-

×

KP Trading Room w/ Paladin and JadeCapFX

1 × $5.00

KP Trading Room w/ Paladin and JadeCapFX

1 × $5.00 -

×

How I Turned 500 USD to 6 Figures in 2 months Trading Options with The Money Printers

1 × $8.00

How I Turned 500 USD to 6 Figures in 2 months Trading Options with The Money Printers

1 × $8.00 -

×

The Crypto Code with Joel Peterson - Adam Short

1 × $15.00

The Crypto Code with Joel Peterson - Adam Short

1 × $15.00 -

×

FOREX Master Blueprint 2010 - 1 DVD + Manual with Forexmentor Frank Paul

1 × $6.00

FOREX Master Blueprint 2010 - 1 DVD + Manual with Forexmentor Frank Paul

1 × $6.00 -

×

How to Trade Diagonal Triangles. Superior Risk Reward Trade Setups

1 × $6.00

How to Trade Diagonal Triangles. Superior Risk Reward Trade Setups

1 × $6.00 -

×

How To Become StressFree Trader with Jason Starzec

1 × $4.00

How To Become StressFree Trader with Jason Starzec

1 × $4.00 -

×

Options Trading with Nick & Gareth - Nick Santiago & Gareth Soloway - InTheMoneyStocks

1 × $31.00

Options Trading with Nick & Gareth - Nick Santiago & Gareth Soloway - InTheMoneyStocks

1 × $31.00 -

×

How I Trade the QQQs with Don Miller

1 × $6.00

How I Trade the QQQs with Don Miller

1 × $6.00 -

×

Option Insanity Strategy with PDS Trader

1 × $69.00

Option Insanity Strategy with PDS Trader

1 × $69.00 -

×

AllStreet Investing - Master the Market LEVEL 2 - DAYTRADING

1 × $23.00

AllStreet Investing - Master the Market LEVEL 2 - DAYTRADING

1 × $23.00 -

×

Royal Exchange Forex with Jan Teslar

1 × $6.00

Royal Exchange Forex with Jan Teslar

1 × $6.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

High Powered Investing with Amine Bouchentouf

1 × $6.00

High Powered Investing with Amine Bouchentouf

1 × $6.00 -

×

How Stocks Work with David L.Scott

1 × $6.00

How Stocks Work with David L.Scott

1 × $6.00 -

×

How to Build Fortune. Trading Stock Index Futures with Dennis Minogue

1 × $6.00

How to Build Fortune. Trading Stock Index Futures with Dennis Minogue

1 × $6.00 -

×

High Probability ETF Trading: 7 Professional Strategies To Improve Your ETF Trading with Larry Connors

1 × $6.00

High Probability ETF Trading: 7 Professional Strategies To Improve Your ETF Trading with Larry Connors

1 × $6.00 -

×

Investment Madness with John Nofsinger

1 × $6.00

Investment Madness with John Nofsinger

1 × $6.00 -

×

Keynes & The Market with Justyn Walsh

1 × $6.00

Keynes & The Market with Justyn Walsh

1 × $6.00 -

×

7 Figures Forex Course

1 × $15.00

7 Figures Forex Course

1 × $15.00 -

×

Pairs Trading The Final Frontier with Don Kaufman

1 × $6.00

Pairs Trading The Final Frontier with Don Kaufman

1 × $6.00 -

×

Alternative Assets and Strategic Allocation with John Abbink

1 × $6.00

Alternative Assets and Strategic Allocation with John Abbink

1 × $6.00 -

×

All About Market Timing with Leslie N.Masonson

1 × $6.00

All About Market Timing with Leslie N.Masonson

1 × $6.00 -

×

6 (The Proper BackGround)

1 × $6.00

6 (The Proper BackGround)

1 × $6.00 -

×

An Introduction to Market Risk Measurement with Kevin Dowd

1 × $6.00

An Introduction to Market Risk Measurement with Kevin Dowd

1 × $6.00 -

×

How Do You See Risk? A Guide to Evaluating & Applying Technical Volatility Indicators class with Jeff Bierman

1 × $6.00

How Do You See Risk? A Guide to Evaluating & Applying Technical Volatility Indicators class with Jeff Bierman

1 × $6.00 -

×

The Candlestick Training Series with Timon Weller

1 × $6.00

The Candlestick Training Series with Timon Weller

1 × $6.00 -

×

Alpha Quant Program with Lucas Inglese - Quantreo

1 × $15.00

Alpha Quant Program with Lucas Inglese - Quantreo

1 × $15.00 -

×

The Compleat DayTrader I & II with Jack Bernstein

1 × $6.00

The Compleat DayTrader I & II with Jack Bernstein

1 × $6.00 -

×

Knowing Where the Energy is Coming From with Charles Drummond

1 × $6.00

Knowing Where the Energy is Coming From with Charles Drummond

1 × $6.00 -

×

LARGE CAP MOMENTUM STRATEGY with Nick Radge

1 × $179.00

LARGE CAP MOMENTUM STRATEGY with Nick Radge

1 × $179.00 -

×

Star Traders Forex Intermediate Course I with Karen Foo

1 × $8.00

Star Traders Forex Intermediate Course I with Karen Foo

1 × $8.00 -

×

Option Greeks Class with Don Kaufman

1 × $6.00

Option Greeks Class with Don Kaufman

1 × $6.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

How You Can Be Right While the Crowd Loses with Jack Bernstein

1 × $6.00

How You Can Be Right While the Crowd Loses with Jack Bernstein

1 × $6.00 -

×

HST Mobile

1 × $31.00

HST Mobile

1 × $31.00 -

×

A Comparison of Popular Trading Systems (2nd Ed.) with Lars Kestner

1 × $6.00

A Comparison of Popular Trading Systems (2nd Ed.) with Lars Kestner

1 × $6.00 -

×

Forex Trading Course with Mike Norman

1 × $17.00

Forex Trading Course with Mike Norman

1 × $17.00 -

×

Options Bootcamp with Sid Woolfolk

1 × $6.00

Options Bootcamp with Sid Woolfolk

1 × $6.00 -

×

How I've Achieved Triple-Digit Returns Daytrading: 4 Hours A Day with David Floyd

1 × $6.00

How I've Achieved Triple-Digit Returns Daytrading: 4 Hours A Day with David Floyd

1 × $6.00 -

×

All Access Online Trading Course with Steve Luke

1 × $6.00

All Access Online Trading Course with Steve Luke

1 × $6.00 -

×

A Complete Beginner to Advanced Trading Mentorship Program with Habby Forex Trading Academy

1 × $5.00

A Complete Beginner to Advanced Trading Mentorship Program with Habby Forex Trading Academy

1 × $5.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

All Candlestick Patterns Tested And Ranked with Quantified Strategies

1 × $8.00

All Candlestick Patterns Tested And Ranked with Quantified Strategies

1 × $8.00 -

×

Options 201: Vertical and Calendar Spread Essentials 5 Part Class with Don Kaufman On Demand Replay

1 × $6.00

Options 201: Vertical and Calendar Spread Essentials 5 Part Class with Don Kaufman On Demand Replay

1 × $6.00 -

×

Contrarian Investment Strategies: The Next Generation with David Dreman

1 × $4.00

Contrarian Investment Strategies: The Next Generation with David Dreman

1 × $4.00 -

×

3_8’s to Wealth (Audio 84 MB+ WorkBooks) with Darlene Nelson

1 × $6.00

3_8’s to Wealth (Audio 84 MB+ WorkBooks) with Darlene Nelson

1 × $6.00 -

×

3 Volatility Strategies with Quantified Strategies

1 × $23.00

3 Volatility Strategies with Quantified Strategies

1 × $23.00 -

×

An Introduction to Capital Markets with Andrew M.Chisholm

1 × $6.00

An Introduction to Capital Markets with Andrew M.Chisholm

1 × $6.00 -

×

30 Day Masterclass with Joe Elite Trader Hub ICT

1 × $6.00

30 Day Masterclass with Joe Elite Trader Hub ICT

1 × $6.00 -

×

RSI Unleashed: Building a Comprehensive Trading Framework By Doc Severson

1 × $6.00

RSI Unleashed: Building a Comprehensive Trading Framework By Doc Severson

1 × $6.00 -

×

An Ultimate Guide to Successful Investing with Trading Tuitions

1 × $23.00

An Ultimate Guide to Successful Investing with Trading Tuitions

1 × $23.00 -

×

The Delphi Scalper 4 - Video + Metatrader Indicators with Jason Fielder

1 × $6.00

The Delphi Scalper 4 - Video + Metatrader Indicators with Jason Fielder

1 × $6.00 -

×

Options Trading. The Hidden Reality Course with Charles Cottle

1 × $6.00

Options Trading. The Hidden Reality Course with Charles Cottle

1 × $6.00 -

×

Supply And Demand Zone Trading Course with Trading180

1 × $5.00

Supply And Demand Zone Trading Course with Trading180

1 × $5.00 -

×

Altucher’s Top 1% Advisory Newsletter 2016 with James Altucher

1 × $6.00

Altucher’s Top 1% Advisory Newsletter 2016 with James Altucher

1 × $6.00 -

×

The Master Trader Bundle with Gareth Soloway

1 × $39.00

The Master Trader Bundle with Gareth Soloway

1 × $39.00 -

×

How Do You Read Charts? A Guide to Classic Price Pattern Recognition Class with Professor Jeff Bierman

1 × $6.00

How Do You Read Charts? A Guide to Classic Price Pattern Recognition Class with Professor Jeff Bierman

1 × $6.00 -

×

4 Strategies That Will Make You a Professional Day Trader with Jerremy Newsome

1 × $6.00

4 Strategies That Will Make You a Professional Day Trader with Jerremy Newsome

1 × $6.00 -

×

3 Swing Trading Examples, With Charts, Instructions, And Definitions To Get You Started by Alan Farley

1 × $6.00

3 Swing Trading Examples, With Charts, Instructions, And Definitions To Get You Started by Alan Farley

1 × $6.00 -

×

S&P 500 Secrets + Next Level Risk Management with Tradacc

1 × $8.00

S&P 500 Secrets + Next Level Risk Management with Tradacc

1 × $8.00 -

×

3-Line Break Method For Daytrading Eminis with Chris Curran

1 × $6.00

3-Line Break Method For Daytrading Eminis with Chris Curran

1 × $6.00 -

×

3 Day WorkShop with HYDRA

1 × $13.00

3 Day WorkShop with HYDRA

1 × $13.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Russell Futures Scalping Course with Bill McDowell

1 × $6.00

Russell Futures Scalping Course with Bill McDowell

1 × $6.00 -

×

Secrets to Picking Small Cap Winners with Gareth Soloway - InTheMoneyStocks

1 × $116.00

Secrets to Picking Small Cap Winners with Gareth Soloway - InTheMoneyStocks

1 × $116.00 -

×

2 Day Personal Training Course (Seminar Package) with Martin Pring

1 × $6.00

2 Day Personal Training Course (Seminar Package) with Martin Pring

1 × $6.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

101 Option Trading Secrets with Kenneth Trester

1 × $6.00

101 Option Trading Secrets with Kenneth Trester

1 × $6.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

12 Strategies for Picking Tops & Bottoms

1 × $23.00

12 Strategies for Picking Tops & Bottoms

1 × $23.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

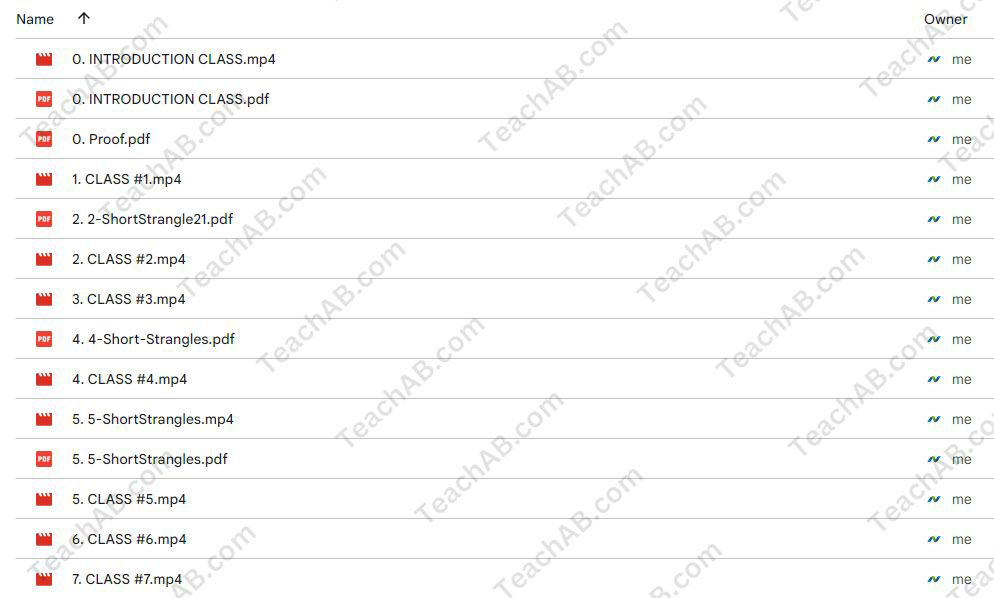

Monthly Income with Short Strangles, Dan’s Way – Dan Sheridan – Sheridan Options Mentoring

$297.00 Original price was: $297.00.$69.00Current price is: $69.00.

File Size: 4.22 GB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Monthly Income with Short Strangles, Dan’s Way – Dan Sheridan – Sheridan Options Mentoring” below:

Monthly Income with Short Strangles, Dan’s Way – Dan Sheridan – Sheridan Options Mentoring

Introduction

Generating consistent monthly income through options trading is an art that Dan Sheridan of Sheridan Options Mentoring has mastered. One of his preferred strategies is the short strangle, which allows traders to capitalize on market stability or mild fluctuation. This article explores how Dan Sheridan approaches short strangles to generate regular income.

Who is Dan Sheridan?

Dan Sheridan is the founder of Sheridan Options Mentoring and a veteran options trader with over 30 years of experience. His expertise lies in crafting strategies that help traders achieve steady returns while managing risk effectively.

Understanding Short Strangles

Before diving into Dan’s specific approach, it’s essential to grasp the basics of the short strangle strategy.

What is a Short Strangle?

A short strangle involves selling an out-of-the-money (OTM) put and an out-of-the-money (OTM) call with the same expiration date. This strategy profits from limited price movement in the underlying asset.

Benefits of Trading Short Strangles

The primary advantage of a short strangle is its ability to generate profit from theta decay or time decay, as long as the underlying asset stays within a specific price range.

Setting Up a Short Strangle the Dan Sheridan Way

Dan Sheridan’s approach to setting up short strangles involves several key steps to maximize effectiveness and safety.

Choosing the Right Underlying Assets

Learn how Dan selects stocks or indexes that exhibit the ideal volatility and liquidity for this strategy.

Determining Strike Prices

Insight into how Dan chooses strike prices that balance risk and return, maximizing the probability of profit.

Risk Management Techniques

Managing risk is crucial in options trading, especially when employing strategies like short strangles.

Adjustment Strategies

Dan Sheridan emphasizes the importance of knowing when and how to adjust an open strangle to manage risk or lock in profits.

Using Stop Losses

How Dan incorporates stop losses into his trading plan to protect against unforeseen market moves.

Optimizing the Trade

To make the most out of a short strangle strategy, Dan Sheridan recommends several optimization techniques.

Timing the Market

Understanding the best times to enter and exit trades based on market cycles and event-driven volatility.

Selecting Expiration Dates

How choosing the right expiration dates can significantly impact the success of the short strangle strategy.

Tools and Software for Trading Short Strangles

Discover the tools and software that Dan Sheridan recommends for efficiently managing and monitoring short strangles.

Recommended Trading Platforms

Overview of the best trading platforms that offer the necessary tools for setting up and adjusting short strangles.

Analytical Tools Needed

Specific analytical tools that can help traders make informed decisions about their short strangle trades.

Learning from Dan Sheridan

Dan Sheridan’s teaching methodology combines theoretical knowledge with practical insights.

Educational Programs and Workshops

Explore the variety of educational programs and workshops offered by Sheridan Options Mentoring that focus on short strangles and other options strategies.

One-on-One Coaching Sessions

The benefits of personalized coaching sessions with Dan Sheridan, which are tailored to individual trader needs and experience levels.

Community and Support

Being part of a trading community can provide significant benefits, from shared knowledge to emotional support.

Joining the Sheridan Community

How traders can join the Sheridan Options Mentoring community to gain access to forums, discussions, and group coaching sessions.

Success Stories

Hear from traders who have successfully implemented Dan Sheridan’s short strangle strategies to generate consistent monthly income.

Testimonials from Real Traders

Sharing success stories and testimonials from traders who have benefited from Dan Sheridan’s mentoring and strategies.

Conclusion

Trading short strangles the Dan Sheridan way offers a practical and strategic approach to generating monthly income through options trading. By understanding the nuances of this strategy and adhering to a disciplined trading plan, traders can achieve both stability and profitability in their trading careers.

FAQs

- Is the short strangle strategy suitable for beginners?

- While potentially profitable, short strangles require a solid understanding of options trading, making them more suitable for intermediate to advanced traders.

- What is the potential risk of trading short strangles?

- The risk involves significant losses if the underlying asset moves dramatically beyond the strike prices of the options sold.

- How much capital is needed to start trading short strangles?

- It varies based on the underlying asset and market conditions, but traders should have enough capital to cover potential margin requirements and losses.

- Can short strangles be automated?

- While some aspects can be automated, successful short strangle trading often requires manual adjustments based on market conditions.

- How can I start learning with Dan Sheridan?

- Visit the Sheridan Options Mentoring website to explore courses, sign up for webinars, or register for personal coaching.

Be the first to review “Monthly Income with Short Strangles, Dan’s Way – Dan Sheridan – Sheridan Options Mentoring” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.