-

×

Master Stock Course

1 × $6.00

Master Stock Course

1 × $6.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Market Profile Video with FutexLive

1 × $6.00

Market Profile Video with FutexLive

1 × $6.00 -

×

From Walden to Wall Street: Frontiers of Conservation Finance with James Levitt

1 × $6.00

From Walden to Wall Street: Frontiers of Conservation Finance with James Levitt

1 × $6.00 -

×

Investment Strategies for the 21th Century with Frank Amstrong

1 × $6.00

Investment Strategies for the 21th Century with Frank Amstrong

1 × $6.00 -

×

Elite Gap Trading with Nick Santiago - InTheMoneyStocks

1 × $93.00

Elite Gap Trading with Nick Santiago - InTheMoneyStocks

1 × $93.00 -

×

A Course in Trading with Donald Mack & Wetsel Market Bureau

1 × $6.00

A Course in Trading with Donald Mack & Wetsel Market Bureau

1 × $6.00 -

×

How To Become StressFree Trader with Jason Starzec

1 × $4.00

How To Become StressFree Trader with Jason Starzec

1 × $4.00 -

×

Option Greeks Class with Don Kaufman

1 × $6.00

Option Greeks Class with Don Kaufman

1 × $6.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Volume Profile 2023 (Elite Pack) with Trader Dale

1 × $5.00

Volume Profile 2023 (Elite Pack) with Trader Dale

1 × $5.00 -

×

How Stocks Work with David L.Scott

1 × $6.00

How Stocks Work with David L.Scott

1 × $6.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Profitable Binary Options Strategies

1 × $5.00

Profitable Binary Options Strategies

1 × $5.00 -

×

3 Day Master Advanced Workshop Seminar (Video & Manuals 8.48 GB)

1 × $6.00

3 Day Master Advanced Workshop Seminar (Video & Manuals 8.48 GB)

1 × $6.00 -

×

Volume Profile 2023 (Order Flow Pack) with Trader Dale

1 × $5.00

Volume Profile 2023 (Order Flow Pack) with Trader Dale

1 × $5.00 -

×

Profitable Strategies with Gemify Academy

1 × $10.00

Profitable Strategies with Gemify Academy

1 × $10.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

Cash Flow Investing Course

1 × $20.00

Cash Flow Investing Course

1 × $20.00 -

×

Staying Alive in the Markets (Video & Manual) with Mark Cook

1 × $6.00

Staying Alive in the Markets (Video & Manual) with Mark Cook

1 × $6.00 -

×

The Day Trader: From the Pit to the PC with Lewis Borsellino

1 × $6.00

The Day Trader: From the Pit to the PC with Lewis Borsellino

1 × $6.00 -

×

A Comprehensive Guide to Intraday Trading Strategies & Setups Class with Jeff Bierman

1 × $6.00

A Comprehensive Guide to Intraday Trading Strategies & Setups Class with Jeff Bierman

1 × $6.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

4×4 Course with Gregoire Dupont

1 × $6.00

4×4 Course with Gregoire Dupont

1 × $6.00 -

×

Five Trading Trends of 2005 with Dan Denning

1 × $6.00

Five Trading Trends of 2005 with Dan Denning

1 × $6.00 -

×

Quantitative Trading: How to Build Your Own Algorithmic Trading Business (1st Edition) with Ernest Chan

1 × $6.00

Quantitative Trading: How to Build Your Own Algorithmic Trading Business (1st Edition) with Ernest Chan

1 × $6.00 -

×

Active Beta Indexes with Khalid Ghayur

1 × $6.00

Active Beta Indexes with Khalid Ghayur

1 × $6.00 -

×

Trading Options Effectively with Paul Forchione

1 × $4.00

Trading Options Effectively with Paul Forchione

1 × $4.00 -

×

Master Class Recording 2019 with Oil Trading Academy

1 × $17.00

Master Class Recording 2019 with Oil Trading Academy

1 × $17.00 -

×

A Really Friendly Guide to Wavelets with C.Vallens

1 × $6.00

A Really Friendly Guide to Wavelets with C.Vallens

1 × $6.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00

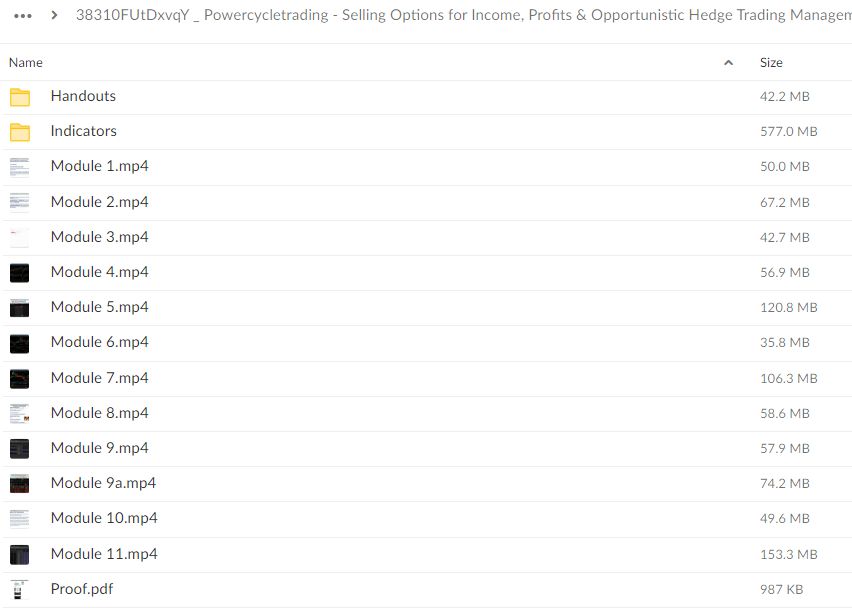

Selling Options for Income, Profits & Opportunistic Hedge Trading Management with Powercycletrading

$497.00 Original price was: $497.00.$69.00Current price is: $69.00.

File Size: 1.46 GB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Selling Options for Income, Profits & Opportunistic Hedge Trading Management with Powercycletrading ” below:

Unlocking the Potential of Selling Options: A Comprehensive Guide

In the dynamic world of options trading, selling options can be a powerful strategy for generating income, capturing profits, and managing risk. At Powercycletrading, we believe in empowering traders with the knowledge and tools they need to succeed in the options market. In this guide, we’ll explore the ins and outs of selling options for income, profits, and opportunistic hedge trading management.

Understanding Selling Options

What Does it Mean to Sell Options?

- Selling options involves taking on an obligation to buy or sell an underlying asset at a predetermined price within a specified time frame.

Why Sell Options?

- Selling options can be a lucrative strategy, allowing traders to collect premiums and potentially profit from time decay and decreases in volatility.

Income Generation Strategies

1. Covered Call Writing

- Covered call writing involves selling call options against a stock position that you already own. It’s a popular strategy for generating income in neutral to slightly bullish markets.

2. Cash-Secured Put Selling

- Cash-secured put selling involves selling put options against cash reserves to potentially acquire a stock at a lower price or generate income if the option expires worthless.

Profit-Capturing Strategies

1. Vertical Credit Spreads

- Vertical credit spreads involve simultaneously selling and buying options of the same type (either calls or puts) with different strike prices, aiming to profit from the narrowing of the spread.

2. Iron Condors

- Iron condors are a type of neutral options strategy that involves selling both a call spread and a put spread with the same expiration date but different strike prices, profiting from low volatility and range-bound markets.

Hedge Trading Management

1. Protective Put Strategy

- The protective put strategy involves buying put options to protect a long stock position from potential downside risk, acting as a form of insurance.

2. Collar Strategy

- The collar strategy involves simultaneously buying protective puts and selling covered calls against a long stock position, providing downside protection while capping potential gains.

Conclusion

Selling options can be a valuable addition to any trader’s arsenal, offering a range of strategies for income generation, profit capture, and risk management. With the guidance and expertise of Powercycletrading, traders can unlock the full potential of selling options in their trading portfolios.

FAQs

1. Is selling options riskier than buying options?

While selling options involves taking on obligations and potential unlimited risk, it can also be a more conservative strategy when used correctly with proper risk management.

2. Can selling options be profitable in all market conditions?

Yes, selling options can be profitable in various market conditions, including bullish, bearish, and neutral markets, depending on the strategy employed.

3. How much capital do I need to start selling options?

The capital requirements for selling options vary depending on the specific strategy and the underlying asset. It’s essential to assess your risk tolerance and financial situation before engaging in options selling.

4. What are the potential risks of selling options?

The main risks of selling options include unlimited potential losses (in the case of naked options) and the obligation to buy or sell the underlying asset at the agreed-upon price.

5. How can I learn more about selling options strategies?

Powercycletrading offers comprehensive educational resources, including courses, webinars, and coaching sessions, to help traders master the art of selling options.

Be the first to review “Selling Options for Income, Profits & Opportunistic Hedge Trading Management with Powercycletrading” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.