-

×

Trader University Course

1 × $5.00

Trader University Course

1 × $5.00 -

×

Secrets of Swiss Banking with Hoyt Barber

1 × $6.00

Secrets of Swiss Banking with Hoyt Barber

1 × $6.00 -

×

Using Options to Buy Stocks: Build Wealth with Little Risk and No Capital - Dennis Eisen

1 × $4.00

Using Options to Buy Stocks: Build Wealth with Little Risk and No Capital - Dennis Eisen

1 × $4.00 -

×

Toni’s Market Club with Toni Turner

1 × $6.00

Toni’s Market Club with Toni Turner

1 × $6.00 -

×

Foreign Exchange Option Pricing: A Practitioner's Guide with Iain Clark

1 × $6.00

Foreign Exchange Option Pricing: A Practitioner's Guide with Iain Clark

1 × $6.00 -

×

Strategy, Value and Risk - The Real Options Approach with Jamie Rogers

1 × $6.00

Strategy, Value and Risk - The Real Options Approach with Jamie Rogers

1 × $6.00 -

×

Super CD Companion for Metastock with Martin Pring

1 × $6.00

Super CD Companion for Metastock with Martin Pring

1 × $6.00 -

×

Elite Trend Trader with Frank Bunn

1 × $23.00

Elite Trend Trader with Frank Bunn

1 × $23.00 -

×

Mastertrader – Mastering Swing Trading

1 × $31.00

Mastertrader – Mastering Swing Trading

1 × $31.00 -

×

Technical Analysis Entry & Exit with Andrew Baxter

1 × $6.00

Technical Analysis Entry & Exit with Andrew Baxter

1 × $6.00 -

×

Options Professional Online Webinar (2010-01 – 2010-02) with J.L.Lord

1 × $6.00

Options Professional Online Webinar (2010-01 – 2010-02) with J.L.Lord

1 × $6.00 -

×

Speculating with Foreign Currencies with Liverpool Group

1 × $6.00

Speculating with Foreign Currencies with Liverpool Group

1 × $6.00 -

×

Learn To Fish Part II - Generating Consistent Income Through Day Trading with Daniel

1 × $6.00

Learn To Fish Part II - Generating Consistent Income Through Day Trading with Daniel

1 × $6.00 -

×

New Market Mavericks with Geoff Cutmore

1 × $6.00

New Market Mavericks with Geoff Cutmore

1 × $6.00 -

×

High Probability Trading with Marcel Link

1 × $6.00

High Probability Trading with Marcel Link

1 × $6.00 -

×

The Best (Public) Trading Methods I’ve Found for Futures & Equities with Perry J.Kaufman

1 × $6.00

The Best (Public) Trading Methods I’ve Found for Futures & Equities with Perry J.Kaufman

1 × $6.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

The Price Action Manual, 2nd Ed 2008 with Bryce Gilmore

1 × $4.00

The Price Action Manual, 2nd Ed 2008 with Bryce Gilmore

1 × $4.00 -

×

Explosive Growth Options & Stocks with Base Camp Trading

1 × $5.00

Explosive Growth Options & Stocks with Base Camp Trading

1 × $5.00 -

×

WYCKOFF TRADING COURSE (WTC) PART I – ANALYSIS (Fall 2021) with Roman Bogomazov

1 × $209.00

WYCKOFF TRADING COURSE (WTC) PART I – ANALYSIS (Fall 2021) with Roman Bogomazov

1 × $209.00 -

×

Pattern, Price & Time: Using Gann Theory in Trading Systems (1st Edition) with James Hyerczyk

1 × $6.00

Pattern, Price & Time: Using Gann Theory in Trading Systems (1st Edition) with James Hyerczyk

1 × $6.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

ICT Mentorship 2016-17 with Inner Circle Trading

1 × $6.00

ICT Mentorship 2016-17 with Inner Circle Trading

1 × $6.00 -

×

Practical Applications of Candlestick Charts with Gary Wagner

1 × $6.00

Practical Applications of Candlestick Charts with Gary Wagner

1 × $6.00 -

×

CMT Association Entire Webinars

1 × $31.00

CMT Association Entire Webinars

1 × $31.00 -

×

Correct Stage for Average with Stan Weinstein

1 × $6.00

Correct Stage for Average with Stan Weinstein

1 × $6.00 -

×

Dow Theory for the 21st Century: Technical Indicators for Improving Your Investment Results with Jack Schannep

1 × $6.00

Dow Theory for the 21st Century: Technical Indicators for Improving Your Investment Results with Jack Schannep

1 × $6.00 -

×

Market Profile Video with FutexLive

1 × $6.00

Market Profile Video with FutexLive

1 × $6.00 -

×

The Definitive Guide To Futures Trading (Volume II) with Larry Williams

1 × $6.00

The Definitive Guide To Futures Trading (Volume II) with Larry Williams

1 × $6.00 -

×

Developing Mindfulness: The Observer of Thought with Traders State Of Mind

1 × $6.00

Developing Mindfulness: The Observer of Thought with Traders State Of Mind

1 × $6.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

The Jupiter Effect with John Gribbin & Stephen Plagemann

1 × $6.00

The Jupiter Effect with John Gribbin & Stephen Plagemann

1 × $6.00 -

×

Computerized Trading. Maximizing Day Trading and Overnight Profits with Mark Jurik

1 × $6.00

Computerized Trading. Maximizing Day Trading and Overnight Profits with Mark Jurik

1 × $6.00 -

×

Planetary Stock Trading with Bill Meridian

1 × $6.00

Planetary Stock Trading with Bill Meridian

1 × $6.00 -

×

The Inner Circle Seminar

1 × $15.00

The Inner Circle Seminar

1 × $15.00 -

×

TOP Momentum Bundle with Top Trade Tools

1 × $62.00

TOP Momentum Bundle with Top Trade Tools

1 × $62.00 -

×

Steidlmayer On Markets. Trading with Market Profile with J.Peter Steidlmayer

1 × $6.00

Steidlmayer On Markets. Trading with Market Profile with J.Peter Steidlmayer

1 × $6.00 -

×

Stock Trading Course Level 2 Market Snapper™ 2019 with Piranha Profits

1 × $6.00

Stock Trading Course Level 2 Market Snapper™ 2019 with Piranha Profits

1 × $6.00 -

×

Butterflies For Monthly Income 2016 with Dan Sheridan

1 × $15.00

Butterflies For Monthly Income 2016 with Dan Sheridan

1 × $15.00 -

×

Perfecting Execution and Trade Management Online Masterclass with The Trading Framework

1 × $6.00

Perfecting Execution and Trade Management Online Masterclass with The Trading Framework

1 × $6.00 -

×

Compound Stock Earnings Master Class 2009 Ft Worth Tx September 12 13 DVD set

1 × $6.00

Compound Stock Earnings Master Class 2009 Ft Worth Tx September 12 13 DVD set

1 × $6.00 -

×

Advanced AmiBroker Coding with Matt Radtke & Connors Research

1 × $23.00

Advanced AmiBroker Coding with Matt Radtke & Connors Research

1 × $23.00 -

×

The 5 Day Momentum Method

1 × $6.00

The 5 Day Momentum Method

1 × $6.00 -

×

Sang Lucci Master Course 2021 with Sang Lucci

1 × $6.00

Sang Lucci Master Course 2021 with Sang Lucci

1 × $6.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Math Trading Course 2023

1 × $34.00

Math Trading Course 2023

1 × $34.00 -

×

The Holy Grail Forex Strategy - 7 Setups To Conquer The Kingdom with Justin Whitebread-Lanaro - 1 Minute Master

1 × $15.00

The Holy Grail Forex Strategy - 7 Setups To Conquer The Kingdom with Justin Whitebread-Lanaro - 1 Minute Master

1 × $15.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Boomerang Day Trader (Aug 2012)

1 × $54.00

Boomerang Day Trader (Aug 2012)

1 × $54.00 -

×

Philadelphia Seminar Replay & PDF Study Guide with ASFX Day Trading

1 × $31.00

Philadelphia Seminar Replay & PDF Study Guide with ASFX Day Trading

1 × $31.00 -

×

Applying Fibonacci Analysis to Price Action

1 × $6.00

Applying Fibonacci Analysis to Price Action

1 × $6.00 -

×

Stock Trading Simplified - 3 DVD + PDF Workbook with John Person

1 × $6.00

Stock Trading Simplified - 3 DVD + PDF Workbook with John Person

1 × $6.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

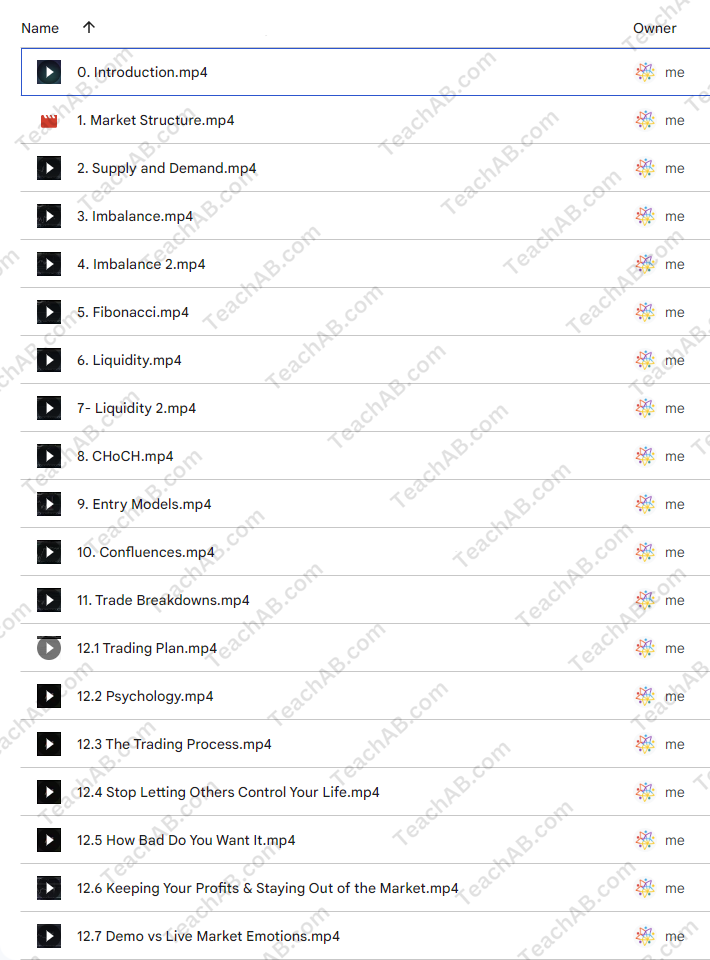

Low Timeframe Supply and Demand with SMC Gelo

$5.00

File Size: 822 MB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Low Timeframe Supply and Demand with SMC Gelo” below:

Low Timeframe Supply and Demand with SMC Gelo

Introduction

Navigating the complexities of the Forex market requires not only knowledge and strategy but also an understanding of market dynamics like supply and demand. SMC Gelo, a notable figure in this field, emphasizes the significance of these factors in low timeframe trading. This article explores the intricate dance of supply and demand in short-term Forex markets, guided by the expertise of SMC Gelo.

Who is SMC Gelo?

SMC Gelo is a respected trader and analyst known for his deep understanding of market mechanics, particularly in Forex trading. His strategies focus on low timeframe environments where supply and demand signals can be highly dynamic.

Understanding Supply and Demand

Before diving into specifics, it’s crucial to grasp the fundamental concepts of supply and demand in the trading context.

Basic Principles of Supply and Demand

The market is driven by these two forces, determining the price levels of currencies based on their perceived abundance or scarcity.

How Supply and Demand Affect Forex Prices

Significant price movements can occur when either supply exceeds demand, driving prices down, or demand exceeds supply, pushing prices up.

SMC Gelo’s Approach to Low Timeframe Trading

SMC Gelo’s methodology shines in the fast-paced environment of low timeframe trading, where quick decisions are crucial.

Key Strategies for Low Timeframes

Learn about the specific strategies SMC Gelo uses to identify and capitalize on supply and demand imbalances in short durations.

Tools and Indicators Used

SMC Gelo employs various technical indicators to detect shifts in supply and demand on lower timeframes.

Applying SMC Gelo’s Strategies

Here’s how you can put SMC Gelo’s teachings into practice to improve your trading performance.

Chart Setup and Analysis

A step-by-step guide to setting up your charts like SMC Gelo for optimal trading results.

Identifying Entry and Exit Points

Discover how to pinpoint precise entry and exit points using supply and demand zones.

Benefits of Low Timeframe Trading

While challenging, there are distinct advantages to trading on lower timeframes.

Quick Returns

Shorter trading periods can lead to quicker returns, appealing to those who prefer fast-paced trading.

Enhanced Market Feel

Regular trading on lower timeframes can enhance your ‘market feel’, improving your instinctive trading abilities.

Challenges and How to Overcome Them

Low timeframe trading is not without its challenges, which SMC Gelo addresses with specific strategies.

Dealing with Market Noise

Learn techniques to filter out the ‘noise’ that is typical in lower timeframes, focusing only on significant market moves.

Risk Management Techniques

Effective strategies to manage risks when trading in highly volatile, short-term markets.

SMC Gelo’s Teaching and Resources

Explore the educational resources that SMC Gelo offers to aspiring traders.

Online Courses and Webinars

Details on SMC Gelo’s comprehensive online courses and live webinars designed to teach low timeframe trading strategies.

Books and Publications

Recommended readings and publications authored by SMC Gelo that delve deeper into Forex trading principles.

Success Stories from SMC Gelo’s Students

Hear from those who have successfully applied SMC Gelo’s methods in their trading.

Testimonials

Real-life success stories from traders who have transformed their trading approach with the help of SMC Gelo.

Conclusion

Mastering low timeframe supply and demand with SMC Gelo can significantly enhance your trading skills, allowing you to make more informed and strategic decisions in the Forex market. With the right tools and knowledge, you can navigate these dynamic waters with confidence and success.

FAQs

- What exactly is low timeframe trading?

- It involves trading on charts with smaller time intervals, such as minutes or hours, allowing for quick decisions and trades.

- Is low timeframe trading suitable for beginners?

- It can be challenging for beginners due to its fast-paced nature, but with proper education and practice, it’s achievable.

- How important are technical indicators in SMC Gelo’s strategy?

- Very important. Indicators help identify the best supply and demand zones, crucial for making trades based on his strategies.

- Can SMC Gelo’s strategies be applied to other financial markets?

- Yes, while they are optimized for Forex, the principles of supply and demand apply universally and can be adapted.

- Where can I find more about SMC Gelo’s courses and teachings?

- Visit his official website or social media channels for the latest on courses, webinars, and other resources.

Be the first to review “Low Timeframe Supply and Demand with SMC Gelo” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Reviews

There are no reviews yet.