-

×

Professional Training Program with OpenTrader

1 × $6.00

Professional Training Program with OpenTrader

1 × $6.00 -

×

Trading Calendar Spreads with Option Pit

1 × $39.00

Trading Calendar Spreads with Option Pit

1 × $39.00 -

×

Long-Term Secrets to Short-Term Trading with Larry Williams

1 × $6.00

Long-Term Secrets to Short-Term Trading with Larry Williams

1 × $6.00 -

×

PiScaled

1 × $6.00

PiScaled

1 × $6.00 -

×

Guide to Getting Short and Collecting Income with Don Kaufman

1 × $6.00

Guide to Getting Short and Collecting Income with Don Kaufman

1 × $6.00 -

×

Restore & Enhance Your Biofield (Advanced) by Spirituality Zone

1 × $15.40

Restore & Enhance Your Biofield (Advanced) by Spirituality Zone

1 × $15.40 -

×

The Bull Hunter with Dan Denning

1 × $6.00

The Bull Hunter with Dan Denning

1 × $6.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

Signature Trade from Forexia with Dylan Forexia

1 × $85.00

Signature Trade from Forexia with Dylan Forexia

1 × $85.00 -

×

Gimme My Money Back with Ali Velshi

1 × $6.00

Gimme My Money Back with Ali Velshi

1 × $6.00 -

×

Investment Strategies for the 21th Century with Frank Amstrong

1 × $6.00

Investment Strategies for the 21th Century with Frank Amstrong

1 × $6.00 -

×

Millionaire Traders with Kathy Lien & Boris Schlossberg

1 × $6.00

Millionaire Traders with Kathy Lien & Boris Schlossberg

1 × $6.00 -

×

Adz Trading Academy

1 × $5.00

Adz Trading Academy

1 × $5.00 -

×

Learn Investing & Trading with Danny Devan

1 × $23.00

Learn Investing & Trading with Danny Devan

1 × $23.00 -

×

Sure Fire Forex Trading with Mark McRae

1 × $6.00

Sure Fire Forex Trading with Mark McRae

1 × $6.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

Forex Trading Bootcamp For Traders & Investors (2020)

1 × $6.00

Forex Trading Bootcamp For Traders & Investors (2020)

1 × $6.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Practical Speculation with Victor Niederhoffer, Laurel Kenner

1 × $6.00

Practical Speculation with Victor Niederhoffer, Laurel Kenner

1 × $6.00 -

×

Gann Simplified with Clif Droke

1 × $6.00

Gann Simplified with Clif Droke

1 × $6.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

Full Pips & Profit Strategy with Pips & Profits

1 × $18.00

Full Pips & Profit Strategy with Pips & Profits

1 × $18.00 -

×

Kickstart Course with Tradelikerocket

1 × $46.00

Kickstart Course with Tradelikerocket

1 × $46.00 -

×

PowerWave Trading with Dar Wong

1 × $4.00

PowerWave Trading with Dar Wong

1 × $4.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

Reminiscences of a Stock Operator (75th Aniversary Ed.) with Edwin Lefevre

1 × $6.00

Reminiscences of a Stock Operator (75th Aniversary Ed.) with Edwin Lefevre

1 × $6.00 -

×

FuturesTrader71 - webinar series (4 webinars)

1 × $6.00

FuturesTrader71 - webinar series (4 webinars)

1 × $6.00 -

×

How To Scale Up Your Trading - Online Trading Seminar Replay with Austin Silver - ASFX

1 × $31.00

How To Scale Up Your Trading - Online Trading Seminar Replay with Austin Silver - ASFX

1 × $31.00 -

×

Futures Trading Secrets Home Study Course 2004 with Bill McCready

1 × $7.00

Futures Trading Secrets Home Study Course 2004 with Bill McCready

1 × $7.00 -

×

Pairs Trading: Quantitative Methods and Analysis with Ganapathy Vidyamurthy

1 × $6.00

Pairs Trading: Quantitative Methods and Analysis with Ganapathy Vidyamurthy

1 × $6.00 -

×

News FX Strategy with Zain Agha

1 × $6.00

News FX Strategy with Zain Agha

1 × $6.00 -

×

The Complete Short Course on Ripple Cryptocurrency with Saad Hameed

1 × $5.00

The Complete Short Course on Ripple Cryptocurrency with Saad Hameed

1 × $5.00 -

×

Our 3 Bread and Butter Trades In This Low IV Market Advanced Class with Day Trading Zones

1 × $39.00

Our 3 Bread and Butter Trades In This Low IV Market Advanced Class with Day Trading Zones

1 × $39.00 -

×

BETT Strategy with TopTradeTools

1 × $35.00

BETT Strategy with TopTradeTools

1 × $35.00 -

×

MASTERING SWING TRADING May 2024 with Roman Bogomazov

1 × $194.00

MASTERING SWING TRADING May 2024 with Roman Bogomazov

1 × $194.00 -

×

Modern Darvas Trading

1 × $6.00

Modern Darvas Trading

1 × $6.00 -

×

Rockwell Day Trading - Starter Package

1 × $6.00

Rockwell Day Trading - Starter Package

1 × $6.00 -

×

How I Trade Growth Stocks In Bull And Bear Markets

1 × $54.00

How I Trade Growth Stocks In Bull And Bear Markets

1 × $54.00 -

×

Simpler Options - Stock Trading Patterns

1 × $6.00

Simpler Options - Stock Trading Patterns

1 × $6.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

Essentials Of Payroll Management & Accounting with Steven M.Bragg

1 × $6.00

Essentials Of Payroll Management & Accounting with Steven M.Bragg

1 × $6.00 -

×

MTI - Trend Trader Course (Feb 2014)

1 × $23.00

MTI - Trend Trader Course (Feb 2014)

1 × $23.00 -

×

RTM + Suppy and Demand with Nora Bystra

1 × $6.00

RTM + Suppy and Demand with Nora Bystra

1 × $6.00 -

×

How to Trade a Vertical Market with Armstrong Economics

1 × $155.00

How to Trade a Vertical Market with Armstrong Economics

1 × $155.00 -

×

Level II Trading Warfare - The Undergroundtrader's Powerful Weapons for Winning - Jea Yu

1 × $6.00

Level II Trading Warfare - The Undergroundtrader's Powerful Weapons for Winning - Jea Yu

1 × $6.00 -

×

A Seminar On Ocean Theory Home Study Trading Course with Pat Raffalovich

1 × $6.00

A Seminar On Ocean Theory Home Study Trading Course with Pat Raffalovich

1 × $6.00 -

×

Inner Circle Trader ICT Mentorship 2021 with Michael Huddleston

1 × $5.00

Inner Circle Trader ICT Mentorship 2021 with Michael Huddleston

1 × $5.00 -

×

Pre-Previews. 23 Articles and Forecasts

1 × $6.00

Pre-Previews. 23 Articles and Forecasts

1 × $6.00 -

×

Patterns to Profits with Ryan Mallory - Share Planner

1 × $6.00

Patterns to Profits with Ryan Mallory - Share Planner

1 × $6.00 -

×

More on the Short Cycles of Interest Rates (Article) with Arie Melnik, Alan Kraus

1 × $6.00

More on the Short Cycles of Interest Rates (Article) with Arie Melnik, Alan Kraus

1 × $6.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

The WWA Core Concepts Bootcamp

1 × $6.00

The WWA Core Concepts Bootcamp

1 × $6.00 -

×

FX Cartel Online Course

1 × $31.00

FX Cartel Online Course

1 × $31.00 -

×

Master The Art of Technical Analysis with Raul Gonzalez

1 × $31.00

Master The Art of Technical Analysis with Raul Gonzalez

1 × $31.00 -

×

Stealth Trader (Ebook) with Andy Jordan - Trading Educators

1 × $132.00

Stealth Trader (Ebook) with Andy Jordan - Trading Educators

1 × $132.00 -

×

Options University - FX Technical Analysis

1 × $6.00

Options University - FX Technical Analysis

1 × $6.00 -

×

Option Hydra - Mar 2020 Edition - Basics with Rajandran R

1 × $23.00

Option Hydra - Mar 2020 Edition - Basics with Rajandran R

1 × $23.00 -

×

8 Successful Iron Condor Methodologies with Dan Sheridan

1 × $23.00

8 Successful Iron Condor Methodologies with Dan Sheridan

1 × $23.00 -

×

Swing Trading for a Living (7 Video Cds & WorkBook 2.1 GB)

1 × $6.00

Swing Trading for a Living (7 Video Cds & WorkBook 2.1 GB)

1 × $6.00 -

×

Market Trader Forecasting Modeling Course

1 × $6.00

Market Trader Forecasting Modeling Course

1 × $6.00 -

×

Slim Miller's Cycle Analysis Workshop with Steve "Slim" Miller

1 × $6.00

Slim Miller's Cycle Analysis Workshop with Steve "Slim" Miller

1 × $6.00 -

×

Change Happens. Do You Profit Or Does Someone Else (Traders Expo Las Vegas Dec 2005) by Tobin Smith

1 × $6.00

Change Happens. Do You Profit Or Does Someone Else (Traders Expo Las Vegas Dec 2005) by Tobin Smith

1 × $6.00 -

×

DApp Mastermind (Crypto DApps) – Passive Income with DApps and SMART Contracts with Jason BTO

1 × $6.00

DApp Mastermind (Crypto DApps) – Passive Income with DApps and SMART Contracts with Jason BTO

1 × $6.00

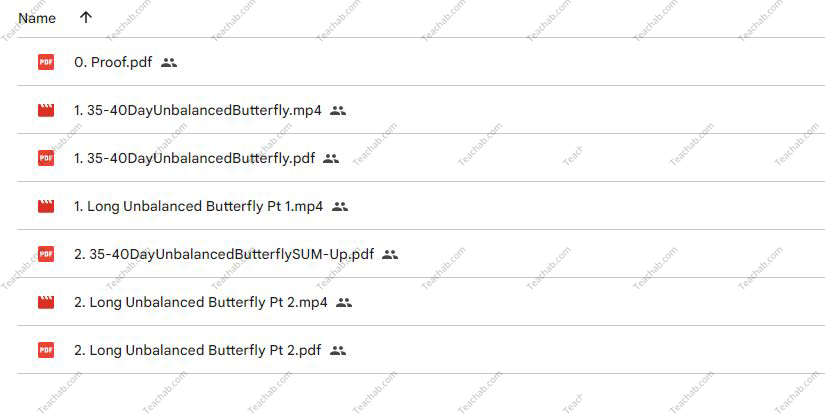

The SPX 35-40 Day Delta Neutral Unbalanced Butterfly with Sheridan Options Mentoring

$247.00 Original price was: $247.00.$15.00Current price is: $15.00.

File Size: 410.9 MB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “The SPX 35-40 Day Delta Neutral Unbalanced Butterfly with Sheridan Options Mentoring” below:

Mastering the SPX 35-40 Day Delta Neutral Unbalanced Butterfly with Sheridan Options Mentoring

Introduction

In the intricate world of options trading, mastering specific strategies can significantly enhance your trading results. The SPX 35-40 Day Delta Neutral Unbalanced Butterfly is one such strategy, taught by Sheridan Options Mentoring. This article will guide you through the nuances of this strategy, its benefits, and how you can learn it through Sheridan Options Mentoring.

Understanding the SPX Index

Before diving into the strategy, it’s crucial to understand the SPX or the S&P 500 index, which is a market-capitalization-weighted index of 500 of the largest publicly traded companies in the U.S. It’s a key indicator of the overall stock market performance.

What is a Delta Neutral Strategy?

Delta neutral strategies are options strategies that are designed to be insensitive to changes in the price of the underlying asset, aiming for profits primarily through time decay or volatility changes.

The Unbalanced Butterfly Explained

The unbalanced butterfly, a variant of the standard butterfly option, involves setting up the trade with unbalanced quantities of options at different strike prices, allowing traders to manage risk while maintaining potential profitability.

Why Choose the SPX 35-40 Day Strategy?

This specific timeframe and strategy combination is designed to capitalize on the unique behaviors of the SPX options market around 35-40 days to expiration, balancing risk and reward effectively.

Benefits of Delta Neutral Trading

- Reduced Risk: Minimizes the impact of price movements in the underlying asset.

- Profit from Volatility: Potentially gain from volatility changes rather than directional movements.

- Flexibility: Adjust the positions as market conditions change.

Learning with Sheridan Options Mentoring

Sheridan Options Mentoring offers comprehensive training on various options strategies, including the SPX 35-40 Day Delta Neutral Unbalanced Butterfly.

Course Features

- Expert Instruction: Learn from seasoned professionals with years of trading experience.

- Interactive Sessions: Engage in live trading sessions and Q&A with mentors.

- Practical Application: Apply what you learn through guided trading scenarios.

Course Benefits

- Deep Understanding: Gain a thorough grasp of delta neutral strategies.

- Hands-On Experience: Practical application in the real market.

- Community Support: Access to a community of like-minded traders for ongoing support.

Module Breakdown of the Course

Here’s what you can expect to learn in the different modules of the course:

Module 1: Basics of Options Trading

- Understanding Options

- Fundamentals of Options Strategies

Module 2: Introduction to Delta Neutral Strategies

- Concepts and Applications

- Setting Up Delta Neutral Positions

Module 3: Mastering the Unbalanced Butterfly

- Trade Setup

- Risk Management Techniques

- Adjustment Strategies

Module 4: The SPX 35-40 Day Trade

- Why 35-40 Days?

- Detailed Trade Analysis

- Live Trade Examples

How to Enroll

To start learning this powerful trading strategy, follow these steps:

- Visit Sheridan Options Mentoring Online: Access detailed course information and schedules.

- Sign Up for the Course: Choose the right course plan according to your trading level and goals.

- Engage Actively in Learning: Participate in the courses and apply the strategies in live market conditions.

Conclusion

Whether you’re a novice trader looking to get started with options or an experienced trader aiming to refine your strategies, the SPX 35-40 Day Delta Neutral Unbalanced Butterfly course from Sheridan Options Mentoring offers a unique opportunity to learn a sophisticated trading technique that balances risk and reward. Harness the power of this strategy to enhance your trading acumen and potentially increase your market returns.

FAQs About the SPX 35-40 Day Strategy

1. What makes the SPX 35-40 day strategy unique?

This strategy utilizes the specific market conditions and volatility patterns observed around 35-40 days to expiration, offering a balanced approach between risk and potential returns.

2. Is the course suitable for beginners?

While having a basic understanding of options is helpful, the course is designed with modules that bring beginners up to speed before advancing to more complex strategies.

3. What are the prerequisites for enrolling in the course?

A basic knowledge of stocks and options is recommended, but beginners can benefit from the introductory modules offered.

4. How long does the course take to complete?

The course duration varies, but most traders can expect to spend about 4-8 weeks to go through the comprehensive training and practical sessions.

5. Can I trade the SPX 35-40 day strategy with a small portfolio?

Yes, the strategy can be scaled to suit different portfolio sizes, making it accessible to traders with varying amounts of capital.

Be the first to review “The SPX 35-40 Day Delta Neutral Unbalanced Butterfly with Sheridan Options Mentoring” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.