-

×

MTI - Trend Trader Course (Feb 2014)

1 × $23.00

MTI - Trend Trader Course (Feb 2014)

1 × $23.00 -

×

Million Dollar Bond Strategies Video with Paul Judd

1 × $6.00

Million Dollar Bond Strategies Video with Paul Judd

1 × $6.00 -

×

On Board Fanta Sea One Seminar with Felix Homogratus

1 × $6.00

On Board Fanta Sea One Seminar with Felix Homogratus

1 × $6.00 -

×

Pit Bull with Martin Schwartz

1 × $6.00

Pit Bull with Martin Schwartz

1 × $6.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

Scientific Forex with Cristina Ciurea

1 × $6.00

Scientific Forex with Cristina Ciurea

1 × $6.00 -

×

How to Create & Manage a Mutal Fund or ETF with Melinda Gerber

1 × $6.00

How to Create & Manage a Mutal Fund or ETF with Melinda Gerber

1 × $6.00 -

×

WealthFRX Trading Mastery 3.0

1 × $5.00

WealthFRX Trading Mastery 3.0

1 × $5.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

HunterFX Video Course with HunterFX

1 × $6.00

HunterFX Video Course with HunterFX

1 × $6.00 -

×

Black Gold Strategies

1 × $23.00

Black Gold Strategies

1 × $23.00 -

×

Investor’s Guide to Charting By Alistair Blair

1 × $6.00

Investor’s Guide to Charting By Alistair Blair

1 × $6.00 -

×

Practical Approach to Trend Following By Rajandran R

1 × $15.00

Practical Approach to Trend Following By Rajandran R

1 × $15.00 -

×

ICT Mentorship 2016-17 with Inner Circle Trading

1 × $6.00

ICT Mentorship 2016-17 with Inner Circle Trading

1 × $6.00 -

×

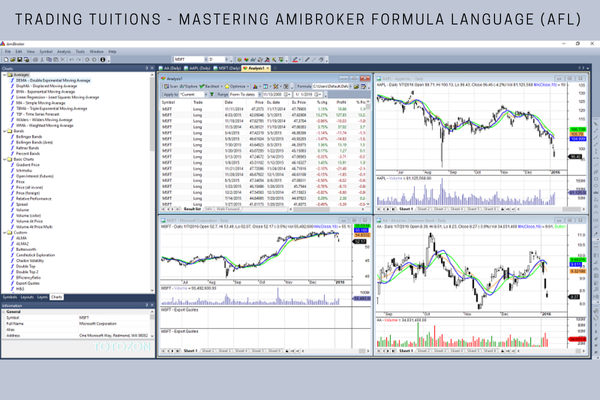

Trading Tuitions - Mastering Amibroker Formula Language (AFL)

1 × $15.00

Trading Tuitions - Mastering Amibroker Formula Language (AFL)

1 × $15.00 -

×

How to Make Money in Deflationary Markets with Gary Shilling

1 × $6.00

How to Make Money in Deflationary Markets with Gary Shilling

1 × $6.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

5 Technical Signals You Should Not Trade Without (4 CDs) with Toni Hansen

1 × $6.00

5 Technical Signals You Should Not Trade Without (4 CDs) with Toni Hansen

1 × $6.00 -

×

Secret Income with James Altucher

1 × $62.00

Secret Income with James Altucher

1 × $62.00 -

×

Trading by the Book (tradingeducators.com)

1 × $6.00

Trading by the Book (tradingeducators.com)

1 × $6.00 -

×

LEAPS Trading Strategies- Powerful Techniques for Options Trading Success - Marty Kearney

1 × $6.00

LEAPS Trading Strategies- Powerful Techniques for Options Trading Success - Marty Kearney

1 × $6.00 -

×

Chart Pattern Profits

1 × $6.00

Chart Pattern Profits

1 × $6.00 -

×

Options University - Ron Ianieri – Options University Live Seminars

1 × $6.00

Options University - Ron Ianieri – Options University Live Seminars

1 × $6.00 -

×

4×4 Course with Gregoire Dupont

1 × $6.00

4×4 Course with Gregoire Dupont

1 × $6.00 -

×

Trading With Venus

1 × $31.00

Trading With Venus

1 × $31.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

How to Invest in ETFs By The Investors Podcast

1 × $6.00

How to Invest in ETFs By The Investors Podcast

1 × $6.00 -

×

Geometry of Markets I with Bruce Gilmore

1 × $6.00

Geometry of Markets I with Bruce Gilmore

1 × $6.00 -

×

Practical Introduction to Bollinger Bands 2013

1 × $6.00

Practical Introduction to Bollinger Bands 2013

1 × $6.00 -

×

HST Mobile

1 × $31.00

HST Mobile

1 × $31.00 -

×

GANNacci Code Elite + Training Course

1 × $31.00

GANNacci Code Elite + Training Course

1 × $31.00 -

×

Increasing Vertical Spread Probabilities with Technical Analysis with Doc Severson

1 × $6.00

Increasing Vertical Spread Probabilities with Technical Analysis with Doc Severson

1 × $6.00 -

×

Trading the Moves - Consistent Gains in All Markets with Ed Downs

1 × $6.00

Trading the Moves - Consistent Gains in All Markets with Ed Downs

1 × $6.00 -

×

My Favorite Trades – Trading Mastery

1 × $6.00

My Favorite Trades – Trading Mastery

1 × $6.00 -

×

Create Winning MT4/MT5 Forex Trading Robots without Coding - Ransom Enupe

1 × $6.00

Create Winning MT4/MT5 Forex Trading Robots without Coding - Ransom Enupe

1 × $6.00 -

×

CFA Level 1,2 & 3 Complete Course 2010 48 CD’s with Schweser

1 × $6.00

CFA Level 1,2 & 3 Complete Course 2010 48 CD’s with Schweser

1 × $6.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

Trading Masterclass XVII with Wysetrade

1 × $6.00

Trading Masterclass XVII with Wysetrade

1 × $6.00 -

×

Harmonic Elliott Wave: The Case for Modification of R. N. Elliott's Impulsive Wave Structure with Ian Copsey

1 × $6.00

Harmonic Elliott Wave: The Case for Modification of R. N. Elliott's Impulsive Wave Structure with Ian Copsey

1 × $6.00 -

×

Advanced Risk Reversals and Rolling Thunder with Stratagem Trade

1 × $54.00

Advanced Risk Reversals and Rolling Thunder with Stratagem Trade

1 × $54.00 -

×

Trading MoneyTides & Chaos in the Stock Market with Hans Hannula

1 × $6.00

Trading MoneyTides & Chaos in the Stock Market with Hans Hannula

1 × $6.00 -

×

Sacredscience - Edward Johndro – Collected Articles

1 × $6.00

Sacredscience - Edward Johndro – Collected Articles

1 × $6.00 -

×

Cryptocurrency Investing Master Class with Stone River eLearning

1 × $6.00

Cryptocurrency Investing Master Class with Stone River eLearning

1 × $6.00 -

×

Exploring MetaStock Basic with Martin Pring

1 × $6.00

Exploring MetaStock Basic with Martin Pring

1 × $6.00 -

×

Price Action Prophet

1 × $54.00

Price Action Prophet

1 × $54.00 -

×

A Complete Guide to Technical Trading Tactics with John Person

1 × $6.00

A Complete Guide to Technical Trading Tactics with John Person

1 × $6.00 -

×

The 30-Day Cash Flow Blueprint with Andy Tanner

1 × $31.00

The 30-Day Cash Flow Blueprint with Andy Tanner

1 × $31.00 -

×

Hedge Funds for Dummies

1 × $6.00

Hedge Funds for Dummies

1 × $6.00 -

×

Options For Gold, Oil and Other Commodities

1 × $6.00

Options For Gold, Oil and Other Commodities

1 × $6.00 -

×

S&P Market Timing Course For E-mini & Options Traders

1 × $6.00

S&P Market Timing Course For E-mini & Options Traders

1 × $6.00 -

×

Master Class with Gerald Appel

1 × $6.00

Master Class with Gerald Appel

1 × $6.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

Price Action Trading with Bill Eykyn

1 × $6.00

Price Action Trading with Bill Eykyn

1 × $6.00 -

×

Prometheus Course with QuantProgram

1 × $13.00

Prometheus Course with QuantProgram

1 × $13.00 -

×

Forex Candlestick System. High Profit Forex Trading with B.M.Davis

1 × $6.00

Forex Candlestick System. High Profit Forex Trading with B.M.Davis

1 × $6.00 -

×

Empirical Market Microstructure

1 × $6.00

Empirical Market Microstructure

1 × $6.00 -

×

Order Flow Analysis

1 × $15.00

Order Flow Analysis

1 × $15.00 -

×

Investment Strategies for the 21th Century with Frank Amstrong

1 × $6.00

Investment Strategies for the 21th Century with Frank Amstrong

1 × $6.00 -

×

Learn To Profit From The Forex Market with FX Hustle

1 × $6.00

Learn To Profit From The Forex Market with FX Hustle

1 × $6.00 -

×

RiskDoctor Slingshot Hedge – Options Trading Strategies – Slingshot Hedge with Charles Cottle

1 × $6.00

RiskDoctor Slingshot Hedge – Options Trading Strategies – Slingshot Hedge with Charles Cottle

1 × $6.00 -

×

Real-Time Course with Rich Swannell

1 × $6.00

Real-Time Course with Rich Swannell

1 × $6.00 -

×

Oliver Velez - Core, Swing, Guerrilla, Momentum Trading, Micro Trading Tactics

1 × $23.00

Oliver Velez - Core, Swing, Guerrilla, Momentum Trading, Micro Trading Tactics

1 × $23.00 -

×

Profit Power Seminar

1 × $23.00

Profit Power Seminar

1 × $23.00 -

×

Advances in International Investments: Traditional and Alternative Approaches with Hung-Gay Fung, Xiaoqing Eleanor Xu & Jot Yau

1 × $6.00

Advances in International Investments: Traditional and Alternative Approaches with Hung-Gay Fung, Xiaoqing Eleanor Xu & Jot Yau

1 × $6.00 -

×

Surplus Trader Secrets Masterclass Coaching Program

1 × $6.00

Surplus Trader Secrets Masterclass Coaching Program

1 × $6.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

Forex Courses Collection

1 × $55.00

Forex Courses Collection

1 × $55.00 -

×

Simple Cyclical Analysis with Stan Erlich

1 × $6.00

Simple Cyclical Analysis with Stan Erlich

1 × $6.00 -

×

Forex and Stocks Trading Course - Set and Forget with Alfonso Moreno

1 × $6.00

Forex and Stocks Trading Course - Set and Forget with Alfonso Moreno

1 × $6.00 -

×

High Reward Low Risk Forex Trading with Jarratt Davis and Vic Noble

1 × $6.00

High Reward Low Risk Forex Trading with Jarratt Davis and Vic Noble

1 × $6.00 -

×

Managing Investment Portfolios (3rd Ed.) with John Maginn

1 × $6.00

Managing Investment Portfolios (3rd Ed.) with John Maginn

1 × $6.00 -

×

Simple Sector Trading Strategies with John Murphy

1 × $6.00

Simple Sector Trading Strategies with John Murphy

1 × $6.00 -

×

5 Day Volume Profile Analysis Indicator Course with Mark Stone

1 × $54.00

5 Day Volume Profile Analysis Indicator Course with Mark Stone

1 × $54.00 -

×

Modern Darvas Trading

1 × $6.00

Modern Darvas Trading

1 × $6.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

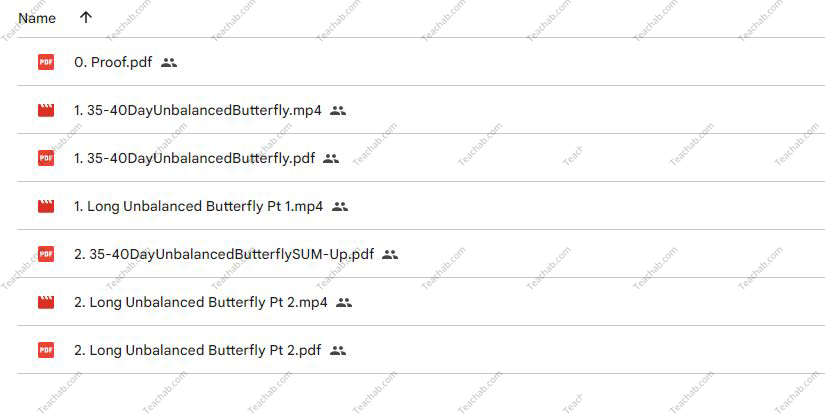

The SPX 35-40 Day Delta Neutral Unbalanced Butterfly with Sheridan Options Mentoring

$247.00 Original price was: $247.00.$15.00Current price is: $15.00.

File Size: 410.9 MB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “The SPX 35-40 Day Delta Neutral Unbalanced Butterfly with Sheridan Options Mentoring” below:

Mastering the SPX 35-40 Day Delta Neutral Unbalanced Butterfly with Sheridan Options Mentoring

Introduction

In the intricate world of options trading, mastering specific strategies can significantly enhance your trading results. The SPX 35-40 Day Delta Neutral Unbalanced Butterfly is one such strategy, taught by Sheridan Options Mentoring. This article will guide you through the nuances of this strategy, its benefits, and how you can learn it through Sheridan Options Mentoring.

Understanding the SPX Index

Before diving into the strategy, it’s crucial to understand the SPX or the S&P 500 index, which is a market-capitalization-weighted index of 500 of the largest publicly traded companies in the U.S. It’s a key indicator of the overall stock market performance.

What is a Delta Neutral Strategy?

Delta neutral strategies are options strategies that are designed to be insensitive to changes in the price of the underlying asset, aiming for profits primarily through time decay or volatility changes.

The Unbalanced Butterfly Explained

The unbalanced butterfly, a variant of the standard butterfly option, involves setting up the trade with unbalanced quantities of options at different strike prices, allowing traders to manage risk while maintaining potential profitability.

Why Choose the SPX 35-40 Day Strategy?

This specific timeframe and strategy combination is designed to capitalize on the unique behaviors of the SPX options market around 35-40 days to expiration, balancing risk and reward effectively.

Benefits of Delta Neutral Trading

- Reduced Risk: Minimizes the impact of price movements in the underlying asset.

- Profit from Volatility: Potentially gain from volatility changes rather than directional movements.

- Flexibility: Adjust the positions as market conditions change.

Learning with Sheridan Options Mentoring

Sheridan Options Mentoring offers comprehensive training on various options strategies, including the SPX 35-40 Day Delta Neutral Unbalanced Butterfly.

Course Features

- Expert Instruction: Learn from seasoned professionals with years of trading experience.

- Interactive Sessions: Engage in live trading sessions and Q&A with mentors.

- Practical Application: Apply what you learn through guided trading scenarios.

Course Benefits

- Deep Understanding: Gain a thorough grasp of delta neutral strategies.

- Hands-On Experience: Practical application in the real market.

- Community Support: Access to a community of like-minded traders for ongoing support.

Module Breakdown of the Course

Here’s what you can expect to learn in the different modules of the course:

Module 1: Basics of Options Trading

- Understanding Options

- Fundamentals of Options Strategies

Module 2: Introduction to Delta Neutral Strategies

- Concepts and Applications

- Setting Up Delta Neutral Positions

Module 3: Mastering the Unbalanced Butterfly

- Trade Setup

- Risk Management Techniques

- Adjustment Strategies

Module 4: The SPX 35-40 Day Trade

- Why 35-40 Days?

- Detailed Trade Analysis

- Live Trade Examples

How to Enroll

To start learning this powerful trading strategy, follow these steps:

- Visit Sheridan Options Mentoring Online: Access detailed course information and schedules.

- Sign Up for the Course: Choose the right course plan according to your trading level and goals.

- Engage Actively in Learning: Participate in the courses and apply the strategies in live market conditions.

Conclusion

Whether you’re a novice trader looking to get started with options or an experienced trader aiming to refine your strategies, the SPX 35-40 Day Delta Neutral Unbalanced Butterfly course from Sheridan Options Mentoring offers a unique opportunity to learn a sophisticated trading technique that balances risk and reward. Harness the power of this strategy to enhance your trading acumen and potentially increase your market returns.

FAQs About the SPX 35-40 Day Strategy

1. What makes the SPX 35-40 day strategy unique?

This strategy utilizes the specific market conditions and volatility patterns observed around 35-40 days to expiration, offering a balanced approach between risk and potential returns.

2. Is the course suitable for beginners?

While having a basic understanding of options is helpful, the course is designed with modules that bring beginners up to speed before advancing to more complex strategies.

3. What are the prerequisites for enrolling in the course?

A basic knowledge of stocks and options is recommended, but beginners can benefit from the introductory modules offered.

4. How long does the course take to complete?

The course duration varies, but most traders can expect to spend about 4-8 weeks to go through the comprehensive training and practical sessions.

5. Can I trade the SPX 35-40 day strategy with a small portfolio?

Yes, the strategy can be scaled to suit different portfolio sizes, making it accessible to traders with varying amounts of capital.

Be the first to review “The SPX 35-40 Day Delta Neutral Unbalanced Butterfly with Sheridan Options Mentoring” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.