-

×

The Ultimate Investor with Dean LeBaron

1 × $4.00

The Ultimate Investor with Dean LeBaron

1 × $4.00 -

×

Future Energy with Bill Paul

1 × $6.00

Future Energy with Bill Paul

1 × $6.00 -

×

The Market Geometry Basic Seminar DVD with Market Geometry

1 × $31.00

The Market Geometry Basic Seminar DVD with Market Geometry

1 × $31.00 -

×

The Art of the Trade: What I Learned (and Lost) Trading the Chicago Futures Markets - Jason Alan Jankovsky

1 × $6.00

The Art of the Trade: What I Learned (and Lost) Trading the Chicago Futures Markets - Jason Alan Jankovsky

1 × $6.00 -

×

Trading Options at Expiration: Strategies and Models for Winning the Endgame with Jeff Augen

1 × $6.00

Trading Options at Expiration: Strategies and Models for Winning the Endgame with Jeff Augen

1 × $6.00 -

×

Fundamentals of the Stock Market with B.O’Neill Wyss

1 × $6.00

Fundamentals of the Stock Market with B.O’Neill Wyss

1 × $6.00 -

×

Essentials Of Payroll Management & Accounting with Steven M.Bragg

1 × $6.00

Essentials Of Payroll Management & Accounting with Steven M.Bragg

1 × $6.00 -

×

AstroFX Course

1 × $6.00

AstroFX Course

1 × $6.00 -

×

The Insider's Guide to 52 Homes in 52 Weeks: Acquire Your Real Estate Fortune Today with Dolf De Roos

1 × $6.00

The Insider's Guide to 52 Homes in 52 Weeks: Acquire Your Real Estate Fortune Today with Dolf De Roos

1 × $6.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Principles of Artificial Neural Networks (2nd Ed.) with Daniel Graupe

1 × $6.00

Principles of Artificial Neural Networks (2nd Ed.) with Daniel Graupe

1 × $6.00 -

×

Evolved Trader with Mark Croock

1 × $69.00

Evolved Trader with Mark Croock

1 × $69.00 -

×

Profitable Strategies with Gemify Academy

1 × $10.00

Profitable Strategies with Gemify Academy

1 × $10.00 -

×

Supercharge your Options Spread Trading with John Summa

1 × $6.00

Supercharge your Options Spread Trading with John Summa

1 × $6.00 -

×

Exploiting Volatility: Mastering Equity and Index Options with David Lerman

1 × $6.00

Exploiting Volatility: Mastering Equity and Index Options with David Lerman

1 × $6.00 -

×

F.A.M.E. Home Study Course with Doug Sutton

1 × $6.00

F.A.M.E. Home Study Course with Doug Sutton

1 × $6.00 -

×

Fixed Income Securities (2nd Ed.) with Bruce Tuckman

1 × $10.00

Fixed Income Securities (2nd Ed.) with Bruce Tuckman

1 × $10.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

Investing in stocks: Avoid stock market loss

1 × $15.00

Investing in stocks: Avoid stock market loss

1 × $15.00 -

×

Complete Short Black Scholes Options Trading Pricing Course

1 × $6.00

Complete Short Black Scholes Options Trading Pricing Course

1 × $6.00 -

×

Fractal Markets FX (SMC)

1 × $5.00

Fractal Markets FX (SMC)

1 × $5.00 -

×

Drewize Banks Course

1 × $5.00

Drewize Banks Course

1 × $5.00 -

×

Trading Floor Training

1 × $6.00

Trading Floor Training

1 × $6.00 -

×

Commodity Speculation for Beginners with Charles Huff, Barbara Marinacci

1 × $6.00

Commodity Speculation for Beginners with Charles Huff, Barbara Marinacci

1 × $6.00 -

×

60 Seconds Sure Shot Strategy with Albert E

1 × $6.00

60 Seconds Sure Shot Strategy with Albert E

1 × $6.00 -

×

Traders Secret Library

1 × $6.00

Traders Secret Library

1 × $6.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

Becoming Rich with Mark Tier

1 × $6.00

Becoming Rich with Mark Tier

1 × $6.00 -

×

Fundamentals Trading

1 × $6.00

Fundamentals Trading

1 × $6.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

Krautgap By John Piper

1 × $6.00

Krautgap By John Piper

1 × $6.00 -

×

Electronic Trading "TNT" II How - To Win Trading Stuff with Joe Ross & Mark Cherlin

1 × $6.00

Electronic Trading "TNT" II How - To Win Trading Stuff with Joe Ross & Mark Cherlin

1 × $6.00 -

×

How to Invest in ETFs By The Investors Podcast

1 × $6.00

How to Invest in ETFs By The Investors Podcast

1 × $6.00 -

×

Activedaytrader - Elite Earnings Pusuit

1 × $54.00

Activedaytrader - Elite Earnings Pusuit

1 × $54.00 -

×

Yes You Can Time the Market! with Ben Stein

1 × $6.00

Yes You Can Time the Market! with Ben Stein

1 × $6.00 -

×

Ez-Forex Trading System 4.2 with Beau Diamond

1 × $6.00

Ez-Forex Trading System 4.2 with Beau Diamond

1 × $6.00 -

×

Blueprint to Extreme Reversals with Aiman Almansoori - Trading Terminal

1 × $8.00

Blueprint to Extreme Reversals with Aiman Almansoori - Trading Terminal

1 × $8.00 -

×

D.A.T.E. Unlock Your Trading DNA Worskshop with Geoff Bysshe

1 × $6.00

D.A.T.E. Unlock Your Trading DNA Worskshop with Geoff Bysshe

1 × $6.00 -

×

Alexander Elder Full Courses Package

1 × $6.00

Alexander Elder Full Courses Package

1 × $6.00 -

×

Proven Chart Patterns: Key Indicators for Success in Today’s Markets with Chris Manning

1 × $6.00

Proven Chart Patterns: Key Indicators for Success in Today’s Markets with Chris Manning

1 × $6.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Forex Trading using Intermarket Analysis with Louis Mendelsohn

1 × $6.00

Forex Trading using Intermarket Analysis with Louis Mendelsohn

1 × $6.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Commitment Workshop for Traders by Adrienne Laris Toghraie

1 × $6.00

Commitment Workshop for Traders by Adrienne Laris Toghraie

1 × $6.00 -

×

Dan Sheridan Options Mentoring Weekly Webinars

1 × $6.00

Dan Sheridan Options Mentoring Weekly Webinars

1 × $6.00 -

×

Andrews Pitchfork Basic

1 × $6.00

Andrews Pitchfork Basic

1 × $6.00 -

×

Fed Balance Sheet 201 with Joseph Wang - Central Banking 101

1 × $10.00

Fed Balance Sheet 201 with Joseph Wang - Central Banking 101

1 × $10.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

How to Make Money in the Futures Market … and Lots of It with Charles Drummond

1 × $6.00

How to Make Money in the Futures Market … and Lots of It with Charles Drummond

1 × $6.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

Setups of a Winning Trader with Gareth Soloway

1 × $521.00

Setups of a Winning Trader with Gareth Soloway

1 × $521.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

Secrets to Succesful Forex Trading Course with Jose Soto

1 × $6.00

Secrets to Succesful Forex Trading Course with Jose Soto

1 × $6.00 -

×

The Practical Handbook of Genetic Algorithms with Lance Chambers

1 × $6.00

The Practical Handbook of Genetic Algorithms with Lance Chambers

1 × $6.00 -

×

Investment Titans: Investment Insights from the Minds that Move Wall Street with Jonathan Burton

1 × $6.00

Investment Titans: Investment Insights from the Minds that Move Wall Street with Jonathan Burton

1 × $6.00 -

×

Simple Methods for Detecting Buying and Selling Points in Securities with James Liveright

1 × $6.00

Simple Methods for Detecting Buying and Selling Points in Securities with James Liveright

1 × $6.00 -

×

Index Funds with Mark Hebner

1 × $6.00

Index Funds with Mark Hebner

1 × $6.00 -

×

What Ranks Schema Course with Clint Butler

1 × $23.00

What Ranks Schema Course with Clint Butler

1 × $23.00 -

×

Lessons 1-30 & Tradestation Code with Charles Drummond

1 × $6.00

Lessons 1-30 & Tradestation Code with Charles Drummond

1 × $6.00 -

×

The Complete Guide to Option Selling, 2nd 2009 with James Cordier & Michael Gross

1 × $6.00

The Complete Guide to Option Selling, 2nd 2009 with James Cordier & Michael Gross

1 × $6.00 -

×

Master The Art of Technical Analysis with Raul Gonzalez

1 × $31.00

Master The Art of Technical Analysis with Raul Gonzalez

1 × $31.00 -

×

ChangeWave Investing 2.0 with Tobin Smith

1 × $6.00

ChangeWave Investing 2.0 with Tobin Smith

1 × $6.00 -

×

Executive Mentoring Elliot Wave Course (Video & Manuals)

1 × $6.00

Executive Mentoring Elliot Wave Course (Video & Manuals)

1 × $6.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

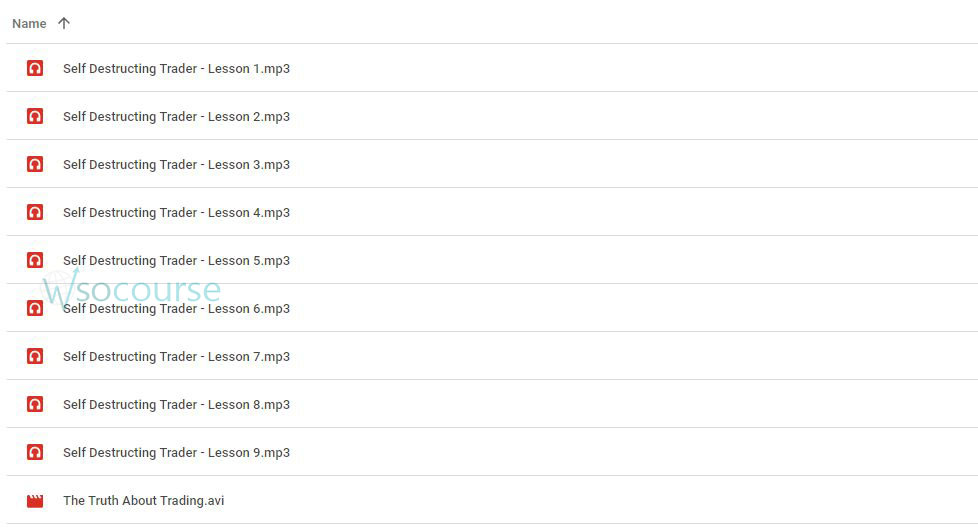

Self-Destructing Trader with Ryan Jonesc

$6.00

File Size: Cooming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Self-Destructing Trader with Ryan Jonesc” below:

Self-Destructing Trader with Ryan Jonesc

In today’s fast-paced trading world, the term “self-destructing trader” might sound more like a dramatic movie title than a reality. However, it is a significant concept that every trader, novice or seasoned, should be aware of. We will dive deep into what it means to be a self-destructing trader and how, with guidance from experts like Ryan Jonesc, you can avoid falling into this risky category.

What is a Self-Destructing Trader?

A self-destructing trader is someone who, despite having the tools and knowledge, ends up making decisions that adversely affect their trading performance. This typically stems from poor risk management, emotional decision-making, and a lack of consistent strategy.

Understanding the Psychological Traps

- Emotional Trading: Often, traders let emotions, like fear and greed, drive their decisions.

- Overconfidence: After a few successes, some traders become overconfident, leading to risky behaviors.

- Lack of Adaptability: The inability to adapt to changing markets can spell disaster for a trader.

The Role of Strategy in Avoiding Self-Destruction

Without a solid strategy, traders often find themselves reacting impulsively to market volatility. A well-defined strategy helps maintain focus and discipline, crucial for long-term success.

Developing a Resilient Trading Plan

Creating a resilient trading plan involves understanding the markets, knowing your risk tolerance, and setting clear goals. Ryan Jonesc emphasizes the importance of a tailored plan that suits your individual trading style.

Risk Management: The Key to Sustainability

Effective risk management is non-negotiable in trading. By managing your risks, you safeguard your capital and ensure that you live to trade another day.

Essential Risk Management Techniques

- Position Sizing: Determine how much of your portfolio to risk on a single trade.

- Stop-Loss Orders: Set stop-loss orders to limit potential losses.

- Regular Reviews: Continually review and adjust your strategy based on performance and market conditions.

Emotional Discipline: Staying in Control

Techniques to Enhance Emotional Discipline

- Mindfulness and Meditation: These practices can help maintain calm and focus.

- Keeping a Trading Journal: Documenting your trades and emotions can provide insights and help avoid past mistakes.

- Educational Resources: Continually learning about trading can help keep emotions at bay and decisions rational.

Technology’s Role in Trading

In the age of technology, traders have tools at their fingertips that can help avoid the pitfalls of self-destruction. Automated trading systems, for instance, can execute trades based on pre-set criteria, thus removing emotional bias.

Choosing the Right Tools

Selecting the right technological tools is crucial. They should enhance your trading strategy without complicating your decision-making process.

Learning from Experts Like Ryan Jonesc

Ryan Jonesc, a seasoned trader and educator, has been instrumental in guiding many traders through the complexities of the market. His insights into trading psychology and risk management are invaluable for anyone looking to avoid becoming a self-destructing trader.

Jonesc’s Top Tips for Sustainable Trading

- Stay Educated: Keep up-to-date with market trends and trading strategies.

- Be Consistent: Apply your trading strategies consistently, regardless of emotions.

- Seek Guidance: Don’t hesitate to seek advice from experienced traders.

Conclusion

Avoiding the pitfalls of a self-destructing trader requires discipline, a solid strategy, and effective risk management. With the insights from Ryan Jonesc and a commitment to continuous learning and self-improvement, traders can hope to achieve long-term success in the trading world.

Commonly Asked Questions:

- Business Model Innovation: Accept the truth of a legitimate business! Our strategy is organising a group buy in which participants share the costs. We use these cash to acquire popular courses from sale pages and make them available to people with limited financial resources. Despite the authors’ worries, our clients love the cost and accessibility we give.

- The Legal Environment: Yes or No The legality of our activity is ambiguous. While we don’t have specific permission from the course authors to resell the material, there is a technicality at work. The author did not specify any limits on resale when purchasing the course. This legal intricacy is both an opportunity for us and a boon for individuals looking for low-cost access.

- Quality Control: Uncovering the Truth

Getting to the heart of the issue – quality. Purchasing the course straight from the sale page guarantees that all documents and resources are the same as those obtained through traditional channels.

However, we distinguish ourselves by going beyond personal research and resale. It is crucial to note that we are not the official course providers, which means that the following premium services are not included in our package:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not permitted.

- No access to the author’s private membership forum.

- There is no direct email support available from the author or their team.

We operate independently, with the goal of bridging the pricing gap without the extra services provided by official course channels. Your comprehension of our distinct approach is much appreciated.

Be the first to review “Self-Destructing Trader with Ryan Jonesc” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Reviews

There are no reviews yet.