SPX All Put Flat ButterFly with Mark Fenton – Sheridan Options Mentoring

$247.00 Original price was: $247.00.$39.00Current price is: $39.00.

File Size: 336 MB

Delivery Time: 1–12 hours

Media Type: Online Course

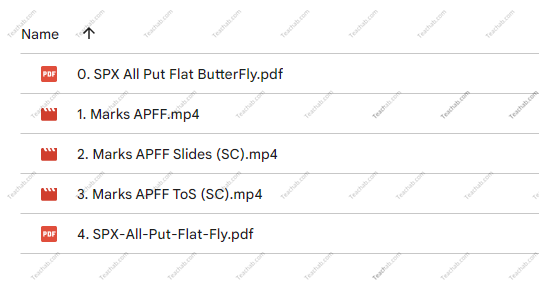

Content Proof: Watch Here!

You may check content proof of “SPX All Put Flat ButterFly with Mark Fenton – Sheridan Options Mentoring” below:

In the ever-evolving landscape of options trading, strategies like the SPX All Put Flat Butterfly not only demonstrate innovative financial acumen but also highlight the importance of precision and adaptability. Led by Mark Fenton at Sheridan Options Mentoring, this specific strategy offers a unique approach to managing risk while seeking profit in the S&P 500 index options. This article will delve into the nuances of this strategy, exploring how it can be a game-changer in your trading portfolio.

Introduction to SPX All Put Flat Butterfly

What is an All Put Flat Butterfly?

The All Put Flat Butterfly is an advanced options strategy involving multiple puts to create positions that profit from minimal movement in the underlying asset, in this case, the S&P 500 index. This strategy is especially appealing during periods of low volatility or when little movement is expected in the market.

Understanding the Strategy

Components of the Flat Butterfly

- Sell At-The-Money Puts: The core of the butterfly, where you sell puts at the market’s current level.

- Buy Out-of-The-Money Puts: These are typically set at a lower strike price, bracketing the position.

- Buy In-The-Money Puts: Positioned at a higher strike, completing the ‘wings’ of the butterfly.

Why Use All Puts?

Using puts exclusively allows for a more predictable risk profile and potentially higher returns in a flat or bearish market scenario.

Mark Fenton’s Expertise

Who is Mark Fenton?

A seasoned trader and mentor, Mark Fenton’s expertise in options is well-regarded within the Sheridan community. His approach to options trading is both educational and practical, making complex strategies accessible to traders at all levels.

Advantages of Learning from Mark

- Detailed Strategy Breakdowns

- Real-World Application

- Ongoing Mentorship and Support

Navigating Market Conditions with the Flat Butterfly

Ideal Market Conditions for This Strategy

- Low Volatility: The strategy thrives in a stable market where drastic price swings are unlikely.

- Predictable Market Phases: When market trends are clear and steady, regardless of the direction.

Risk Management

- Defined Risk: All potential losses are known in advance, a key feature of the flat butterfly.

- Adjustments: Mark teaches how to adjust the strikes to respond to market changes effectively.

Course Outline: SPX All Put Flat Butterfly

Key Modules of the Course

- Introduction to Options Basics

- Deep Dive into Butterfly Strategies

- Specifics of the All Put Flat Butterfly

- Risk Management Techniques

- Live Trade Execution

Learning Outcomes

- Strategic Depth: Gain a thorough understanding of one of the most nuanced trading strategies.

- Hands-On Experience: Apply concepts through simulated trading scenarios under Mark’s guidance.

Who Should Enroll?

Target Audience

- Intermediate Traders: Those with some options trading experience.

- Advanced Traders: Seasoned traders looking to diversify their strategies.

- Financial Educators: Professionals seeking to broaden their teaching portfolio.

Benefits of the Strategy

Why Choose the SPX All Put Flat Butterfly?

- Capital Efficiency: Requires less capital compared to more straightforward put or call buys.

- Profit Potential in Stable Markets: Maximizes the chance of profit when little movement is expected in the SPX.

Preparing for the Course

What You Need to Prepare

- Basic Options Knowledge

- Access to Trading Software

- Commitment to Learning

Success Stories and Testimonials

Feedback from Previous Participants

Many participants have praised the course for its clarity, depth, and practical applicability, noting significant improvements in their trading tactics.

Conclusion

The SPX All Put Flat Butterfly strategy, as taught by Mark Fenton through Sheridan Options Mentoring, offers a sophisticated toolset for traders aiming to capitalize on specific market conditions. This strategy’s focus on risk management and capital efficiency makes it a valuable addition to any trader’s arsenal.

Frequently Asked Questions

- What is the SPX All Put Flat Butterfly? It’s a refined options strategy focusing on put options to profit from minimal market movement.

- Why is this strategy effective in low volatility? It capitalizes on market stability, which enhances the predictability of outcomes.

- Who can benefit from learning this strategy? Intermediate to advanced traders looking for risk-managed trading setups.

- What are the key risks involved? While losses are limited, improper execution or misunderstanding of market conditions can lead to suboptimal outcomes.

- How can I enroll in the course? Visit Sheridan Options Mentoring’s website and navigate to the courses section for enrollment details.

Be the first to review “SPX All Put Flat ButterFly with Mark Fenton – Sheridan Options Mentoring” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Ultimate Trading Course with Dodgy's Dungeon

Ultimate Trading Course with Dodgy's Dungeon

Reviews

There are no reviews yet.