-

×

The Beginners Guide to Commodities Investing with Brian & Gayle Rice

1 × $6.00

The Beginners Guide to Commodities Investing with Brian & Gayle Rice

1 × $6.00 -

×

The Afluent Desktop Currency Trader with Amin Sadak

1 × $6.00

The Afluent Desktop Currency Trader with Amin Sadak

1 × $6.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

The Loyalty Effect with Frederick Reichheld

1 × $6.00

The Loyalty Effect with Frederick Reichheld

1 × $6.00 -

×

Commitments of Traders : Strategies for Tracking the Market and Trading Profitably with Floyd Upperman

1 × $6.00

Commitments of Traders : Strategies for Tracking the Market and Trading Profitably with Floyd Upperman

1 × $6.00 -

×

60 Seconds Sure Shot Strategy with Albert E

1 × $6.00

60 Seconds Sure Shot Strategy with Albert E

1 × $6.00 -

×

Carolyn Boroden Package

1 × $15.00

Carolyn Boroden Package

1 × $15.00 -

×

Risk Management Toolkit with Peter Bain

1 × $6.00

Risk Management Toolkit with Peter Bain

1 × $6.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

Bing CPA Bootcamp

1 × $15.00

Bing CPA Bootcamp

1 × $15.00 -

×

Market Maps. High Probability Trading Techniques with Timothy Morge

1 × $6.00

Market Maps. High Probability Trading Techniques with Timothy Morge

1 × $6.00 -

×

Advances in International Investments: Traditional and Alternative Approaches with Hung-Gay Fung, Xiaoqing Eleanor Xu & Jot Yau

1 × $6.00

Advances in International Investments: Traditional and Alternative Approaches with Hung-Gay Fung, Xiaoqing Eleanor Xu & Jot Yau

1 × $6.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

Synthetic and Structured Assets: A Practical Guide to Investment and Risk with Erik Banks

1 × $6.00

Synthetic and Structured Assets: A Practical Guide to Investment and Risk with Erik Banks

1 × $6.00 -

×

Market Risk Analysis, Volume III, Pricing, Hedging and Trading Financial Instruments with Carol Alexander

1 × $6.00

Market Risk Analysis, Volume III, Pricing, Hedging and Trading Financial Instruments with Carol Alexander

1 × $6.00 -

×

Day Trading and Swing Trading Futures with Price Action by Humberto Malaspina

1 × $5.00

Day Trading and Swing Trading Futures with Price Action by Humberto Malaspina

1 × $5.00 -

×

An Introduction to Market Risk Measurement with Kevin Dowd

1 × $6.00

An Introduction to Market Risk Measurement with Kevin Dowd

1 × $6.00 -

×

AllStreet Investing - Master the Market LEVEL 2 - DAYTRADING

1 × $23.00

AllStreet Investing - Master the Market LEVEL 2 - DAYTRADING

1 × $23.00 -

×

Complete Portfolio and Stock Comparison Spreadsheet with Joseph Hogue

1 × $6.00

Complete Portfolio and Stock Comparison Spreadsheet with Joseph Hogue

1 × $6.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Simple Sector Trading Strategies with John Murphy

1 × $6.00

Simple Sector Trading Strategies with John Murphy

1 × $6.00 -

×

Traders Workshop – Forex Full Course with Jason Stapleton

1 × $6.00

Traders Workshop – Forex Full Course with Jason Stapleton

1 × $6.00 -

×

Mao, Marx & the Market: Capitalist Adventures in Russia and China with Dean LeBaro

1 × $6.00

Mao, Marx & the Market: Capitalist Adventures in Russia and China with Dean LeBaro

1 × $6.00 -

×

Traders Classroom Collection Volume 1-4 with Jeffrey Kennedy

1 × $15.00

Traders Classroom Collection Volume 1-4 with Jeffrey Kennedy

1 × $15.00 -

×

How to Build Fortune. Trading Stock Index Futures with Dennis Minogue

1 × $6.00

How to Build Fortune. Trading Stock Index Futures with Dennis Minogue

1 × $6.00 -

×

Capital Asset Investment with Anthony F.Herbst

1 × $6.00

Capital Asset Investment with Anthony F.Herbst

1 × $6.00 -

×

Safety in the Market. Smarter Starter Pack 1st Edition

1 × $6.00

Safety in the Market. Smarter Starter Pack 1st Edition

1 × $6.00 -

×

Market Profile E-Course with Charles Gough - Pirate Traders

1 × $17.00

Market Profile E-Course with Charles Gough - Pirate Traders

1 × $17.00 -

×

The Stock Market Trading Secrets of the Late (1940, scaned)

1 × $6.00

The Stock Market Trading Secrets of the Late (1940, scaned)

1 × $6.00 -

×

Power Cycle Trading - Boot Camp for Swing Trading

1 × $6.00

Power Cycle Trading - Boot Camp for Swing Trading

1 × $6.00 -

×

Stock Option Trading 3 – Easy Advanced Profits and Success with Scott Paton

1 × $6.00

Stock Option Trading 3 – Easy Advanced Profits and Success with Scott Paton

1 × $6.00 -

×

Alpha Quant Program with Lucas Inglese - Quantreo

1 × $15.00

Alpha Quant Program with Lucas Inglese - Quantreo

1 × $15.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

Math Trading Course 2023

1 × $34.00

Math Trading Course 2023

1 × $34.00 -

×

The HV7 Option Trading System with Amy Meissner – Aeromir

1 × $8.00

The HV7 Option Trading System with Amy Meissner – Aeromir

1 × $8.00 -

×

The Taylor Trading Technique with G.Douglas Taylor

1 × $6.00

The Taylor Trading Technique with G.Douglas Taylor

1 × $6.00 -

×

Advanced Trading Applications of Candlestick Charting with Gary S.Wagner & Bradley L.Matheny

1 × $6.00

Advanced Trading Applications of Candlestick Charting with Gary S.Wagner & Bradley L.Matheny

1 × $6.00 -

×

Steady Compounding Investing Academy Course with Steady Compounding

1 × $55.00

Steady Compounding Investing Academy Course with Steady Compounding

1 × $55.00 -

×

Advanced Strategies in Forex Trading with Don Schellenberg

1 × $6.00

Advanced Strategies in Forex Trading with Don Schellenberg

1 × $6.00 -

×

The New Science of Asset Allocation with Thomas Schneeweis

1 × $6.00

The New Science of Asset Allocation with Thomas Schneeweis

1 × $6.00 -

×

Guide to Getting Short and Collecting Income with Don Kaufman

1 × $6.00

Guide to Getting Short and Collecting Income with Don Kaufman

1 × $6.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Simple Setups For Consistent Profits with Base Camp Trading

$97.00 Original price was: $97.00.$6.00Current price is: $6.00.

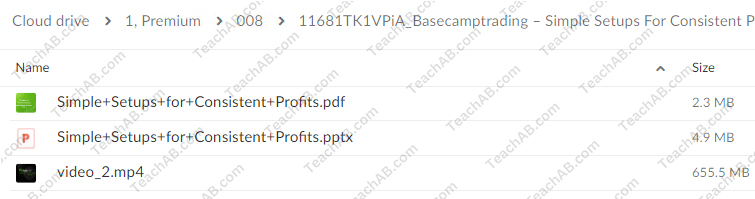

File Size: 662.7 MB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Simple Setups For Consistent Profits with Base Camp Trading” below:

Simple Setups For Consistent Profits with Base Camp Trading

Introduction

Achieving consistent profits in trading is the ultimate goal for any trader. Base Camp Trading, a renowned trading education provider, offers a variety of simple yet effective setups designed to help traders achieve this goal. In this article, we will explore the key setups and strategies taught by Base Camp Trading, providing a comprehensive guide to help traders enhance their performance and profitability.

Who is Base Camp Trading?

Background and Expertise

Base Camp Trading is a leading provider of trading education and resources. Their team of experienced traders and educators offers practical insights and strategies to help traders succeed in various market conditions.

Key Offerings

- Educational Courses: Comprehensive courses covering different aspects of trading.

- Trading Setups: Simple and effective setups designed for consistent profits.

- Community Support: Access to a community of traders and ongoing support.

Understanding Trading Setups

What is a Trading Setup?

A trading setup is a specific condition or combination of conditions that indicate a potential trading opportunity. Setups help traders identify when to enter or exit trades based on technical and fundamental analysis.

Importance of Simple Setups

Simple setups are crucial because they are easy to understand and implement, reducing the chances of errors and increasing the likelihood of consistent profits.

Key Setups by Base Camp Trading

Trend Following Setups

Identifying Trends

Base Camp Trading teaches traders to identify and follow trends, capitalizing on the market’s momentum. Trends are identified using tools like moving averages and trendlines.

Entry and Exit Points

Traders are guided on the best points to enter and exit trades within a trend to maximize profits and minimize losses.

Breakout Setups

Recognizing Breakouts

Breakout setups involve entering a trade when the price breaks through a significant support or resistance level. This strategy aims to capture significant price movements.

Setting Targets

Setting profit targets and stop-loss orders is essential to manage risk and ensure consistent profits from breakout trades.

Reversal Setups

Identifying Reversals

Reversal setups are used to identify points where the market is likely to change direction. Indicators such as RSI and MACD are commonly used to spot potential reversals.

Timing the Entry

Accurate timing is crucial for reversal setups. Base Camp Trading provides strategies to enter trades at the right moment to capture the reversal effectively.

Scalping Setups

Quick Trades

Scalping involves making quick trades to capture small price movements. This setup requires a keen eye for detail and quick execution.

Risk Management

Effective risk management is critical in scalping to ensure that small gains are not offset by larger losses.

Implementing Base Camp Trading Setups

Developing a Trading Plan

- Define Objectives: Set clear trading goals and objectives.

- Select Setups: Choose the setups that align with your trading style and goals.

- Risk Management: Incorporate risk management techniques, such as stop-loss orders and position sizing.

Backtesting Strategies

Before applying setups in live trading, backtest them using historical data to assess their effectiveness and refine your approach.

Live Trading

Start with small positions when transitioning to live trading. Gradually increase your position size as you gain confidence and experience.

Tools and Resources for Trading

Recommended Trading Platforms

Base Camp Trading recommends using reliable trading platforms that offer advanced charting tools, real-time data, and robust security features.

Educational Materials

Leverage the educational resources provided by Base Camp Trading, including tutorials, webinars, and community support.

Common Mistakes to Avoid

Overtrading

Avoid making too many trades, which can lead to increased costs and emotional exhaustion.

Ignoring Risk Management

Never neglect risk management practices, such as setting stop-loss orders and proper position sizing.

Chasing the Market

Stick to your trading plan and avoid chasing the market based on emotions or hunches.

Advanced Techniques in Trading

Multiple Time Frame Analysis

Analyzing multiple time frames provides a broader perspective on market trends and potential trade setups.

Algorithmic Trading

For advanced traders, algorithmic trading can automate strategies and ensure consistent execution.

Case Studies

Successful Trend Following

A trader uses Base Camp Trading’s trend-following setup, identifying a strong upward trend in the S&P 500. By following the strategy, the trader achieves consistent profits over several months.

Profitable Breakout Trade

Another trader applies the breakout setup from Base Camp Trading, entering a position as the EUR/USD breaks through key resistance levels. This approach leads to significant gains.

Conclusion

Base Camp Trading’s simple setups provide a robust framework for achieving consistent profits in trading. By understanding and implementing these setups, traders can enhance their performance, manage risks effectively, and achieve their trading goals. Embrace the strategies and principles taught by Base Camp Trading to navigate the complexities of the market and build a successful trading career.

Commonly Asked Questions:

- Business Model Innovation: Accept the truth of a legitimate business! Our strategy is organising a group buy in which participants share the costs. We use these cash to acquire popular courses from sale pages and make them available to people with limited financial resources. Despite the authors’ worries, our clients love the cost and accessibility we give.

- The Legal Environment: Yes or No The legality of our activity is ambiguous. While we don’t have specific permission from the course authors to resell the material, there is a technicality at work. The author did not specify any limits on resale when purchasing the course. This legal intricacy is both an opportunity for us and a boon for individuals looking for low-cost access.

- Quality Control: Uncovering the Truth

Getting to the heart of the issue – quality. Purchasing the course straight from the sale page guarantees that all documents and resources are the same as those obtained through traditional channels.

However, we distinguish ourselves by going beyond personal research and resale. It is crucial to note that we are not the official course providers, which means that the following premium services are not included in our package:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not permitted.

- No access to the author’s private membership forum.

- There is no direct email support available from the author or their team.

We operate independently, with the goal of bridging the pricing gap without the extra services provided by official course channels. Your comprehension of our distinct approach is much appreciated.

Be the first to review “Simple Setups For Consistent Profits with Base Camp Trading” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.