-

×

Professional Training Program with OpenTrader

1 × $6.00

Professional Training Program with OpenTrader

1 × $6.00 -

×

Timing Solution Terra Incognita Edition Build 24 (timingsolution.com)

1 × $6.00

Timing Solution Terra Incognita Edition Build 24 (timingsolution.com)

1 × $6.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

How Charts Can Help You in the Stock Market with William Jiller

1 × $6.00

How Charts Can Help You in the Stock Market with William Jiller

1 × $6.00 -

×

JeaFx 2023 with James Allen

1 × $5.00

JeaFx 2023 with James Allen

1 × $5.00 -

×

Electronic AGS Trading Workshop with John Carter & Hunert Senters

1 × $6.00

Electronic AGS Trading Workshop with John Carter & Hunert Senters

1 × $6.00 -

×

Winning on Wall Street (Updated & Revised Ed.) with Martin Zweig

1 × $6.00

Winning on Wall Street (Updated & Revised Ed.) with Martin Zweig

1 × $6.00 -

×

FX Accelerator

1 × $31.00

FX Accelerator

1 × $31.00 -

×

Trading Economic Data System with CopperChips

1 × $6.00

Trading Economic Data System with CopperChips

1 × $6.00 -

×

Elliott Flat Waves CD with David Elliott

1 × $6.00

Elliott Flat Waves CD with David Elliott

1 × $6.00 -

×

How To Predict The Future DVD with Robert Kiyosaki

1 × $6.00

How To Predict The Future DVD with Robert Kiyosaki

1 × $6.00 -

×

Trading Options at Expiration: Strategies and Models for Winning the Endgame with Jeff Augen

1 × $6.00

Trading Options at Expiration: Strategies and Models for Winning the Endgame with Jeff Augen

1 × $6.00 -

×

FX Cartel Online Course

1 × $31.00

FX Cartel Online Course

1 × $31.00 -

×

6 Live Sentiment Analysis Trading Bots using Python with The A.I. Whisperer

1 × $5.00

6 Live Sentiment Analysis Trading Bots using Python with The A.I. Whisperer

1 × $5.00 -

×

Accumulation & Distribution with Larry Williams

1 × $4.00

Accumulation & Distribution with Larry Williams

1 × $4.00 -

×

REMORA OPTIONS TRADING (Silver Membership)

1 × $23.00

REMORA OPTIONS TRADING (Silver Membership)

1 × $23.00 -

×

Wyckoff Analysis Series. Module 2. Wyckoff Candle Volume Analysis

1 × $6.00

Wyckoff Analysis Series. Module 2. Wyckoff Candle Volume Analysis

1 × $6.00 -

×

New York Institute of Finance – Futures. A Personal Seminar

1 × $6.00

New York Institute of Finance – Futures. A Personal Seminar

1 × $6.00 -

×

Practical Approach to Amibroker Scanners and Exploration with Rajandran R

1 × $4.00

Practical Approach to Amibroker Scanners and Exploration with Rajandran R

1 × $4.00 -

×

Momentum Explained

1 × $6.00

Momentum Explained

1 × $6.00 -

×

Trading in the Bluff with John Templeton

1 × $6.00

Trading in the Bluff with John Templeton

1 × $6.00 -

×

Stock Cycles with Michael Alexander

1 × $6.00

Stock Cycles with Michael Alexander

1 × $6.00 -

×

Put Option Strategies for Smarter Trading with Michael Thomsett

1 × $6.00

Put Option Strategies for Smarter Trading with Michael Thomsett

1 × $6.00 -

×

Long-Term Memory in the Stock Market Prices (Article) with Andrew W.Lo

1 × $6.00

Long-Term Memory in the Stock Market Prices (Article) with Andrew W.Lo

1 × $6.00 -

×

Monthly Newsletter 99-01 with Elliott Wave Theorist

1 × $6.00

Monthly Newsletter 99-01 with Elliott Wave Theorist

1 × $6.00 -

×

Opening Price Principle: Best Kept Secret on Wall Street - Larry Pesavento & Peggy MacKay

1 × $6.00

Opening Price Principle: Best Kept Secret on Wall Street - Larry Pesavento & Peggy MacKay

1 × $6.00 -

×

Online Course: Forex Trading By Fxtc.co

1 × $5.00

Online Course: Forex Trading By Fxtc.co

1 × $5.00 -

×

Footprint Deep Dive

1 × $15.00

Footprint Deep Dive

1 × $15.00 -

×

XLT– Option Trading Course

1 × $6.00

XLT– Option Trading Course

1 × $6.00 -

×

PiScaled

1 × $6.00

PiScaled

1 × $6.00 -

×

Day & Position Trading Using DiNapoli Levels with Joe Dinapoli & Merrick Okamoto

1 × $6.00

Day & Position Trading Using DiNapoli Levels with Joe Dinapoli & Merrick Okamoto

1 × $6.00 -

×

Diamonetrics For The Novice & Professional By Charles Cottle

1 × $4.00

Diamonetrics For The Novice & Professional By Charles Cottle

1 × $4.00 -

×

Market Profile Training with Futexlive

1 × $23.00

Market Profile Training with Futexlive

1 × $23.00 -

×

How I Trade Major First-Hour Reversals For Rapid Gains with Kevin Haggerty

1 × $6.00

How I Trade Major First-Hour Reversals For Rapid Gains with Kevin Haggerty

1 × $6.00 -

×

Market Maker’s Method Dec 2010 (PDF, MT4 Indicators, Video 600 MB)

1 × $6.00

Market Maker’s Method Dec 2010 (PDF, MT4 Indicators, Video 600 MB)

1 × $6.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Steve Nison Member Files

1 × $6.00

Steve Nison Member Files

1 × $6.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

MotiveWave Ultimate v5.1.3 (OFA, OFA AlgoX), (Aug 2017)

1 × $101.00

MotiveWave Ultimate v5.1.3 (OFA, OFA AlgoX), (Aug 2017)

1 × $101.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

Growing Rich with Growth Stocks: Wall Street's Top Money Managers Reveal the 12 Rules for Investment Success - Kirk Kazanjian

1 × $6.00

Growing Rich with Growth Stocks: Wall Street's Top Money Managers Reveal the 12 Rules for Investment Success - Kirk Kazanjian

1 × $6.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

Pristine - Trading the Pristine Method 2

1 × $6.00

Pristine - Trading the Pristine Method 2

1 × $6.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

Momentum Options Trading Course with Eric Jellerson

1 × $272.00

Momentum Options Trading Course with Eric Jellerson

1 × $272.00 -

×

John Bollinger on Bollinger Bands

1 × $6.00

John Bollinger on Bollinger Bands

1 × $6.00 -

×

The 10 Essentials of Forex Trading with Jared Martinez

1 × $6.00

The 10 Essentials of Forex Trading with Jared Martinez

1 × $6.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

Stock Options Day Trading Mindset for Success with Allen Maxwell, Scott Paton, & Scott Alex

1 × $5.00

Stock Options Day Trading Mindset for Success with Allen Maxwell, Scott Paton, & Scott Alex

1 × $5.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

How to Spot Trading Opportunities

1 × $6.00

How to Spot Trading Opportunities

1 × $6.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

Your Next Great Stock: How to Screen the Market for Tomorrow's Top Performers with Jack Hough

1 × $6.00

Your Next Great Stock: How to Screen the Market for Tomorrow's Top Performers with Jack Hough

1 × $6.00 -

×

Hot Commodities: How Anyone Can Invest Profitably in the World's Best Market with Jim Rogers

1 × $6.00

Hot Commodities: How Anyone Can Invest Profitably in the World's Best Market with Jim Rogers

1 × $6.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

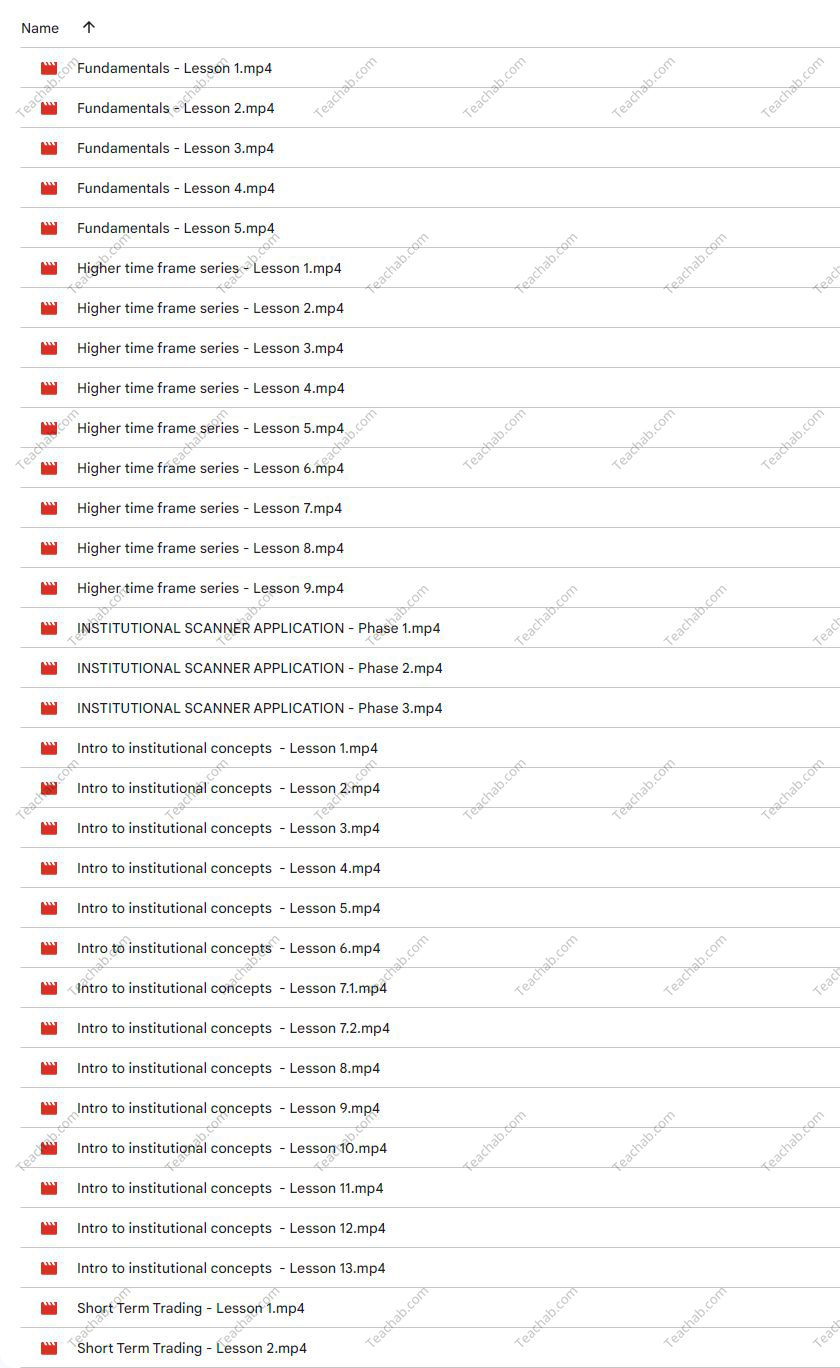

SMT FX Trading

$5.00

File Size: 6.84 GB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “SMT FX Trading” below:

Unlocking the Potential of SMT FX Trading

Welcome to the dynamic world of SMT FX Trading, where we delve into the nuances of Smart Money Trading in the forex market. Designed for both novice traders and seasoned market analysts, SMT FX Trading offers a comprehensive approach to understanding how smart money operates and how you can align your trading strategies accordingly.

1. Introduction to SMT FX Trading

What is SMT FX Trading?

SMT FX Trading refers to the strategy of tracking and interpreting the market activities of smart money traders—those who are considered to have significant influence and information advantages in the forex market.

2. The Importance of Smart Money

Influence of Smart Money

Understanding the movements of smart money can give traders insights into potential market directions before they become obvious to the public.

3. Core Principles of SMT FX Trading

Understanding Market Sentiment

Learn how to read the underlying sentiments in the market to predict future movements effectively.

Analyzing Volume and Price

Discover how to use volume as a key indicator in conjunction with price action to identify smart money’s footprints.

4. Tools and Techniques in SMT FX Trading

Advanced Analytical Tools

We explore the software and analytical methods used to track and analyze smart money transactions.

Technical Indicators Used in SMT

Uncover the specific indicators that can signal smart money activity.

5. Benefits of SMT FX Trading

Enhanced Trading Decisions

Adopting SMT techniques can lead to more informed and potentially more profitable trading decisions.

Risk Management

Learn how to manage risks by understanding when and where the smart money is likely to drive the market.

6. SMT FX Trading Strategies

Developing Your Strategy

We guide you on how to develop robust trading strategies based on smart money trends.

Entry and Exit Points

Determine optimal entry and exit points using SMT analysis.

7. Who Should Engage in SMT FX Trading?

Is SMT FX Trading Right for You?

This section helps you assess whether SMT FX Trading aligns with your trading goals and risk tolerance.

8. Learning SMT FX Trading

Educational Resources

Explore available courses, books, and online resources to get started with SMT FX Trading.

Practical Training Sessions

Hands-on training opportunities to apply SMT principles in real-time trading environments.

9. Integration of SMT FX Trading with Other Strategies

Complementary Strategies

Learn how to combine SMT FX Trading with other trading strategies for optimal results.

10. The Future of SMT FX Trading

Trends and Predictions

Discuss future trends in SMT FX Trading and how it could evolve with advancing technology.

11. Expert Insights on SMT FX Trading

Advice from the Pros

Tips and tricks from experienced traders who specialize in Smart Money Trading.

12. Common Mistakes in SMT FX Trading

Pitfalls to Avoid

Identify common errors that new traders make when trying to implement SMT strategies.

13. Success Stories

Testimonials from Successful Traders

Real-life success stories from traders who have mastered SMT FX Trading.

14. FAQs Before You Start

Essential Information

Provide answers to frequently asked questions for those new to SMT FX Trading.

15. Conclusion

Embracing SMT FX Trading can significantly enhance your trading capabilities, providing you with a deeper understanding of market forces and the tools to navigate them effectively. Whether you are just starting out or looking to refine your trading approach, understanding smart money can be your key to success.

FAQs

- What exactly is SMT in forex trading?

SMT, or Smart Money Trading, involves strategies that focus on identifying and capitalizing on the market moves made by financially influential players or smart money.

2. How can a beginner learn SMT FX Trading?

Beginners can start by studying basic forex trading principles, then gradually incorporate SMT analysis by using specific indicators and attending specialized courses.

3. What tools are essential for SMT FX Trading?

Key tools include volume analysis software, advanced charting packages, and access to comprehensive market data feeds.

4. Is SMT FX Trading risky?

Like all trading strategies, SMT FX Trading involves risk, but with proper risk management techniques, these can be substantially reduced.

5. Can SMT FX Trading be automated?

Some aspects of SMT FX Trading can be automated with algorithms designed to track and react to market indicators that suggest smart money activities.

Be the first to review “SMT FX Trading” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.