-

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

Mastering The Markets

1 × $4.00

Mastering The Markets

1 × $4.00 -

×

5 Week Live Web Seminar (Video & WorkBook ) with Larry Connors

1 × $6.00

5 Week Live Web Seminar (Video & WorkBook ) with Larry Connors

1 × $6.00 -

×

How To Trade Fundamental News Release 2022 with Patrick Muke

1 × $6.00

How To Trade Fundamental News Release 2022 with Patrick Muke

1 × $6.00 -

×

Team Candlecharts Trading Strategies with Candle Charts

1 × $31.00

Team Candlecharts Trading Strategies with Candle Charts

1 × $31.00 -

×

The Ultimate Forex System

1 × $6.00

The Ultimate Forex System

1 × $6.00 -

×

International Mergers & Acquisitions Activity Since 1990 with Greg Gregoriou & Luc Renneboog

1 × $6.00

International Mergers & Acquisitions Activity Since 1990 with Greg Gregoriou & Luc Renneboog

1 × $6.00 -

×

Daytraders Survival Guide with Christopher Farrell

1 × $6.00

Daytraders Survival Guide with Christopher Farrell

1 × $6.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Money Management

1 × $6.00

Money Management

1 × $6.00 -

×

ETF Profit Driver Course with Bill Poulos

1 × $6.00

ETF Profit Driver Course with Bill Poulos

1 × $6.00 -

×

A Forex System For Catching Pips All Day Long with Forex Pip Fishing

1 × $4.00

A Forex System For Catching Pips All Day Long with Forex Pip Fishing

1 × $4.00 -

×

Sector Rotation & Market Timing with Frank Barbera

1 × $6.00

Sector Rotation & Market Timing with Frank Barbera

1 × $6.00 -

×

How I Make A Living Daytrading Stocks with David Floyd

1 × $4.00

How I Make A Living Daytrading Stocks with David Floyd

1 × $4.00 -

×

ATM Forex 2009 System Manual, Videos & Indicators with Keith Cotterill

1 × $6.00

ATM Forex 2009 System Manual, Videos & Indicators with Keith Cotterill

1 × $6.00 -

×

GTA Professional Course with Gova Trading Academy

1 × $5.00

GTA Professional Course with Gova Trading Academy

1 × $5.00 -

×

Cheat Code Trading System

1 × $13.00

Cheat Code Trading System

1 × $13.00 -

×

Getting Started in Value Investing with Charles Mizrahi

1 × $6.00

Getting Started in Value Investing with Charles Mizrahi

1 × $6.00 -

×

OPTIONS FOR BEGINNERS

1 × $6.00

OPTIONS FOR BEGINNERS

1 × $6.00 -

×

Advanced Forex Trading Momentum vs Reversals with Indicators Webinar - Mark Whistler

1 × $6.00

Advanced Forex Trading Momentum vs Reversals with Indicators Webinar - Mark Whistler

1 × $6.00 -

×

The Complete XAUUSD GOLD Forex Scalping System On Real Trading Account with Forex Lia

1 × $5.00

The Complete XAUUSD GOLD Forex Scalping System On Real Trading Account with Forex Lia

1 × $5.00 -

×

Crash Profits Make Money When Stocks Sink and Soar with Martin D.Weiss

1 × $6.00

Crash Profits Make Money When Stocks Sink and Soar with Martin D.Weiss

1 × $6.00 -

×

The Investor Accelerator Premium Membership

1 × $34.00

The Investor Accelerator Premium Membership

1 × $34.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

The Bare Essentials Of Investing: Teaching The Horse To Talk with Harold Bierman

1 × $6.00

The Bare Essentials Of Investing: Teaching The Horse To Talk with Harold Bierman

1 × $6.00 -

×

Forty Cents for Financial Freedom with Darlene Nelson

1 × $6.00

Forty Cents for Financial Freedom with Darlene Nelson

1 × $6.00 -

×

Indicator Companion for Metastock with Martin Pring

1 × $6.00

Indicator Companion for Metastock with Martin Pring

1 × $6.00 -

×

Advanced Nuances & Exceptions eCourse with Jim Dalton

1 × $15.00

Advanced Nuances & Exceptions eCourse with Jim Dalton

1 × $15.00 -

×

Day Trading and Swing Trading the Currency Market with Kathy Lien

1 × $6.00

Day Trading and Swing Trading the Currency Market with Kathy Lien

1 × $6.00 -

×

Pristine - Dan Gibby – Mastering Breakouts & Breakdowns

1 × $6.00

Pristine - Dan Gibby – Mastering Breakouts & Breakdowns

1 × $6.00 -

×

The Vest Pocket CFO (3rd Ed) with Jae Shim

1 × $6.00

The Vest Pocket CFO (3rd Ed) with Jae Shim

1 × $6.00 -

×

Dan Sheridan 2011 Calendar Workshop

1 × $6.00

Dan Sheridan 2011 Calendar Workshop

1 × $6.00 -

×

Forex Income Engine Course 2008 - 6 CDs + Manual

1 × $6.00

Forex Income Engine Course 2008 - 6 CDs + Manual

1 × $6.00 -

×

Unlocking Wealth: Secret to Market Timing with John Crane

1 × $6.00

Unlocking Wealth: Secret to Market Timing with John Crane

1 × $6.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Advanced Ichimoku Kinkō Hyō - Ichimoku Cloud Strategy with Rafał Zuchowicz - TopMasterTrader

1 × $17.00

Advanced Ichimoku Kinkō Hyō - Ichimoku Cloud Strategy with Rafał Zuchowicz - TopMasterTrader

1 × $17.00 -

×

My Life as a Quant with Emanuel Derman

1 × $6.00

My Life as a Quant with Emanuel Derman

1 × $6.00 -

×

All About Bonds & Mutual Funds with Esme Faerber

1 × $6.00

All About Bonds & Mutual Funds with Esme Faerber

1 × $6.00 -

×

Trading Economic Data System with CopperChips

1 × $6.00

Trading Economic Data System with CopperChips

1 × $6.00 -

×

How To Invest By Instinct: Instinctively Self Guided Investments with Lin Eldridge

1 × $6.00

How To Invest By Instinct: Instinctively Self Guided Investments with Lin Eldridge

1 × $6.00 -

×

Currency Strategy with Callum Henderson

1 × $6.00

Currency Strategy with Callum Henderson

1 × $6.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Low Timeframe Supply and Demand with SMC Gelo

$5.00

File Size: 822 MB

Delivery Time: 1–12 hours

Media Type: Online Course

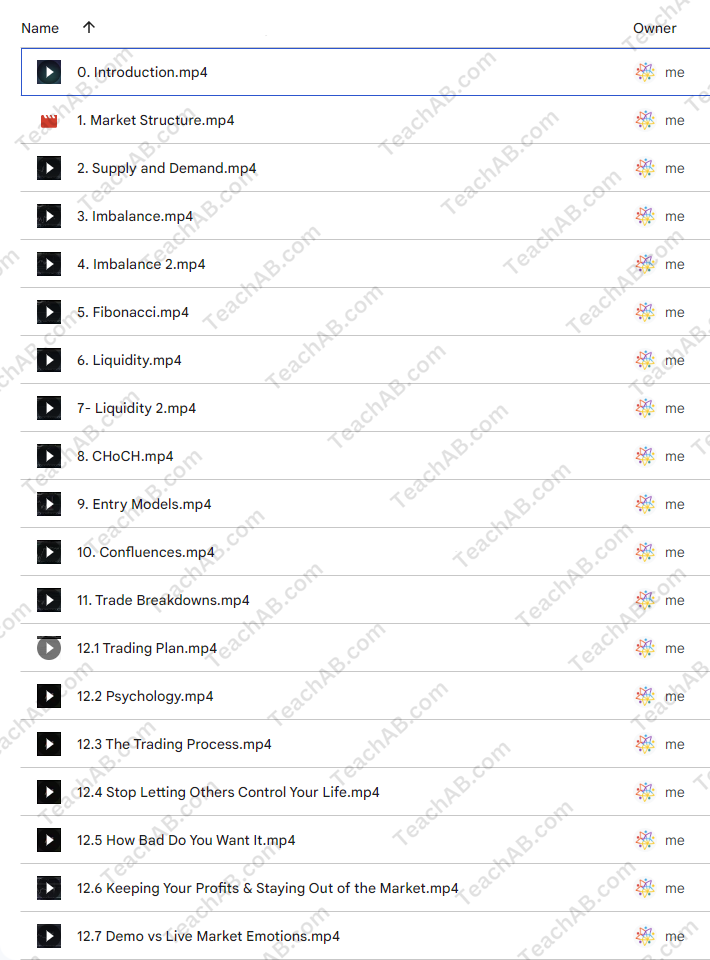

Content Proof: Watch Here!

You may check content proof of “Low Timeframe Supply and Demand with SMC Gelo” below:

Low Timeframe Supply and Demand with SMC Gelo

Introduction

Navigating the complexities of the Forex market requires not only knowledge and strategy but also an understanding of market dynamics like supply and demand. SMC Gelo, a notable figure in this field, emphasizes the significance of these factors in low timeframe trading. This article explores the intricate dance of supply and demand in short-term Forex markets, guided by the expertise of SMC Gelo.

Who is SMC Gelo?

SMC Gelo is a respected trader and analyst known for his deep understanding of market mechanics, particularly in Forex trading. His strategies focus on low timeframe environments where supply and demand signals can be highly dynamic.

Understanding Supply and Demand

Before diving into specifics, it’s crucial to grasp the fundamental concepts of supply and demand in the trading context.

Basic Principles of Supply and Demand

The market is driven by these two forces, determining the price levels of currencies based on their perceived abundance or scarcity.

How Supply and Demand Affect Forex Prices

Significant price movements can occur when either supply exceeds demand, driving prices down, or demand exceeds supply, pushing prices up.

SMC Gelo’s Approach to Low Timeframe Trading

SMC Gelo’s methodology shines in the fast-paced environment of low timeframe trading, where quick decisions are crucial.

Key Strategies for Low Timeframes

Learn about the specific strategies SMC Gelo uses to identify and capitalize on supply and demand imbalances in short durations.

Tools and Indicators Used

SMC Gelo employs various technical indicators to detect shifts in supply and demand on lower timeframes.

Applying SMC Gelo’s Strategies

Here’s how you can put SMC Gelo’s teachings into practice to improve your trading performance.

Chart Setup and Analysis

A step-by-step guide to setting up your charts like SMC Gelo for optimal trading results.

Identifying Entry and Exit Points

Discover how to pinpoint precise entry and exit points using supply and demand zones.

Benefits of Low Timeframe Trading

While challenging, there are distinct advantages to trading on lower timeframes.

Quick Returns

Shorter trading periods can lead to quicker returns, appealing to those who prefer fast-paced trading.

Enhanced Market Feel

Regular trading on lower timeframes can enhance your ‘market feel’, improving your instinctive trading abilities.

Challenges and How to Overcome Them

Low timeframe trading is not without its challenges, which SMC Gelo addresses with specific strategies.

Dealing with Market Noise

Learn techniques to filter out the ‘noise’ that is typical in lower timeframes, focusing only on significant market moves.

Risk Management Techniques

Effective strategies to manage risks when trading in highly volatile, short-term markets.

SMC Gelo’s Teaching and Resources

Explore the educational resources that SMC Gelo offers to aspiring traders.

Online Courses and Webinars

Details on SMC Gelo’s comprehensive online courses and live webinars designed to teach low timeframe trading strategies.

Books and Publications

Recommended readings and publications authored by SMC Gelo that delve deeper into Forex trading principles.

Success Stories from SMC Gelo’s Students

Hear from those who have successfully applied SMC Gelo’s methods in their trading.

Testimonials

Real-life success stories from traders who have transformed their trading approach with the help of SMC Gelo.

Conclusion

Mastering low timeframe supply and demand with SMC Gelo can significantly enhance your trading skills, allowing you to make more informed and strategic decisions in the Forex market. With the right tools and knowledge, you can navigate these dynamic waters with confidence and success.

FAQs

- What exactly is low timeframe trading?

- It involves trading on charts with smaller time intervals, such as minutes or hours, allowing for quick decisions and trades.

- Is low timeframe trading suitable for beginners?

- It can be challenging for beginners due to its fast-paced nature, but with proper education and practice, it’s achievable.

- How important are technical indicators in SMC Gelo’s strategy?

- Very important. Indicators help identify the best supply and demand zones, crucial for making trades based on his strategies.

- Can SMC Gelo’s strategies be applied to other financial markets?

- Yes, while they are optimized for Forex, the principles of supply and demand apply universally and can be adapted.

- Where can I find more about SMC Gelo’s courses and teachings?

- Visit his official website or social media channels for the latest on courses, webinars, and other resources.

Be the first to review “Low Timeframe Supply and Demand with SMC Gelo” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Reviews

There are no reviews yet.