-

×

Wave Trader Software 2004 with Bryce Gilmore

1 × $6.00

Wave Trader Software 2004 with Bryce Gilmore

1 × $6.00 -

×

Forex Master Class with Falcon Trading Academy

1 × $5.00

Forex Master Class with Falcon Trading Academy

1 × $5.00 -

×

Greatest Trading Tools

1 × $6.00

Greatest Trading Tools

1 × $6.00 -

×

Certification in Point & Figure Chart & P&F Chart Patterns

1 × $6.00

Certification in Point & Figure Chart & P&F Chart Patterns

1 × $6.00 -

×

Price Action Trading Volume 2 with Fractal Flow Pro

1 × $6.00

Price Action Trading Volume 2 with Fractal Flow Pro

1 × $6.00 -

×

MOJO TOOLBOX with ProTrader Mike

1 × $23.00

MOJO TOOLBOX with ProTrader Mike

1 × $23.00 -

×

Trading Double Diagonals in 2019 with Dan Sheridan - Sheridan Options Mentoring

1 × $5.00

Trading Double Diagonals in 2019 with Dan Sheridan - Sheridan Options Mentoring

1 × $5.00 -

×

Kase StatWare 9.7.3

1 × $23.00

Kase StatWare 9.7.3

1 × $23.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

AstroFX Course

1 × $6.00

AstroFX Course

1 × $6.00 -

×

Nico FX Journal (SMC)

1 × $5.00

Nico FX Journal (SMC)

1 × $5.00 -

×

Value Based Power Trading

1 × $6.00

Value Based Power Trading

1 × $6.00 -

×

The Oil Money (open code) (Nov 2013)

1 × $6.00

The Oil Money (open code) (Nov 2013)

1 × $6.00 -

×

Simple Profit Trading System 2020

1 × $54.00

Simple Profit Trading System 2020

1 × $54.00 -

×

The Fortune Strategy. An Instruction Manual

1 × $6.00

The Fortune Strategy. An Instruction Manual

1 × $6.00 -

×

Start Trading Stocks Using Technical Analysis with Corey Halliday

1 × $6.00

Start Trading Stocks Using Technical Analysis with Corey Halliday

1 × $6.00 -

×

Tradeonix Trading System

1 × $31.00

Tradeonix Trading System

1 × $31.00 -

×

Van Tharp Courses Collection

1 × $41.00

Van Tharp Courses Collection

1 × $41.00 -

×

REMORA OPTIONS TRADING (Silver Membership)

1 × $23.00

REMORA OPTIONS TRADING (Silver Membership)

1 × $23.00 -

×

Complete Trading Bundle with AAA Quants

1 × $27.00

Complete Trading Bundle with AAA Quants

1 × $27.00 -

×

Astrology & Stock Market Forecasting with Louise McWhirter

1 × $4.00

Astrology & Stock Market Forecasting with Louise McWhirter

1 × $4.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

The Option Pit VIX Primer

1 × $31.00

The Option Pit VIX Primer

1 × $31.00 -

×

STREAM ALERTS

1 × $6.00

STREAM ALERTS

1 × $6.00 -

×

The Septiform System of the Cosmos with Alec Stuart

1 × $6.00

The Septiform System of the Cosmos with Alec Stuart

1 × $6.00 -

×

Onyx Trade House

1 × $7.00

Onyx Trade House

1 × $7.00 -

×

Beginner Forex Mastery Course with Harrison Uwah - MHU FX Academy

1 × $78.00

Beginner Forex Mastery Course with Harrison Uwah - MHU FX Academy

1 × $78.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Six Setups Using Ichimoku Kinkō Hyō with Alphashark

1 × $15.00

Six Setups Using Ichimoku Kinkō Hyō with Alphashark

1 × $15.00 -

×

Month 01 to 08 2018

1 × $62.00

Month 01 to 08 2018

1 × $62.00 -

×

Lifetime Membership

1 × $840.00

Lifetime Membership

1 × $840.00 -

×

Winning With The Market with Douglas R.Sease

1 × $6.00

Winning With The Market with Douglas R.Sease

1 × $6.00 -

×

Winning System For Trading High-Performance Stocks with Tim Cho

1 × $6.00

Winning System For Trading High-Performance Stocks with Tim Cho

1 × $6.00 -

×

Exacttrading - Price Action Trader Course

1 × $15.00

Exacttrading - Price Action Trader Course

1 × $15.00 -

×

ChangeWave Investing 2.0 with Tobin Smith

1 × $6.00

ChangeWave Investing 2.0 with Tobin Smith

1 × $6.00 -

×

Insider’s Guide To Forex Trading Howard Gilmore

1 × $6.00

Insider’s Guide To Forex Trading Howard Gilmore

1 × $6.00 -

×

![Strike Zone Trading - Forex Course [81 Videos (MP4) + 96 Software files (EXEEX4MQ4CHRWNDTPL) + 17 DOCS (TXTCSVXLSXPDF) + Images (PNGJPGGIF)]](https://www.totozon.com/wp-content/uploads/2024/05/Strike-Zone-Trading-Forex-Course-81-Videos-MP4-96-Software-files-EXEEX4MQ4CHRWNDTPL-17-DOCS-TXTCSVXLSXPDF-Images-PNGJPGGIF.jpg) Strike Zone Trading - Forex Course [81 Videos (MP4) + 96 Software files (EXE/EX4/MQ4/CHR/WND/TPL) + 17 DOCS (TXT/CSV/XLSX/PDF) + Images (PNG/JPG/GIF)]

1 × $6.00

Strike Zone Trading - Forex Course [81 Videos (MP4) + 96 Software files (EXE/EX4/MQ4/CHR/WND/TPL) + 17 DOCS (TXT/CSV/XLSX/PDF) + Images (PNG/JPG/GIF)]

1 × $6.00 -

×

Larry Williams Newsletters (1994-1997)

1 × $6.00

Larry Williams Newsletters (1994-1997)

1 × $6.00 -

×

Scientific Trading Machine with Nicola Delic

1 × $54.00

Scientific Trading Machine with Nicola Delic

1 × $54.00 -

×

Neowave. Taking Elliott Wave into the 21st Century with Glenn Neely

1 × $6.00

Neowave. Taking Elliott Wave into the 21st Century with Glenn Neely

1 × $6.00 -

×

The Bollinger Bands Swing Trading System 2004 with Larry Connors

1 × $6.00

The Bollinger Bands Swing Trading System 2004 with Larry Connors

1 × $6.00 -

×

Gaining Option Leverage: Using Market Makers Tactics with Jon Najarian

1 × $4.00

Gaining Option Leverage: Using Market Makers Tactics with Jon Najarian

1 × $4.00 -

×

Insider Signal Exclusive Forex Course with Andy X

1 × $7.00

Insider Signal Exclusive Forex Course with Andy X

1 × $7.00 -

×

Cycles – Gann and Fibonnacci 1997 with Stan Harley

1 × $6.00

Cycles – Gann and Fibonnacci 1997 with Stan Harley

1 × $6.00 -

×

The Blueprint for Successful Stock Trading with Jeff Tompkins

1 × $6.00

The Blueprint for Successful Stock Trading with Jeff Tompkins

1 × $6.00 -

×

Trendfund.com - Scalping, Options, Advanced Options

1 × $4.00

Trendfund.com - Scalping, Options, Advanced Options

1 × $4.00 -

×

Trading Mastery For Financial Freedom with Marv Eisen

1 × $10.00

Trading Mastery For Financial Freedom with Marv Eisen

1 × $10.00 -

×

Video Course with Trading Template

1 × $54.00

Video Course with Trading Template

1 × $54.00 -

×

Raghee Horner's Workspace Bundle + Live Trading By Raghee Horner - Simpler Trading

1 × $23.00

Raghee Horner's Workspace Bundle + Live Trading By Raghee Horner - Simpler Trading

1 × $23.00 -

×

The Tape Reader’s Bundle with The Price Action Room

1 × $62.00

The Tape Reader’s Bundle with The Price Action Room

1 × $62.00 -

×

Ultimate Guide to Stock Investing

1 × $6.00

Ultimate Guide to Stock Investing

1 × $6.00 -

×

Macro to Micro Volatility Trading with Mark Whistler

1 × $5.00

Macro to Micro Volatility Trading with Mark Whistler

1 × $5.00 -

×

The ETF Handbook, + website: How to Value and Trade Exchange Traded Funds (1st Edition) with David Abner

1 × $6.00

The ETF Handbook, + website: How to Value and Trade Exchange Traded Funds (1st Edition) with David Abner

1 × $6.00 -

×

W.O.W. Guaranteed Income with Chuck Hughes

1 × $31.00

W.O.W. Guaranteed Income with Chuck Hughes

1 × $31.00 -

×

Graphs, Application to Speculation with George Cole

1 × $6.00

Graphs, Application to Speculation with George Cole

1 × $6.00 -

×

MLT Divergence Indicator with Major League Trading

1 × $23.00

MLT Divergence Indicator with Major League Trading

1 × $23.00 -

×

The A.M. Trader with MarketGauge

1 × $31.00

The A.M. Trader with MarketGauge

1 × $31.00 -

×

Trade Execution & Trade Management with Kam Dhadwar

1 × $6.00

Trade Execution & Trade Management with Kam Dhadwar

1 × $6.00 -

×

Zanzibar System for the EuroFx with Joe Ross

1 × $4.00

Zanzibar System for the EuroFx with Joe Ross

1 × $4.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

FX At One Glance - Ichimoku First Glance Video Course

1 × $23.00

FX At One Glance - Ichimoku First Glance Video Course

1 × $23.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Trend Trading: Timing Market Tides with Kedrick Brown

1 × $6.00

Trend Trading: Timing Market Tides with Kedrick Brown

1 × $6.00 -

×

Dynamic Swing Trader-NETPICKS (Unlocked)

1 × $54.00

Dynamic Swing Trader-NETPICKS (Unlocked)

1 × $54.00 -

×

BigTrends Home Study Course

1 × $6.00

BigTrends Home Study Course

1 × $6.00 -

×

ZipTraderU 2023 with ZipTrader

1 × $5.00

ZipTraderU 2023 with ZipTrader

1 × $5.00 -

×

Essentials Home Study Kit with J.L.Lord - Random Walk Trading

1 × $23.00

Essentials Home Study Kit with J.L.Lord - Random Walk Trading

1 × $23.00 -

×

LT Gamma Confirmation

1 × $23.00

LT Gamma Confirmation

1 × $23.00 -

×

The Ed Ponsi Forex Playbook: Strategies and Trade Set-Ups with Ed Ponsi

1 × $6.00

The Ed Ponsi Forex Playbook: Strategies and Trade Set-Ups with Ed Ponsi

1 × $6.00 -

×

Futures & Options 101 with Talkin Options

1 × $8.00

Futures & Options 101 with Talkin Options

1 × $8.00 -

×

Top 20 SP500 Trading Strategies Course with Larry Connors

1 × $23.00

Top 20 SP500 Trading Strategies Course with Larry Connors

1 × $23.00 -

×

Tunnel Trading Course (No Software) with Joshua Martinez

1 × $101.00

Tunnel Trading Course (No Software) with Joshua Martinez

1 × $101.00 -

×

Ultimate Gann Course Coaching Online Classroom 2009 with David Bowden & Aaron Lynch

1 × $23.00

Ultimate Gann Course Coaching Online Classroom 2009 with David Bowden & Aaron Lynch

1 × $23.00 -

×

Short-Term Traders’ Secrets. Candlesticks, Gaps & Breakout Patterns Revealed with Steve Nison & Ken Calhoun

1 × $6.00

Short-Term Traders’ Secrets. Candlesticks, Gaps & Breakout Patterns Revealed with Steve Nison & Ken Calhoun

1 × $6.00 -

×

How to Collect Income Being Short with Don Kaufman

1 × $6.00

How to Collect Income Being Short with Don Kaufman

1 × $6.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

The Art Of Adaptive Trading Using Market Profile & Market Delta

1 × $23.00

The Art Of Adaptive Trading Using Market Profile & Market Delta

1 × $23.00 -

×

The Winning Watch-List with Ryan Mallory

1 × $31.00

The Winning Watch-List with Ryan Mallory

1 × $31.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

Meeting of the Minds (Video ) with Larry Connors

1 × $6.00

Meeting of the Minds (Video ) with Larry Connors

1 × $6.00 -

×

Forever in Profit

1 × $31.00

Forever in Profit

1 × $31.00 -

×

Random Walk Trading Options Professional

1 × $31.00

Random Walk Trading Options Professional

1 × $31.00 -

×

Trading with Fibonacci and Market Structure - Price Action Volume Trader

1 × $23.00

Trading with Fibonacci and Market Structure - Price Action Volume Trader

1 × $23.00 -

×

Wall Street Training

1 × $6.00

Wall Street Training

1 × $6.00 -

×

The PB Code Masterclass - Stock Options Trading Course with Ryan Coisson

1 × $5.00

The PB Code Masterclass - Stock Options Trading Course with Ryan Coisson

1 × $5.00 -

×

Weekly Diagonal Spreads for Consistent Income By Doc Severson

1 × $6.00

Weekly Diagonal Spreads for Consistent Income By Doc Severson

1 × $6.00 -

×

Dow Jones Secret. Never Lose a Trade with Karl Dittmann

1 × $6.00

Dow Jones Secret. Never Lose a Trade with Karl Dittmann

1 × $6.00 -

×

MTI - Scalping Course

1 × $15.00

MTI - Scalping Course

1 × $15.00 -

×

European Fixed Income Markets with Jonathan Batten

1 × $6.00

European Fixed Income Markets with Jonathan Batten

1 × $6.00 -

×

Bollinger Bands Trading Strategies That Work

1 × $6.00

Bollinger Bands Trading Strategies That Work

1 × $6.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Astro View Horse Racing Show

1 × $6.00

Astro View Horse Racing Show

1 × $6.00 -

×

With LIVE Examples of Forex Trading

1 × $6.00

With LIVE Examples of Forex Trading

1 × $6.00 -

×

Ultra Blue Forex 2024 with Russ Horn

1 × $17.00

Ultra Blue Forex 2024 with Russ Horn

1 × $17.00 -

×

Tape Reading Small Caps with Jtrader

1 × $23.00

Tape Reading Small Caps with Jtrader

1 × $23.00 -

×

Activedaytrader - Bond Trading Bootcamp

1 × $8.00

Activedaytrader - Bond Trading Bootcamp

1 × $8.00 -

×

Understanding Wall Street (4th Ed.) with Jeffrey Little

1 × $6.00

Understanding Wall Street (4th Ed.) with Jeffrey Little

1 × $6.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

Math for the Trades with LearningExpress

1 × $6.00

Math for the Trades with LearningExpress

1 × $6.00 -

×

The Secret of Selecting Stocks for Immediate and Substantial Gains with Larry Williams

1 × $6.00

The Secret of Selecting Stocks for Immediate and Substantial Gains with Larry Williams

1 × $6.00

Short-Term Trading, Long-Term Profits with John Leizman – McGraw-Hill

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Short-Term Trading, Long-Term Profits with John Leizman – McGraw-Hill” below:

Short-Term Trading, Long-Term Profits with John Leizman – McGraw-Hill

Navigating the stock market can be a daunting task, but John Leizman’s book, “Short-Term Trading, Long-Term Profits,” published by McGraw-Hill, offers a comprehensive guide to mastering this art. This article delves into the key strategies and concepts presented by Leizman, providing insights on how to achieve long-term profitability through short-term trading.

Understanding Short-Term Trading

What is Short-Term Trading?

Short-term trading involves buying and selling securities within a brief time frame, typically ranging from a few minutes to several days. This approach aims to capitalize on short-term market movements.

Importance of Short-Term Trading

Short-term trading can generate significant returns in a short period, offering liquidity and flexibility. However, it requires a solid understanding of market dynamics and effective risk management.

Who is John Leizman?

John Leizman’s Background

John Leizman is a seasoned trader and financial expert with years of experience in the stock market. He is renowned for his practical strategies and insightful analysis, making his teachings valuable for both novice and experienced traders.

Contributions to Trading Literature

Leizman has authored several books and articles, providing in-depth knowledge on trading strategies, market analysis, and investment techniques. His work emphasizes the balance between short-term tactics and long-term goals.

Key Concepts in Short-Term Trading

Technical Analysis

Understanding Charts

Technical analysis relies heavily on chart patterns to predict future price movements. Familiarity with candlestick charts, line charts, and bar charts is essential.

Key Indicators

- Moving Averages: Help identify trends by smoothing out price data.

- Relative Strength Index (RSI): Measures the speed and change of price movements.

- MACD (Moving Average Convergence Divergence): Indicates the strength and direction of a trend.

Risk Management

Setting Stop-Loss Orders

Stop-loss orders automatically sell a security when it reaches a certain price, limiting potential losses.

Position Sizing

Determining the size of each trade based on the trader’s risk tolerance and capital ensures manageable risk exposure.

Trading Psychology

Managing Emotions

Emotional control is crucial in trading. Greed and fear can lead to impulsive decisions that undermine trading strategies.

Maintaining Discipline

Sticking to a trading plan and avoiding impulsive trades are key to long-term success.

Strategies for Short-Term Trading

Scalping

What is Scalping?

Scalping involves making numerous trades within a day to profit from small price changes. It requires quick decision-making and execution.

Tips for Successful Scalping

- Use Tight Stop-Losses: Minimize losses by setting tight stop-loss levels.

- Focus on Liquid Markets: High liquidity ensures smoother trade execution.

Day Trading

What is Day Trading?

Day trading involves buying and selling securities within the same trading day, avoiding overnight market risks.

Key Techniques

- Trend Following: Identify and follow market trends.

- Breakout Trading: Trade on significant price movements above or below resistance and support levels.

Swing Trading

What is Swing Trading?

Swing trading aims to capture price swings over several days to weeks. It requires patience and a good understanding of market cycles.

Effective Swing Trading Strategies

- Use Technical Indicators: Utilize tools like moving averages and RSI.

- Identify Support and Resistance Levels: Base your trades on key price levels.

Implementing Leizman’s Strategies

Step-by-Step Guide

Step 1: Develop a Trading Plan

Create a detailed plan outlining your trading strategies, risk management rules, and financial goals.

Step 2: Educate Yourself

Continuously learn about market trends, technical analysis, and trading strategies. Use resources like Leizman’s book and online courses.

Step 3: Practice with a Demo Account

Use a demo account to practice your trading strategies without risking real money. This helps build confidence and refine techniques.

Step 4: Start Small

Begin with small trades to minimize risk. Gradually increase your position size as you gain experience and confidence.

Step 5: Monitor and Adjust

Regularly review your trades and adjust your strategies based on performance and market conditions.

Practical Tips for Success

Stay Informed

Keep up with market news, economic indicators, and geopolitical events that can impact prices.

Use Technology

Leverage trading platforms and tools for real-time data analysis and trade execution.

Maintain Discipline

Stick to your trading plan and avoid making decisions based on emotions or market noise.

Benefits of Short-Term Trading

Liquidity

Short-term trading offers high liquidity, allowing traders to quickly enter and exit positions.

Flexibility

Traders can adapt to changing market conditions and capitalize on short-term opportunities.

Potential for High Returns

With the right strategies and risk management, short-term trading can yield significant profits.

Common Challenges and Solutions

Challenge 1: Market Volatility

Volatility can lead to unpredictable price movements.

Solution: Use Stop-Loss Orders

Implement stop-loss orders to protect against significant losses.

Challenge 2: Emotional Decision-Making

Emotions can cloud judgment and lead to poor trading decisions.

Solution: Practice Emotional Control

Develop techniques to manage stress and maintain discipline.

Conclusion

“Short-Term Trading, Long-Term Profits” by John Leizman provides invaluable insights into achieving sustained profitability through short-term trading strategies. By mastering technical analysis, managing risk, and maintaining discipline, traders can enhance their performance and achieve their financial goals. Continuous learning and disciplined execution are key to success in the dynamic world of trading.

FAQs

1. What is short-term trading?

- Short-term trading involves buying and selling securities within a brief time frame to capitalize on market movements.

2. Who is John Leizman?

- John Leizman is a financial expert and seasoned trader known for his practical trading strategies and insightful analysis.

3. What are some key strategies for short-term trading?

- Key strategies include scalping, day trading, and swing trading, each with specific techniques and risk management practices.

4. How can I manage risk in short-term trading?

- Manage risk by setting stop-loss orders, determining position sizes, and maintaining discipline in your trading plan.

5. What are the benefits of short-term trading?

- Benefits include high liquidity, flexibility, and the potential for significant returns with effective strategies and risk management.

Be the first to review “Short-Term Trading, Long-Term Profits with John Leizman – McGraw-Hill” Cancel reply

You must be logged in to post a review.

Related products

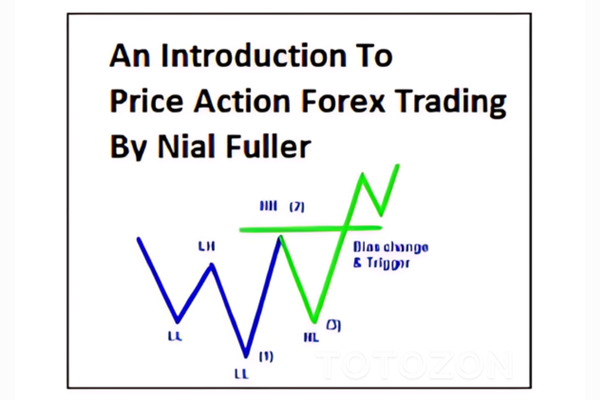

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Reviews

There are no reviews yet.