-

×

Point and Figure Mentorship Course

1 × $54.00

Point and Figure Mentorship Course

1 × $54.00 -

×

Neowave. Inovations that Make Elliott Wave Work Better for You with Glenn Neely

1 × $6.00

Neowave. Inovations that Make Elliott Wave Work Better for You with Glenn Neely

1 × $6.00 -

×

Guide to Winning with Automated Trading Systems with Jack Schwager

1 × $6.00

Guide to Winning with Automated Trading Systems with Jack Schwager

1 × $6.00 -

×

Read the Greed. Take the Money & Teleseminar

1 × $6.00

Read the Greed. Take the Money & Teleseminar

1 × $6.00 -

×

The Tickmaster Indicator with Alphashark

1 × $54.00

The Tickmaster Indicator with Alphashark

1 × $54.00 -

×

Scanning for Gold with Doug Sutton

1 × $31.00

Scanning for Gold with Doug Sutton

1 × $31.00 -

×

The Ultimate Step By Step Guide to Online Currency Trading with Cynthia Marcy, Erol Bortucene

1 × $6.00

The Ultimate Step By Step Guide to Online Currency Trading with Cynthia Marcy, Erol Bortucene

1 × $6.00 -

×

Tandem Trader with Investors Underground

1 × $6.00

Tandem Trader with Investors Underground

1 × $6.00 -

×

Main Online Course with Cue Banks

1 × $90.00

Main Online Course with Cue Banks

1 × $90.00 -

×

Interactive Course

1 × $6.00

Interactive Course

1 × $6.00 -

×

Fibonacci Swing Trader 2.0 with Frank Paul - Forexmentor

1 × $6.00

Fibonacci Swing Trader 2.0 with Frank Paul - Forexmentor

1 × $6.00 -

×

XLT - Futures Trading Course

1 × $54.00

XLT - Futures Trading Course

1 × $54.00 -

×

The Options Course Woorkbook. Exercises and Tests for Options Course Book with George Fontanillis

1 × $6.00

The Options Course Woorkbook. Exercises and Tests for Options Course Book with George Fontanillis

1 × $6.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

Breakthrough Strategies for Predicting Any Market: Charting Elliott Wave, Lucas, Fibonacci and Time for Profit - Jeff Greenblatt & Dawn Bolton-Smith

1 × $6.00

Breakthrough Strategies for Predicting Any Market: Charting Elliott Wave, Lucas, Fibonacci and Time for Profit - Jeff Greenblatt & Dawn Bolton-Smith

1 × $6.00 -

×

Winning Chart Patterns. 7 Patterns That Really Work with Ed Downs

1 × $6.00

Winning Chart Patterns. 7 Patterns That Really Work with Ed Downs

1 × $6.00 -

×

The Fundamentals of Options Trading Basis with Joseph Frey

1 × $6.00

The Fundamentals of Options Trading Basis with Joseph Frey

1 × $6.00 -

×

Andrews Pitchfork Basic

1 × $6.00

Andrews Pitchfork Basic

1 × $6.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

Tape Reading & Market Tactics with Humphrey Neill

1 × $6.00

Tape Reading & Market Tactics with Humphrey Neill

1 × $6.00 -

×

Active Trader Program (Smarter Starter Pack + the Number One Trading Plan)

1 × $15.00

Active Trader Program (Smarter Starter Pack + the Number One Trading Plan)

1 × $15.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

Beginner Course + access to Introductory Course

1 × $6.00

Beginner Course + access to Introductory Course

1 × $6.00 -

×

Building Winning Trading Systems with Tradestation (with CD) - George Pruitt

1 × $6.00

Building Winning Trading Systems with Tradestation (with CD) - George Pruitt

1 × $6.00 -

×

Building Automated Trading Systems C++.NET with Benjamin Van Vliet

1 × $6.00

Building Automated Trading Systems C++.NET with Benjamin Van Vliet

1 × $6.00 -

×

Bear Trap Indicator with Markay Latimer

1 × $5.00

Bear Trap Indicator with Markay Latimer

1 × $5.00 -

×

Multi Squeeze Pro Indicator (PREMIUM)

1 × $69.00

Multi Squeeze Pro Indicator (PREMIUM)

1 × $69.00 -

×

Trend Trading Techniques with Rob Hoffman

1 × $6.00

Trend Trading Techniques with Rob Hoffman

1 × $6.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Investing Classroom 2022 with Danny Devan

1 × $15.00

Investing Classroom 2022 with Danny Devan

1 × $15.00 -

×

Voodoo Lines Indicator

1 × $62.00

Voodoo Lines Indicator

1 × $62.00 -

×

Ultra Blue Forex 2024 with Russ Horn

1 × $17.00

Ultra Blue Forex 2024 with Russ Horn

1 × $17.00 -

×

When Buy Means Sell : An Investor's Guide to Investing When It Counts with Eric Shkolnik

1 × $6.00

When Buy Means Sell : An Investor's Guide to Investing When It Counts with Eric Shkolnik

1 × $6.00 -

×

Currency Trading Seminar with Peter Bain

1 × $6.00

Currency Trading Seminar with Peter Bain

1 × $6.00 -

×

Overnight Trading with Nightly Patterns

1 × $5.00

Overnight Trading with Nightly Patterns

1 × $5.00 -

×

BETT Strategy with TopTradeTools

1 × $35.00

BETT Strategy with TopTradeTools

1 × $35.00 -

×

Intermarket Technical Analysis with John J.Murphy

1 × $6.00

Intermarket Technical Analysis with John J.Murphy

1 × $6.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

The Extracted MBA with Kelly Vinal

1 × $6.00

The Extracted MBA with Kelly Vinal

1 × $6.00 -

×

Credit Spreads Deep Dive with Jay Bailey - Sheridan Options Mentoring

1 × $31.00

Credit Spreads Deep Dive with Jay Bailey - Sheridan Options Mentoring

1 × $31.00 -

×

FX Childs Play System

1 × $6.00

FX Childs Play System

1 × $6.00 -

×

Triple Play Trading Ideas & Mentoring with MarketGauge

1 × $54.00

Triple Play Trading Ideas & Mentoring with MarketGauge

1 × $54.00 -

×

Mindful Trading e-Workbook with Traders State Of Mind

1 × $6.00

Mindful Trading e-Workbook with Traders State Of Mind

1 × $6.00 -

×

Technical Analysis: Power Tools for Active Investors with Gerald Appel

1 × $6.00

Technical Analysis: Power Tools for Active Investors with Gerald Appel

1 × $6.00 -

×

W.O.W. Guaranteed Income with Chuck Hughes

1 × $31.00

W.O.W. Guaranteed Income with Chuck Hughes

1 × $31.00 -

×

Cracking The Forex Code with Kevin Adams

1 × $6.00

Cracking The Forex Code with Kevin Adams

1 × $6.00 -

×

Art of Yen Course (Feb 2014)

1 × $23.00

Art of Yen Course (Feb 2014)

1 × $23.00 -

×

Essentials Home Study Kit with J.L.Lord - Random Walk Trading

1 × $23.00

Essentials Home Study Kit with J.L.Lord - Random Walk Trading

1 × $23.00 -

×

Forex Trading Strategies Modules 1-3 Complete Set with Blake Young - Shadow Trader

1 × $54.00

Forex Trading Strategies Modules 1-3 Complete Set with Blake Young - Shadow Trader

1 × $54.00 -

×

Teresa Lo's PowerTools for eSignal (Dec. 2006) (powerswings.com)

1 × $6.00

Teresa Lo's PowerTools for eSignal (Dec. 2006) (powerswings.com)

1 × $6.00 -

×

Terry Ashman’s Gann Swings Swing Trading Course (HotTrader Tutorial)

1 × $6.00

Terry Ashman’s Gann Swings Swing Trading Course (HotTrader Tutorial)

1 × $6.00 -

×

Ocean’s CPA Force (Ebook)

1 × $6.00

Ocean’s CPA Force (Ebook)

1 × $6.00 -

×

Intra-Day Trading Tactics with Greg Capra

1 × $6.00

Intra-Day Trading Tactics with Greg Capra

1 × $6.00 -

×

Artificial Intelligence with Larry Pesavento

1 × $6.00

Artificial Intelligence with Larry Pesavento

1 × $6.00 -

×

Lazy Gap Trader Course with David Frost

1 × $6.00

Lazy Gap Trader Course with David Frost

1 × $6.00 -

×

The Market Matrix

1 × $6.00

The Market Matrix

1 × $6.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Flux Trigger Pack - Back To The Future Trading

1 × $15.00

Flux Trigger Pack - Back To The Future Trading

1 × $15.00 -

×

Trading Protege / Inner Circle Course - 9 DVDs + Manual 2004

1 × $6.00

Trading Protege / Inner Circle Course - 9 DVDs + Manual 2004

1 × $6.00 -

×

Cycles: What they are, what they mean, how to profit by them - Dick Stoken

1 × $6.00

Cycles: What they are, what they mean, how to profit by them - Dick Stoken

1 × $6.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00

Low Timeframe Supply and Demand with SMC Gelo

$5.00

File Size: 822 MB

Delivery Time: 1–12 hours

Media Type: Online Course

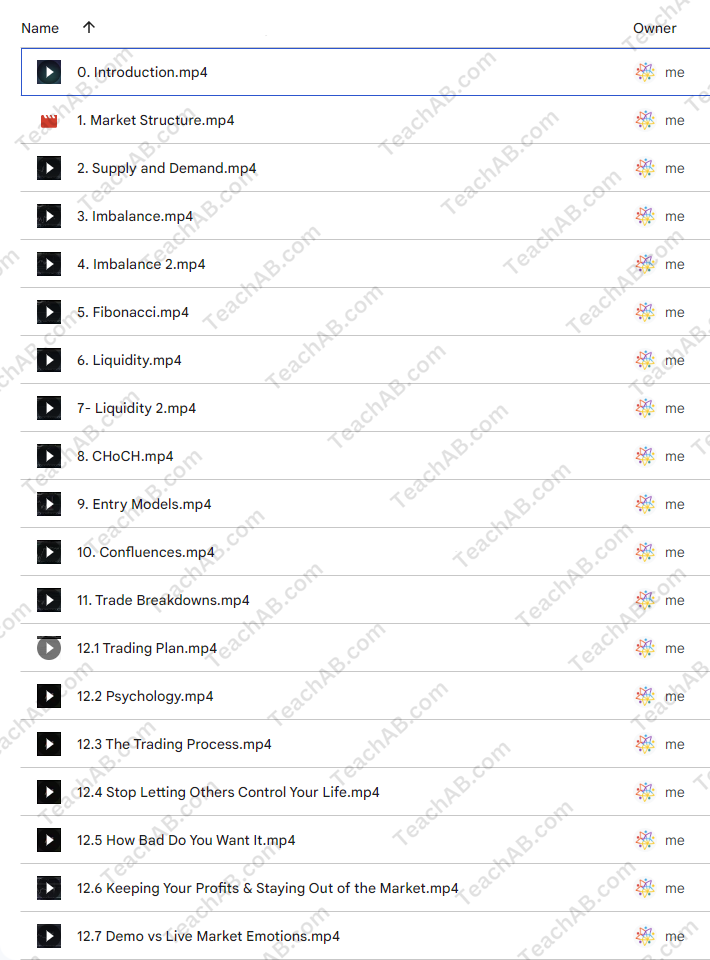

Content Proof: Watch Here!

You may check content proof of “Low Timeframe Supply and Demand with SMC Gelo” below:

Low Timeframe Supply and Demand with SMC Gelo

Introduction

Navigating the complexities of the Forex market requires not only knowledge and strategy but also an understanding of market dynamics like supply and demand. SMC Gelo, a notable figure in this field, emphasizes the significance of these factors in low timeframe trading. This article explores the intricate dance of supply and demand in short-term Forex markets, guided by the expertise of SMC Gelo.

Who is SMC Gelo?

SMC Gelo is a respected trader and analyst known for his deep understanding of market mechanics, particularly in Forex trading. His strategies focus on low timeframe environments where supply and demand signals can be highly dynamic.

Understanding Supply and Demand

Before diving into specifics, it’s crucial to grasp the fundamental concepts of supply and demand in the trading context.

Basic Principles of Supply and Demand

The market is driven by these two forces, determining the price levels of currencies based on their perceived abundance or scarcity.

How Supply and Demand Affect Forex Prices

Significant price movements can occur when either supply exceeds demand, driving prices down, or demand exceeds supply, pushing prices up.

SMC Gelo’s Approach to Low Timeframe Trading

SMC Gelo’s methodology shines in the fast-paced environment of low timeframe trading, where quick decisions are crucial.

Key Strategies for Low Timeframes

Learn about the specific strategies SMC Gelo uses to identify and capitalize on supply and demand imbalances in short durations.

Tools and Indicators Used

SMC Gelo employs various technical indicators to detect shifts in supply and demand on lower timeframes.

Applying SMC Gelo’s Strategies

Here’s how you can put SMC Gelo’s teachings into practice to improve your trading performance.

Chart Setup and Analysis

A step-by-step guide to setting up your charts like SMC Gelo for optimal trading results.

Identifying Entry and Exit Points

Discover how to pinpoint precise entry and exit points using supply and demand zones.

Benefits of Low Timeframe Trading

While challenging, there are distinct advantages to trading on lower timeframes.

Quick Returns

Shorter trading periods can lead to quicker returns, appealing to those who prefer fast-paced trading.

Enhanced Market Feel

Regular trading on lower timeframes can enhance your ‘market feel’, improving your instinctive trading abilities.

Challenges and How to Overcome Them

Low timeframe trading is not without its challenges, which SMC Gelo addresses with specific strategies.

Dealing with Market Noise

Learn techniques to filter out the ‘noise’ that is typical in lower timeframes, focusing only on significant market moves.

Risk Management Techniques

Effective strategies to manage risks when trading in highly volatile, short-term markets.

SMC Gelo’s Teaching and Resources

Explore the educational resources that SMC Gelo offers to aspiring traders.

Online Courses and Webinars

Details on SMC Gelo’s comprehensive online courses and live webinars designed to teach low timeframe trading strategies.

Books and Publications

Recommended readings and publications authored by SMC Gelo that delve deeper into Forex trading principles.

Success Stories from SMC Gelo’s Students

Hear from those who have successfully applied SMC Gelo’s methods in their trading.

Testimonials

Real-life success stories from traders who have transformed their trading approach with the help of SMC Gelo.

Conclusion

Mastering low timeframe supply and demand with SMC Gelo can significantly enhance your trading skills, allowing you to make more informed and strategic decisions in the Forex market. With the right tools and knowledge, you can navigate these dynamic waters with confidence and success.

FAQs

- What exactly is low timeframe trading?

- It involves trading on charts with smaller time intervals, such as minutes or hours, allowing for quick decisions and trades.

- Is low timeframe trading suitable for beginners?

- It can be challenging for beginners due to its fast-paced nature, but with proper education and practice, it’s achievable.

- How important are technical indicators in SMC Gelo’s strategy?

- Very important. Indicators help identify the best supply and demand zones, crucial for making trades based on his strategies.

- Can SMC Gelo’s strategies be applied to other financial markets?

- Yes, while they are optimized for Forex, the principles of supply and demand apply universally and can be adapted.

- Where can I find more about SMC Gelo’s courses and teachings?

- Visit his official website or social media channels for the latest on courses, webinars, and other resources.

Be the first to review “Low Timeframe Supply and Demand with SMC Gelo” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Reviews

There are no reviews yet.