-

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

FX Savages Courses Collection

1 × $7.00

FX Savages Courses Collection

1 × $7.00 -

×

Options Trading Business with The Daytrading Room

1 × $23.00

Options Trading Business with The Daytrading Room

1 × $23.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

Bank Financial Model with Cash Flow Investing Pro

1 × $15.00

Bank Financial Model with Cash Flow Investing Pro

1 × $15.00 -

×

Hot Commodities: How Anyone Can Invest Profitably in the World's Best Market with Jim Rogers

1 × $6.00

Hot Commodities: How Anyone Can Invest Profitably in the World's Best Market with Jim Rogers

1 × $6.00 -

×

Fig Combo Course

1 × $5.00

Fig Combo Course

1 × $5.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

Ichimokutrade - Ichimoku 101

1 × $15.00

Ichimokutrade - Ichimoku 101

1 × $15.00 -

×

ICT Charter 2020 with Inner Circle Trader

1 × $13.00

ICT Charter 2020 with Inner Circle Trader

1 × $13.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

The Day Trader’s Course with Lewis Borsellino

1 × $6.00

The Day Trader’s Course with Lewis Borsellino

1 × $6.00 -

×

One Week S&P Workshop II with Linda Raschke

1 × $5.00

One Week S&P Workshop II with Linda Raschke

1 × $5.00 -

×

FOREX STRATEGY #1 with Steven Primo

1 × $39.00

FOREX STRATEGY #1 with Steven Primo

1 × $39.00 -

×

The LP Trading Course

1 × $13.00

The LP Trading Course

1 × $13.00 -

×

Robotic Trading: Skill Sharpening with Claytrader

1 × $23.00

Robotic Trading: Skill Sharpening with Claytrader

1 × $23.00 -

×

Stocks, Options & Collars with J.L.Lord

1 × $6.00

Stocks, Options & Collars with J.L.Lord

1 × $6.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

The Future of Technology with Tom Standage

1 × $4.00

The Future of Technology with Tom Standage

1 × $4.00 -

×

Real Motion Trading with MarketGauge

1 × $62.00

Real Motion Trading with MarketGauge

1 × $62.00 -

×

The Golden Rule with Jim Gibbons

1 × $6.00

The Golden Rule with Jim Gibbons

1 × $6.00 -

×

FOREX GENERATION MASTER COURSE

1 × $6.00

FOREX GENERATION MASTER COURSE

1 × $6.00 -

×

How To Trade the Best Currency Pairs Using The Ichimoku Cloud with Alphashark

1 × $31.00

How To Trade the Best Currency Pairs Using The Ichimoku Cloud with Alphashark

1 × $31.00 -

×

Mastering the Gaps - Trading Gaps

1 × $15.00

Mastering the Gaps - Trading Gaps

1 × $15.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

Stocks with Strauss

1 × $31.00

Stocks with Strauss

1 × $31.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

MACD Divergence Fully Automatic Indicator for ThinkOrSwim TOS

1 × $6.00

MACD Divergence Fully Automatic Indicator for ThinkOrSwim TOS

1 × $6.00 -

×

Overnight Profit Strategy PRO with Allison Ostrander

1 × $6.00

Overnight Profit Strategy PRO with Allison Ostrander

1 × $6.00 -

×

Protecting your Retirement Account in a Correction with Dan Sheridan - Sheridan Options Mentoring

1 × $31.00

Protecting your Retirement Account in a Correction with Dan Sheridan - Sheridan Options Mentoring

1 × $31.00 -

×

Optionpit - Mastering Iron Condors and Butterflies

1 × $15.00

Optionpit - Mastering Iron Condors and Butterflies

1 × $15.00 -

×

Position Dissection with Charles Cottle

1 × $4.00

Position Dissection with Charles Cottle

1 × $4.00 -

×

Gold Nuggets for Stock and Commodity Traders with George Bayer

1 × $6.00

Gold Nuggets for Stock and Commodity Traders with George Bayer

1 × $6.00 -

×

European Fixed Income Markets with Jonathan Batten

1 × $6.00

European Fixed Income Markets with Jonathan Batten

1 × $6.00 -

×

Investing in the stock market

1 × $6.00

Investing in the stock market

1 × $6.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

Forex Ulitmatum with Matt Jordan & Patrick Cuthbert

1 × $6.00

Forex Ulitmatum with Matt Jordan & Patrick Cuthbert

1 × $6.00 -

×

How To Trade Fundamental News Release 2022 with Patrick Muke

1 × $6.00

How To Trade Fundamental News Release 2022 with Patrick Muke

1 × $6.00 -

×

PIPSOCIETY - FOREX AMAZING STRATEGY

1 × $15.00

PIPSOCIETY - FOREX AMAZING STRATEGY

1 × $15.00 -

×

LARGE CAP MOMENTUM STRATEGY with Nick Radge

1 × $179.00

LARGE CAP MOMENTUM STRATEGY with Nick Radge

1 × $179.00 -

×

Hit and Run Trading Updated Version with Jeff Cooper

1 × $6.00

Hit and Run Trading Updated Version with Jeff Cooper

1 × $6.00 -

×

Evolved Traders with Riley Coleman

1 × $5.00

Evolved Traders with Riley Coleman

1 × $5.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

IncomeMAX Spreads and Straddles with Hari Swaminathan

1 × $15.00

IncomeMAX Spreads and Straddles with Hari Swaminathan

1 × $15.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Read the Greed. Take the Money & Teleseminar

1 × $6.00

Read the Greed. Take the Money & Teleseminar

1 × $6.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

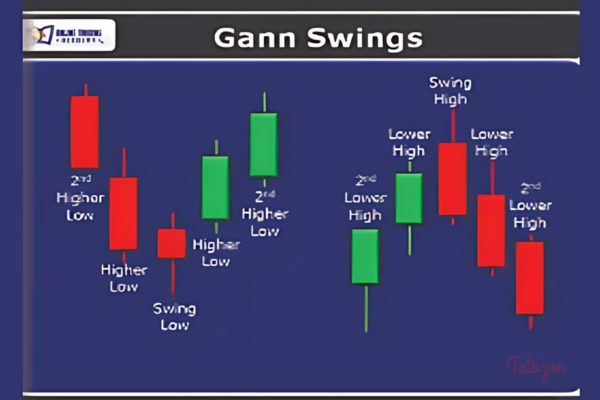

Terry Ashman’s Gann Swings Swing Trading Course (HotTrader Tutorial)

1 × $6.00

Terry Ashman’s Gann Swings Swing Trading Course (HotTrader Tutorial)

1 × $6.00 -

×

Going Global 2015

1 × $6.00

Going Global 2015

1 × $6.00 -

×

Market Profile Course

1 × $54.00

Market Profile Course

1 × $54.00 -

×

Consistent Intraday Strategies and Setups Class with Don Kaufman

1 × $6.00

Consistent Intraday Strategies and Setups Class with Don Kaufman

1 × $6.00 -

×

Ichimokutrade - Elliot Wave 101

1 × $15.00

Ichimokutrade - Elliot Wave 101

1 × $15.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

FX SpeedRunner

1 × $5.00

FX SpeedRunner

1 × $5.00 -

×

Market Trader Forecasting Modeling Course

1 × $6.00

Market Trader Forecasting Modeling Course

1 × $6.00 -

×

TCG Educational Course Bundle Entries & Exits + Trading

1 × $23.00

TCG Educational Course Bundle Entries & Exits + Trading

1 × $23.00 -

×

Special Webinars Module 2 with Trader Dante

1 × $6.00

Special Webinars Module 2 with Trader Dante

1 × $6.00 -

×

Jesse Livermore Trading System with Joe Marwood - Marwood Research

1 × $15.00

Jesse Livermore Trading System with Joe Marwood - Marwood Research

1 × $15.00 -

×

Neall Concord-Cushing - Secret of Forecasting Using Wave59 Tools (Book I & II)

1 × $6.00

Neall Concord-Cushing - Secret of Forecasting Using Wave59 Tools (Book I & II)

1 × $6.00 -

×

From Walden to Wall Street: Frontiers of Conservation Finance with James Levitt

1 × $6.00

From Walden to Wall Street: Frontiers of Conservation Finance with James Levitt

1 × $6.00 -

×

Introduction To Advanced Options Trading 201

1 × $23.00

Introduction To Advanced Options Trading 201

1 × $23.00 -

×

Introduction to Fibonacci Time Analysis with Carolyn Boroden

1 × $6.00

Introduction to Fibonacci Time Analysis with Carolyn Boroden

1 × $6.00 -

×

Gold XAUUSD Trading Strategy - The Gold Box with The Trading Guide

1 × $5.00

Gold XAUUSD Trading Strategy - The Gold Box with The Trading Guide

1 × $5.00 -

×

MMfx Course August 2011 + MT4 Ind. Jan 2012

1 × $15.00

MMfx Course August 2011 + MT4 Ind. Jan 2012

1 × $15.00 -

×

Forex Course with Forever Blue

1 × $6.00

Forex Course with Forever Blue

1 × $6.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

How to Consistently Win Trading Stocks in 30 Days or Less

1 × $15.00

How to Consistently Win Trading Stocks in 30 Days or Less

1 × $15.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

How To Day-Trade Micro Eminis with Dr. Stoxx

1 × $5.00

How To Day-Trade Micro Eminis with Dr. Stoxx

1 × $5.00 -

×

Basic Astrotech

1 × $6.00

Basic Astrotech

1 × $6.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

Options University - Ron Ianieri – Options University Live Seminars

1 × $6.00

Options University - Ron Ianieri – Options University Live Seminars

1 × $6.00 -

×

Grand Slam Options

1 × $23.00

Grand Slam Options

1 × $23.00 -

×

Stocks & Commodities Magazine S&C on DVD 11.26 (1982-2008)

1 × $6.00

Stocks & Commodities Magazine S&C on DVD 11.26 (1982-2008)

1 × $6.00 -

×

Special Bootcamp with Smart Earners Academy

1 × $5.00

Special Bootcamp with Smart Earners Academy

1 × $5.00 -

×

Kase StatWare 9.7.3

1 × $23.00

Kase StatWare 9.7.3

1 × $23.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

The Haller Theory of Stock Market Trends

1 × $6.00

The Haller Theory of Stock Market Trends

1 × $6.00 -

×

Markets 101 Complete Course with Joseph Wang - Central Banking 101

1 × $13.00

Markets 101 Complete Course with Joseph Wang - Central Banking 101

1 × $13.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Multi-Squeeze Indicator For TOS

1 × $31.00

Multi-Squeeze Indicator For TOS

1 × $31.00 -

×

Intra-Day Trading Techniques CD with Greg Capra

1 × $6.00

Intra-Day Trading Techniques CD with Greg Capra

1 × $6.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

Short-Term Trading, Long-Term Profits with John Leizman – McGraw-Hill

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Short-Term Trading, Long-Term Profits with John Leizman – McGraw-Hill” below:

Short-Term Trading, Long-Term Profits with John Leizman – McGraw-Hill

Navigating the stock market can be a daunting task, but John Leizman’s book, “Short-Term Trading, Long-Term Profits,” published by McGraw-Hill, offers a comprehensive guide to mastering this art. This article delves into the key strategies and concepts presented by Leizman, providing insights on how to achieve long-term profitability through short-term trading.

Understanding Short-Term Trading

What is Short-Term Trading?

Short-term trading involves buying and selling securities within a brief time frame, typically ranging from a few minutes to several days. This approach aims to capitalize on short-term market movements.

Importance of Short-Term Trading

Short-term trading can generate significant returns in a short period, offering liquidity and flexibility. However, it requires a solid understanding of market dynamics and effective risk management.

Who is John Leizman?

John Leizman’s Background

John Leizman is a seasoned trader and financial expert with years of experience in the stock market. He is renowned for his practical strategies and insightful analysis, making his teachings valuable for both novice and experienced traders.

Contributions to Trading Literature

Leizman has authored several books and articles, providing in-depth knowledge on trading strategies, market analysis, and investment techniques. His work emphasizes the balance between short-term tactics and long-term goals.

Key Concepts in Short-Term Trading

Technical Analysis

Understanding Charts

Technical analysis relies heavily on chart patterns to predict future price movements. Familiarity with candlestick charts, line charts, and bar charts is essential.

Key Indicators

- Moving Averages: Help identify trends by smoothing out price data.

- Relative Strength Index (RSI): Measures the speed and change of price movements.

- MACD (Moving Average Convergence Divergence): Indicates the strength and direction of a trend.

Risk Management

Setting Stop-Loss Orders

Stop-loss orders automatically sell a security when it reaches a certain price, limiting potential losses.

Position Sizing

Determining the size of each trade based on the trader’s risk tolerance and capital ensures manageable risk exposure.

Trading Psychology

Managing Emotions

Emotional control is crucial in trading. Greed and fear can lead to impulsive decisions that undermine trading strategies.

Maintaining Discipline

Sticking to a trading plan and avoiding impulsive trades are key to long-term success.

Strategies for Short-Term Trading

Scalping

What is Scalping?

Scalping involves making numerous trades within a day to profit from small price changes. It requires quick decision-making and execution.

Tips for Successful Scalping

- Use Tight Stop-Losses: Minimize losses by setting tight stop-loss levels.

- Focus on Liquid Markets: High liquidity ensures smoother trade execution.

Day Trading

What is Day Trading?

Day trading involves buying and selling securities within the same trading day, avoiding overnight market risks.

Key Techniques

- Trend Following: Identify and follow market trends.

- Breakout Trading: Trade on significant price movements above or below resistance and support levels.

Swing Trading

What is Swing Trading?

Swing trading aims to capture price swings over several days to weeks. It requires patience and a good understanding of market cycles.

Effective Swing Trading Strategies

- Use Technical Indicators: Utilize tools like moving averages and RSI.

- Identify Support and Resistance Levels: Base your trades on key price levels.

Implementing Leizman’s Strategies

Step-by-Step Guide

Step 1: Develop a Trading Plan

Create a detailed plan outlining your trading strategies, risk management rules, and financial goals.

Step 2: Educate Yourself

Continuously learn about market trends, technical analysis, and trading strategies. Use resources like Leizman’s book and online courses.

Step 3: Practice with a Demo Account

Use a demo account to practice your trading strategies without risking real money. This helps build confidence and refine techniques.

Step 4: Start Small

Begin with small trades to minimize risk. Gradually increase your position size as you gain experience and confidence.

Step 5: Monitor and Adjust

Regularly review your trades and adjust your strategies based on performance and market conditions.

Practical Tips for Success

Stay Informed

Keep up with market news, economic indicators, and geopolitical events that can impact prices.

Use Technology

Leverage trading platforms and tools for real-time data analysis and trade execution.

Maintain Discipline

Stick to your trading plan and avoid making decisions based on emotions or market noise.

Benefits of Short-Term Trading

Liquidity

Short-term trading offers high liquidity, allowing traders to quickly enter and exit positions.

Flexibility

Traders can adapt to changing market conditions and capitalize on short-term opportunities.

Potential for High Returns

With the right strategies and risk management, short-term trading can yield significant profits.

Common Challenges and Solutions

Challenge 1: Market Volatility

Volatility can lead to unpredictable price movements.

Solution: Use Stop-Loss Orders

Implement stop-loss orders to protect against significant losses.

Challenge 2: Emotional Decision-Making

Emotions can cloud judgment and lead to poor trading decisions.

Solution: Practice Emotional Control

Develop techniques to manage stress and maintain discipline.

Conclusion

“Short-Term Trading, Long-Term Profits” by John Leizman provides invaluable insights into achieving sustained profitability through short-term trading strategies. By mastering technical analysis, managing risk, and maintaining discipline, traders can enhance their performance and achieve their financial goals. Continuous learning and disciplined execution are key to success in the dynamic world of trading.

FAQs

1. What is short-term trading?

- Short-term trading involves buying and selling securities within a brief time frame to capitalize on market movements.

2. Who is John Leizman?

- John Leizman is a financial expert and seasoned trader known for his practical trading strategies and insightful analysis.

3. What are some key strategies for short-term trading?

- Key strategies include scalping, day trading, and swing trading, each with specific techniques and risk management practices.

4. How can I manage risk in short-term trading?

- Manage risk by setting stop-loss orders, determining position sizes, and maintaining discipline in your trading plan.

5. What are the benefits of short-term trading?

- Benefits include high liquidity, flexibility, and the potential for significant returns with effective strategies and risk management.

Be the first to review “Short-Term Trading, Long-Term Profits with John Leizman – McGraw-Hill” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.