-

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

Winning Market Systems. 83 Ways to Beat the Market

1 × $6.00

Winning Market Systems. 83 Ways to Beat the Market

1 × $6.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

The 1st TradingMarkets Trend Following Summit

1 × $54.00

The 1st TradingMarkets Trend Following Summit

1 × $54.00 -

×

Turnaround Trader Formula with Ifan Wei - T3 Live

1 × $23.00

Turnaround Trader Formula with Ifan Wei - T3 Live

1 × $23.00 -

×

MTI - Scalping Course

1 × $15.00

MTI - Scalping Course

1 × $15.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

The Folio Management Phenomenon with Gene Walden

1 × $6.00

The Folio Management Phenomenon with Gene Walden

1 × $6.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

Getting Started in Options (3rd Ed.) with Michael Thomsett

1 × $6.00

Getting Started in Options (3rd Ed.) with Michael Thomsett

1 × $6.00 -

×

Workshop Metals Mastery

1 × $23.00

Workshop Metals Mastery

1 × $23.00 -

×

Option Screening. Finding Profitable Trades with Lawrence Gavanagh

1 × $6.00

Option Screening. Finding Profitable Trades with Lawrence Gavanagh

1 × $6.00 -

×

The Conscious Investor: Profiting from the Timeless Value Approach with John Price

1 × $6.00

The Conscious Investor: Profiting from the Timeless Value Approach with John Price

1 × $6.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

Iron Condor - Advanced

1 × $31.00

Iron Condor - Advanced

1 × $31.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

TTM Slingshot & Value Charts Indicators

1 × $6.00

TTM Slingshot & Value Charts Indicators

1 × $6.00 -

×

9-Day Calendar Deep Dive 2023 with Jay Bailey - Sheridan Options Mentoring

1 × $31.00

9-Day Calendar Deep Dive 2023 with Jay Bailey - Sheridan Options Mentoring

1 × $31.00 -

×

Ultimate Gann Trading

1 × $15.00

Ultimate Gann Trading

1 × $15.00 -

×

Level 3 - AlgoX Trading Tactics

1 × $31.00

Level 3 - AlgoX Trading Tactics

1 × $31.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

The Essays of Waren Buffet. Lessons for Corporate America with Lawrence A.Cunningham

1 × $6.00

The Essays of Waren Buffet. Lessons for Corporate America with Lawrence A.Cunningham

1 × $6.00 -

×

Trading Options for Dummies with George Fontanills

1 × $6.00

Trading Options for Dummies with George Fontanills

1 × $6.00 -

×

TrendFund.com – 11 DVDs

1 × $69.00

TrendFund.com – 11 DVDs

1 × $69.00 -

×

Safety in the Markets 9-DVD Series with David Bowden

1 × $6.00

Safety in the Markets 9-DVD Series with David Bowden

1 × $6.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

ZipTraderU 2022 - Your Map To The Stock Market with ZipTrader

1 × $69.00

ZipTraderU 2022 - Your Map To The Stock Market with ZipTrader

1 × $69.00 -

×

Trends & Trendlines with Albert Yang

1 × $4.00

Trends & Trendlines with Albert Yang

1 × $4.00 -

×

TTM Trend Anchor Indicator for Tradestation & MultiCharts

1 × $6.00

TTM Trend Anchor Indicator for Tradestation & MultiCharts

1 × $6.00 -

×

Big Morning Profits with Base Camp Trading

1 × $4.00

Big Morning Profits with Base Camp Trading

1 × $4.00 -

×

Winter 2016 Ignite Trading Conference (2016)

1 × $23.00

Winter 2016 Ignite Trading Conference (2016)

1 × $23.00 -

×

Elder-disk 1.01 for NinjaTrader7

1 × $6.00

Elder-disk 1.01 for NinjaTrader7

1 × $6.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

The Encyclopedia Trading Strategies

1 × $6.00

The Encyclopedia Trading Strategies

1 × $6.00 -

×

Beginner Options Trading Class with Bill Johnson

1 × $6.00

Beginner Options Trading Class with Bill Johnson

1 × $6.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

WinXgo + Manual (moneytide.com)

1 × $6.00

WinXgo + Manual (moneytide.com)

1 × $6.00 -

×

The Volatility Course + The Volatility Course Workbook with George Fontanills & Tom Gentile

1 × $6.00

The Volatility Course + The Volatility Course Workbook with George Fontanills & Tom Gentile

1 × $6.00 -

×

TTW TradeFinder and Bookmap Course with Trading To Win

1 × $10.00

TTW TradeFinder and Bookmap Course with Trading To Win

1 × $10.00 -

×

The Secret To Making 7 Figures In A Year with Steven Dux

1 × $31.00

The Secret To Making 7 Figures In A Year with Steven Dux

1 × $31.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Trading on Momentum with Ken Wolff

1 × $6.00

Trading on Momentum with Ken Wolff

1 × $6.00 -

×

Hit & Run Trading II with Jeff Cooper

1 × $4.00

Hit & Run Trading II with Jeff Cooper

1 × $4.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Two Simple Setups For All Markets (Parts 1, 2, 3) with Rob Hoffman

1 × $31.00

Two Simple Setups For All Markets (Parts 1, 2, 3) with Rob Hoffman

1 × $31.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

Essential Technical Analysis with Leigh Stevens

1 × $6.00

Essential Technical Analysis with Leigh Stevens

1 × $6.00 -

×

Winning Chart Patterns. 7 Patterns That Really Work with Ed Downs

1 × $6.00

Winning Chart Patterns. 7 Patterns That Really Work with Ed Downs

1 × $6.00 -

×

Technical Analysis of the Currency Market Classic Techniques for Profiting from Market Swings and Trader Sentiment with Boris Schlossberg

1 × $6.00

Technical Analysis of the Currency Market Classic Techniques for Profiting from Market Swings and Trader Sentiment with Boris Schlossberg

1 × $6.00 -

×

Intermediate Options Trading Course

1 × $39.00

Intermediate Options Trading Course

1 × $39.00 -

×

Options University - FX Options Trading Course 2008

1 × $6.00

Options University - FX Options Trading Course 2008

1 × $6.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

Winning with Options with Michael Thomsett

1 × $6.00

Winning with Options with Michael Thomsett

1 × $6.00 -

×

Ultimate Breakout

1 × $54.00

Ultimate Breakout

1 × $54.00 -

×

Vertical Spreads. Strategy Intensive

1 × $4.00

Vertical Spreads. Strategy Intensive

1 × $4.00 -

×

TTM Squeeze Clone for eSignal

1 × $6.00

TTM Squeeze Clone for eSignal

1 × $6.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

Ultimate Gann Course Coaching Safety in The Market COMPLETE 12 Modules with Aaron Lynch

1 × $6.00

Ultimate Gann Course Coaching Safety in The Market COMPLETE 12 Modules with Aaron Lynch

1 × $6.00 -

×

Yuri Shamenko Videos

1 × $5.00

Yuri Shamenko Videos

1 × $5.00 -

×

Bitcoin - Trading – Watch me manage my own account

1 × $8.00

Bitcoin - Trading – Watch me manage my own account

1 × $8.00 -

×

The Profit-Taker Breakthrough with Don Abrams

1 × $4.00

The Profit-Taker Breakthrough with Don Abrams

1 × $4.00 -

×

The Stock Market Mastery Program with Ryan Hildreth

1 × $12.00

The Stock Market Mastery Program with Ryan Hildreth

1 × $12.00 -

×

The Stock Market Course with George Fontanills & Tom Gentile

1 × $6.00

The Stock Market Course with George Fontanills & Tom Gentile

1 × $6.00 -

×

Unedited Superconference 2010

1 × $15.00

Unedited Superconference 2010

1 × $15.00 -

×

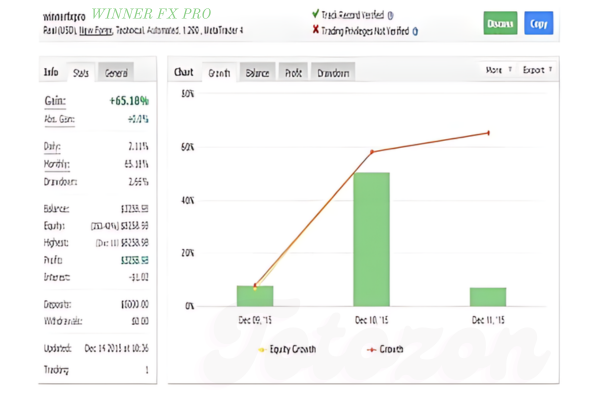

WINNER FX PRO

1 × $15.00

WINNER FX PRO

1 × $15.00 -

×

Trading NQ At The US Open with TradeSmart

1 × $10.00

Trading NQ At The US Open with TradeSmart

1 × $10.00 -

×

The Ultimate Trading Guide & Code with George Pruitt, John R.Hill

1 × $6.00

The Ultimate Trading Guide & Code with George Pruitt, John R.Hill

1 × $6.00 -

×

Tradeciety Online Forex Trading MasterClass

1 × $5.00

Tradeciety Online Forex Trading MasterClass

1 × $5.00 -

×

Turtle Trading Concepts with Russell Sands

1 × $6.00

Turtle Trading Concepts with Russell Sands

1 × $6.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

Trend Trading Course

1 × $15.00

Trend Trading Course

1 × $15.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

Video Course with Trading Template

1 × $54.00

Video Course with Trading Template

1 × $54.00 -

×

Tape Reading Small Caps with Jtrader

1 × $23.00

Tape Reading Small Caps with Jtrader

1 × $23.00 -

×

Twelve Ways to Survive the Next Twelve Months with Adam Lass

1 × $6.00

Twelve Ways to Survive the Next Twelve Months with Adam Lass

1 × $6.00 -

×

Trampoline Trading with Claytrader

1 × $6.00

Trampoline Trading with Claytrader

1 × $6.00 -

×

Bradley F.Cowan (Cycle-Trader.com)

1 × $23.00

Bradley F.Cowan (Cycle-Trader.com)

1 × $23.00 -

×

Investing Courses Bundle

1 × $31.00

Investing Courses Bundle

1 × $31.00 -

×

The Silver Edge Forex Training Program with T3 Live

1 × $5.00

The Silver Edge Forex Training Program with T3 Live

1 × $5.00 -

×

Trading Framework with Retail Capital

1 × $24.00

Trading Framework with Retail Capital

1 × $24.00 -

×

With All Odds Forex System I & II with Barry Thornton

1 × $6.00

With All Odds Forex System I & II with Barry Thornton

1 × $6.00 -

×

ADVANCED Swing Trading Strategy - Forex Trading Stock Trading

1 × $15.00

ADVANCED Swing Trading Strategy - Forex Trading Stock Trading

1 × $15.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

Unleash Stock Trading Genius: Money Machine with Talmadge Harper - Harper Healing

1 × $15.00

Unleash Stock Trading Genius: Money Machine with Talmadge Harper - Harper Healing

1 × $15.00 -

×

Tunnel Through the Air (1994 Conference of Astro-Timing Techniques) with Bonnie Lee Hill

1 × $4.00

Tunnel Through the Air (1994 Conference of Astro-Timing Techniques) with Bonnie Lee Hill

1 × $4.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Forex Knight Mentoring Program with Hector Deville

1 × $5.00

Forex Knight Mentoring Program with Hector Deville

1 × $5.00 -

×

Buy the Fear Sell the Greed

1 × $6.00

Buy the Fear Sell the Greed

1 × $6.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Pro Trend Trader 2017 with James Orr

1 × $31.00

Pro Trend Trader 2017 with James Orr

1 × $31.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

Schooloftrade - SOT Beginners Course (May 2014)

1 × $23.00

Schooloftrade - SOT Beginners Course (May 2014)

1 × $23.00 -

×

The Expected Return Calculator

1 × $23.00

The Expected Return Calculator

1 × $23.00 -

×

Kaizen Pipsology: Forex Mentorship

1 × $8.00

Kaizen Pipsology: Forex Mentorship

1 × $8.00 -

×

The Winning Secret

1 × $23.00

The Winning Secret

1 × $23.00 -

×

The Secret of Selecting Stocks for Immediate and Substantial Gains with Larry Williams

1 × $6.00

The Secret of Selecting Stocks for Immediate and Substantial Gains with Larry Williams

1 × $6.00 -

×

The Volume Traders 2.0 with Sebastian - The Volume Traders

1 × $5.00

The Volume Traders 2.0 with Sebastian - The Volume Traders

1 × $5.00 -

×

Zm Capitals Full course + Ebook with Zain Mokhles - ZmCapitals

1 × $31.00

Zm Capitals Full course + Ebook with Zain Mokhles - ZmCapitals

1 × $31.00 -

×

Things You Need To Know About Full Time Trading with Rajandran R

1 × $4.00

Things You Need To Know About Full Time Trading with Rajandran R

1 × $4.00 -

×

The Situational Order Flow Trading Course with Mike Valtos

1 × $20.00

The Situational Order Flow Trading Course with Mike Valtos

1 × $20.00 -

×

Intra-Day Trading Strategies. Proven Steps to Short-Term Trading Profits with Jeff Cooper

1 × $4.00

Intra-Day Trading Strategies. Proven Steps to Short-Term Trading Profits with Jeff Cooper

1 × $4.00 -

×

Trading the Eclipses

1 × $6.00

Trading the Eclipses

1 × $6.00 -

×

Course (Video, PDF, MT4 Indicators)

1 × $6.00

Course (Video, PDF, MT4 Indicators)

1 × $6.00 -

×

The Secret to Extraordinary Wealth in the Options Market - 4 DVDs

1 × $31.00

The Secret to Extraordinary Wealth in the Options Market - 4 DVDs

1 × $31.00 -

×

Uncertainty & Expectation Strategies for the Trading of Risk with Gerald Ashley

1 × $6.00

Uncertainty & Expectation Strategies for the Trading of Risk with Gerald Ashley

1 × $6.00 -

×

Using EasyLanguage 2000 with Arthur G.Putt, William Brower

1 × $4.00

Using EasyLanguage 2000 with Arthur G.Putt, William Brower

1 × $4.00 -

×

The Econometrics of Macroeconomic Modelling with Gunnar Bardsen

1 × $6.00

The Econometrics of Macroeconomic Modelling with Gunnar Bardsen

1 × $6.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

BGFX Trading Academy

1 × $5.00

BGFX Trading Academy

1 × $5.00 -

×

Channel Surfing Video Course

1 × $23.00

Channel Surfing Video Course

1 × $23.00 -

×

TotalTheo 12 Month Mentorship

1 × $54.00

TotalTheo 12 Month Mentorship

1 × $54.00 -

×

INSIDER HEDGE FUND FORMULA (IHFF)

1 × $6.00

INSIDER HEDGE FUND FORMULA (IHFF)

1 × $6.00 -

×

Greatest Trading Tools

1 × $6.00

Greatest Trading Tools

1 × $6.00 -

×

The Forex Legacy

1 × $6.00

The Forex Legacy

1 × $6.00 -

×

Turning Losing Forex Trades into Winners: Proven Techniques to Reverse Your Losses with Gerald E.Greene

1 × $6.00

Turning Losing Forex Trades into Winners: Proven Techniques to Reverse Your Losses with Gerald E.Greene

1 × $6.00 -

×

The Fortune Strategy. An Instruction Manual

1 × $6.00

The Fortune Strategy. An Instruction Manual

1 × $6.00 -

×

Ultimate Guide To Swing Trading ETF's

1 × $23.00

Ultimate Guide To Swing Trading ETF's

1 × $23.00 -

×

The Engulfing Trader Video Series 2014 with Timon Weller

1 × $6.00

The Engulfing Trader Video Series 2014 with Timon Weller

1 × $6.00 -

×

Trading Psychology with Barry Burns

1 × $4.00

Trading Psychology with Barry Burns

1 × $4.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

Two Options Strategies for Every Investor with Karim Rahemtulla

1 × $6.00

Two Options Strategies for Every Investor with Karim Rahemtulla

1 × $6.00 -

×

Winning in Options with Elliott Wave + 5 Options Strategies with Todd Gordon

1 × $23.00

Winning in Options with Elliott Wave + 5 Options Strategies with Todd Gordon

1 × $23.00 -

×

Trading Hub 2.0 Course

1 × $27.00

Trading Hub 2.0 Course

1 × $27.00 -

×

Integrated Pitchfork Analysis (Volume 1,2,3)

1 × $6.00

Integrated Pitchfork Analysis (Volume 1,2,3)

1 × $6.00 -

×

Millard on Channel Analysis: The key to Share Price Prediction (2nd Ed.) with Brian Millard

1 × $6.00

Millard on Channel Analysis: The key to Share Price Prediction (2nd Ed.) with Brian Millard

1 × $6.00 -

×

Credit Risk from Transaction to Portfolio Management with Andrew Kimber

1 × $6.00

Credit Risk from Transaction to Portfolio Management with Andrew Kimber

1 × $6.00 -

×

Complete Course of Astrology with George Bayer

1 × $6.00

Complete Course of Astrology with George Bayer

1 × $6.00 -

×

Instant Cash With Judgment Liens with Mike Warren

1 × $6.00

Instant Cash With Judgment Liens with Mike Warren

1 × $6.00 -

×

Start Trading Stocks Using Technical Analysis with Corey Halliday

1 × $6.00

Start Trading Stocks Using Technical Analysis with Corey Halliday

1 × $6.00 -

×

TTM Directional Day Filter Indicator with Value Chart for TS

1 × $6.00

TTM Directional Day Filter Indicator with Value Chart for TS

1 × $6.00 -

×

The Forex On Fire System

1 × $6.00

The Forex On Fire System

1 × $6.00 -

×

Examination Morning Session – Essay (2003) with CFA Level 3

1 × $6.00

Examination Morning Session – Essay (2003) with CFA Level 3

1 × $6.00 -

×

WealthFRX Trading Mastery Course 2.0

1 × $5.00

WealthFRX Trading Mastery Course 2.0

1 × $5.00 -

×

DAY TRADE (LONG & SHORT) STRATEGIES PACKAGE - The Chartist

1 × $272.00

DAY TRADE (LONG & SHORT) STRATEGIES PACKAGE - The Chartist

1 × $272.00 -

×

Ultimate Guide Technical Trading

1 × $23.00

Ultimate Guide Technical Trading

1 × $23.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

Z4X Long Term Trading System

1 × $6.00

Z4X Long Term Trading System

1 × $6.00 -

×

Learn Forex Cash Bomb

1 × $6.00

Learn Forex Cash Bomb

1 × $6.00 -

×

Trading Mastery Course 2009

1 × $6.00

Trading Mastery Course 2009

1 × $6.00

The Secret of Selecting Stocks for Immediate and Substantial Gains with Larry Williams

$6.00

File Size: 3.56 MB

Delivery Time: 1–12 hours

Media Type: Online Course

The Secret of Selecting Stocks for Immediate and Substantial Gains with Larry Williams

Selecting stocks for immediate and substantial gains is a goal many traders aspire to achieve. Larry Williams, a legendary trader, has shared invaluable insights into this process. His strategies focus on identifying high-potential stocks using a blend of technical analysis, market sentiment, and unique indicators. In this article, we delve into the secrets of Larry Williams’ approach to selecting stocks for significant gains.

Understanding Larry Williams’ Approach

Who is Larry Williams?

Larry Williams is a renowned trader and author with decades of experience in the financial markets. Known for his innovative trading strategies and tools, Williams has helped countless traders improve their stock-picking skills.

The Core of Williams’ Strategy

At the heart of Williams’ strategy is the belief that successful stock selection involves a combination of technical analysis, understanding market sentiment, and utilizing proprietary indicators. His approach aims to identify stocks poised for immediate and substantial gains.

Key Principles of Stock Selection

Technical Analysis

Technical analysis plays a crucial role in Williams’ stock selection process. By examining historical price data and chart patterns, traders can identify potential entry and exit points.

Market Sentiment

Understanding market sentiment is essential for gauging the overall mood of investors. Williams emphasizes the importance of sentiment indicators to predict market movements.

Proprietary Indicators

Williams has developed several proprietary indicators that aid in stock selection. These tools help identify trends, reversals, and other critical market signals.

Steps to Selecting Stocks for Immediate Gains

Step 1: Identify Potential Candidates

Start by creating a watchlist of potential stocks. Look for companies with strong fundamentals, recent positive news, or those in trending sectors.

Factors to Consider

- Earnings Reports: Positive earnings surprises often lead to substantial gains.

- Industry Trends: Stocks in trending industries tend to perform well.

- News Events: Positive news can drive immediate stock gains.

Step 2: Analyze Technical Indicators

Use technical indicators to analyze the stocks on your watchlist. Look for patterns and signals that indicate potential upward movements.

Key Technical Indicators

- Moving Averages: Identify trends and potential entry points.

- Relative Strength Index (RSI): Gauge overbought or oversold conditions.

- MACD (Moving Average Convergence Divergence): Detect changes in momentum.

Step 3: Assess Market Sentiment

Evaluate market sentiment to understand the broader market context. Sentiment indicators can provide insights into whether the market is likely to support a stock’s upward movement.

Sentiment Indicators

- Volatility Index (VIX): Measures market fear and uncertainty.

- Put/Call Ratio: Indicates bullish or bearish sentiment.

- Investor Surveys: Provide insights into investor confidence.

Step 4: Utilize Proprietary Indicators

Incorporate Larry Williams’ proprietary indicators into your analysis. These tools can offer unique insights and enhance your stock-picking process.

Williams’ Proprietary Indicators

- Williams %R: Measures overbought and oversold conditions.

- Commitment of Traders (COT) Report: Tracks the positions of market participants.

- Seasonal Patterns: Identifies times of the year when stocks historically perform well.

Step 5: Make Informed Decisions

Combine your analysis of technical indicators, market sentiment, and proprietary tools to make informed stock selections. Ensure your decisions are based on a holistic view of the market.

Practical Tips for Immediate Gains

Focus on High-Volume Stocks

High-volume stocks tend to have better liquidity and are more likely to see substantial price movements. Focus on stocks with significant trading volume.

Stay Updated with Market News

Keeping abreast of market news and events can help you identify stocks with immediate gain potential. News-driven moves can create profitable trading opportunities.

Use Stop-Loss Orders

Implementing stop-loss orders can protect your investments from significant losses. This risk management tool helps safeguard your capital.

Monitor Your Positions

Regularly monitor your positions and be ready to act on new information. The market can change rapidly, and staying vigilant is key to capitalizing on gains.

Common Mistakes to Avoid

Overreliance on a Single Indicator

Relying too heavily on one indicator can lead to biased decisions. Use a combination of tools and analysis methods for a comprehensive view.

Ignoring Market Sentiment

Market sentiment plays a crucial role in stock movements. Ignoring sentiment indicators can result in missed opportunities or unexpected losses.

Failing to Manage Risk

Effective risk management is essential for long-term success. Always use stop-loss orders and diversify your portfolio to mitigate risks.

Conclusion

Selecting stocks for immediate and substantial gains requires a strategic approach. Larry Williams’ insights provide a valuable framework for identifying high-potential stocks. By combining technical analysis, market sentiment, and proprietary indicators, you can make informed decisions and enhance your trading success. Stay disciplined, manage your risks, and continuously refine your strategies to achieve substantial gains in the stock market.

FAQs

1. What is the primary focus of Larry Williams’ stock selection strategy?

- Williams’ strategy focuses on combining technical analysis, market sentiment, and proprietary indicators to identify high-potential stocks.

2. How important is market sentiment in stock selection?

- Market sentiment is crucial as it provides insights into investor confidence and overall market mood, influencing stock movements.

3. What are some key technical indicators to use?

- Key technical indicators include moving averages, RSI, and MACD, which help identify trends and potential entry points.

4. Why should traders focus on high-volume stocks?

- High-volume stocks offer better liquidity and are more likely to experience substantial price movements, providing profitable trading opportunities.

5. How can stop-loss orders help in trading?

- Stop-loss orders help manage risk by automatically selling a stock if it reaches a predetermined price, protecting against significant losses.

Be the first to review “The Secret of Selecting Stocks for Immediate and Substantial Gains with Larry Williams” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.