-

×

Broker Robbery University Course with Billi Richy FX

1 × $5.00

Broker Robbery University Course with Billi Richy FX

1 × $5.00 -

×

Sharp Edge Institutional Trading Program 2022 (No indicators) with CompassFX

1 × $139.00

Sharp Edge Institutional Trading Program 2022 (No indicators) with CompassFX

1 × $139.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

Order Flow Trading Course with Orderflows

1 × $23.00

Order Flow Trading Course with Orderflows

1 × $23.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

The Option Pit VIX Primer

1 × $31.00

The Option Pit VIX Primer

1 × $31.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

The Secret Code of Japanese Candlesticks with Felipe Tudela

1 × $5.00

The Secret Code of Japanese Candlesticks with Felipe Tudela

1 × $5.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

King Zulfan Academy – Course with Malaysian Trader

1 × $5.00

King Zulfan Academy – Course with Malaysian Trader

1 × $5.00 -

×

Ultimate Guide Technical Trading

1 × $23.00

Ultimate Guide Technical Trading

1 × $23.00 -

×

Trend Hunter Strategy

1 × $5.00

Trend Hunter Strategy

1 × $5.00 -

×

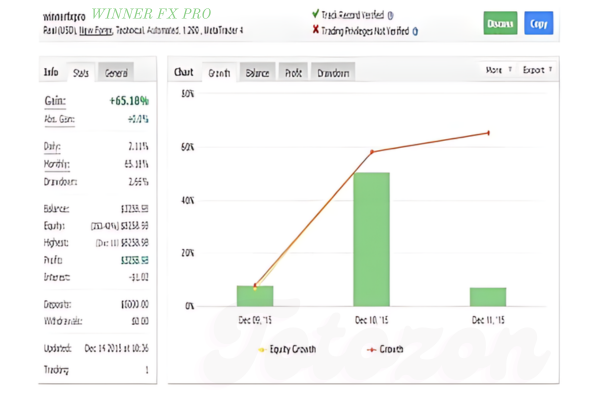

WINNER FX PRO

1 × $15.00

WINNER FX PRO

1 × $15.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

GMB Master Academy

1 × $31.00

GMB Master Academy

1 × $31.00 -

×

Practical Speculation with Victor Niederhoffer, Laurel Kenner

1 × $6.00

Practical Speculation with Victor Niederhoffer, Laurel Kenner

1 × $6.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

Ultimate Candlestick Training Package and Bonus Candlestick Analysis Technician Seminar

1 × $23.00

Ultimate Candlestick Training Package and Bonus Candlestick Analysis Technician Seminar

1 × $23.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

Wealthpress Jump Trade Package (Course Only, None-elert)

1 × $85.00

Wealthpress Jump Trade Package (Course Only, None-elert)

1 × $85.00 -

×

Jtrader - Risk Management 1on1

1 × $23.00

Jtrader - Risk Management 1on1

1 × $23.00 -

×

Ron Ianieri – Advanced Options Strategies

1 × $6.00

Ron Ianieri – Advanced Options Strategies

1 × $6.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

Trading The Curran 3-Line Break Method A Professional Strategy For Daytrading The Eminis By Chris Curran

1 × $4.00

Trading The Curran 3-Line Break Method A Professional Strategy For Daytrading The Eminis By Chris Curran

1 × $4.00 -

×

Scalp Trading using the Hybrid System with Traders Reality

1 × $27.00

Scalp Trading using the Hybrid System with Traders Reality

1 × $27.00 -

×

Tick Trader Bundle with Top Trade Tools

1 × $54.00

Tick Trader Bundle with Top Trade Tools

1 × $54.00 -

×

The Smart Income Strategy with Anthony Verner

1 × $171.00

The Smart Income Strategy with Anthony Verner

1 × $171.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

Trade Like a Bookie

1 × $6.00

Trade Like a Bookie

1 × $6.00 -

×

Equity Derivates with Marcus Overhaus, Andrew Ferraris, Thomas Knudsen, Ross Milward, Laurent Nguyen-Ngoc & Gero Schindlmayr

1 × $6.00

Equity Derivates with Marcus Overhaus, Andrew Ferraris, Thomas Knudsen, Ross Milward, Laurent Nguyen-Ngoc & Gero Schindlmayr

1 × $6.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

Chart Mastery Course 2024 with Quantum

1 × $24.00

Chart Mastery Course 2024 with Quantum

1 × $24.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Trendline Mastery Video Course with Frank Paul & Peter Bain

1 × $6.00

Trendline Mastery Video Course with Frank Paul & Peter Bain

1 × $6.00 -

×

Full Pips & Profit Strategy with Pips & Profits

1 × $18.00

Full Pips & Profit Strategy with Pips & Profits

1 × $18.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Developting a Forex Trading Plan Webminar

1 × $6.00

Developting a Forex Trading Plan Webminar

1 × $6.00 -

×

Power Income FUTURES Day Trading Course with Trade Out Loud

1 × $31.00

Power Income FUTURES Day Trading Course with Trade Out Loud

1 × $31.00 -

×

Trading Strategies for Capital Markets with Joseph Benning

1 × $6.00

Trading Strategies for Capital Markets with Joseph Benning

1 × $6.00 -

×

Foundations Of Stocks And Options (2015) with TradeSmart University

1 × $5.00

Foundations Of Stocks And Options (2015) with TradeSmart University

1 × $5.00 -

×

How to Use Spreads to Construct a Trading Roadmap

1 × $6.00

How to Use Spreads to Construct a Trading Roadmap

1 × $6.00 -

×

Three Point Reversal Method of Point & Figure Stock Market Trading with A.W.Cohen

1 × $6.00

Three Point Reversal Method of Point & Figure Stock Market Trading with A.W.Cohen

1 × $6.00 -

×

Atlas Forex Trading Course

1 × $5.00

Atlas Forex Trading Course

1 × $5.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

Options Foundations Class

1 × $23.00

Options Foundations Class

1 × $23.00 -

×

Ultimate Gann Trading

1 × $15.00

Ultimate Gann Trading

1 × $15.00 -

×

Breakouts: The Quintessential Approach – Feibel Trading

1 × $31.00

Breakouts: The Quintessential Approach – Feibel Trading

1 × $31.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

Using EasyLanguage 2000 with Arthur G.Putt, William Brower

1 × $4.00

Using EasyLanguage 2000 with Arthur G.Putt, William Brower

1 × $4.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Mastering The Markets

1 × $4.00

Mastering The Markets

1 × $4.00 -

×

Million Dollar Traders Course with Lex Van Dam

1 × $5.00

Million Dollar Traders Course with Lex Van Dam

1 × $5.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

The Winning Watch-List with Ryan Mallory

1 × $31.00

The Winning Watch-List with Ryan Mallory

1 × $31.00 -

×

Short-Term Trading Course with Mark Boucher

1 × $6.00

Short-Term Trading Course with Mark Boucher

1 × $6.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Forex Options Trading

1 × $6.00

Forex Options Trading

1 × $6.00 -

×

Options University - 3rd Anual Forex Superconference

1 × $3.00

Options University - 3rd Anual Forex Superconference

1 × $3.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

The Expected Return Calculator

1 × $23.00

The Expected Return Calculator

1 × $23.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

Greg Capra – 5 Pristine Trading DVD’s

1 × $31.00

Greg Capra – 5 Pristine Trading DVD’s

1 × $31.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Trading Courses Bundle

1 × $31.00

Trading Courses Bundle

1 × $31.00 -

×

Trading Framework with Retail Capital

1 × $24.00

Trading Framework with Retail Capital

1 × $24.00 -

×

Back to the Futures

1 × $31.00

Back to the Futures

1 × $31.00 -

×

TTM Slingshot

1 × $6.00

TTM Slingshot

1 × $6.00 -

×

Time Factor Digital Course with William McLaren

1 × $6.00

Time Factor Digital Course with William McLaren

1 × $6.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

Turning Point. Analysis in Price and Time

1 × $6.00

Turning Point. Analysis in Price and Time

1 × $6.00 -

×

Getting Rich in America with Dwight Lee

1 × $6.00

Getting Rich in America with Dwight Lee

1 × $6.00 -

×

Activedaytrader - 3 Important Ways to Manage Your Options Position

1 × $15.00

Activedaytrader - 3 Important Ways to Manage Your Options Position

1 × $15.00 -

×

ITPM - The Emergency Trading Room Portfolio Repair from Covid 19

1 × $15.00

ITPM - The Emergency Trading Room Portfolio Repair from Covid 19

1 × $15.00 -

×

Uncertainty & Expectation Strategies for the Trading of Risk with Gerald Ashley

1 × $6.00

Uncertainty & Expectation Strategies for the Trading of Risk with Gerald Ashley

1 × $6.00 -

×

London Super Conference 2018

1 × $54.00

London Super Conference 2018

1 × $54.00 -

×

Winning with Value Charts with Dave Stendahl

1 × $6.00

Winning with Value Charts with Dave Stendahl

1 × $6.00 -

×

Winning the Mental Game on Wall Street with John Magee

1 × $6.00

Winning the Mental Game on Wall Street with John Magee

1 × $6.00 -

×

Rate of Change Indicator with Alphashark

1 × $31.00

Rate of Change Indicator with Alphashark

1 × $31.00 -

×

Sports Trading Journey with Jack Birkhead

1 × $23.00

Sports Trading Journey with Jack Birkhead

1 × $23.00 -

×

Trend Trading Course

1 × $15.00

Trend Trading Course

1 × $15.00 -

×

KvngSolz Fx Mentorship

1 × $27.00

KvngSolz Fx Mentorship

1 × $27.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

Millard on Channel Analysis: The key to Share Price Prediction (2nd Ed.) with Brian Millard

1 × $6.00

Millard on Channel Analysis: The key to Share Price Prediction (2nd Ed.) with Brian Millard

1 × $6.00 -

×

Insiders guide to Trading Weekly Options with John Carter

1 × $54.00

Insiders guide to Trading Weekly Options with John Carter

1 × $54.00 -

×

The Next Big Investment Boom with Mark Shipman

1 × $6.00

The Next Big Investment Boom with Mark Shipman

1 × $6.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

Trading the Fast Moves for Maximum Profit with William McLaren

1 × $4.00

Trading the Fast Moves for Maximum Profit with William McLaren

1 × $4.00 -

×

Video Bundle - 4d & "Into The Abyss" with Blackrabbitfx

1 × $6.00

Video Bundle - 4d & "Into The Abyss" with Blackrabbitfx

1 × $6.00 -

×

DreamerGG – Mentorship 2023

1 × $5.00

DreamerGG – Mentorship 2023

1 × $5.00 -

×

XLT - Forex Trading Course

1 × $6.00

XLT - Forex Trading Course

1 × $6.00 -

×

Trading Hub 2.0 Course

1 × $27.00

Trading Hub 2.0 Course

1 × $27.00 -

×

Ultimate Breakout

1 × $54.00

Ultimate Breakout

1 × $54.00 -

×

Astrology At Work & Others

1 × $6.00

Astrology At Work & Others

1 × $6.00 -

×

TTM Trading with the Anchor Indicators Video

1 × $6.00

TTM Trading with the Anchor Indicators Video

1 × $6.00 -

×

Trading the Eclipses

1 × $6.00

Trading the Eclipses

1 × $6.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

Trend Trader PRO Suite Training Course

1 × $5.00

Trend Trader PRO Suite Training Course

1 × $5.00 -

×

The Scalper’s Boot Camp (Sep 2011)

1 × $23.00

The Scalper’s Boot Camp (Sep 2011)

1 × $23.00

Shorting for Profit

$379.00 Original price was: $379.00.$31.00Current price is: $31.00.

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Shorting for Profit – Claytrader: Mastering Short Selling

Introduction

Are you ready to expand your trading strategies and capitalize on market downturns? Shorting for Profit – Claytrader is designed to help traders understand and execute short selling with confidence and precision. This guide will explore the fundamentals of short selling, its benefits, and how you can use it to enhance your trading portfolio.

What is Short Selling?

Short selling involves borrowing shares of a stock you believe will decrease in value, selling them at the current market price, and then repurchasing them at a lower price. The difference between the selling price and the repurchase price is your profit.

Key Concepts of Short Selling

- Borrowing Shares

- Selling High, Buying Low

- Profit from Declines

Why Use Short Selling?

Short selling allows traders to profit from declining markets, providing a hedge against long positions and diversifying trading strategies. It can be particularly useful during bear markets or periods of high volatility.

Benefits of Short Selling

- Profit in Bear Markets

- Diversify Strategies

- Hedge Long Positions

Claytrader’s Approach to Short Selling

Who is Claytrader?

Claytrader is a renowned trader and educator known for his practical trading strategies and educational content. With years of experience, Claytrader provides insights and techniques to help traders succeed in various market conditions.

Claytrader’s Philosophy

Claytrader believes in a disciplined approach to trading, emphasizing risk management, technical analysis, and continuous learning. His strategies are designed to be accessible to traders of all levels.

Components of Shorting for Profit

Market Analysis Tools

Shorting for Profit incorporates a range of market analysis tools to identify profitable short selling opportunities. These tools include technical indicators, chart patterns, and real-time data feeds.

Essential Analysis Tools

- Moving Averages

- Relative Strength Index (RSI)

- Volume Analysis

Trade Execution Strategies

Effective trade execution is crucial for short selling success. Shorting for Profit provides strategies for precise entry and exit points to maximize profits and minimize losses.

Key Execution Strategies

- Identifying Overbought Conditions

- Timing Market Entry

- Setting Stop-Loss Orders

Setting Up for Short Selling

Choosing the Right Trading Platform

To implement short selling effectively, you need a robust trading platform with advanced charting capabilities and fast execution speeds. Popular platforms include MetaTrader, TradingView, and Thinkorswim.

Steps to Set Up for Short Selling

- Select a Reliable Broker: Ensure the broker supports short selling and provides the necessary tools.

- Install on Trading Platform: Follow the provided instructions for installation.

- Configure Settings: Customize the tools according to your trading preferences.

Customizing Your Workspace

Set up your trading workspace to include essential indicators and chart setups that align with short selling methodology.

Optimal Workspace Configuration

- Primary Chart with Key Indicators

- Supplementary Charts for Market Analysis

- Alert Notifications for Trade Setups

Implementing Shorting for Profit

Identifying Trade Opportunities

Shorting for Profit helps identify high-probability trade opportunities by combining various indicators and analysis techniques.

Key Signals to Watch For

- Breakouts and Reversals

- Divergence in Momentum Indicators

- Volume Confirmations

Executing Trades

Once a trade opportunity is identified, execute your trades with precision. Use limit orders to enter at the best possible prices and set stop-loss orders to manage risk.

Entry and Exit Strategies

- Entry: When indicators align and signal a high-probability setup.

- Exit: At predefined profit targets or when indicators suggest a trend reversal.

Managing Risk

Effective risk management is crucial for long-term success. Use short selling tools to set tight stop-loss orders and adjust your position size based on market conditions.

Risk Management Techniques

- Stop-Loss Orders

- Position Sizing

- Diversification

Advanced Techniques for Short Selling

Combining with Other Strategies

Enhance the effectiveness of short selling by combining it with other trading strategies. For instance, integrating options strategies can provide additional hedging opportunities.

Example: Combining Strategies

- Short Selling + Options Trading

- Short Selling + Swing Trading

Using Fundamental Analysis

Incorporate fundamental analysis to complement the technical signals provided by short selling. Understanding the broader market context can help you make more informed trading decisions.

Key Fundamental Factors

- Economic Indicators

- Company Earnings Reports

- Geopolitical Events

Common Pitfalls and How to Avoid Them

Over-Reliance on Single Tool

While short selling is powerful, relying solely on it can be risky. Combine it with other analysis methods to ensure well-rounded decision-making.

Tips to Avoid Over-Reliance

- Use Multiple Indicators

- Stay Informed About Market News

- Continuously Review and Adjust Your Strategy

Ignoring Market Conditions

Market conditions can change rapidly. Regularly update your analysis and adjust your strategy as needed.

Staying Informed

- Monitor Market News

- Use Economic Calendars

- Follow Expert Analysis

Success Stories from Shorting for Profit Users

Jane D., Professional Trader

“Shorting for Profit has significantly improved my trading accuracy. The tools and insights are incredibly reliable.”

Mike T., New Trader

“As a beginner, Shorting for Profit has given me the confidence to make informed trading decisions. The system is easy to use and very effective.”

Sarah L., Experienced Trader

“Shorting for Profit has become an essential part of my trading toolkit. The high-accuracy signals are game-changers.”

Conclusion

Shorting for Profit – Claytrader offers traders a structured and disciplined approach to short selling. By combining thorough preparation, precise targeting, and efficient execution, this system helps traders achieve consistent success in the financial markets.

Commonly Asked Questions:

- Business Model Innovation: Accept the truth of a legitimate business! Our strategy is organising a group buy in which participants share the costs. We use these cash to acquire popular courses from sale pages and make them available to people with limited financial resources. Despite the authors’ worries, our clients love the cost and accessibility we give.

- The Legal Environment: Yes or No The legality of our activity is ambiguous. While we don’t have specific permission from the course authors to resell the material, there is a technicality at work. The author did not specify any limits on resale when purchasing the course. This legal intricacy is both an opportunity for us and a boon for individuals looking for low-cost access.

- Quality Control: Uncovering the Truth

Getting to the heart of the issue – quality. Purchasing the course straight from the sale page guarantees that all documents and resources are the same as those obtained through traditional channels.

However, we distinguish ourselves by going beyond personal research and resale. It is crucial to note that we are not the official course providers, which means that the following premium services are not included in our package:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not permitted.

- No access to the author’s private membership forum.

- There is no direct email support available from the author or their team.

We operate independently, with the goal of bridging the pricing gap without the extra services provided by official course channels. Your comprehension of our distinct approach is much appreciated.

Be the first to review “Shorting for Profit” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Reviews

There are no reviews yet.