-

×

How to Trade Options 101 2021 with The Travel Trader

1 × $54.00

How to Trade Options 101 2021 with The Travel Trader

1 × $54.00 -

×

Exchange Traded Funds & E-Mini Stock Index Futures with David Lerman

1 × $6.00

Exchange Traded Funds & E-Mini Stock Index Futures with David Lerman

1 × $6.00 -

×

Latent Curve Models with Kenneth Bollen

1 × $6.00

Latent Curve Models with Kenneth Bollen

1 × $6.00 -

×

MTA - Technically Speaking Newsletters

1 × $6.00

MTA - Technically Speaking Newsletters

1 × $6.00 -

×

FXS Analytics Training and Q&A Access with FXS Analytics

1 × $6.00

FXS Analytics Training and Q&A Access with FXS Analytics

1 × $6.00 -

×

On Board Fanta Sea One Seminar with Felix Homogratus

1 × $6.00

On Board Fanta Sea One Seminar with Felix Homogratus

1 × $6.00 -

×

Beat The Market Maker

1 × $62.00

Beat The Market Maker

1 × $62.00 -

×

Trading on the Edge with Guido J.Deboeck

1 × $6.00

Trading on the Edge with Guido J.Deboeck

1 × $6.00 -

×

Attracting Abundance with EFT by Carol Look

1 × $6.00

Attracting Abundance with EFT by Carol Look

1 × $6.00 -

×

The Connors Research Volatility Trading Strategy Summit

1 × $85.00

The Connors Research Volatility Trading Strategy Summit

1 × $85.00 -

×

Using Robert’s Indicators with Rob Hoffman

1 × $6.00

Using Robert’s Indicators with Rob Hoffman

1 × $6.00 -

×

The Best Mechanical DayTrading System I Know with Bruce Babcock

1 × $6.00

The Best Mechanical DayTrading System I Know with Bruce Babcock

1 × $6.00 -

×

FXjake Daily Trader Program

1 × $31.00

FXjake Daily Trader Program

1 × $31.00 -

×

High Probability Continuation and Reversal Patterns

1 × $23.00

High Probability Continuation and Reversal Patterns

1 × $23.00 -

×

PayTrading with Eric Shawn

1 × $6.00

PayTrading with Eric Shawn

1 × $6.00 -

×

Trend Trading: Timing Market Tides with Kedrick Brown

1 × $6.00

Trend Trading: Timing Market Tides with Kedrick Brown

1 × $6.00 -

×

Technical Analysis with Alexander Elder Video Series

1 × $6.00

Technical Analysis with Alexander Elder Video Series

1 × $6.00 -

×

Sang Lucci Master Course 2021 with Sang Lucci

1 × $6.00

Sang Lucci Master Course 2021 with Sang Lucci

1 × $6.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

DApp Mastermind (Crypto DApps) – Passive Income with DApps and SMART Contracts with Jason BTO

1 × $6.00

DApp Mastermind (Crypto DApps) – Passive Income with DApps and SMART Contracts with Jason BTO

1 × $6.00 -

×

Volume Breakout Indicator

1 × $31.00

Volume Breakout Indicator

1 × $31.00 -

×

Consistent Intraday Strategies and Setups Class with Don Kaufman

1 × $6.00

Consistent Intraday Strategies and Setups Class with Don Kaufman

1 × $6.00 -

×

Bear Market Investing Strategies with Harry Schultz

1 × $6.00

Bear Market Investing Strategies with Harry Schultz

1 × $6.00 -

×

Reading The Tape Trade Series with CompassFX

1 × $10.00

Reading The Tape Trade Series with CompassFX

1 × $10.00 -

×

Unlocking the Mysteries of Trend Analysis - Rick Bensignor

1 × $6.00

Unlocking the Mysteries of Trend Analysis - Rick Bensignor

1 × $6.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

The Box Strategy with Blue Capital Academy

1 × $23.00

The Box Strategy with Blue Capital Academy

1 × $23.00 -

×

THE FULL PACKAGE! 8 COURSES with InTheMoneyStocks

1 × $443.00

THE FULL PACKAGE! 8 COURSES with InTheMoneyStocks

1 × $443.00 -

×

My General Counsel™

1 × $23.00

My General Counsel™

1 × $23.00 -

×

Main Online Course with MadCharts

1 × $5.00

Main Online Course with MadCharts

1 × $5.00 -

×

Simple Setups For Consistent Profits with Base Camp Trading

1 × $6.00

Simple Setups For Consistent Profits with Base Camp Trading

1 × $6.00 -

×

Full Pips & Profit Strategy with Pips & Profits

1 × $18.00

Full Pips & Profit Strategy with Pips & Profits

1 × $18.00 -

×

Elite Trend Trader with Frank Bunn

1 × $23.00

Elite Trend Trader with Frank Bunn

1 × $23.00 -

×

MOJO TOOLBOX with ProTrader Mike

1 × $23.00

MOJO TOOLBOX with ProTrader Mike

1 × $23.00 -

×

DAY TRADING COURSE 2018

1 × $6.00

DAY TRADING COURSE 2018

1 × $6.00 -

×

Interactive Course

1 × $6.00

Interactive Course

1 × $6.00 -

×

Reedstrader 101: Mechanical Trading Strategy Workshop - REEDSTRADER

1 × $31.00

Reedstrader 101: Mechanical Trading Strategy Workshop - REEDSTRADER

1 × $31.00 -

×

Mastering the Trade

1 × $6.00

Mastering the Trade

1 × $6.00 -

×

ICinDER V2 Cycle Analysis and TrendGuide Pack and Bloodhound Ultimate (May 2015)

1 × $31.00

ICinDER V2 Cycle Analysis and TrendGuide Pack and Bloodhound Ultimate (May 2015)

1 × $31.00 -

×

Predicting Market Trends with Periodic Number Cycle

1 × $6.00

Predicting Market Trends with Periodic Number Cycle

1 × $6.00 -

×

Yin Yang Forex Training Program

1 × $85.00

Yin Yang Forex Training Program

1 × $85.00 -

×

Trading Trend Pullbacks - 3-Step Technical Analysis Method with Richard Deutsch

1 × $6.00

Trading Trend Pullbacks - 3-Step Technical Analysis Method with Richard Deutsch

1 × $6.00 -

×

Amazing Day Trading Ninjatrader Indicator Perfect For Stocks, Futures And Forex

1 × $15.00

Amazing Day Trading Ninjatrader Indicator Perfect For Stocks, Futures And Forex

1 × $15.00 -

×

Academy - Pick Stocks Like A Pro

1 × $15.00

Academy - Pick Stocks Like A Pro

1 × $15.00 -

×

Adz Trading Academy

1 × $5.00

Adz Trading Academy

1 × $5.00 -

×

Avoiding Trading Mistakes with Mark D.Cook

1 × $6.00

Avoiding Trading Mistakes with Mark D.Cook

1 × $6.00 -

×

Forecasting Profits Using Price & Time with Ed Gately

1 × $6.00

Forecasting Profits Using Price & Time with Ed Gately

1 × $6.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

The Zone Trader Training Series with Timon Weller

1 × $8.00

The Zone Trader Training Series with Timon Weller

1 × $8.00 -

×

June 2010 Training Video

1 × $6.00

June 2010 Training Video

1 × $6.00 -

×

I Segreti Del Trading Di Breve Termine (Italian) with Larry Williams

1 × $6.00

I Segreti Del Trading Di Breve Termine (Italian) with Larry Williams

1 × $6.00 -

×

Millionaire Playbook with Jeremy Lefebvre

1 × $62.00

Millionaire Playbook with Jeremy Lefebvre

1 × $62.00 -

×

Day Trading with Lines in the Sky By R.L.Muehlberg

1 × $6.00

Day Trading with Lines in the Sky By R.L.Muehlberg

1 × $6.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

RDCC – Over 150 Hours Risk Doctor Group Coaching Clinics with Charles Cottle

1 × $6.00

RDCC – Over 150 Hours Risk Doctor Group Coaching Clinics with Charles Cottle

1 × $6.00 -

×

Adaptation in Sports Training (1995) with Atko Viru

1 × $23.00

Adaptation in Sports Training (1995) with Atko Viru

1 × $23.00 -

×

Intelligent Futures Trading (chickgoslin.com)

1 × $6.00

Intelligent Futures Trading (chickgoslin.com)

1 × $6.00 -

×

Module I - Foundation with FX MindShift

1 × $6.00

Module I - Foundation with FX MindShift

1 × $6.00 -

×

What Every Investor Shoud Know About Accounting Fraud with Jeff Madura

1 × $6.00

What Every Investor Shoud Know About Accounting Fraud with Jeff Madura

1 × $6.00 -

×

Market Mindfields. Dancing with Gorilla

1 × $6.00

Market Mindfields. Dancing with Gorilla

1 × $6.00 -

×

Practical Introduction to Bollinger Bands 2013

1 × $6.00

Practical Introduction to Bollinger Bands 2013

1 × $6.00 -

×

Revolutionary Proven 3 Step with NFTs Cracked

1 × $6.00

Revolutionary Proven 3 Step with NFTs Cracked

1 × $6.00 -

×

Self-Destructing Trader with Ryan Jonesc

1 × $6.00

Self-Destructing Trader with Ryan Jonesc

1 × $6.00 -

×

iMF Tracker – Order Flow Program 2023

1 × $5.00

iMF Tracker – Order Flow Program 2023

1 × $5.00 -

×

Stop Being the Stock Market Plankton with Idan Gabrieli

1 × $6.00

Stop Being the Stock Market Plankton with Idan Gabrieli

1 × $6.00 -

×

FX At One Glance - Ichimoku First Glance Video Course

1 × $23.00

FX At One Glance - Ichimoku First Glance Video Course

1 × $23.00 -

×

Zulu Trading Method for the Soybeans with Joe Ross

1 × $6.00

Zulu Trading Method for the Soybeans with Joe Ross

1 × $6.00 -

×

Exacttrading - Price Action Trader Course

1 × $15.00

Exacttrading - Price Action Trader Course

1 × $15.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

The BULLFx Forex Trading Course

1 × $5.00

The BULLFx Forex Trading Course

1 × $5.00 -

×

The Handbook of Commodity Investing with Frank Fabozzi, Roland Fuss & Dieter Kaiser

1 × $6.00

The Handbook of Commodity Investing with Frank Fabozzi, Roland Fuss & Dieter Kaiser

1 × $6.00 -

×

SOT Intermediate Course (May 2014)

1 × $23.00

SOT Intermediate Course (May 2014)

1 × $23.00 -

×

Commitment Workshop for Traders by Adrienne Laris Toghraie

1 × $6.00

Commitment Workshop for Traders by Adrienne Laris Toghraie

1 × $6.00 -

×

Foundations of Stock & Options. Home Study Course

1 × $6.00

Foundations of Stock & Options. Home Study Course

1 × $6.00 -

×

Introduction To Market Turning Points Caused - The Demand & Supply Of Big Banks Institution - Golden Bridge Trading

1 × $6.00

Introduction To Market Turning Points Caused - The Demand & Supply Of Big Banks Institution - Golden Bridge Trading

1 × $6.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Low Timeframe Supply and Demand with SMC Gelo

$5.00

File Size: 822 MB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

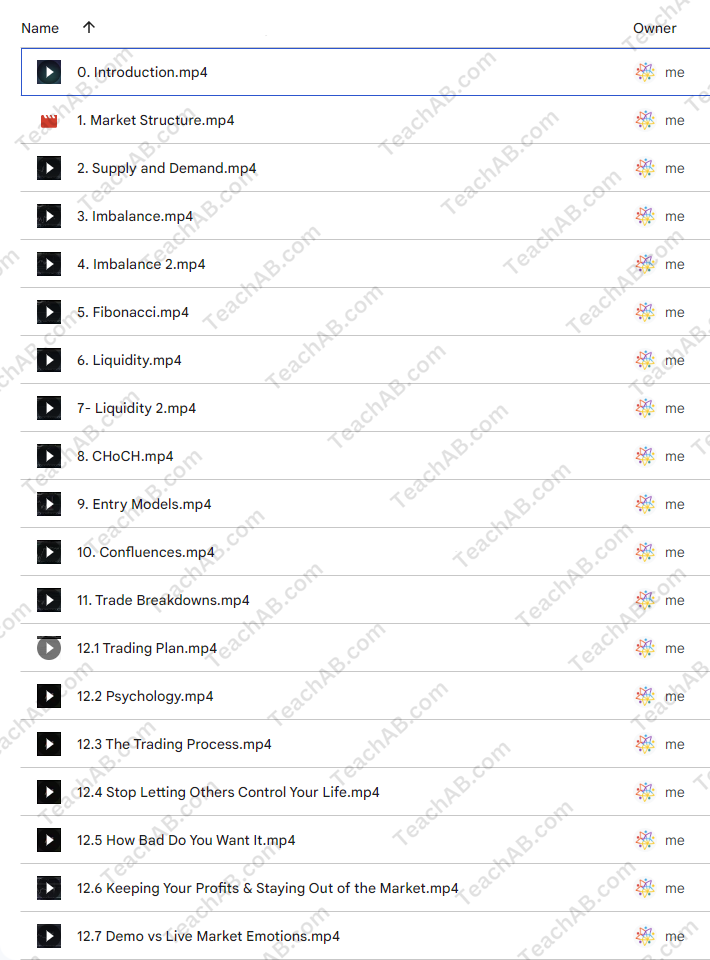

You may check content proof of “Low Timeframe Supply and Demand with SMC Gelo” below:

Low Timeframe Supply and Demand with SMC Gelo

Introduction

Navigating the complexities of the Forex market requires not only knowledge and strategy but also an understanding of market dynamics like supply and demand. SMC Gelo, a notable figure in this field, emphasizes the significance of these factors in low timeframe trading. This article explores the intricate dance of supply and demand in short-term Forex markets, guided by the expertise of SMC Gelo.

Who is SMC Gelo?

SMC Gelo is a respected trader and analyst known for his deep understanding of market mechanics, particularly in Forex trading. His strategies focus on low timeframe environments where supply and demand signals can be highly dynamic.

Understanding Supply and Demand

Before diving into specifics, it’s crucial to grasp the fundamental concepts of supply and demand in the trading context.

Basic Principles of Supply and Demand

The market is driven by these two forces, determining the price levels of currencies based on their perceived abundance or scarcity.

How Supply and Demand Affect Forex Prices

Significant price movements can occur when either supply exceeds demand, driving prices down, or demand exceeds supply, pushing prices up.

SMC Gelo’s Approach to Low Timeframe Trading

SMC Gelo’s methodology shines in the fast-paced environment of low timeframe trading, where quick decisions are crucial.

Key Strategies for Low Timeframes

Learn about the specific strategies SMC Gelo uses to identify and capitalize on supply and demand imbalances in short durations.

Tools and Indicators Used

SMC Gelo employs various technical indicators to detect shifts in supply and demand on lower timeframes.

Applying SMC Gelo’s Strategies

Here’s how you can put SMC Gelo’s teachings into practice to improve your trading performance.

Chart Setup and Analysis

A step-by-step guide to setting up your charts like SMC Gelo for optimal trading results.

Identifying Entry and Exit Points

Discover how to pinpoint precise entry and exit points using supply and demand zones.

Benefits of Low Timeframe Trading

While challenging, there are distinct advantages to trading on lower timeframes.

Quick Returns

Shorter trading periods can lead to quicker returns, appealing to those who prefer fast-paced trading.

Enhanced Market Feel

Regular trading on lower timeframes can enhance your ‘market feel’, improving your instinctive trading abilities.

Challenges and How to Overcome Them

Low timeframe trading is not without its challenges, which SMC Gelo addresses with specific strategies.

Dealing with Market Noise

Learn techniques to filter out the ‘noise’ that is typical in lower timeframes, focusing only on significant market moves.

Risk Management Techniques

Effective strategies to manage risks when trading in highly volatile, short-term markets.

SMC Gelo’s Teaching and Resources

Explore the educational resources that SMC Gelo offers to aspiring traders.

Online Courses and Webinars

Details on SMC Gelo’s comprehensive online courses and live webinars designed to teach low timeframe trading strategies.

Books and Publications

Recommended readings and publications authored by SMC Gelo that delve deeper into Forex trading principles.

Success Stories from SMC Gelo’s Students

Hear from those who have successfully applied SMC Gelo’s methods in their trading.

Testimonials

Real-life success stories from traders who have transformed their trading approach with the help of SMC Gelo.

Conclusion

Mastering low timeframe supply and demand with SMC Gelo can significantly enhance your trading skills, allowing you to make more informed and strategic decisions in the Forex market. With the right tools and knowledge, you can navigate these dynamic waters with confidence and success.

FAQs

- What exactly is low timeframe trading?

- It involves trading on charts with smaller time intervals, such as minutes or hours, allowing for quick decisions and trades.

- Is low timeframe trading suitable for beginners?

- It can be challenging for beginners due to its fast-paced nature, but with proper education and practice, it’s achievable.

- How important are technical indicators in SMC Gelo’s strategy?

- Very important. Indicators help identify the best supply and demand zones, crucial for making trades based on his strategies.

- Can SMC Gelo’s strategies be applied to other financial markets?

- Yes, while they are optimized for Forex, the principles of supply and demand apply universally and can be adapted.

- Where can I find more about SMC Gelo’s courses and teachings?

- Visit his official website or social media channels for the latest on courses, webinars, and other resources.

Be the first to review “Low Timeframe Supply and Demand with SMC Gelo” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.