-

×

Selling Options For A Living Class with Don Kaufman

1 × $6.00

Selling Options For A Living Class with Don Kaufman

1 × $6.00 -

×

Value Investing Bootcamp with Nick Kraakman

1 × $15.00

Value Investing Bootcamp with Nick Kraakman

1 × $15.00 -

×

Investment Fables with Aswath Damodaran

1 × $6.00

Investment Fables with Aswath Damodaran

1 × $6.00 -

×

Ichimokutrade - Fibonacci 101

1 × $15.00

Ichimokutrade - Fibonacci 101

1 × $15.00 -

×

CFA Pro Qbank 2007 & 2008 with Schweser

1 × $6.00

CFA Pro Qbank 2007 & 2008 with Schweser

1 × $6.00 -

×

Defending Options with Simpler Options

1 × $6.00

Defending Options with Simpler Options

1 × $6.00 -

×

TradingWithBilz Course

1 × $10.00

TradingWithBilz Course

1 × $10.00 -

×

Chaos and order in the Capital Markets with Edgar E.Peters

1 × $6.00

Chaos and order in the Capital Markets with Edgar E.Peters

1 × $6.00 -

×

The Psychology of Risk (Audio) with Ari Kiev

1 × $6.00

The Psychology of Risk (Audio) with Ari Kiev

1 × $6.00 -

×

BigTrends Home Study Course

1 × $6.00

BigTrends Home Study Course

1 × $6.00 -

×

Bulls on Wall Street Mentorship

1 × $31.00

Bulls on Wall Street Mentorship

1 × $31.00 -

×

Relentless Trading Course Advanced with Ryan Relentless

1 × $5.00

Relentless Trading Course Advanced with Ryan Relentless

1 × $5.00 -

×

Galactic Trader Seminar

1 × $15.00

Galactic Trader Seminar

1 × $15.00 -

×

Bing CPA Bootcamp

1 × $15.00

Bing CPA Bootcamp

1 × $15.00 -

×

Double Your Capital In 30 Days(2016) with GFA Flips

1 × $5.00

Double Your Capital In 30 Days(2016) with GFA Flips

1 × $5.00 -

×

Vajex Trading Mentorship Program

1 × $13.00

Vajex Trading Mentorship Program

1 × $13.00 -

×

John Bollinger on Bollinger Bands

1 × $6.00

John Bollinger on Bollinger Bands

1 × $6.00 -

×

Part-Time Day Trading Courses

1 × $54.00

Part-Time Day Trading Courses

1 × $54.00 -

×

Build A Career In Forex Trading - Learn Fundamental Analysis - Luciano Kelly & Learn Forex Mentor

1 × $4.00

Build A Career In Forex Trading - Learn Fundamental Analysis - Luciano Kelly & Learn Forex Mentor

1 × $4.00 -

×

Trend Trading: Timing Market Tides with Kedrick Brown

1 × $6.00

Trend Trading: Timing Market Tides with Kedrick Brown

1 × $6.00 -

×

Point And Figure Part III By Bruce Fraser & Roman Bogomazov - Wyckoff Analytics

1 × $23.00

Point And Figure Part III By Bruce Fraser & Roman Bogomazov - Wyckoff Analytics

1 × $23.00 -

×

Rocket Science for Traders with John Ehlers

1 × $6.00

Rocket Science for Traders with John Ehlers

1 × $6.00 -

×

Module 3 – Short Term Time Frame Trading In The Bund

1 × $6.00

Module 3 – Short Term Time Frame Trading In The Bund

1 × $6.00 -

×

Mastering the Gaps - Trading Gaps

1 × $15.00

Mastering the Gaps - Trading Gaps

1 × $15.00 -

×

The Right Stock at the Right Time. Prospering in the Coming Good Years with Larry Williams

1 × $6.00

The Right Stock at the Right Time. Prospering in the Coming Good Years with Larry Williams

1 × $6.00 -

×

Double Top Trader Trading System with Anthony Gibson

1 × $6.00

Double Top Trader Trading System with Anthony Gibson

1 × $6.00 -

×

The Oil Money (open code) (Nov 2013)

1 × $6.00

The Oil Money (open code) (Nov 2013)

1 × $6.00 -

×

The Hedge Fund Edge. Maximum Profit, Minimum Risk. Global Trading Trend Strategies - Mark Boucher

1 × $6.00

The Hedge Fund Edge. Maximum Profit, Minimum Risk. Global Trading Trend Strategies - Mark Boucher

1 × $6.00 -

×

The Triple Bottom Line

1 × $6.00

The Triple Bottom Line

1 × $6.00 -

×

NYC REPLAYS 2018

1 × $6.00

NYC REPLAYS 2018

1 × $6.00 -

×

CFA Level 1 - Schweser Study Notes 2006 (schweser.com)

1 × $6.00

CFA Level 1 - Schweser Study Notes 2006 (schweser.com)

1 × $6.00 -

×

6-2-4 Winning Strategies & Systems with Jack Bernstein

1 × $6.00

6-2-4 Winning Strategies & Systems with Jack Bernstein

1 × $6.00 -

×

Exclusive Footprint and Market Profile with Adam Set

1 × $5.00

Exclusive Footprint and Market Profile with Adam Set

1 × $5.00 -

×

Money Management

1 × $6.00

Money Management

1 × $6.00 -

×

ICT – Inner Circle Trader 2020 Weekly Review

1 × $20.00

ICT – Inner Circle Trader 2020 Weekly Review

1 × $20.00 -

×

Stock Patterns for DayTrading I & II with Barry Rudd

1 × $6.00

Stock Patterns for DayTrading I & II with Barry Rudd

1 × $6.00 -

×

Complete Trading System with Segma Singh

1 × $6.00

Complete Trading System with Segma Singh

1 × $6.00 -

×

Flipping Cash Rockstar with Lucas Adamski

1 × $6.00

Flipping Cash Rockstar with Lucas Adamski

1 × $6.00 -

×

Elite Keys to Trading Success Class

1 × $23.00

Elite Keys to Trading Success Class

1 × $23.00 -

×

Alexander Elder Full Courses Package

1 × $6.00

Alexander Elder Full Courses Package

1 × $6.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Currency Trading Seminar with Peter Bain

1 × $6.00

Currency Trading Seminar with Peter Bain

1 × $6.00 -

×

The Big Picture Trading Strategy with Avery T.Horton Jr.

1 × $7.00

The Big Picture Trading Strategy with Avery T.Horton Jr.

1 × $7.00 -

×

Scalping Master Class with Day One Traders

1 × $5.00

Scalping Master Class with Day One Traders

1 × $5.00 -

×

Mastering Debit Spreads with Vince Vora

1 × $15.00

Mastering Debit Spreads with Vince Vora

1 × $15.00 -

×

Strategies of a Winning Trader 2023 with Gareth Soloway

1 × $209.00

Strategies of a Winning Trader 2023 with Gareth Soloway

1 × $209.00 -

×

Trader University with Matthew Kratter

1 × $6.00

Trader University with Matthew Kratter

1 × $6.00 -

×

Constellation Software

1 × $85.00

Constellation Software

1 × $85.00 -

×

Elliott Wave Educational Video Series (10 dvds, video)

1 × $6.00

Elliott Wave Educational Video Series (10 dvds, video)

1 × $6.00 -

×

Read the Greed – LIVE!: Vol. II with Mike Reed

1 × $6.00

Read the Greed – LIVE!: Vol. II with Mike Reed

1 × $6.00 -

×

Triple Your Trading Profits Couse with David Jenyns

1 × $6.00

Triple Your Trading Profits Couse with David Jenyns

1 × $6.00 -

×

The Six Sigma Handbook with Thomas Pyzdek

1 × $6.00

The Six Sigma Handbook with Thomas Pyzdek

1 × $6.00 -

×

Sharp Edge Institutional Ultimate Trade Program – CompassFX

1 × $101.00

Sharp Edge Institutional Ultimate Trade Program – CompassFX

1 × $101.00 -

×

Elliott Flat Waves CD with David Elliott

1 × $6.00

Elliott Flat Waves CD with David Elliott

1 × $6.00 -

×

News FX Strategy with Zain Agha

1 × $6.00

News FX Strategy with Zain Agha

1 × $6.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

Advanced Risk Reversals and Rolling Thunder with Stratagem Trade

1 × $54.00

Advanced Risk Reversals and Rolling Thunder with Stratagem Trade

1 × $54.00 -

×

Forex Rebellion Trading System

1 × $5.00

Forex Rebellion Trading System

1 × $5.00 -

×

Winning With The Market with Douglas R.Sease

1 × $6.00

Winning With The Market with Douglas R.Sease

1 × $6.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

Dividend Key Home Study Course with Hubb Financial

1 × $6.00

Dividend Key Home Study Course with Hubb Financial

1 × $6.00 -

×

Forex Profit Multiplier with Bill & Greg Poulos

1 × $6.00

Forex Profit Multiplier with Bill & Greg Poulos

1 × $6.00 -

×

Stock Market Forecast Tools SMFT-1 (Sept 2013)

1 × $6.00

Stock Market Forecast Tools SMFT-1 (Sept 2013)

1 × $6.00 -

×

Equity Derivates with Marcus Overhaus, Andrew Ferraris, Thomas Knudsen, Ross Milward, Laurent Nguyen-Ngoc & Gero Schindlmayr

1 × $6.00

Equity Derivates with Marcus Overhaus, Andrew Ferraris, Thomas Knudsen, Ross Milward, Laurent Nguyen-Ngoc & Gero Schindlmayr

1 × $6.00 -

×

Learn To Trade Markets with Karl Richards

1 × $6.00

Learn To Trade Markets with Karl Richards

1 × $6.00 -

×

Dan Dowd Trading

1 × $5.00

Dan Dowd Trading

1 × $5.00 -

×

Introduction to Futures & Options Markets (2nd Ed.)

1 × $6.00

Introduction to Futures & Options Markets (2nd Ed.)

1 × $6.00 -

×

Andy’s EMini Bar – 40 Min System with Joe Ross

1 × $6.00

Andy’s EMini Bar – 40 Min System with Joe Ross

1 × $6.00 -

×

Big Fish: Mako Momentum Strategy

1 × $23.00

Big Fish: Mako Momentum Strategy

1 × $23.00 -

×

The Inve$tment A$trology Articles with Alan Richter

1 × $6.00

The Inve$tment A$trology Articles with Alan Richter

1 × $6.00 -

×

Field of Vision Program – Digital Download

1 × $31.00

Field of Vision Program – Digital Download

1 × $31.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

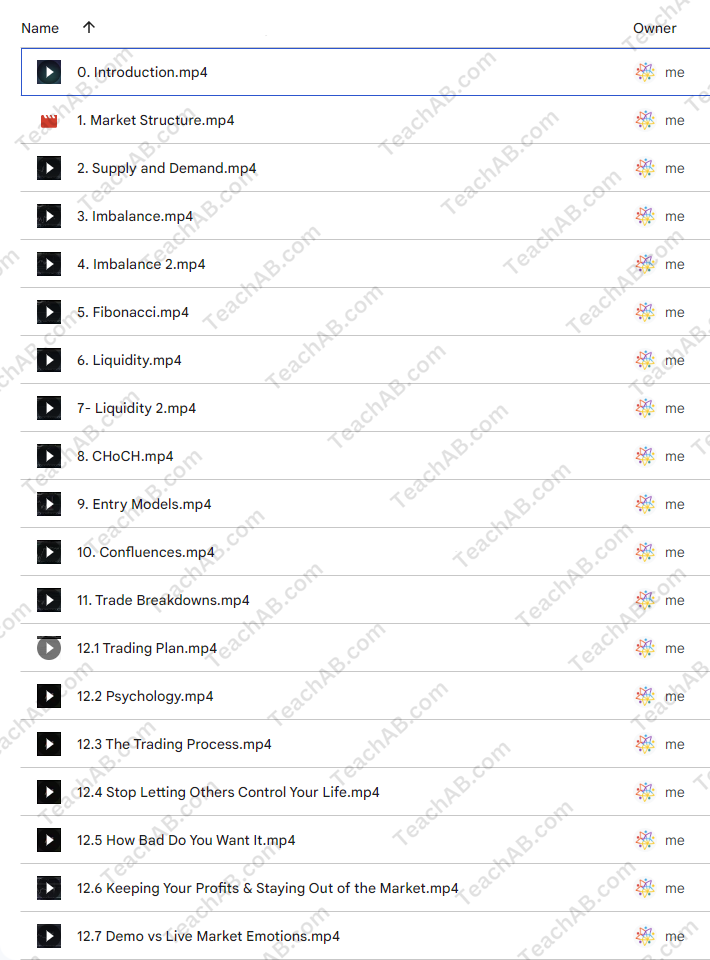

Low Timeframe Supply and Demand with SMC Gelo

$5.00

File Size: 822 MB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Low Timeframe Supply and Demand with SMC Gelo” below:

Low Timeframe Supply and Demand with SMC Gelo

Introduction

Navigating the complexities of the Forex market requires not only knowledge and strategy but also an understanding of market dynamics like supply and demand. SMC Gelo, a notable figure in this field, emphasizes the significance of these factors in low timeframe trading. This article explores the intricate dance of supply and demand in short-term Forex markets, guided by the expertise of SMC Gelo.

Who is SMC Gelo?

SMC Gelo is a respected trader and analyst known for his deep understanding of market mechanics, particularly in Forex trading. His strategies focus on low timeframe environments where supply and demand signals can be highly dynamic.

Understanding Supply and Demand

Before diving into specifics, it’s crucial to grasp the fundamental concepts of supply and demand in the trading context.

Basic Principles of Supply and Demand

The market is driven by these two forces, determining the price levels of currencies based on their perceived abundance or scarcity.

How Supply and Demand Affect Forex Prices

Significant price movements can occur when either supply exceeds demand, driving prices down, or demand exceeds supply, pushing prices up.

SMC Gelo’s Approach to Low Timeframe Trading

SMC Gelo’s methodology shines in the fast-paced environment of low timeframe trading, where quick decisions are crucial.

Key Strategies for Low Timeframes

Learn about the specific strategies SMC Gelo uses to identify and capitalize on supply and demand imbalances in short durations.

Tools and Indicators Used

SMC Gelo employs various technical indicators to detect shifts in supply and demand on lower timeframes.

Applying SMC Gelo’s Strategies

Here’s how you can put SMC Gelo’s teachings into practice to improve your trading performance.

Chart Setup and Analysis

A step-by-step guide to setting up your charts like SMC Gelo for optimal trading results.

Identifying Entry and Exit Points

Discover how to pinpoint precise entry and exit points using supply and demand zones.

Benefits of Low Timeframe Trading

While challenging, there are distinct advantages to trading on lower timeframes.

Quick Returns

Shorter trading periods can lead to quicker returns, appealing to those who prefer fast-paced trading.

Enhanced Market Feel

Regular trading on lower timeframes can enhance your ‘market feel’, improving your instinctive trading abilities.

Challenges and How to Overcome Them

Low timeframe trading is not without its challenges, which SMC Gelo addresses with specific strategies.

Dealing with Market Noise

Learn techniques to filter out the ‘noise’ that is typical in lower timeframes, focusing only on significant market moves.

Risk Management Techniques

Effective strategies to manage risks when trading in highly volatile, short-term markets.

SMC Gelo’s Teaching and Resources

Explore the educational resources that SMC Gelo offers to aspiring traders.

Online Courses and Webinars

Details on SMC Gelo’s comprehensive online courses and live webinars designed to teach low timeframe trading strategies.

Books and Publications

Recommended readings and publications authored by SMC Gelo that delve deeper into Forex trading principles.

Success Stories from SMC Gelo’s Students

Hear from those who have successfully applied SMC Gelo’s methods in their trading.

Testimonials

Real-life success stories from traders who have transformed their trading approach with the help of SMC Gelo.

Conclusion

Mastering low timeframe supply and demand with SMC Gelo can significantly enhance your trading skills, allowing you to make more informed and strategic decisions in the Forex market. With the right tools and knowledge, you can navigate these dynamic waters with confidence and success.

FAQs

- What exactly is low timeframe trading?

- It involves trading on charts with smaller time intervals, such as minutes or hours, allowing for quick decisions and trades.

- Is low timeframe trading suitable for beginners?

- It can be challenging for beginners due to its fast-paced nature, but with proper education and practice, it’s achievable.

- How important are technical indicators in SMC Gelo’s strategy?

- Very important. Indicators help identify the best supply and demand zones, crucial for making trades based on his strategies.

- Can SMC Gelo’s strategies be applied to other financial markets?

- Yes, while they are optimized for Forex, the principles of supply and demand apply universally and can be adapted.

- Where can I find more about SMC Gelo’s courses and teachings?

- Visit his official website or social media channels for the latest on courses, webinars, and other resources.

Be the first to review “Low Timeframe Supply and Demand with SMC Gelo” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Reviews

There are no reviews yet.