-

×

Gold Trading Boot Camp: How to Master the Basics and Become a Successful Commodities Investor - Gregory Weldon & Dennis Gartman

1 × $6.00

Gold Trading Boot Camp: How to Master the Basics and Become a Successful Commodities Investor - Gregory Weldon & Dennis Gartman

1 × $6.00 -

×

The Psychology of Risk (Audio) with Ari Kiev

1 × $6.00

The Psychology of Risk (Audio) with Ari Kiev

1 × $6.00 -

×

Price Ladder Training

1 × $15.00

Price Ladder Training

1 × $15.00 -

×

Intro To Trading - 3 Module Bundle

1 × $23.00

Intro To Trading - 3 Module Bundle

1 × $23.00 -

×

High Reward Low Risk Forex Trading with Jarratt Davis and Vic Noble

1 × $6.00

High Reward Low Risk Forex Trading with Jarratt Davis and Vic Noble

1 × $6.00 -

×

Engineering Analysis: Interactive Methods and Programs with FORTRAN, QuickBASIC, MATLAB, and Mathematica with Yen-Ching Pao

1 × $6.00

Engineering Analysis: Interactive Methods and Programs with FORTRAN, QuickBASIC, MATLAB, and Mathematica with Yen-Ching Pao

1 × $6.00 -

×

Advent Forex Course with Cecil Robles

1 × $6.00

Advent Forex Course with Cecil Robles

1 × $6.00 -

×

How to Make Money in the Futures Market … and Lots of It with Charles Drummond

1 × $6.00

How to Make Money in the Futures Market … and Lots of It with Charles Drummond

1 × $6.00 -

×

Scalping the Nasdaq Emini Futures Method (Includes Indicators) with Ryan Watts

1 × $4.00

Scalping the Nasdaq Emini Futures Method (Includes Indicators) with Ryan Watts

1 × $4.00 -

×

The Great Depression with David Burg

1 × $6.00

The Great Depression with David Burg

1 × $6.00 -

×

Confessions of a Pit Trader 2003 with Rick Burgess

1 × $6.00

Confessions of a Pit Trader 2003 with Rick Burgess

1 × $6.00 -

×

Does a Holy Grail Really Exist with John Hayden

1 × $6.00

Does a Holy Grail Really Exist with John Hayden

1 × $6.00 -

×

Passages To Profitability: A Comprehensive Guide To Channel Trading with Professor Jeff Bierman, CMT

1 × $6.00

Passages To Profitability: A Comprehensive Guide To Channel Trading with Professor Jeff Bierman, CMT

1 × $6.00 -

×

The Active Investor Blueprint with Steve Nison - Candle Charts

1 × $23.00

The Active Investor Blueprint with Steve Nison - Candle Charts

1 × $23.00 -

×

Practical Introduction to Bollinger Bands 2013

1 × $6.00

Practical Introduction to Bollinger Bands 2013

1 × $6.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

Contrarian Investing with Anthony M.Gallea, William Patalon

1 × $6.00

Contrarian Investing with Anthony M.Gallea, William Patalon

1 × $6.00 -

×

![Robert Miner-Complete Price Tutorial Series [5 Videos (AVI)] img](https://www.totozon.com/wp-content/uploads/2024/05/Robert-Miner-Complete-Price-Tutorial-Series-5-Videos-AVI-img.png) Robert Miner-Complete Price Tutorial Series [5 Videos (AVI)]

1 × $6.00

Robert Miner-Complete Price Tutorial Series [5 Videos (AVI)]

1 × $6.00 -

×

My Life as a Quant with Emanuel Derman

1 × $6.00

My Life as a Quant with Emanuel Derman

1 × $6.00 -

×

The Newly Revised Hal Method of Cyclic Analysis with Walter Bressert

1 × $5.00

The Newly Revised Hal Method of Cyclic Analysis with Walter Bressert

1 × $5.00 -

×

Daytrade (Italian) with Guiuseppe Migliorino

1 × $6.00

Daytrade (Italian) with Guiuseppe Migliorino

1 × $6.00 -

×

The Broken Wing Butterfly Options Strategy with Greg Loehr

1 × $23.00

The Broken Wing Butterfly Options Strategy with Greg Loehr

1 × $23.00 -

×

Stock Trading Simplified - 3 DVD + PDF Workbook with John Person

1 × $6.00

Stock Trading Simplified - 3 DVD + PDF Workbook with John Person

1 × $6.00 -

×

Storehouse Tutorial Group Videos

1 × $23.00

Storehouse Tutorial Group Videos

1 × $23.00 -

×

Forex Trading with Ed Ponsi

1 × $6.00

Forex Trading with Ed Ponsi

1 × $6.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

Self-Destructing Trader with Ryan Jonesc

$6.00

File Size: Cooming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

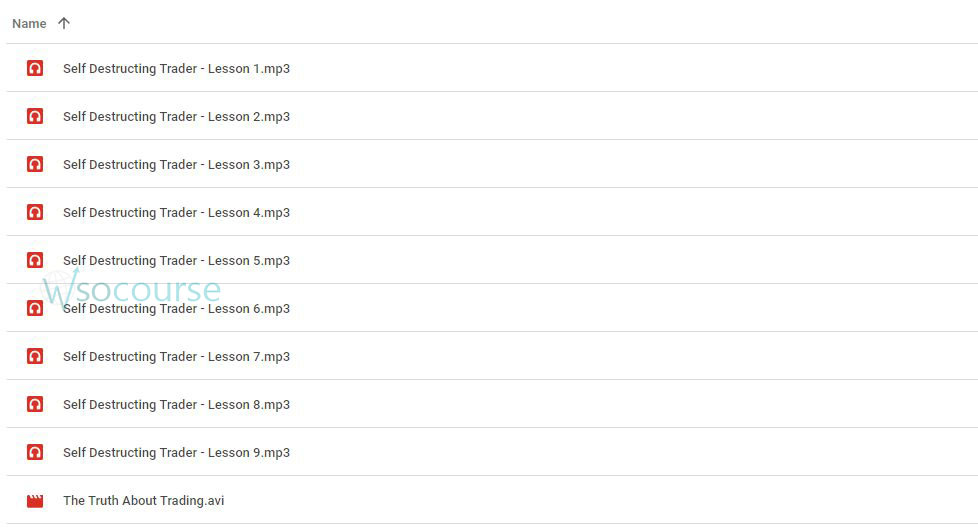

Content Proof: Watch Here!

You may check content proof of “Self-Destructing Trader with Ryan Jonesc” below:

Self-Destructing Trader with Ryan Jonesc

In today’s fast-paced trading world, the term “self-destructing trader” might sound more like a dramatic movie title than a reality. However, it is a significant concept that every trader, novice or seasoned, should be aware of. We will dive deep into what it means to be a self-destructing trader and how, with guidance from experts like Ryan Jonesc, you can avoid falling into this risky category.

What is a Self-Destructing Trader?

A self-destructing trader is someone who, despite having the tools and knowledge, ends up making decisions that adversely affect their trading performance. This typically stems from poor risk management, emotional decision-making, and a lack of consistent strategy.

Understanding the Psychological Traps

- Emotional Trading: Often, traders let emotions, like fear and greed, drive their decisions.

- Overconfidence: After a few successes, some traders become overconfident, leading to risky behaviors.

- Lack of Adaptability: The inability to adapt to changing markets can spell disaster for a trader.

The Role of Strategy in Avoiding Self-Destruction

Without a solid strategy, traders often find themselves reacting impulsively to market volatility. A well-defined strategy helps maintain focus and discipline, crucial for long-term success.

Developing a Resilient Trading Plan

Creating a resilient trading plan involves understanding the markets, knowing your risk tolerance, and setting clear goals. Ryan Jonesc emphasizes the importance of a tailored plan that suits your individual trading style.

Risk Management: The Key to Sustainability

Effective risk management is non-negotiable in trading. By managing your risks, you safeguard your capital and ensure that you live to trade another day.

Essential Risk Management Techniques

- Position Sizing: Determine how much of your portfolio to risk on a single trade.

- Stop-Loss Orders: Set stop-loss orders to limit potential losses.

- Regular Reviews: Continually review and adjust your strategy based on performance and market conditions.

Emotional Discipline: Staying in Control

Techniques to Enhance Emotional Discipline

- Mindfulness and Meditation: These practices can help maintain calm and focus.

- Keeping a Trading Journal: Documenting your trades and emotions can provide insights and help avoid past mistakes.

- Educational Resources: Continually learning about trading can help keep emotions at bay and decisions rational.

Technology’s Role in Trading

In the age of technology, traders have tools at their fingertips that can help avoid the pitfalls of self-destruction. Automated trading systems, for instance, can execute trades based on pre-set criteria, thus removing emotional bias.

Choosing the Right Tools

Selecting the right technological tools is crucial. They should enhance your trading strategy without complicating your decision-making process.

Learning from Experts Like Ryan Jonesc

Ryan Jonesc, a seasoned trader and educator, has been instrumental in guiding many traders through the complexities of the market. His insights into trading psychology and risk management are invaluable for anyone looking to avoid becoming a self-destructing trader.

Jonesc’s Top Tips for Sustainable Trading

- Stay Educated: Keep up-to-date with market trends and trading strategies.

- Be Consistent: Apply your trading strategies consistently, regardless of emotions.

- Seek Guidance: Don’t hesitate to seek advice from experienced traders.

Conclusion

Avoiding the pitfalls of a self-destructing trader requires discipline, a solid strategy, and effective risk management. With the insights from Ryan Jonesc and a commitment to continuous learning and self-improvement, traders can hope to achieve long-term success in the trading world.

Commonly Asked Questions:

- Business Model Innovation: Accept the truth of a legitimate business! Our strategy is organising a group buy in which participants share the costs. We use these cash to acquire popular courses from sale pages and make them available to people with limited financial resources. Despite the authors’ worries, our clients love the cost and accessibility we give.

- The Legal Environment: Yes or No The legality of our activity is ambiguous. While we don’t have specific permission from the course authors to resell the material, there is a technicality at work. The author did not specify any limits on resale when purchasing the course. This legal intricacy is both an opportunity for us and a boon for individuals looking for low-cost access.

- Quality Control: Uncovering the Truth

Getting to the heart of the issue – quality. Purchasing the course straight from the sale page guarantees that all documents and resources are the same as those obtained through traditional channels.

However, we distinguish ourselves by going beyond personal research and resale. It is crucial to note that we are not the official course providers, which means that the following premium services are not included in our package:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not permitted.

- No access to the author’s private membership forum.

- There is no direct email support available from the author or their team.

We operate independently, with the goal of bridging the pricing gap without the extra services provided by official course channels. Your comprehension of our distinct approach is much appreciated.

Be the first to review “Self-Destructing Trader with Ryan Jonesc” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.