-

×

Tradingology Complete Options Course with David Vallieres

1 × $6.00

Tradingology Complete Options Course with David Vallieres

1 × $6.00 -

×

Freak Forex Technicals with Ken FX Freak

1 × $6.00

Freak Forex Technicals with Ken FX Freak

1 × $6.00 -

×

Tape Reading Small Caps with Jtrader

1 × $23.00

Tape Reading Small Caps with Jtrader

1 × $23.00 -

×

Trading Patterns for Producing Huge Profits with Barry Burns

1 × $4.00

Trading Patterns for Producing Huge Profits with Barry Burns

1 × $4.00 -

×

Introduction to Stocks & Forex

1 × $15.00

Introduction to Stocks & Forex

1 × $15.00 -

×

Workshop Metals Mastery

1 × $23.00

Workshop Metals Mastery

1 × $23.00 -

×

Universal Clock with Jeanne Long

1 × $6.00

Universal Clock with Jeanne Long

1 × $6.00 -

×

TTM Trading with the Anchor Indicators Video

1 × $6.00

TTM Trading with the Anchor Indicators Video

1 × $6.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

The Volume Traders 2.0 with Sebastian - The Volume Traders

1 × $5.00

The Volume Traders 2.0 with Sebastian - The Volume Traders

1 × $5.00 -

×

Order Flow Mastery Course with OrderFlowForex

1 × $6.00

Order Flow Mastery Course with OrderFlowForex

1 × $6.00 -

×

Elite Day Trading Bundle (Series 4) with The Swag Academy

1 × $101.00

Elite Day Trading Bundle (Series 4) with The Swag Academy

1 × $101.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

Complete Trading Bundle with AAA Quants

1 × $27.00

Complete Trading Bundle with AAA Quants

1 × $27.00 -

×

Woodies Collection and AutoTrader 7.0.1.6

1 × $31.00

Woodies Collection and AutoTrader 7.0.1.6

1 × $31.00 -

×

XLT - Futures Trading Course

1 × $54.00

XLT - Futures Trading Course

1 × $54.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

Using Fundamental Analysis with Andrew Baxter

1 × $6.00

Using Fundamental Analysis with Andrew Baxter

1 × $6.00 -

×

Trading Options Using Auction Market Principles with Alexander Trading

1 × $54.00

Trading Options Using Auction Market Principles with Alexander Trading

1 × $54.00 -

×

Ultimate Gann Course Coaching Online Classroom 2009 with David Bowden & Aaron Lynch

1 × $23.00

Ultimate Gann Course Coaching Online Classroom 2009 with David Bowden & Aaron Lynch

1 × $23.00 -

×

Forex Trading Systems Elearning Course - Busted Breakout System with Van Tharp

1 × $6.00

Forex Trading Systems Elearning Course - Busted Breakout System with Van Tharp

1 × $6.00 -

×

The Complete Options Trading Course (New 2019) with Wealthy Education

1 × $6.00

The Complete Options Trading Course (New 2019) with Wealthy Education

1 × $6.00 -

×

TTM Slingshot

1 × $6.00

TTM Slingshot

1 × $6.00 -

×

Forex Xl Course (1.0+2.0+3.0)

1 × $10.00

Forex Xl Course (1.0+2.0+3.0)

1 × $10.00 -

×

Trading Forecasts Manual with Yuri Shramenko

1 × $4.00

Trading Forecasts Manual with Yuri Shramenko

1 × $4.00 -

×

Intra-Day Trading Tactics with Greg Capra

1 × $6.00

Intra-Day Trading Tactics with Greg Capra

1 × $6.00 -

×

TTW TradeFinder and Bookmap Course with Trading To Win

1 × $10.00

TTW TradeFinder and Bookmap Course with Trading To Win

1 × $10.00 -

×

MACD Divergence Fully Automatic Indicator for ThinkOrSwim TOS

1 × $6.00

MACD Divergence Fully Automatic Indicator for ThinkOrSwim TOS

1 × $6.00 -

×

The Liquidity Theory of Asset Prices with Gordon Pepper & Michael Oliver

1 × $6.00

The Liquidity Theory of Asset Prices with Gordon Pepper & Michael Oliver

1 × $6.00 -

×

Z4X Long Term Trading System

1 × $6.00

Z4X Long Term Trading System

1 × $6.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Start Trading Stocks Using Technical Analysis Part 2 with Corey Halliday

1 × $15.00

Start Trading Stocks Using Technical Analysis Part 2 with Corey Halliday

1 × $15.00 -

×

TTM Trend Anchor Indicator for Tradestation & MultiCharts

1 × $6.00

TTM Trend Anchor Indicator for Tradestation & MultiCharts

1 × $6.00 -

×

Area 61 with BCFX

1 × $6.00

Area 61 with BCFX

1 × $6.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Value Investing Bootcamp with Nick Kraakman

1 × $15.00

Value Investing Bootcamp with Nick Kraakman

1 × $15.00 -

×

Building a Better Trader with Glenn Ring

1 × $6.00

Building a Better Trader with Glenn Ring

1 × $6.00 -

×

ZR Trading Complete Program (Arabic + French)

1 × $10.00

ZR Trading Complete Program (Arabic + French)

1 × $10.00 -

×

How to Use Spreads to Construct a Trading Roadmap

1 × $6.00

How to Use Spreads to Construct a Trading Roadmap

1 × $6.00 -

×

Trading Weekly Options for Income in 2016 with Dan Sheridan

1 × $23.00

Trading Weekly Options for Income in 2016 with Dan Sheridan

1 × $23.00 -

×

Dan Sheridan Options Mentoring Weekly Webinars

1 × $6.00

Dan Sheridan Options Mentoring Weekly Webinars

1 × $6.00 -

×

Cybernetic Analysis for Stocks & Futures with John Ehlers

1 × $6.00

Cybernetic Analysis for Stocks & Futures with John Ehlers

1 × $6.00 -

×

InterMarket Analysis (Ed.2004) with John J.Murphy

1 × $6.00

InterMarket Analysis (Ed.2004) with John J.Murphy

1 × $6.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

Introduction to Fibonacci Time Analysis with Carolyn Boroden

1 × $6.00

Introduction to Fibonacci Time Analysis with Carolyn Boroden

1 × $6.00 -

×

Neowave. Inovations that Make Elliott Wave Work Better for You with Glenn Neely

1 × $6.00

Neowave. Inovations that Make Elliott Wave Work Better for You with Glenn Neely

1 × $6.00 -

×

The Basics of Swing Trading with Jason Bond

1 × $31.00

The Basics of Swing Trading with Jason Bond

1 × $31.00 -

×

Interpreting Balance of Power with Peter Worden

1 × $6.00

Interpreting Balance of Power with Peter Worden

1 × $6.00 -

×

Squeeze Pro Indicator + Buy/Sell Signals (PREMIUM)

1 × $85.00

Squeeze Pro Indicator + Buy/Sell Signals (PREMIUM)

1 × $85.00 -

×

The Motley Fool Million Dollar Portfolio: How to Build and Grow a Panic-Proof Investment Portfolio with David Gardner & Tom Gardner

1 × $6.00

The Motley Fool Million Dollar Portfolio: How to Build and Grow a Panic-Proof Investment Portfolio with David Gardner & Tom Gardner

1 × $6.00 -

×

Dow Theory for the 21st Century: Technical Indicators for Improving Your Investment Results with Jack Schannep

1 × $6.00

Dow Theory for the 21st Century: Technical Indicators for Improving Your Investment Results with Jack Schannep

1 × $6.00 -

×

Risk Free Projections Course

1 × $85.00

Risk Free Projections Course

1 × $85.00 -

×

How To Read The Trend (Recorded Session) with TradeSmart

1 × $31.00

How To Read The Trend (Recorded Session) with TradeSmart

1 × $31.00 -

×

Options Trading Training – The Blend Dc with Charles Cottle

1 × $4.00

Options Trading Training – The Blend Dc with Charles Cottle

1 × $4.00 -

×

Oliver Velez & Greg Capra - Trading the Pristine Method. The Refresher Course - I & II

1 × $15.00

Oliver Velez & Greg Capra - Trading the Pristine Method. The Refresher Course - I & II

1 × $15.00

SJG Trading – Butterflies Class with Steve Ganz

$497.00 Original price was: $497.00.$31.00Current price is: $31.00.

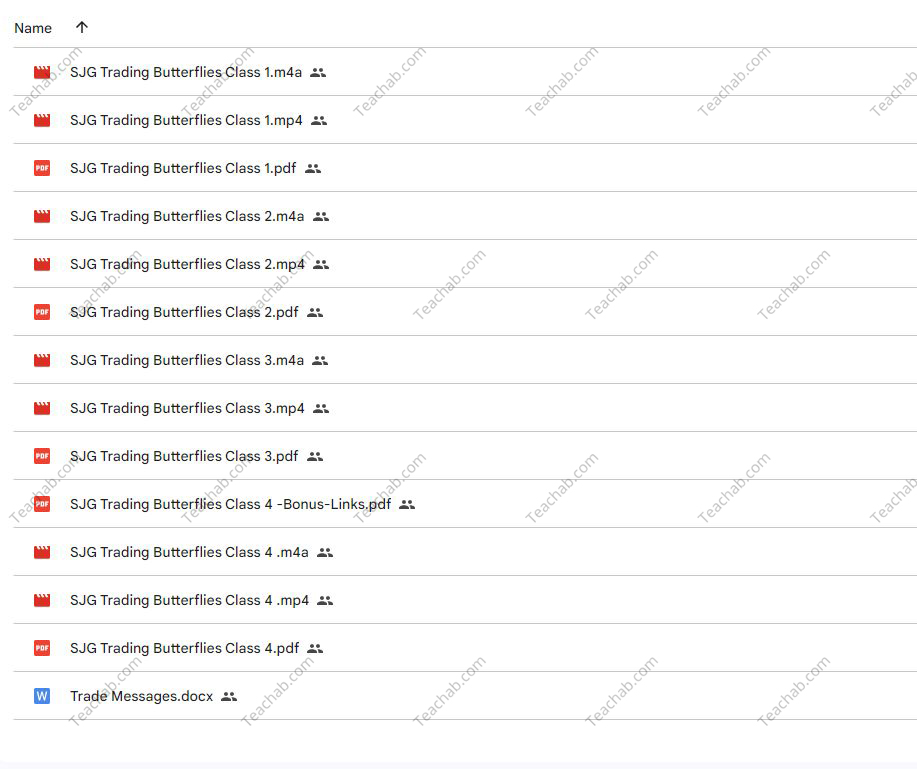

File Size: 1.22 GB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “SJG Trading – Butterflies Class with Steve Ganz” below:

SJG Trading – Butterflies Class with Steve Ganz

Introduction

In the dynamic world of options trading, mastering complex strategies can be the key to success. SJG Trading’s Butterflies Class, led by the renowned Steve Ganz, offers traders an unparalleled opportunity to learn about the intricate butterfly spread strategy.

Who is Steve Ganz?

Steve Ganz is a veteran trader with decades of experience in the options market. His expertise and unique teaching methods have made him a respected figure in trading circles.

Overview of the Butterfly Spread

The butterfly spread is an advanced options strategy involving multiple position types to capitalize on stocks that are expected to trade in a relatively tight range.

Why Choose SJG Trading?

SJG Trading is known for its high-quality educational programs that combine theoretical knowledge with practical trading skills.

Innovative Teaching Methods

- Interactive Sessions: Hands-on practice in a simulated trading environment.

- Visual Learning: Utilizing charts and real-time data for better understanding.

Course Objectives

The primary goal is to equip traders with the skills to efficiently set up, manage, and profit from butterfly spreads.

Course Structure

The Butterflies Class is meticulously structured to cater to both beginners and experienced traders.

Introduction to Options

Understanding the basics of options trading, including calls, puts, and trading mechanics.

Core Concepts of Butterfly Spreads

- Setup: How to construct a butterfly spread.

- Risk Management: Techniques to minimize losses.

Advanced Techniques

Learning the subtleties that can make or break a butterfly spread strategy.

Tools and Resources

Participants will gain access to various tools and resources that enhance their learning experience.

Proprietary Software

Exclusive tools designed to help traders analyze and execute butterfly spreads.

Comprehensive Study Materials

- E-Books: Detailed guides on strategies and market analysis.

- Video Tutorials: Step-by-step instructions on trade setups.

Support and Mentorship

Ongoing support from Steve Ganz and the team to ensure continuous learning.

Trading Simulation

Practical application of concepts through simulated trading sessions, which are a core component of the course.

Real-time Practice

Engaging in trades within a controlled environment to test out strategies safely.

Feedback and Analysis

Personalized feedback from Steve Ganz on trading performance and strategy refinement.

Community Interaction

An active community forum for discussion and strategy sharing with fellow students.

Success Stories

Hear from alumni who have successfully applied their knowledge gained from the Butterflies Class to excel in trading.

Transformations

Real-life examples of how the course has changed trading careers.

Testimonials

Positive feedback and endorsements from past participants.

Enrolling in the Course

Detailed information on how to join the Butterflies Class and start your journey with SJG Trading.

Registration Process

Simple steps to sign up and secure a spot in the upcoming session.

Investment Details

Overview of course fees, payment options, and return on investment.

Course Availability

Up-to-date information on course schedules and availability.

Conclusion

SJG Trading’s Butterflies Class with Steve Ganz offers an in-depth exploration of butterfly spreads that could significantly enhance your trading portfolio. Whether you are looking to refine your skills or start from scratch, this course promises comprehensive training with one of the best in the business.

FAQs

1. Is the Butterflies Class suitable for beginners? Absolutely! It’s designed to help even newcomers grasp complex strategies through step-by-step guidance.

2. How long does the course take to complete? The course typically runs for several weeks, providing ample time for thorough understanding and practice.

3. Can the strategies learned be applied in any market? Yes, while focused on options, the strategies are adaptable to various market conditions.

4. What is the student to instructor ratio in the course? The course maintains a low student-to-instructor ratio to ensure personalized attention.

5. Are there any prerequisites for joining the Butterflies Class? A basic understanding of options is helpful but not required, as the course covers all necessary fundamentals.

Be the first to review “SJG Trading – Butterflies Class with Steve Ganz” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.