-

×

Quantitative Trading and Money Management, Revised Edition (5th Edition) with Fred Gehm

1 × $6.00

Quantitative Trading and Money Management, Revised Edition (5th Edition) with Fred Gehm

1 × $6.00 -

×

Marber on Markets – How to Make Money from Charts with Brian Marber

1 × $6.00

Marber on Markets – How to Make Money from Charts with Brian Marber

1 × $6.00 -

×

Mastertrader – Mastering Swing Trading

1 × $31.00

Mastertrader – Mastering Swing Trading

1 × $31.00 -

×

Trading in the Bluff with John Templeton

1 × $6.00

Trading in the Bluff with John Templeton

1 × $6.00 -

×

Newtonian Trading Strategy Video Course with Fractal Flow Pro

1 × $6.00

Newtonian Trading Strategy Video Course with Fractal Flow Pro

1 × $6.00 -

×

Cheat Code Trading System

1 × $13.00

Cheat Code Trading System

1 × $13.00 -

×

Trade with a Day Job USA v2010 with Markets Mastered

1 × $6.00

Trade with a Day Job USA v2010 with Markets Mastered

1 × $6.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Forex Trading Strategies Modules 1-3 Complete Set with Blake Young - Shadow Trader

1 × $54.00

Forex Trading Strategies Modules 1-3 Complete Set with Blake Young - Shadow Trader

1 × $54.00 -

×

The Japanese Money Tree with Andrew H.Shipley

1 × $6.00

The Japanese Money Tree with Andrew H.Shipley

1 × $6.00 -

×

Zap Seminar - Ablesys

1 × $6.00

Zap Seminar - Ablesys

1 × $6.00 -

×

Krautgap By John Piper

1 × $6.00

Krautgap By John Piper

1 × $6.00 -

×

Hedge Fund Investment Management with Izze Nelken

1 × $6.00

Hedge Fund Investment Management with Izze Nelken

1 × $6.00 -

×

Investing with LEAPS. What You Should Know About Long Term Investing with James Bittman

1 × $6.00

Investing with LEAPS. What You Should Know About Long Term Investing with James Bittman

1 × $6.00 -

×

NQ Price Action Mastery with Trade Smart

1 × $15.00

NQ Price Action Mastery with Trade Smart

1 × $15.00 -

×

7 Commandments of Stock Investing with Gene Marcial

1 × $6.00

7 Commandments of Stock Investing with Gene Marcial

1 × $6.00 -

×

Dan Sheridan 2011 Calendar Workshop

1 × $6.00

Dan Sheridan 2011 Calendar Workshop

1 × $6.00 -

×

Commodity Futures Traders Club (CTCN) Issues 01 – 77

1 × $6.00

Commodity Futures Traders Club (CTCN) Issues 01 – 77

1 × $6.00 -

×

Forex Trading for Newbies Complete Course with Chuck Low

1 × $6.00

Forex Trading for Newbies Complete Course with Chuck Low

1 × $6.00 -

×

How To Be a Profitable Forex Trader with Corey Halliday

1 × $6.00

How To Be a Profitable Forex Trader with Corey Halliday

1 × $6.00 -

×

FlowRider Trading Course with Boris Schlossberg and Kathy Lien - Bkforex

1 × $15.00

FlowRider Trading Course with Boris Schlossberg and Kathy Lien - Bkforex

1 × $15.00 -

×

Trading Trend Pullbacks - 3-Step Technical Analysis Method with Richard Deutsch

1 × $6.00

Trading Trend Pullbacks - 3-Step Technical Analysis Method with Richard Deutsch

1 × $6.00 -

×

DNA Wealth Blueprint 3 (Complete)

1 × $54.00

DNA Wealth Blueprint 3 (Complete)

1 × $54.00 -

×

Baby Blue Trading Technique for the E-Minis with Dave Wright

1 × $6.00

Baby Blue Trading Technique for the E-Minis with Dave Wright

1 × $6.00 -

×

Trade from Anywhere

1 × $6.00

Trade from Anywhere

1 × $6.00 -

×

Investing Online for Dummies (5th Edition) with Kathleen Sindell

1 × $6.00

Investing Online for Dummies (5th Edition) with Kathleen Sindell

1 × $6.00 -

×

The Bond Book (2nd Ed.) with Annette Thau

1 × $6.00

The Bond Book (2nd Ed.) with Annette Thau

1 × $6.00 -

×

Advances in International Investments: Traditional and Alternative Approaches with Hung-Gay Fung, Xiaoqing Eleanor Xu & Jot Yau

1 × $6.00

Advances in International Investments: Traditional and Alternative Approaches with Hung-Gay Fung, Xiaoqing Eleanor Xu & Jot Yau

1 × $6.00 -

×

Investing in Corporate Bonds and Credit Risk with Frank Hagenstein

1 × $6.00

Investing in Corporate Bonds and Credit Risk with Frank Hagenstein

1 × $6.00 -

×

Market Risk Analysis, Volume III, Pricing, Hedging and Trading Financial Instruments with Carol Alexander

1 × $6.00

Market Risk Analysis, Volume III, Pricing, Hedging and Trading Financial Instruments with Carol Alexander

1 × $6.00 -

×

Preparing for the Worst: Incorporating Downside Risk in Stock Market Investments with Hrishikesh Vinod & Derrick Reagle

1 × $6.00

Preparing for the Worst: Incorporating Downside Risk in Stock Market Investments with Hrishikesh Vinod & Derrick Reagle

1 × $6.00 -

×

RSD - Alex’s Natural Instinct Method Manifesto

1 × $6.00

RSD - Alex’s Natural Instinct Method Manifesto

1 × $6.00 -

×

Directional Calendars in 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $85.00

Directional Calendars in 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $85.00 -

×

You AreThe Indicator Online Course

1 × $31.00

You AreThe Indicator Online Course

1 × $31.00 -

×

Algohub 2023 Full Completed with Algohub

1 × $5.00

Algohub 2023 Full Completed with Algohub

1 × $5.00 -

×

3 Steps To Supply/Demand + 3 Steps To Market Profile 10% Off Combined Price

1 × $23.00

3 Steps To Supply/Demand + 3 Steps To Market Profile 10% Off Combined Price

1 × $23.00 -

×

Mind & Markets. An Advanced Study Course of Stock Market Education (1951) with Bert Larson

1 × $6.00

Mind & Markets. An Advanced Study Course of Stock Market Education (1951) with Bert Larson

1 × $6.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

DApp Mastermind (Crypto DApps) – Passive Income with DApps and SMART Contracts with Jason BTO

1 × $6.00

DApp Mastermind (Crypto DApps) – Passive Income with DApps and SMART Contracts with Jason BTO

1 × $6.00 -

×

CFA Pro Level 1 2004 CD - Scheweser

1 × $6.00

CFA Pro Level 1 2004 CD - Scheweser

1 × $6.00 -

×

Alternative Assets and Strategic Allocation with John Abbink

1 × $6.00

Alternative Assets and Strategic Allocation with John Abbink

1 × $6.00 -

×

The London Close Trade Strategy with Shirley Hudson & Vic Noble

1 × $4.00

The London Close Trade Strategy with Shirley Hudson & Vic Noble

1 × $4.00 -

×

Bear Market Success Workshop with Base Camp Trading

1 × $15.00

Bear Market Success Workshop with Base Camp Trading

1 × $15.00 -

×

Basic Day Trading Techniques with Michael Jenkins

1 × $6.00

Basic Day Trading Techniques with Michael Jenkins

1 × $6.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

SMT FX Trading

$5.00

File Size: 6.84 GB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

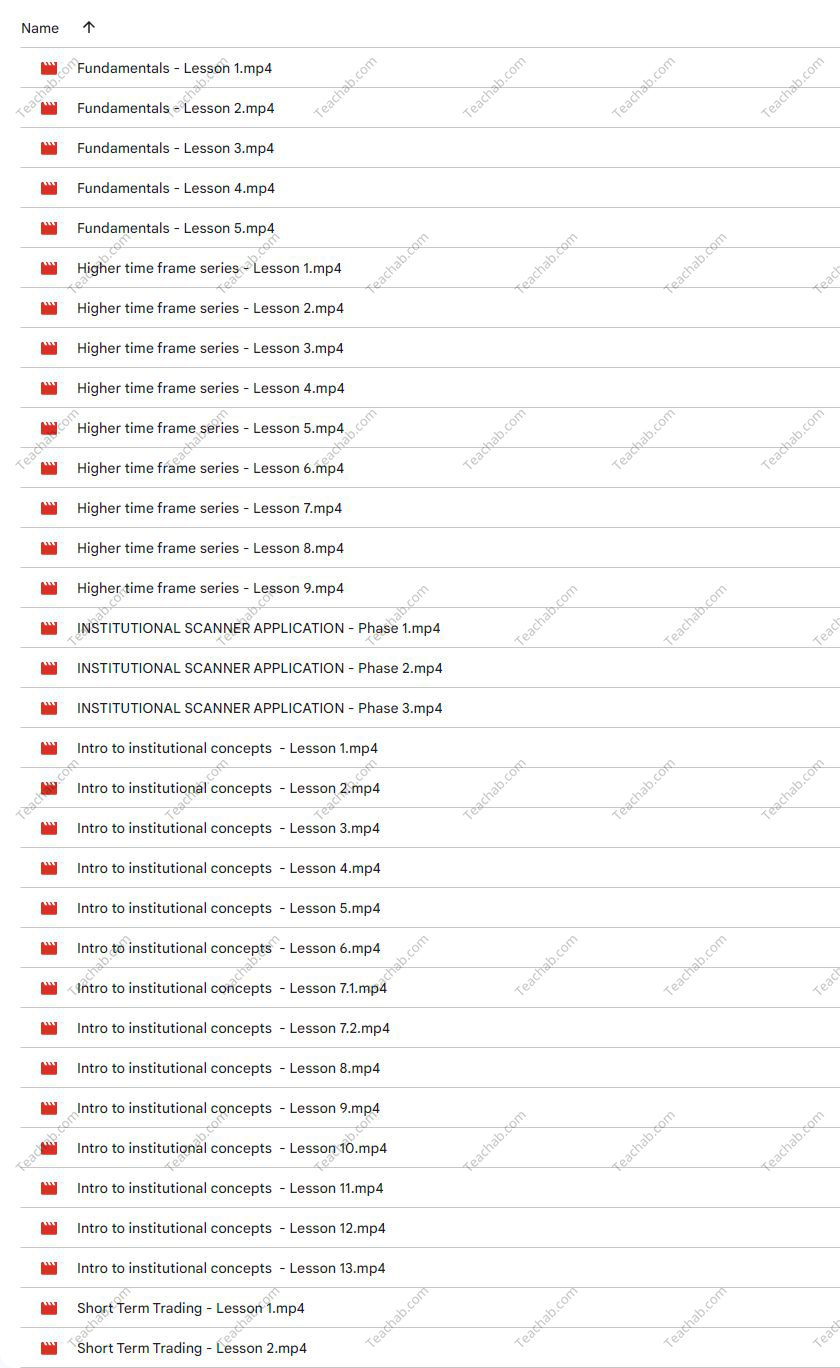

You may check content proof of “SMT FX Trading” below:

Unlocking the Potential of SMT FX Trading

Welcome to the dynamic world of SMT FX Trading, where we delve into the nuances of Smart Money Trading in the forex market. Designed for both novice traders and seasoned market analysts, SMT FX Trading offers a comprehensive approach to understanding how smart money operates and how you can align your trading strategies accordingly.

1. Introduction to SMT FX Trading

What is SMT FX Trading?

SMT FX Trading refers to the strategy of tracking and interpreting the market activities of smart money traders—those who are considered to have significant influence and information advantages in the forex market.

2. The Importance of Smart Money

Influence of Smart Money

Understanding the movements of smart money can give traders insights into potential market directions before they become obvious to the public.

3. Core Principles of SMT FX Trading

Understanding Market Sentiment

Learn how to read the underlying sentiments in the market to predict future movements effectively.

Analyzing Volume and Price

Discover how to use volume as a key indicator in conjunction with price action to identify smart money’s footprints.

4. Tools and Techniques in SMT FX Trading

Advanced Analytical Tools

We explore the software and analytical methods used to track and analyze smart money transactions.

Technical Indicators Used in SMT

Uncover the specific indicators that can signal smart money activity.

5. Benefits of SMT FX Trading

Enhanced Trading Decisions

Adopting SMT techniques can lead to more informed and potentially more profitable trading decisions.

Risk Management

Learn how to manage risks by understanding when and where the smart money is likely to drive the market.

6. SMT FX Trading Strategies

Developing Your Strategy

We guide you on how to develop robust trading strategies based on smart money trends.

Entry and Exit Points

Determine optimal entry and exit points using SMT analysis.

7. Who Should Engage in SMT FX Trading?

Is SMT FX Trading Right for You?

This section helps you assess whether SMT FX Trading aligns with your trading goals and risk tolerance.

8. Learning SMT FX Trading

Educational Resources

Explore available courses, books, and online resources to get started with SMT FX Trading.

Practical Training Sessions

Hands-on training opportunities to apply SMT principles in real-time trading environments.

9. Integration of SMT FX Trading with Other Strategies

Complementary Strategies

Learn how to combine SMT FX Trading with other trading strategies for optimal results.

10. The Future of SMT FX Trading

Trends and Predictions

Discuss future trends in SMT FX Trading and how it could evolve with advancing technology.

11. Expert Insights on SMT FX Trading

Advice from the Pros

Tips and tricks from experienced traders who specialize in Smart Money Trading.

12. Common Mistakes in SMT FX Trading

Pitfalls to Avoid

Identify common errors that new traders make when trying to implement SMT strategies.

13. Success Stories

Testimonials from Successful Traders

Real-life success stories from traders who have mastered SMT FX Trading.

14. FAQs Before You Start

Essential Information

Provide answers to frequently asked questions for those new to SMT FX Trading.

15. Conclusion

Embracing SMT FX Trading can significantly enhance your trading capabilities, providing you with a deeper understanding of market forces and the tools to navigate them effectively. Whether you are just starting out or looking to refine your trading approach, understanding smart money can be your key to success.

FAQs

- What exactly is SMT in forex trading?

SMT, or Smart Money Trading, involves strategies that focus on identifying and capitalizing on the market moves made by financially influential players or smart money.

2. How can a beginner learn SMT FX Trading?

Beginners can start by studying basic forex trading principles, then gradually incorporate SMT analysis by using specific indicators and attending specialized courses.

3. What tools are essential for SMT FX Trading?

Key tools include volume analysis software, advanced charting packages, and access to comprehensive market data feeds.

4. Is SMT FX Trading risky?

Like all trading strategies, SMT FX Trading involves risk, but with proper risk management techniques, these can be substantially reduced.

5. Can SMT FX Trading be automated?

Some aspects of SMT FX Trading can be automated with algorithms designed to track and react to market indicators that suggest smart money activities.

Be the first to review “SMT FX Trading” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.