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

Cycles – Gann and Fibonnacci 1997 with Stan Harley

1 × $6.00

Cycles – Gann and Fibonnacci 1997 with Stan Harley

1 × $6.00 -

×

The Winning Secret

1 × $23.00

The Winning Secret

1 × $23.00 -

×

Mastering the Trade

1 × $6.00

Mastering the Trade

1 × $6.00 -

×

Wealthpress Jump Trade Package (Course Only, None-elert)

1 × $85.00

Wealthpress Jump Trade Package (Course Only, None-elert)

1 × $85.00 -

×

Trading Framework with Retail Capital

1 × $24.00

Trading Framework with Retail Capital

1 × $24.00 -

×

The W.D. Gann Method of Trading with Gerald Marisch

1 × $6.00

The W.D. Gann Method of Trading with Gerald Marisch

1 × $6.00 -

×

Options Trading RD3 Webinar Series

1 × $31.00

Options Trading RD3 Webinar Series

1 × $31.00 -

×

XLT - Forex Trading Course

1 × $6.00

XLT - Forex Trading Course

1 × $6.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

Astro FX 2.0

1 × $6.00

Astro FX 2.0

1 × $6.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

The Multi-Fractal Markets Educational Course with Dylan Forexia

1 × $39.00

The Multi-Fractal Markets Educational Course with Dylan Forexia

1 × $39.00 -

×

Use The Moon – A Trading System with MARKET OCCULTATIONS

1 × $27.00

Use The Moon – A Trading System with MARKET OCCULTATIONS

1 × $27.00 -

×

The WallStreet Waltz with Ken Fisher

1 × $6.00

The WallStreet Waltz with Ken Fisher

1 × $6.00 -

×

Spotting Big Money with Market Profile with John Kepler

1 × $23.00

Spotting Big Money with Market Profile with John Kepler

1 × $23.00 -

×

Ultimate Candlestick Bootcamp & B2 Reversal Indicator & Scanner with Steady Trader Secrets

1 × $23.00

Ultimate Candlestick Bootcamp & B2 Reversal Indicator & Scanner with Steady Trader Secrets

1 × $23.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

Trend Forecasting with Technical Analysis with Louis Mendelsohn & John Murphy

1 × $6.00

Trend Forecasting with Technical Analysis with Louis Mendelsohn & John Murphy

1 × $6.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Turning Point. Analysis in Price and Time

1 × $6.00

Turning Point. Analysis in Price and Time

1 × $6.00 -

×

The Complete FTMO Challenge Course with Petko Aleksandrov - EA Trading Academy

1 × $5.00

The Complete FTMO Challenge Course with Petko Aleksandrov - EA Trading Academy

1 × $5.00 -

×

The PB Code Masterclass - Stock Options Trading Course with Ryan Coisson

1 × $5.00

The PB Code Masterclass - Stock Options Trading Course with Ryan Coisson

1 × $5.00 -

×

The Scalper’s Boot Camp (Sep 2011)

1 × $23.00

The Scalper’s Boot Camp (Sep 2011)

1 × $23.00 -

×

Don Fishback ODDS The Key to 95 Winners

1 × $6.00

Don Fishback ODDS The Key to 95 Winners

1 × $6.00 -

×

Forex Knight Mentoring Program with Hector Deville

1 × $5.00

Forex Knight Mentoring Program with Hector Deville

1 × $5.00 -

×

GMMA Trend Volatility Management with Dary Guppy

1 × $6.00

GMMA Trend Volatility Management with Dary Guppy

1 × $6.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

The Winning Watch-List with Ryan Mallory

1 × $31.00

The Winning Watch-List with Ryan Mallory

1 × $31.00 -

×

The Engulfing Trader Video Series 2014 with Timon Weller

1 × $6.00

The Engulfing Trader Video Series 2014 with Timon Weller

1 × $6.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Trading the Pristine Method 2020 with T3 Live

1 × $39.00

Trading the Pristine Method 2020 with T3 Live

1 × $39.00 -

×

Iron Condor - Advanced

1 × $31.00

Iron Condor - Advanced

1 × $31.00 -

×

TurnSignal Complete 7-6A (Oct 2013)

1 × $6.00

TurnSignal Complete 7-6A (Oct 2013)

1 × $6.00 -

×

Twelve Ways to Survive the Next Twelve Months with Adam Lass

1 × $6.00

Twelve Ways to Survive the Next Twelve Months with Adam Lass

1 × $6.00 -

×

The Next Big Short Class (Risk Twist Spreads) Class with Don Kaufman

1 × $6.00

The Next Big Short Class (Risk Twist Spreads) Class with Don Kaufman

1 × $6.00 -

×

International Trade & Economic Dynamics with Koji Shimomura

1 × $6.00

International Trade & Economic Dynamics with Koji Shimomura

1 × $6.00 -

×

BuySide Global Professional (Jul 2018)

1 × $101.00

BuySide Global Professional (Jul 2018)

1 × $101.00 -

×

Winning in Options with Elliott Wave + 5 Options Strategies with Todd Gordon

1 × $23.00

Winning in Options with Elliott Wave + 5 Options Strategies with Todd Gordon

1 × $23.00 -

×

Rapid Cash & Success System

1 × $31.00

Rapid Cash & Success System

1 × $31.00 -

×

Sacredscience - R.N.Elliott – Nature’s Law. The secret of the Universe

1 × $6.00

Sacredscience - R.N.Elliott – Nature’s Law. The secret of the Universe

1 × $6.00 -

×

Trends & Trendlines with Albert Yang

1 × $4.00

Trends & Trendlines with Albert Yang

1 × $4.00 -

×

The Volume Traders 2.0 with Sebastian - The Volume Traders

1 × $5.00

The Volume Traders 2.0 with Sebastian - The Volume Traders

1 × $5.00 -

×

Integrated Pitchfork Analysis (Volume 1,2,3)

1 × $6.00

Integrated Pitchfork Analysis (Volume 1,2,3)

1 × $6.00 -

×

Hustle Trading FX Course

1 × $10.00

Hustle Trading FX Course

1 × $10.00 -

×

Pro Online Trader. Trade Like a Pro (Video 1.30 GB)

1 × $6.00

Pro Online Trader. Trade Like a Pro (Video 1.30 GB)

1 × $6.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

Trading Courses Bundle

1 × $31.00

Trading Courses Bundle

1 × $31.00 -

×

Balance Trader – Market Profile Trading Course

1 × $23.00

Balance Trader – Market Profile Trading Course

1 × $23.00 -

×

Ultimate Guide Technical Trading

1 × $23.00

Ultimate Guide Technical Trading

1 × $23.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

FX GOAT FOREX TRADING ACADEMY

1 × $8.00

FX GOAT FOREX TRADING ACADEMY

1 × $8.00 -

×

Lessons from the Greatest Stock Traders of all Time with John Boik

1 × $6.00

Lessons from the Greatest Stock Traders of all Time with John Boik

1 × $6.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

Best Trading Strategies Revealed - The Prosperity Trading Course (BTSR)

1 × $78.00

Best Trading Strategies Revealed - The Prosperity Trading Course (BTSR)

1 × $78.00 -

×

TTM Directional Day Filter Indicator with Value Chart for TS

1 × $6.00

TTM Directional Day Filter Indicator with Value Chart for TS

1 × $6.00 -

×

The 1% Club with Trader Mike

1 × $5.00

The 1% Club with Trader Mike

1 × $5.00 -

×

TTM Directional Day Filter System for TS

1 × $6.00

TTM Directional Day Filter System for TS

1 × $6.00 -

×

Unlock the Millionaire Within with Dan Lok

1 × $15.00

Unlock the Millionaire Within with Dan Lok

1 × $15.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

The Secret of Selecting Stocks for Immediate and Substantial Gains with Larry Williams

1 × $6.00

The Secret of Selecting Stocks for Immediate and Substantial Gains with Larry Williams

1 × $6.00 -

×

Forever in Profit

1 × $31.00

Forever in Profit

1 × $31.00 -

×

Trade for Life - 5 Day Trading Laboratory

1 × $54.00

Trade for Life - 5 Day Trading Laboratory

1 × $54.00 -

×

Bollinger Band Jackpot with Mark Deaton

1 × $31.00

Bollinger Band Jackpot with Mark Deaton

1 × $31.00 -

×

QuantZilla

1 × $39.00

QuantZilla

1 × $39.00 -

×

Turnaround Trader Formula with Ifan Wei - T3 Live

1 × $23.00

Turnaround Trader Formula with Ifan Wei - T3 Live

1 × $23.00 -

×

Elder-disk 1.01 for NinjaTrader7

1 × $6.00

Elder-disk 1.01 for NinjaTrader7

1 × $6.00

Stock Traders Almanac 2010 with Jeffrey Hirsch & Yale Hirsch

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Stock Traders Almanac 2010 with Jeffrey Hirsch & Yale Hirsch

Introduction

The “Stock Traders Almanac 2010” by Jeffrey Hirsch and Yale Hirsch is a treasure trove of insights, data, and strategies designed to help traders navigate the complex world of stock markets. This edition continues the legacy of providing invaluable information for both novice and experienced traders. In this article, we explore the key features and benefits of the 2010 Almanac, highlighting how it can enhance your trading strategy.

The Legacy of the Stock Traders Almanac

The Origins of the Almanac

The Stock Traders Almanac was first published in 1967 by Yale Hirsch. It quickly gained a reputation for its detailed market analysis and historical data.

Evolution of the Almanac

Over the years, the Almanac has evolved to include modern trading strategies and tools. Jeffrey Hirsch, Yale’s son, has carried forward this tradition, ensuring the Almanac remains relevant in changing market conditions.

The 2010 Edition

The 2010 edition of the Almanac is particularly significant, offering strategies tailored to the post-2008 financial crisis market landscape.

Key Features of the 2010 Almanac

Historical Market Data

- Monthly and Daily Data: The Almanac provides detailed historical data for each month and day, helping traders identify patterns and trends.

- Seasonal Trends: Analysis of seasonal patterns and their impact on market performance.

Market Analysis

- Technical Indicators: Tools and indicators for technical analysis, such as moving averages and RSI.

- Fundamental Analysis: Insights into economic indicators and their influence on the market.

Trading Strategies

- Best Six Months Strategy: Focuses on the most profitable months of the year for stock trading.

- Santa Claus Rally: Examination of the year-end rally phenomenon.

The Best Six Months Strategy

Understanding the Strategy

The Best Six Months Strategy suggests that the stock market performs best from November to April. This strategy is based on historical performance data.

Historical Performance

Historically, the market has shown higher returns during these six months compared to the rest of the year.

Implementing the Strategy

- Buy in November: Enter the market in November.

- Sell in April: Exit positions in April to avoid the traditionally weaker months.

The Santa Claus Rally

What is the Santa Claus Rally?

The Santa Claus Rally refers to the tendency for the stock market to rise in the last week of December and the first two trading days of January.

Historical Analysis

Historical data supports the existence of this rally, with positive returns in most years.

How to Capitalize on the Rally

- Timing: Enter the market in late December.

- Exit: Consider exiting positions after the first two trading days of January.

Utilizing Technical Indicators

Moving Averages

- Simple Moving Average (SMA): Averages the closing prices over a specified period.

- Exponential Moving Average (EMA): Gives more weight to recent prices for a more responsive indicator.

Relative Strength Index (RSI)

- Overbought/Oversold Conditions: Identifies potential reversal points by measuring the speed and change of price movements.

MACD (Moving Average Convergence Divergence)

- Trend Following: Indicates bullish or bearish trends by comparing short-term and long-term moving averages.

Fundamental Analysis Insights

Economic Indicators

- GDP Growth: A key indicator of economic health.

- Unemployment Rate: Impacts consumer spending and economic stability.

Corporate Earnings

- Earnings Reports: Quarterly earnings reports provide insights into a company’s financial health.

- Earnings Per Share (EPS): Measures a company’s profitability on a per-share basis.

Seasonal Patterns and Trends

January Effect

The January Effect refers to the tendency for small-cap stocks to outperform in January.

Sell in May and Go Away

This adage suggests that the market tends to underperform from May to October.

Holiday Effect

The market often experiences positive returns on trading days preceding a holiday.

Risk Management Strategies

Stop-Loss Orders

Implementing stop-loss orders can help limit potential losses by automatically selling a security when it reaches a predetermined price.

Diversification

Diversify your portfolio to spread risk across various asset classes and sectors.

Hedging

Use options and other derivative instruments to hedge against potential market downturns.

Behavioral Finance

What is Behavioral Finance?

Behavioral finance examines how psychological factors affect market outcomes and investment decisions.

Common Behavioral Biases

- Overconfidence

- Herding

- Loss Aversion

Understanding Financial News

Importance of Financial News

Staying informed about financial news helps you make timely and informed investment decisions.

Reliable Sources of Financial News

- Financial Times

- Wall Street Journal

- Bloomberg

Building a Strong Portfolio

Components of a Strong Portfolio

A well-balanced portfolio includes a mix of stocks, bonds, and other asset classes.

Portfolio Rebalancing

Regularly review and adjust your portfolio to maintain your desired asset allocation.

Evaluating Portfolio Performance

Measure your portfolio’s performance against relevant benchmarks to ensure it meets your financial goals.

Conclusion

The “Stock Traders Almanac 2010” by Jeffrey Hirsch and Yale Hirsch remains an essential tool for traders and investors looking to make informed decisions. By leveraging historical data, market analysis, and strategic insights, you can enhance your trading performance and achieve your financial goals. Stay ahead of the market trends, and let the Almanac guide you through the complexities of stock trading.

FAQs

What is the main focus of the “Stock Traders Almanac 2010”?

The main focus is on providing historical market data, seasonal trends, and strategic insights to aid traders and investors in making informed decisions.

How can the Best Six Months Strategy benefit traders?

The Best Six Months Strategy can help traders capitalize on the historically strong performance of the market from November to April.

What is the Santa Claus Rally?

The Santa Claus Rally refers to the tendency for the stock market to rise during the last week of December and the first two trading days of January.

How important are technical indicators in trading?

Technical indicators are crucial for analyzing market trends, identifying potential entry and exit points, and making informed trading decisions.

Why is risk management important in trading?

Risk management is essential to protect your investment capital and minimize potential losses in the volatile stock market.

Be the first to review “Stock Traders Almanac 2010 with Jeffrey Hirsch & Yale Hirsch” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.