-

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

Forex and Stocks Trading Course - Set and Forget with Alfonso Moreno

1 × $6.00

Forex and Stocks Trading Course - Set and Forget with Alfonso Moreno

1 × $6.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Monthly Income with Short Strangles, Dan’s Way – Dan Sheridan – Sheridan Options Mentoring

$297.00 Original price was: $297.00.$69.00Current price is: $69.00.

File Size: 4.22 GB

Delivery Time: 1–12 hours

Media Type: Online Course

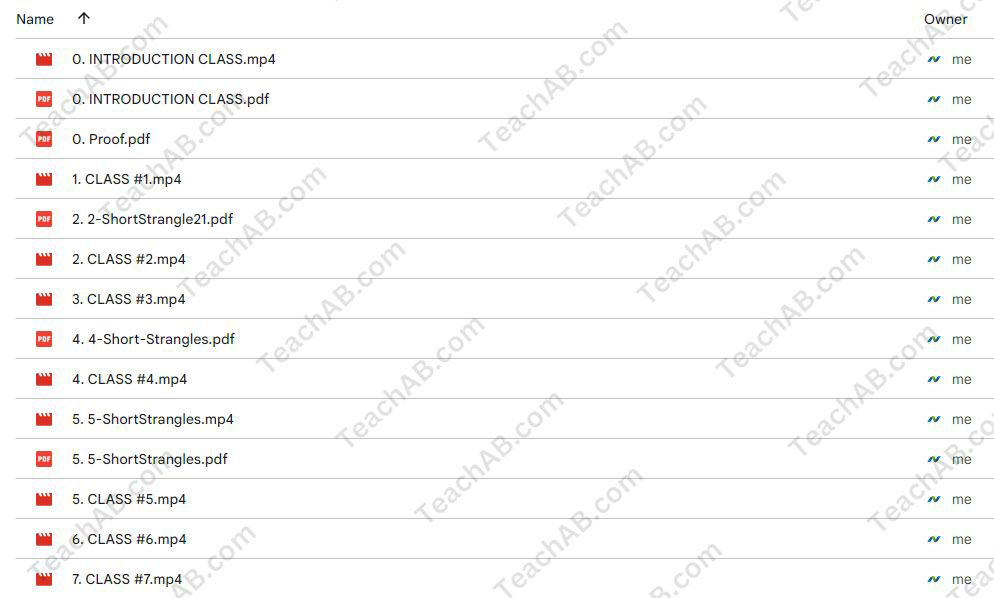

Content Proof: Watch Here!

You may check content proof of “Monthly Income with Short Strangles, Dan’s Way – Dan Sheridan – Sheridan Options Mentoring” below:

Monthly Income with Short Strangles, Dan’s Way – Dan Sheridan – Sheridan Options Mentoring

Introduction

Generating consistent monthly income through options trading is an art that Dan Sheridan of Sheridan Options Mentoring has mastered. One of his preferred strategies is the short strangle, which allows traders to capitalize on market stability or mild fluctuation. This article explores how Dan Sheridan approaches short strangles to generate regular income.

Who is Dan Sheridan?

Dan Sheridan is the founder of Sheridan Options Mentoring and a veteran options trader with over 30 years of experience. His expertise lies in crafting strategies that help traders achieve steady returns while managing risk effectively.

Understanding Short Strangles

Before diving into Dan’s specific approach, it’s essential to grasp the basics of the short strangle strategy.

What is a Short Strangle?

A short strangle involves selling an out-of-the-money (OTM) put and an out-of-the-money (OTM) call with the same expiration date. This strategy profits from limited price movement in the underlying asset.

Benefits of Trading Short Strangles

The primary advantage of a short strangle is its ability to generate profit from theta decay or time decay, as long as the underlying asset stays within a specific price range.

Setting Up a Short Strangle the Dan Sheridan Way

Dan Sheridan’s approach to setting up short strangles involves several key steps to maximize effectiveness and safety.

Choosing the Right Underlying Assets

Learn how Dan selects stocks or indexes that exhibit the ideal volatility and liquidity for this strategy.

Determining Strike Prices

Insight into how Dan chooses strike prices that balance risk and return, maximizing the probability of profit.

Risk Management Techniques

Managing risk is crucial in options trading, especially when employing strategies like short strangles.

Adjustment Strategies

Dan Sheridan emphasizes the importance of knowing when and how to adjust an open strangle to manage risk or lock in profits.

Using Stop Losses

How Dan incorporates stop losses into his trading plan to protect against unforeseen market moves.

Optimizing the Trade

To make the most out of a short strangle strategy, Dan Sheridan recommends several optimization techniques.

Timing the Market

Understanding the best times to enter and exit trades based on market cycles and event-driven volatility.

Selecting Expiration Dates

How choosing the right expiration dates can significantly impact the success of the short strangle strategy.

Tools and Software for Trading Short Strangles

Discover the tools and software that Dan Sheridan recommends for efficiently managing and monitoring short strangles.

Recommended Trading Platforms

Overview of the best trading platforms that offer the necessary tools for setting up and adjusting short strangles.

Analytical Tools Needed

Specific analytical tools that can help traders make informed decisions about their short strangle trades.

Learning from Dan Sheridan

Dan Sheridan’s teaching methodology combines theoretical knowledge with practical insights.

Educational Programs and Workshops

Explore the variety of educational programs and workshops offered by Sheridan Options Mentoring that focus on short strangles and other options strategies.

One-on-One Coaching Sessions

The benefits of personalized coaching sessions with Dan Sheridan, which are tailored to individual trader needs and experience levels.

Community and Support

Being part of a trading community can provide significant benefits, from shared knowledge to emotional support.

Joining the Sheridan Community

How traders can join the Sheridan Options Mentoring community to gain access to forums, discussions, and group coaching sessions.

Success Stories

Hear from traders who have successfully implemented Dan Sheridan’s short strangle strategies to generate consistent monthly income.

Testimonials from Real Traders

Sharing success stories and testimonials from traders who have benefited from Dan Sheridan’s mentoring and strategies.

Conclusion

Trading short strangles the Dan Sheridan way offers a practical and strategic approach to generating monthly income through options trading. By understanding the nuances of this strategy and adhering to a disciplined trading plan, traders can achieve both stability and profitability in their trading careers.

FAQs

- Is the short strangle strategy suitable for beginners?

- While potentially profitable, short strangles require a solid understanding of options trading, making them more suitable for intermediate to advanced traders.

- What is the potential risk of trading short strangles?

- The risk involves significant losses if the underlying asset moves dramatically beyond the strike prices of the options sold.

- How much capital is needed to start trading short strangles?

- It varies based on the underlying asset and market conditions, but traders should have enough capital to cover potential margin requirements and losses.

- Can short strangles be automated?

- While some aspects can be automated, successful short strangle trading often requires manual adjustments based on market conditions.

- How can I start learning with Dan Sheridan?

- Visit the Sheridan Options Mentoring website to explore courses, sign up for webinars, or register for personal coaching.

Be the first to review “Monthly Income with Short Strangles, Dan’s Way – Dan Sheridan – Sheridan Options Mentoring” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.