-

×

The FX Swing Trading Blueprint with Swing FX

1 × $6.00

The FX Swing Trading Blueprint with Swing FX

1 × $6.00 -

×

Value, Price & Profit with Karl Marx

1 × $6.00

Value, Price & Profit with Karl Marx

1 × $6.00 -

×

Futures Spread Trading Intro Course with Thetradingframework

1 × $6.00

Futures Spread Trading Intro Course with Thetradingframework

1 × $6.00 -

×

From Walden to Wall Street: Frontiers of Conservation Finance with James Levitt

1 × $6.00

From Walden to Wall Street: Frontiers of Conservation Finance with James Levitt

1 × $6.00 -

×

BETT Strategy with TopTradeTools

1 × $35.00

BETT Strategy with TopTradeTools

1 × $35.00 -

×

Reversal Magic Video Course

1 × $15.00

Reversal Magic Video Course

1 × $15.00 -

×

Raghee Horner's Workspace Bundle + Live Trading By Raghee Horner - Simpler Trading

1 × $23.00

Raghee Horner's Workspace Bundle + Live Trading By Raghee Horner - Simpler Trading

1 × $23.00 -

×

Engineering Analysis: Interactive Methods and Programs with FORTRAN, QuickBASIC, MATLAB, and Mathematica with Yen-Ching Pao

1 × $6.00

Engineering Analysis: Interactive Methods and Programs with FORTRAN, QuickBASIC, MATLAB, and Mathematica with Yen-Ching Pao

1 × $6.00 -

×

High Probability Trading with Marcel Link

1 × $6.00

High Probability Trading with Marcel Link

1 × $6.00 -

×

Teresa Lo's PowerSwings EOD for eSignal (powerswings.com)

1 × $6.00

Teresa Lo's PowerSwings EOD for eSignal (powerswings.com)

1 × $6.00 -

×

Cloud9Nine Trading Course

1 × $5.00

Cloud9Nine Trading Course

1 × $5.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

Basecamptrading - How to Become a More Consistent Trader

1 × $15.00

Basecamptrading - How to Become a More Consistent Trader

1 × $15.00 -

×

Gaining an Edge when you Trade the S&P Futures with Carolyn Boroden

1 × $6.00

Gaining an Edge when you Trade the S&P Futures with Carolyn Boroden

1 × $6.00 -

×

Trading Economic Data System with CopperChips

1 × $6.00

Trading Economic Data System with CopperChips

1 × $6.00 -

×

Bulls on Wall Street Mentorship

1 × $31.00

Bulls on Wall Street Mentorship

1 × $31.00 -

×

The Ultimate Systems Trader (UST) Advanced - Trading with Rayner

1 × $62.00

The Ultimate Systems Trader (UST) Advanced - Trading with Rayner

1 × $62.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

Ichimoku 101 Cloud Trading Secrets

1 × $24.00

Ichimoku 101 Cloud Trading Secrets

1 × $24.00 -

×

Advanced Price Action Course with Chris Capre

1 × $7.00

Advanced Price Action Course with Chris Capre

1 × $7.00 -

×

Stock Trading Strategies Technical Analysis MasterClass 2 with Jyoti Bansal

1 × $6.00

Stock Trading Strategies Technical Analysis MasterClass 2 with Jyoti Bansal

1 × $6.00 -

×

Channels & Cycles. A Tribute to J.M.Hurst with Brian J.Millard

1 × $6.00

Channels & Cycles. A Tribute to J.M.Hurst with Brian J.Millard

1 × $6.00 -

×

Scalping Master Course with Dayonetraders

1 × $6.00

Scalping Master Course with Dayonetraders

1 × $6.00 -

×

Forecasting Profits Using Price & Time with Ed Gately

1 × $6.00

Forecasting Profits Using Price & Time with Ed Gately

1 × $6.00 -

×

CFA Level 1 - Schweser Study Notes 2006 (schweser.com)

1 × $6.00

CFA Level 1 - Schweser Study Notes 2006 (schweser.com)

1 × $6.00 -

×

Professional Swing Trading College with Steven Primo

1 × $15.00

Professional Swing Trading College with Steven Primo

1 × $15.00 -

×

Basic Astrotech

1 × $6.00

Basic Astrotech

1 × $6.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

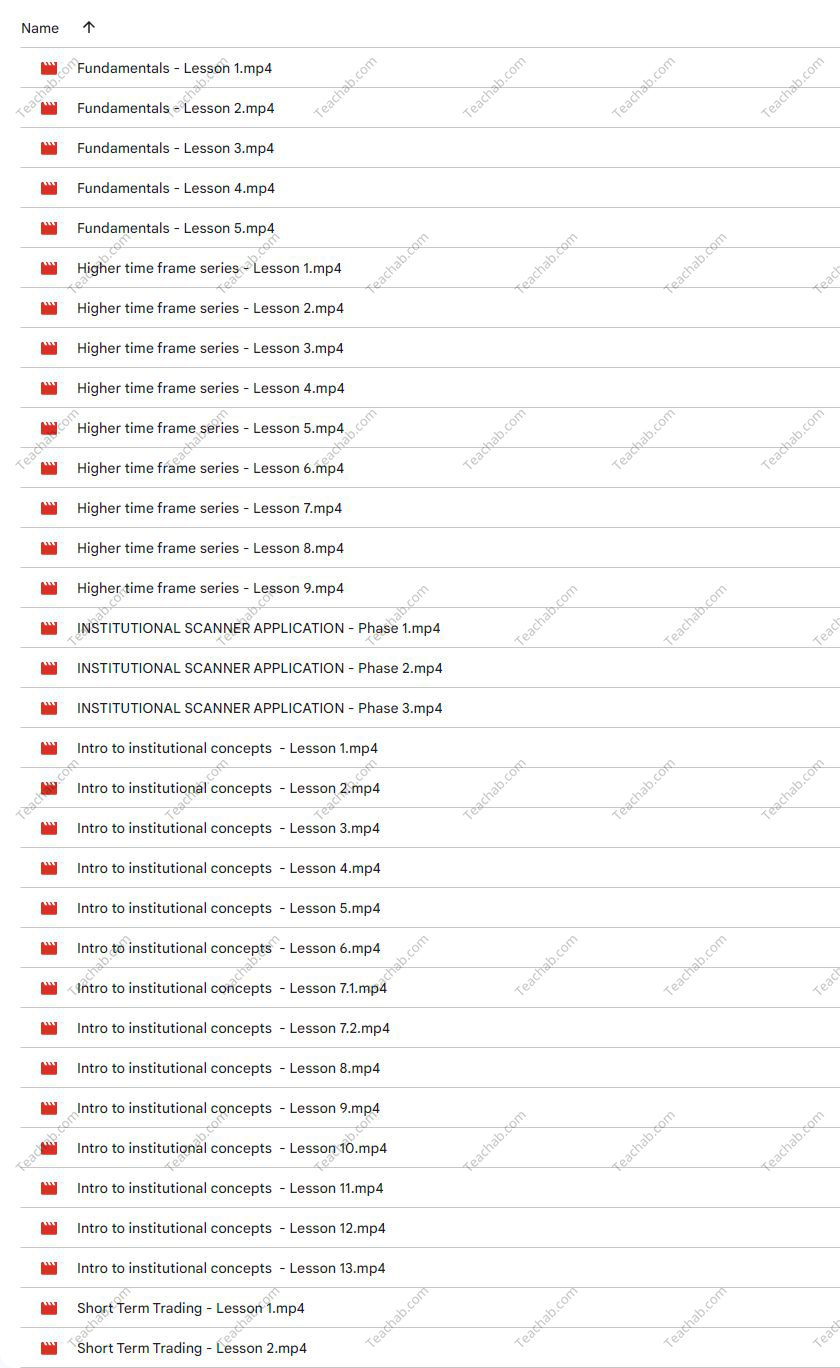

SMT FX Trading

$5.00

File Size: 6.84 GB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “SMT FX Trading” below:

Unlocking the Potential of SMT FX Trading

Welcome to the dynamic world of SMT FX Trading, where we delve into the nuances of Smart Money Trading in the forex market. Designed for both novice traders and seasoned market analysts, SMT FX Trading offers a comprehensive approach to understanding how smart money operates and how you can align your trading strategies accordingly.

1. Introduction to SMT FX Trading

What is SMT FX Trading?

SMT FX Trading refers to the strategy of tracking and interpreting the market activities of smart money traders—those who are considered to have significant influence and information advantages in the forex market.

2. The Importance of Smart Money

Influence of Smart Money

Understanding the movements of smart money can give traders insights into potential market directions before they become obvious to the public.

3. Core Principles of SMT FX Trading

Understanding Market Sentiment

Learn how to read the underlying sentiments in the market to predict future movements effectively.

Analyzing Volume and Price

Discover how to use volume as a key indicator in conjunction with price action to identify smart money’s footprints.

4. Tools and Techniques in SMT FX Trading

Advanced Analytical Tools

We explore the software and analytical methods used to track and analyze smart money transactions.

Technical Indicators Used in SMT

Uncover the specific indicators that can signal smart money activity.

5. Benefits of SMT FX Trading

Enhanced Trading Decisions

Adopting SMT techniques can lead to more informed and potentially more profitable trading decisions.

Risk Management

Learn how to manage risks by understanding when and where the smart money is likely to drive the market.

6. SMT FX Trading Strategies

Developing Your Strategy

We guide you on how to develop robust trading strategies based on smart money trends.

Entry and Exit Points

Determine optimal entry and exit points using SMT analysis.

7. Who Should Engage in SMT FX Trading?

Is SMT FX Trading Right for You?

This section helps you assess whether SMT FX Trading aligns with your trading goals and risk tolerance.

8. Learning SMT FX Trading

Educational Resources

Explore available courses, books, and online resources to get started with SMT FX Trading.

Practical Training Sessions

Hands-on training opportunities to apply SMT principles in real-time trading environments.

9. Integration of SMT FX Trading with Other Strategies

Complementary Strategies

Learn how to combine SMT FX Trading with other trading strategies for optimal results.

10. The Future of SMT FX Trading

Trends and Predictions

Discuss future trends in SMT FX Trading and how it could evolve with advancing technology.

11. Expert Insights on SMT FX Trading

Advice from the Pros

Tips and tricks from experienced traders who specialize in Smart Money Trading.

12. Common Mistakes in SMT FX Trading

Pitfalls to Avoid

Identify common errors that new traders make when trying to implement SMT strategies.

13. Success Stories

Testimonials from Successful Traders

Real-life success stories from traders who have mastered SMT FX Trading.

14. FAQs Before You Start

Essential Information

Provide answers to frequently asked questions for those new to SMT FX Trading.

15. Conclusion

Embracing SMT FX Trading can significantly enhance your trading capabilities, providing you with a deeper understanding of market forces and the tools to navigate them effectively. Whether you are just starting out or looking to refine your trading approach, understanding smart money can be your key to success.

FAQs

- What exactly is SMT in forex trading?

SMT, or Smart Money Trading, involves strategies that focus on identifying and capitalizing on the market moves made by financially influential players or smart money.

2. How can a beginner learn SMT FX Trading?

Beginners can start by studying basic forex trading principles, then gradually incorporate SMT analysis by using specific indicators and attending specialized courses.

3. What tools are essential for SMT FX Trading?

Key tools include volume analysis software, advanced charting packages, and access to comprehensive market data feeds.

4. Is SMT FX Trading risky?

Like all trading strategies, SMT FX Trading involves risk, but with proper risk management techniques, these can be substantially reduced.

5. Can SMT FX Trading be automated?

Some aspects of SMT FX Trading can be automated with algorithms designed to track and react to market indicators that suggest smart money activities.

Be the first to review “SMT FX Trading” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Reviews

There are no reviews yet.