-

×

S&P 500 Secrets + Next Level Risk Management with Tradacc

1 × $8.00

S&P 500 Secrets + Next Level Risk Management with Tradacc

1 × $8.00 -

×

Frank Paul – Fibonacci Swing Trader Foundation Course 2011 (Video, Manuals, 5.1 GB) with Forexmentor

1 × $6.00

Frank Paul – Fibonacci Swing Trader Foundation Course 2011 (Video, Manuals, 5.1 GB) with Forexmentor

1 × $6.00 -

×

Daytraders Bulletin – Recurrent Structures for Profit with Charles Holt

1 × $6.00

Daytraders Bulletin – Recurrent Structures for Profit with Charles Holt

1 × $6.00 -

×

Forty Cents for Financial Freedom with Darlene Nelson

1 × $6.00

Forty Cents for Financial Freedom with Darlene Nelson

1 × $6.00 -

×

Amibroker CBT Intensive Course with Matt Radtke

1 × $31.00

Amibroker CBT Intensive Course with Matt Radtke

1 × $31.00 -

×

Equities Markets Certification (EMC©) with Eric Cheung - Wall Street Prep

1 × $46.00

Equities Markets Certification (EMC©) with Eric Cheung - Wall Street Prep

1 × $46.00 -

×

Smart Money Trading Course with Prosperity Academy

1 × $5.00

Smart Money Trading Course with Prosperity Academy

1 × $5.00 -

×

The Trader's Mindset Course with Chris Mathews

1 × $6.00

The Trader's Mindset Course with Chris Mathews

1 × $6.00 -

×

Gap Trading for Stock and Options Traders with Damon Verial

1 × $6.00

Gap Trading for Stock and Options Traders with Damon Verial

1 × $6.00 -

×

Currency Strategy with Callum Henderson

1 × $6.00

Currency Strategy with Callum Henderson

1 × $6.00 -

×

Handbook on the Knowledge Economy with David Rooney

1 × $6.00

Handbook on the Knowledge Economy with David Rooney

1 × $6.00 -

×

Trading Forex With Market Profile

1 × $15.00

Trading Forex With Market Profile

1 × $15.00 -

×

Forex Trading Made Ez with G.C.Smith

1 × $6.00

Forex Trading Made Ez with G.C.Smith

1 × $6.00 -

×

Trade What You See How To Profit from Pattern Recognition with Larry Pesavento & Leslie Jouflas

1 × $6.00

Trade What You See How To Profit from Pattern Recognition with Larry Pesavento & Leslie Jouflas

1 × $6.00 -

×

FXS Analytics Training and Q&A Access with FXS Analytics

1 × $6.00

FXS Analytics Training and Q&A Access with FXS Analytics

1 × $6.00 -

×

Successful Stock Speculation (1922) with John James

1 × $6.00

Successful Stock Speculation (1922) with John James

1 × $6.00 -

×

Super Structure Trading Home Study Course

1 × $23.00

Super Structure Trading Home Study Course

1 × $23.00 -

×

Capital On Demand Masterclass with Attorney & Nate Dodson

1 × $311.00

Capital On Demand Masterclass with Attorney & Nate Dodson

1 × $311.00 -

×

Fibsdontlie - Fibs Don’t Lie Advanced Course

1 × $15.00

Fibsdontlie - Fibs Don’t Lie Advanced Course

1 × $15.00 -

×

FX Savages Courses Collection

1 × $7.00

FX Savages Courses Collection

1 × $7.00 -

×

Confessions of a Pit Trader 2003 with Rick Burgess

1 × $6.00

Confessions of a Pit Trader 2003 with Rick Burgess

1 × $6.00 -

×

Preparing for the Worst: Incorporating Downside Risk in Stock Market Investments with Hrishikesh Vinod & Derrick Reagle

1 × $6.00

Preparing for the Worst: Incorporating Downside Risk in Stock Market Investments with Hrishikesh Vinod & Derrick Reagle

1 × $6.00 -

×

YouAreTheIndicator Online Course 1.0

1 × $6.00

YouAreTheIndicator Online Course 1.0

1 × $6.00 -

×

Trading Non-Farm Payroll Report

1 × $6.00

Trading Non-Farm Payroll Report

1 × $6.00 -

×

Earnings Reaction Gaps Workshop with John Pocorobba

1 × $27.00

Earnings Reaction Gaps Workshop with John Pocorobba

1 × $27.00 -

×

Strategic Swing Trader with Sami Abusaad

1 × $6.00

Strategic Swing Trader with Sami Abusaad

1 × $6.00 -

×

Short Term Trading. Integrated Pithfork Analysis with Dr. Mircea Dologa

1 × $6.00

Short Term Trading. Integrated Pithfork Analysis with Dr. Mircea Dologa

1 × $6.00 -

×

How to Trade Forex & Cryptocurrency with Bitraged

1 × $5.00

How to Trade Forex & Cryptocurrency with Bitraged

1 × $5.00 -

×

The Gold Standard in Trading Education with Six Figure Capital

1 × $5.00

The Gold Standard in Trading Education with Six Figure Capital

1 × $5.00 -

×

High Yield Investments I & II with Lance Spicer

1 × $6.00

High Yield Investments I & II with Lance Spicer

1 × $6.00 -

×

Option Strategies with Courtney Smith

1 × $6.00

Option Strategies with Courtney Smith

1 × $6.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

Profits in the Stock Market with Harold Gartley

1 × $6.00

Profits in the Stock Market with Harold Gartley

1 × $6.00 -

×

Short-Term Trading with Precision Timing - Jack Bernstein

1 × $6.00

Short-Term Trading with Precision Timing - Jack Bernstein

1 × $6.00 -

×

Euro Trading Course with Bkforex

1 × $6.00

Euro Trading Course with Bkforex

1 × $6.00 -

×

Consistent Small Account Growth Formula with Matt Williamson

1 × $6.00

Consistent Small Account Growth Formula with Matt Williamson

1 × $6.00 -

×

Currency Trading for Dummies with Mark Galant

1 × $6.00

Currency Trading for Dummies with Mark Galant

1 × $6.00 -

×

The Handbook of Alternative Investments with Darrell R.Jobman

1 × $6.00

The Handbook of Alternative Investments with Darrell R.Jobman

1 × $6.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Simple Methods for Detecting Buying and Selling Points in Securities with James Liveright

1 × $6.00

Simple Methods for Detecting Buying and Selling Points in Securities with James Liveright

1 × $6.00 -

×

Developing the Psychological Trader’s Edge with Robin Dayne

1 × $6.00

Developing the Psychological Trader’s Edge with Robin Dayne

1 × $6.00 -

×

The HV7 Option Trading System with Amy Meissner – Aeromir

1 × $8.00

The HV7 Option Trading System with Amy Meissner – Aeromir

1 × $8.00 -

×

The Introduction to the Magee System of Technical Analysis CD with John Magee

1 × $6.00

The Introduction to the Magee System of Technical Analysis CD with John Magee

1 × $6.00 -

×

Cryptocurrency Investment Course 2021 Fund your Retirement with Suppoman

1 × $5.00

Cryptocurrency Investment Course 2021 Fund your Retirement with Suppoman

1 × $5.00 -

×

Cracking The Forex Code with Kevin Adams

1 × $6.00

Cracking The Forex Code with Kevin Adams

1 × $6.00 -

×

Tornado Trend Trading System with John Bartlett

1 × $6.00

Tornado Trend Trading System with John Bartlett

1 × $6.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $179.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $179.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00

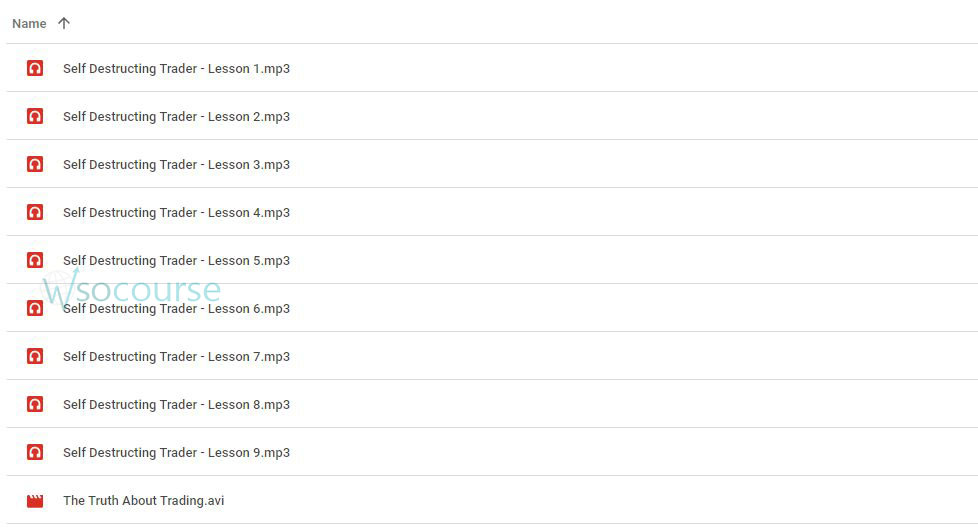

Self-Destructing Trader with Ryan Jonesc

$6.00

File Size: Cooming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Self-Destructing Trader with Ryan Jonesc” below:

Self-Destructing Trader with Ryan Jonesc

In today’s fast-paced trading world, the term “self-destructing trader” might sound more like a dramatic movie title than a reality. However, it is a significant concept that every trader, novice or seasoned, should be aware of. We will dive deep into what it means to be a self-destructing trader and how, with guidance from experts like Ryan Jonesc, you can avoid falling into this risky category.

What is a Self-Destructing Trader?

A self-destructing trader is someone who, despite having the tools and knowledge, ends up making decisions that adversely affect their trading performance. This typically stems from poor risk management, emotional decision-making, and a lack of consistent strategy.

Understanding the Psychological Traps

- Emotional Trading: Often, traders let emotions, like fear and greed, drive their decisions.

- Overconfidence: After a few successes, some traders become overconfident, leading to risky behaviors.

- Lack of Adaptability: The inability to adapt to changing markets can spell disaster for a trader.

The Role of Strategy in Avoiding Self-Destruction

Without a solid strategy, traders often find themselves reacting impulsively to market volatility. A well-defined strategy helps maintain focus and discipline, crucial for long-term success.

Developing a Resilient Trading Plan

Creating a resilient trading plan involves understanding the markets, knowing your risk tolerance, and setting clear goals. Ryan Jonesc emphasizes the importance of a tailored plan that suits your individual trading style.

Risk Management: The Key to Sustainability

Effective risk management is non-negotiable in trading. By managing your risks, you safeguard your capital and ensure that you live to trade another day.

Essential Risk Management Techniques

- Position Sizing: Determine how much of your portfolio to risk on a single trade.

- Stop-Loss Orders: Set stop-loss orders to limit potential losses.

- Regular Reviews: Continually review and adjust your strategy based on performance and market conditions.

Emotional Discipline: Staying in Control

Techniques to Enhance Emotional Discipline

- Mindfulness and Meditation: These practices can help maintain calm and focus.

- Keeping a Trading Journal: Documenting your trades and emotions can provide insights and help avoid past mistakes.

- Educational Resources: Continually learning about trading can help keep emotions at bay and decisions rational.

Technology’s Role in Trading

In the age of technology, traders have tools at their fingertips that can help avoid the pitfalls of self-destruction. Automated trading systems, for instance, can execute trades based on pre-set criteria, thus removing emotional bias.

Choosing the Right Tools

Selecting the right technological tools is crucial. They should enhance your trading strategy without complicating your decision-making process.

Learning from Experts Like Ryan Jonesc

Ryan Jonesc, a seasoned trader and educator, has been instrumental in guiding many traders through the complexities of the market. His insights into trading psychology and risk management are invaluable for anyone looking to avoid becoming a self-destructing trader.

Jonesc’s Top Tips for Sustainable Trading

- Stay Educated: Keep up-to-date with market trends and trading strategies.

- Be Consistent: Apply your trading strategies consistently, regardless of emotions.

- Seek Guidance: Don’t hesitate to seek advice from experienced traders.

Conclusion

Avoiding the pitfalls of a self-destructing trader requires discipline, a solid strategy, and effective risk management. With the insights from Ryan Jonesc and a commitment to continuous learning and self-improvement, traders can hope to achieve long-term success in the trading world.

Commonly Asked Questions:

- Business Model Innovation: Accept the truth of a legitimate business! Our strategy is organising a group buy in which participants share the costs. We use these cash to acquire popular courses from sale pages and make them available to people with limited financial resources. Despite the authors’ worries, our clients love the cost and accessibility we give.

- The Legal Environment: Yes or No The legality of our activity is ambiguous. While we don’t have specific permission from the course authors to resell the material, there is a technicality at work. The author did not specify any limits on resale when purchasing the course. This legal intricacy is both an opportunity for us and a boon for individuals looking for low-cost access.

- Quality Control: Uncovering the Truth

Getting to the heart of the issue – quality. Purchasing the course straight from the sale page guarantees that all documents and resources are the same as those obtained through traditional channels.

However, we distinguish ourselves by going beyond personal research and resale. It is crucial to note that we are not the official course providers, which means that the following premium services are not included in our package:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not permitted.

- No access to the author’s private membership forum.

- There is no direct email support available from the author or their team.

We operate independently, with the goal of bridging the pricing gap without the extra services provided by official course channels. Your comprehension of our distinct approach is much appreciated.

Be the first to review “Self-Destructing Trader with Ryan Jonesc” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.