-

×

How Do You See Risk? A Guide to Evaluating & Applying Technical Volatility Indicators class with Theotrade

1 × $4.00

How Do You See Risk? A Guide to Evaluating & Applying Technical Volatility Indicators class with Theotrade

1 × $4.00 -

×

The Pocket Mortgage Guide: 60 of the Most Important Questions and Answers About Your Home Loan with Jack Guttentag

1 × $6.00

The Pocket Mortgage Guide: 60 of the Most Important Questions and Answers About Your Home Loan with Jack Guttentag

1 × $6.00 -

×

Directional Calendars in 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $85.00

Directional Calendars in 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $85.00 -

×

The Ultimate Trading Resource with Clayton Bell, Alex Viscusi & Ben Chaffee

1 × $6.00

The Ultimate Trading Resource with Clayton Bell, Alex Viscusi & Ben Chaffee

1 × $6.00 -

×

Basic Day Trading Techniques with Michael Jenkins

1 × $6.00

Basic Day Trading Techniques with Michael Jenkins

1 × $6.00 -

×

Index Funds with Mark Hebner

1 × $6.00

Index Funds with Mark Hebner

1 × $6.00 -

×

Get More Leads Quickly with Brittany Lynch

1 × $6.00

Get More Leads Quickly with Brittany Lynch

1 × $6.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

What Products to Watch and Why Class with Don Kaufman

1 × $6.00

What Products to Watch and Why Class with Don Kaufman

1 × $6.00 -

×

Expert Forex Systems with Andrew Fields

1 × $6.00

Expert Forex Systems with Andrew Fields

1 × $6.00 -

×

Alexander Elder Full Courses Package

1 × $6.00

Alexander Elder Full Courses Package

1 × $6.00 -

×

The Complete Value Investing Course (Updated 2019) with Wealthy Education

1 × $6.00

The Complete Value Investing Course (Updated 2019) with Wealthy Education

1 × $6.00 -

×

The Instagram DM Automation Playbook with Natasha Takahashi

1 × $6.00

The Instagram DM Automation Playbook with Natasha Takahashi

1 × $6.00 -

×

Mao, Marx & the Market: Capitalist Adventures in Russia and China with Dean LeBaro

1 × $6.00

Mao, Marx & the Market: Capitalist Adventures in Russia and China with Dean LeBaro

1 × $6.00 -

×

How to Trade a Vertical Market

1 × $93.00

How to Trade a Vertical Market

1 × $93.00 -

×

Complete Trading Course with Sean Dekmar

1 × $5.00

Complete Trading Course with Sean Dekmar

1 × $5.00 -

×

Lazy Emini Trader Master Class

1 × $15.00

Lazy Emini Trader Master Class

1 × $15.00 -

×

Portfolio Management in Practice with Christine Brentani

1 × $6.00

Portfolio Management in Practice with Christine Brentani

1 × $6.00 -

×

Bookmap Masterclass with Trading To Win

1 × $6.00

Bookmap Masterclass with Trading To Win

1 × $6.00 -

×

The Amazing Common Sense Guide To Investment Success with John Thomchick

1 × $6.00

The Amazing Common Sense Guide To Investment Success with John Thomchick

1 × $6.00 -

×

Investing In Fixer-Uppers 2003 with Jay DeCima

1 × $6.00

Investing In Fixer-Uppers 2003 with Jay DeCima

1 × $6.00 -

×

Basecamptrading - Naked Trading Part 2

1 × $6.00

Basecamptrading - Naked Trading Part 2

1 × $6.00 -

×

Options On Futures Class By Mark Fenton - Sheridan Options Mentoring

1 × $6.00

Options On Futures Class By Mark Fenton - Sheridan Options Mentoring

1 × $6.00 -

×

Option Greeks Class with Don Kaufman

1 × $6.00

Option Greeks Class with Don Kaufman

1 × $6.00 -

×

The Best Mechanical DayTrading System I Know with Bruce Babcock

1 × $6.00

The Best Mechanical DayTrading System I Know with Bruce Babcock

1 × $6.00 -

×

Day Trading 101 How To Day Trade Stocks for Passive Income

1 × $6.00

Day Trading 101 How To Day Trade Stocks for Passive Income

1 × $6.00 -

×

Inner Circle Course with Darius Fx

1 × $24.00

Inner Circle Course with Darius Fx

1 × $24.00 -

×

Short Skirt Trading, the Most Bang for the Buck with Linda Raschke

1 × $6.00

Short Skirt Trading, the Most Bang for the Buck with Linda Raschke

1 × $6.00 -

×

Seven Principles of Great Trading (Audio CD) By Van Tharp

1 × $6.00

Seven Principles of Great Trading (Audio CD) By Van Tharp

1 × $6.00 -

×

Gann Masters II with Hallikers Inc

1 × $6.00

Gann Masters II with Hallikers Inc

1 × $6.00 -

×

Bird Watching in Lion Country. Retail Forex Explained with Dirk Du Toit

1 × $4.00

Bird Watching in Lion Country. Retail Forex Explained with Dirk Du Toit

1 × $4.00 -

×

Forecast for 2010 with Larry Williams

1 × $6.00

Forecast for 2010 with Larry Williams

1 × $6.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

The Geography of Money with Benjamin J.Cohen

1 × $6.00

The Geography of Money with Benjamin J.Cohen

1 × $6.00 -

×

Mapping the Markets: A Guide to Stock Market Analysis with Deborah Owen & Robin Griffiths

1 × $6.00

Mapping the Markets: A Guide to Stock Market Analysis with Deborah Owen & Robin Griffiths

1 × $6.00 -

×

Backspreads, Diagonals and Butterflies – Advanced Options Strategies

1 × $6.00

Backspreads, Diagonals and Butterflies – Advanced Options Strategies

1 × $6.00 -

×

Mind of a Trader with Alpesh Patel

1 × $6.00

Mind of a Trader with Alpesh Patel

1 × $6.00 -

×

Master Forecasting Method & Unpublished Stock Market Forecasting Courses with W.D.Gann

1 × $6.00

Master Forecasting Method & Unpublished Stock Market Forecasting Courses with W.D.Gann

1 × $6.00 -

×

Ultimate Options with Andy Tanner & Corey Halliday - The Cashflow Academy

1 × $139.00

Ultimate Options with Andy Tanner & Corey Halliday - The Cashflow Academy

1 × $139.00 -

×

30 Trading Classics with 3T Live

1 × $5.00

30 Trading Classics with 3T Live

1 × $5.00 -

×

Futures & Options Course with Talkin Options

1 × $15.00

Futures & Options Course with Talkin Options

1 × $15.00 -

×

The MissionFX Compounding Course with Nick Shawn

1 × $5.00

The MissionFX Compounding Course with Nick Shawn

1 × $5.00 -

×

How I Quit my Job & Turned 6k into Half Million Trading Commodities with Bob Buran

1 × $4.00

How I Quit my Job & Turned 6k into Half Million Trading Commodities with Bob Buran

1 × $4.00 -

×

Mastering Amibroker Formula Language

1 × $15.00

Mastering Amibroker Formula Language

1 × $15.00 -

×

Using Options to Buy Stocks: Build Wealth with Little Risk and No Capital - Dennis Eisen

1 × $4.00

Using Options to Buy Stocks: Build Wealth with Little Risk and No Capital - Dennis Eisen

1 × $4.00 -

×

A Plan to make $3k Monthly on $25k with Short Term Trades with Dan Sheridan

1 × $23.00

A Plan to make $3k Monthly on $25k with Short Term Trades with Dan Sheridan

1 × $23.00 -

×

Naked Put Selling Acquiring Blue Chip Stocks and Creating Cash Flow with Lee Lowell

1 × $6.00

Naked Put Selling Acquiring Blue Chip Stocks and Creating Cash Flow with Lee Lowell

1 × $6.00 -

×

Mutual Funds: Fifty Years of Research Findings by Seth C. Anderson

1 × $6.00

Mutual Funds: Fifty Years of Research Findings by Seth C. Anderson

1 × $6.00 -

×

A14 Weekly Options Strategy Workshop 2023 with Amy Meissner - Aeromir

1 × $23.00

A14 Weekly Options Strategy Workshop 2023 with Amy Meissner - Aeromir

1 × $23.00 -

×

Trading With Venus

1 × $31.00

Trading With Venus

1 × $31.00 -

×

Pablo Order Flow Education with Pablo

1 × $6.00

Pablo Order Flow Education with Pablo

1 × $6.00 -

×

Applied Portfolio Management with Catherine Shenoy

1 × $6.00

Applied Portfolio Management with Catherine Shenoy

1 × $6.00 -

×

Investing in Corporate Bonds and Credit Risk with Frank Hagenstein

1 × $6.00

Investing in Corporate Bonds and Credit Risk with Frank Hagenstein

1 × $6.00 -

×

Show Tax Losses On Your 1040, Yet Show Lenders You Are Making Money! with Information Services Unlimited

1 × $6.00

Show Tax Losses On Your 1040, Yet Show Lenders You Are Making Money! with Information Services Unlimited

1 × $6.00 -

×

A Comparison of Twelve Technical Trading Systems with Louis Lukac

1 × $6.00

A Comparison of Twelve Technical Trading Systems with Louis Lukac

1 × $6.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

Order Flow Mastery (New 2024) with The Volume Traders

1 × $24.00

Order Flow Mastery (New 2024) with The Volume Traders

1 × $24.00 -

×

PDFT (Price Driven Forex Trading) Course with Avi Frister

1 × $6.00

PDFT (Price Driven Forex Trading) Course with Avi Frister

1 × $6.00 -

×

Traders Trick Advanced Concepts - Recorded Webinar with Joe Ross

1 × $23.00

Traders Trick Advanced Concepts - Recorded Webinar with Joe Ross

1 × $23.00 -

×

Mathematical Problems in Image Processing with Charles E.Chidume

1 × $6.00

Mathematical Problems in Image Processing with Charles E.Chidume

1 × $6.00 -

×

Pete Fader VSA Course

1 × $6.00

Pete Fader VSA Course

1 × $6.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

Forex Trading Education Program (Apr-June 2010) with Jimmy Young

1 × $6.00

Forex Trading Education Program (Apr-June 2010) with Jimmy Young

1 × $6.00 -

×

Fundamental & Technical Analysis Mini Course with Colin Nicholson

1 × $6.00

Fundamental & Technical Analysis Mini Course with Colin Nicholson

1 × $6.00 -

×

New Blueprints for Gains in Stocks and Grains & One-Way Formula for Trading in Stocks and Commodities (Traders' Masterclass) - William Dunnigan

1 × $6.00

New Blueprints for Gains in Stocks and Grains & One-Way Formula for Trading in Stocks and Commodities (Traders' Masterclass) - William Dunnigan

1 × $6.00 -

×

Generate Weekly Income by Trend-Trading Stocks Intraday Class with Corey Rosenbloom

1 × $6.00

Generate Weekly Income by Trend-Trading Stocks Intraday Class with Corey Rosenbloom

1 × $6.00 -

×

Affinity Foundation Stocks Course with Affinitytrading

1 × $6.00

Affinity Foundation Stocks Course with Affinitytrading

1 × $6.00 -

×

Advanced Course with Dimitri Wallace - Gold Minds Global

1 × $6.00

Advanced Course with Dimitri Wallace - Gold Minds Global

1 × $6.00 -

×

Secrets of Trading GBP, JPY, and CHF By Boris Schlossberg and Kathy Lien - Bkforex

1 × $6.00

Secrets of Trading GBP, JPY, and CHF By Boris Schlossberg and Kathy Lien - Bkforex

1 × $6.00 -

×

A Course in Trading with Donald Mack & Wetsel Market Bureau

1 × $6.00

A Course in Trading with Donald Mack & Wetsel Market Bureau

1 × $6.00 -

×

Developing a Forex Trading Plan Webinar

1 × $6.00

Developing a Forex Trading Plan Webinar

1 × $6.00 -

×

ABC Waves TOS Indicator & Live Class with Simpler Options

1 × $6.00

ABC Waves TOS Indicator & Live Class with Simpler Options

1 × $6.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

Andy’s EMini Bar – 60 Min System

1 × $6.00

Andy’s EMini Bar – 60 Min System

1 × $6.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

The Future of Investing with Chris Skinner

1 × $6.00

The Future of Investing with Chris Skinner

1 × $6.00 -

×

SnD SMC Course

1 × $10.00

SnD SMC Course

1 × $10.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00

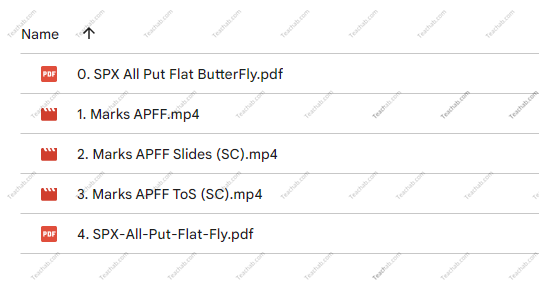

SPX All Put Flat ButterFly with Mark Fenton – Sheridan Options Mentoring

$247.00 Original price was: $247.00.$39.00Current price is: $39.00.

File Size: 336 MB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “SPX All Put Flat ButterFly with Mark Fenton – Sheridan Options Mentoring” below:

In the ever-evolving landscape of options trading, strategies like the SPX All Put Flat Butterfly not only demonstrate innovative financial acumen but also highlight the importance of precision and adaptability. Led by Mark Fenton at Sheridan Options Mentoring, this specific strategy offers a unique approach to managing risk while seeking profit in the S&P 500 index options. This article will delve into the nuances of this strategy, exploring how it can be a game-changer in your trading portfolio.

Introduction to SPX All Put Flat Butterfly

What is an All Put Flat Butterfly?

The All Put Flat Butterfly is an advanced options strategy involving multiple puts to create positions that profit from minimal movement in the underlying asset, in this case, the S&P 500 index. This strategy is especially appealing during periods of low volatility or when little movement is expected in the market.

Understanding the Strategy

Components of the Flat Butterfly

- Sell At-The-Money Puts: The core of the butterfly, where you sell puts at the market’s current level.

- Buy Out-of-The-Money Puts: These are typically set at a lower strike price, bracketing the position.

- Buy In-The-Money Puts: Positioned at a higher strike, completing the ‘wings’ of the butterfly.

Why Use All Puts?

Using puts exclusively allows for a more predictable risk profile and potentially higher returns in a flat or bearish market scenario.

Mark Fenton’s Expertise

Who is Mark Fenton?

A seasoned trader and mentor, Mark Fenton’s expertise in options is well-regarded within the Sheridan community. His approach to options trading is both educational and practical, making complex strategies accessible to traders at all levels.

Advantages of Learning from Mark

- Detailed Strategy Breakdowns

- Real-World Application

- Ongoing Mentorship and Support

Navigating Market Conditions with the Flat Butterfly

Ideal Market Conditions for This Strategy

- Low Volatility: The strategy thrives in a stable market where drastic price swings are unlikely.

- Predictable Market Phases: When market trends are clear and steady, regardless of the direction.

Risk Management

- Defined Risk: All potential losses are known in advance, a key feature of the flat butterfly.

- Adjustments: Mark teaches how to adjust the strikes to respond to market changes effectively.

Course Outline: SPX All Put Flat Butterfly

Key Modules of the Course

- Introduction to Options Basics

- Deep Dive into Butterfly Strategies

- Specifics of the All Put Flat Butterfly

- Risk Management Techniques

- Live Trade Execution

Learning Outcomes

- Strategic Depth: Gain a thorough understanding of one of the most nuanced trading strategies.

- Hands-On Experience: Apply concepts through simulated trading scenarios under Mark’s guidance.

Who Should Enroll?

Target Audience

- Intermediate Traders: Those with some options trading experience.

- Advanced Traders: Seasoned traders looking to diversify their strategies.

- Financial Educators: Professionals seeking to broaden their teaching portfolio.

Benefits of the Strategy

Why Choose the SPX All Put Flat Butterfly?

- Capital Efficiency: Requires less capital compared to more straightforward put or call buys.

- Profit Potential in Stable Markets: Maximizes the chance of profit when little movement is expected in the SPX.

Preparing for the Course

What You Need to Prepare

- Basic Options Knowledge

- Access to Trading Software

- Commitment to Learning

Success Stories and Testimonials

Feedback from Previous Participants

Many participants have praised the course for its clarity, depth, and practical applicability, noting significant improvements in their trading tactics.

Conclusion

The SPX All Put Flat Butterfly strategy, as taught by Mark Fenton through Sheridan Options Mentoring, offers a sophisticated toolset for traders aiming to capitalize on specific market conditions. This strategy’s focus on risk management and capital efficiency makes it a valuable addition to any trader’s arsenal.

Frequently Asked Questions

- What is the SPX All Put Flat Butterfly? It’s a refined options strategy focusing on put options to profit from minimal market movement.

- Why is this strategy effective in low volatility? It capitalizes on market stability, which enhances the predictability of outcomes.

- Who can benefit from learning this strategy? Intermediate to advanced traders looking for risk-managed trading setups.

- What are the key risks involved? While losses are limited, improper execution or misunderstanding of market conditions can lead to suboptimal outcomes.

- How can I enroll in the course? Visit Sheridan Options Mentoring’s website and navigate to the courses section for enrollment details.

Be the first to review “SPX All Put Flat ButterFly with Mark Fenton – Sheridan Options Mentoring” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.