-

×

Trading with Oscillators. Pinpointing Market Extremes with Mark Etzkorn

1 × $6.00

Trading with Oscillators. Pinpointing Market Extremes with Mark Etzkorn

1 × $6.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

Classic Indicators Back to the Future with Linda Raschke

1 × $4.00

Classic Indicators Back to the Future with Linda Raschke

1 × $4.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

Vertex Investing Course (2023)

1 × $8.00

Vertex Investing Course (2023)

1 × $8.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

9-Pack of TOS Indicators

1 × $6.00

9-Pack of TOS Indicators

1 × $6.00 -

×

Trading with Wave59 with Earik Beann

1 × $6.00

Trading with Wave59 with Earik Beann

1 × $6.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

WealthFRX Trading Mastery 3.0

1 × $5.00

WealthFRX Trading Mastery 3.0

1 × $5.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

A Comparison of Twelve Technical Trading Systems with Louis Lukac

1 × $6.00

A Comparison of Twelve Technical Trading Systems with Louis Lukac

1 × $6.00 -

×

B.O.S.S. Swing with Pat Mitchell – Trick Trades

1 × $39.00

B.O.S.S. Swing with Pat Mitchell – Trick Trades

1 × $39.00 -

×

Advanced Forex Patterns with Vic Noble & Darko Ali

1 × $39.00

Advanced Forex Patterns with Vic Noble & Darko Ali

1 × $39.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Volume Breakout Indicator

1 × $31.00

Volume Breakout Indicator

1 × $31.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Wealth Management with Dimitris Chorafas

1 × $6.00

Wealth Management with Dimitris Chorafas

1 × $6.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Volatility Master Class

1 × $62.00

Volatility Master Class

1 × $62.00 -

×

Advanced Course with Dimitri Wallace - Gold Minds Global

1 × $6.00

Advanced Course with Dimitri Wallace - Gold Minds Global

1 × $6.00 -

×

Vom Einsteiger zum Mastertrader 2.0 with Mehrwert Garantier

1 × $109.00

Vom Einsteiger zum Mastertrader 2.0 with Mehrwert Garantier

1 × $109.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

Traders Guide to Emotional Management with Brian McAboy

1 × $4.00

Traders Guide to Emotional Management with Brian McAboy

1 × $4.00 -

×

Tradingmarkets - Introduction to AmiBroker Programming

1 × $15.00

Tradingmarkets - Introduction to AmiBroker Programming

1 × $15.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

Analysis Of Entry Signals Part Two (Fundamentals) with Joe Marwood

1 × $23.00

Analysis Of Entry Signals Part Two (Fundamentals) with Joe Marwood

1 × $23.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

60 Seconds Sure Shot Strategy with Albert E

1 × $6.00

60 Seconds Sure Shot Strategy with Albert E

1 × $6.00 -

×

CFA Level 1 - Schweser Study Notes 2006 (schweser.com)

1 × $6.00

CFA Level 1 - Schweser Study Notes 2006 (schweser.com)

1 × $6.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

![Trading The Elliott Wave Indicator (2003) [1 MP4] by Robert Prechter image](https://www.totozon.com/wp-content/uploads/2024/05/Trading-The-Elliott-Wave-Indicator-2003-1-MP4-by-Robert-Prechter-image.png) Trading The Elliott Wave Indicator (2003) [1 MP4] - Robert Prechter

1 × $6.00

Trading The Elliott Wave Indicator (2003) [1 MP4] - Robert Prechter

1 × $6.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

The STRAT Execution Basics with Jermaine McGruder

1 × $31.00

The STRAT Execution Basics with Jermaine McGruder

1 × $31.00 -

×

Big Fish: Mako Momentum Strategy

1 × $23.00

Big Fish: Mako Momentum Strategy

1 × $23.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

How to Trade a Vertical Market

1 × $93.00

How to Trade a Vertical Market

1 × $93.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Yield Farming MasterClass Course (2022) with Boss Financial

1 × $5.00

Yield Farming MasterClass Course (2022) with Boss Financial

1 × $5.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Build A Career In Forex Trading - Learn Fundamental Analysis - Luciano Kelly & Learn Forex Mentor

1 × $4.00

Build A Career In Forex Trading - Learn Fundamental Analysis - Luciano Kelly & Learn Forex Mentor

1 × $4.00 -

×

30 Days to Market Mastery: A Step-by-Step Guide to Profitable Trading with Jack Bernstein

1 × $6.00

30 Days to Market Mastery: A Step-by-Step Guide to Profitable Trading with Jack Bernstein

1 × $6.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

ABCs of Trading and Tech Analysis (Online Investor Expo, Las Vegas 2000) with Tom Bierovic

1 × $6.00

ABCs of Trading and Tech Analysis (Online Investor Expo, Las Vegas 2000) with Tom Bierovic

1 × $6.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

All Weather Butterfly Program - A Deep Dive With Dan Sheridan

1 × $31.00

All Weather Butterfly Program - A Deep Dive With Dan Sheridan

1 × $31.00 -

×

Daily Market Review 2009-2012 (Video 16 GB) with David Vallieres

1 × $6.00

Daily Market Review 2009-2012 (Video 16 GB) with David Vallieres

1 × $6.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

Vertex Investing Course

1 × $6.00

Vertex Investing Course

1 × $6.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

Volume Profile Trading Strategy with Critical Trading

1 × $15.00

Volume Profile Trading Strategy with Critical Trading

1 × $15.00 -

×

TLM Virtual Trading Summit 2021 with TradeLikeMike

1 × $6.00

TLM Virtual Trading Summit 2021 with TradeLikeMike

1 × $6.00 -

×

A Trader’s Guide To Discipline

1 × $6.00

A Trader’s Guide To Discipline

1 × $6.00 -

×

AmiBroker Ultimate Pack Pro v6.20.1 x64 (Feb 2017)

1 × $6.00

AmiBroker Ultimate Pack Pro v6.20.1 x64 (Feb 2017)

1 × $6.00 -

×

Trading Option Greeks with Dan Passarelli

1 × $6.00

Trading Option Greeks with Dan Passarelli

1 × $6.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Back to the Basics

1 × $6.00

Back to the Basics

1 × $6.00 -

×

Advanced Pattern Trader Course with Trade Empowered

1 × $23.00

Advanced Pattern Trader Course with Trade Empowered

1 × $23.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Black Gold Strategies

1 × $23.00

Black Gold Strategies

1 × $23.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

The Tyler Method For Successful Triangle Trading with Chris Tyler

1 × $6.00

The Tyler Method For Successful Triangle Trading with Chris Tyler

1 × $6.00 -

×

ActiveBeta Indexes. Capturing Systematic Sources of Active Equity Returns (HTML) with Andrew Lo

1 × $6.00

ActiveBeta Indexes. Capturing Systematic Sources of Active Equity Returns (HTML) with Andrew Lo

1 × $6.00 -

×

5-Step-Trading Stocks II - Avoid Common Trading Mistakes - Online Course (April 2014)

1 × $23.00

5-Step-Trading Stocks II - Avoid Common Trading Mistakes - Online Course (April 2014)

1 × $23.00 -

×

9-Day Calendar Deep Dive 2023 with Jay Bailey - Sheridan Options Mentoring

1 × $31.00

9-Day Calendar Deep Dive 2023 with Jay Bailey - Sheridan Options Mentoring

1 × $31.00 -

×

Winning on Wall Street (Updated & Revised Ed.) with Martin Zweig

1 × $6.00

Winning on Wall Street (Updated & Revised Ed.) with Martin Zweig

1 × $6.00 -

×

Advanced GET 8.0 EOD

1 × $6.00

Advanced GET 8.0 EOD

1 × $6.00 -

×

WealthFRX Trading Mastery Course 2.0

1 × $5.00

WealthFRX Trading Mastery Course 2.0

1 × $5.00 -

×

YTC Price Action Trader

1 × $6.00

YTC Price Action Trader

1 × $6.00 -

×

War Room Psychology Vol. 2 with Pat Mitchell – Trick Trades

1 × $23.00

War Room Psychology Vol. 2 with Pat Mitchell – Trick Trades

1 × $23.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

The SPX 35-40 Day Delta Neutral Unbalanced Butterfly with Sheridan Options Mentoring

$247.00 Original price was: $247.00.$15.00Current price is: $15.00.

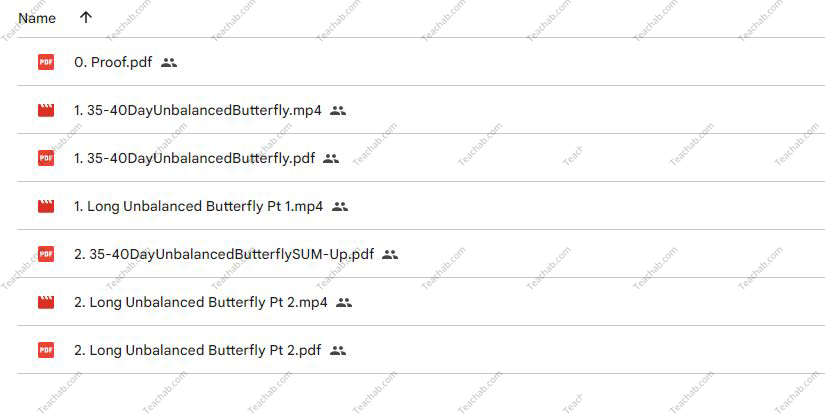

File Size: 410.9 MB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “The SPX 35-40 Day Delta Neutral Unbalanced Butterfly with Sheridan Options Mentoring” below:

Mastering the SPX 35-40 Day Delta Neutral Unbalanced Butterfly with Sheridan Options Mentoring

Introduction

In the intricate world of options trading, mastering specific strategies can significantly enhance your trading results. The SPX 35-40 Day Delta Neutral Unbalanced Butterfly is one such strategy, taught by Sheridan Options Mentoring. This article will guide you through the nuances of this strategy, its benefits, and how you can learn it through Sheridan Options Mentoring.

Understanding the SPX Index

Before diving into the strategy, it’s crucial to understand the SPX or the S&P 500 index, which is a market-capitalization-weighted index of 500 of the largest publicly traded companies in the U.S. It’s a key indicator of the overall stock market performance.

What is a Delta Neutral Strategy?

Delta neutral strategies are options strategies that are designed to be insensitive to changes in the price of the underlying asset, aiming for profits primarily through time decay or volatility changes.

The Unbalanced Butterfly Explained

The unbalanced butterfly, a variant of the standard butterfly option, involves setting up the trade with unbalanced quantities of options at different strike prices, allowing traders to manage risk while maintaining potential profitability.

Why Choose the SPX 35-40 Day Strategy?

This specific timeframe and strategy combination is designed to capitalize on the unique behaviors of the SPX options market around 35-40 days to expiration, balancing risk and reward effectively.

Benefits of Delta Neutral Trading

- Reduced Risk: Minimizes the impact of price movements in the underlying asset.

- Profit from Volatility: Potentially gain from volatility changes rather than directional movements.

- Flexibility: Adjust the positions as market conditions change.

Learning with Sheridan Options Mentoring

Sheridan Options Mentoring offers comprehensive training on various options strategies, including the SPX 35-40 Day Delta Neutral Unbalanced Butterfly.

Course Features

- Expert Instruction: Learn from seasoned professionals with years of trading experience.

- Interactive Sessions: Engage in live trading sessions and Q&A with mentors.

- Practical Application: Apply what you learn through guided trading scenarios.

Course Benefits

- Deep Understanding: Gain a thorough grasp of delta neutral strategies.

- Hands-On Experience: Practical application in the real market.

- Community Support: Access to a community of like-minded traders for ongoing support.

Module Breakdown of the Course

Here’s what you can expect to learn in the different modules of the course:

Module 1: Basics of Options Trading

- Understanding Options

- Fundamentals of Options Strategies

Module 2: Introduction to Delta Neutral Strategies

- Concepts and Applications

- Setting Up Delta Neutral Positions

Module 3: Mastering the Unbalanced Butterfly

- Trade Setup

- Risk Management Techniques

- Adjustment Strategies

Module 4: The SPX 35-40 Day Trade

- Why 35-40 Days?

- Detailed Trade Analysis

- Live Trade Examples

How to Enroll

To start learning this powerful trading strategy, follow these steps:

- Visit Sheridan Options Mentoring Online: Access detailed course information and schedules.

- Sign Up for the Course: Choose the right course plan according to your trading level and goals.

- Engage Actively in Learning: Participate in the courses and apply the strategies in live market conditions.

Conclusion

Whether you’re a novice trader looking to get started with options or an experienced trader aiming to refine your strategies, the SPX 35-40 Day Delta Neutral Unbalanced Butterfly course from Sheridan Options Mentoring offers a unique opportunity to learn a sophisticated trading technique that balances risk and reward. Harness the power of this strategy to enhance your trading acumen and potentially increase your market returns.

FAQs About the SPX 35-40 Day Strategy

1. What makes the SPX 35-40 day strategy unique?

This strategy utilizes the specific market conditions and volatility patterns observed around 35-40 days to expiration, offering a balanced approach between risk and potential returns.

2. Is the course suitable for beginners?

While having a basic understanding of options is helpful, the course is designed with modules that bring beginners up to speed before advancing to more complex strategies.

3. What are the prerequisites for enrolling in the course?

A basic knowledge of stocks and options is recommended, but beginners can benefit from the introductory modules offered.

4. How long does the course take to complete?

The course duration varies, but most traders can expect to spend about 4-8 weeks to go through the comprehensive training and practical sessions.

5. Can I trade the SPX 35-40 day strategy with a small portfolio?

Yes, the strategy can be scaled to suit different portfolio sizes, making it accessible to traders with varying amounts of capital.

Be the first to review “The SPX 35-40 Day Delta Neutral Unbalanced Butterfly with Sheridan Options Mentoring” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Reviews

There are no reviews yet.