-

×

Strees Relief for Traders Workshop with Adrienne Laris Toghraie

1 × $6.00

Strees Relief for Traders Workshop with Adrienne Laris Toghraie

1 × $6.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

Essential Technical Analysis with Leigh Stevens

1 × $6.00

Essential Technical Analysis with Leigh Stevens

1 × $6.00 -

×

Technical Analysis Package with Martin Pring

1 × $4.00

Technical Analysis Package with Martin Pring

1 × $4.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Tradematic Trading Strategy

1 × $31.00

Tradematic Trading Strategy

1 × $31.00 -

×

FXCharger

1 × $23.00

FXCharger

1 × $23.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

Iconic Trader Program with Urban Forex

1 × $5.00

Iconic Trader Program with Urban Forex

1 × $5.00 -

×

The Thirty-Second Jewel in PDF with Constance Brown

1 × $8.00

The Thirty-Second Jewel in PDF with Constance Brown

1 × $8.00 -

×

Order Flow Mastery (New 2024) with The Volume Traders

1 × $24.00

Order Flow Mastery (New 2024) with The Volume Traders

1 × $24.00 -

×

Raghee Horner - Submarket Sonar - Live Trading + Indicator

1 × $39.00

Raghee Horner - Submarket Sonar - Live Trading + Indicator

1 × $39.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Advanced Symmetrics Mental Harmonics Course

1 × $15.00

Advanced Symmetrics Mental Harmonics Course

1 × $15.00 -

×

Reversal Magic Video Course

1 × $15.00

Reversal Magic Video Course

1 × $15.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

FX At One Glance - Ichimoku Advanced Japanese Techniques

1 × $15.00

FX At One Glance - Ichimoku Advanced Japanese Techniques

1 × $15.00 -

×

TTM Directional Day Filter System for TS

1 × $6.00

TTM Directional Day Filter System for TS

1 × $6.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

Butterflies For Monthly Income 2016 with Dan Sheridan

1 × $15.00

Butterflies For Monthly Income 2016 with Dan Sheridan

1 × $15.00 -

×

Jtrader - A+ Setups Small Caps

1 × $23.00

Jtrader - A+ Setups Small Caps

1 × $23.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

MACD Divergence Fully Automatic Indicator for ThinkOrSwim TOS

1 × $6.00

MACD Divergence Fully Automatic Indicator for ThinkOrSwim TOS

1 × $6.00 -

×

Guide To Selling High Probability Spreads Class with Don Kaufman

1 × $6.00

Guide To Selling High Probability Spreads Class with Don Kaufman

1 × $6.00 -

×

Trend Forecasting with Technical Analysis with Louis Mendelsohn & John Murphy

1 × $6.00

Trend Forecasting with Technical Analysis with Louis Mendelsohn & John Murphy

1 × $6.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Pine Script Mastery Course with Matthew Slabosz

1 × $5.00

Pine Script Mastery Course with Matthew Slabosz

1 × $5.00 -

×

DAY TRADE (LONG & SHORT) STRATEGIES PACKAGE - The Chartist

1 × $272.00

DAY TRADE (LONG & SHORT) STRATEGIES PACKAGE - The Chartist

1 × $272.00 -

×

War Room Psychology Vol. 2 with Pat Mitchell – Trick Trades

1 × $23.00

War Room Psychology Vol. 2 with Pat Mitchell – Trick Trades

1 × $23.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

Introduction to Futures Trading and Live Trade Demonstration with Hari Swaminathan

1 × $6.00

Introduction to Futures Trading and Live Trade Demonstration with Hari Swaminathan

1 × $6.00 -

×

Self-Study Day Trading Course

1 × $39.00

Self-Study Day Trading Course

1 × $39.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

Ultimate Day Trading Program with Maroun4x

1 × $5.00

Ultimate Day Trading Program with Maroun4x

1 × $5.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

Classical Technical Analysis as a Powerful Trading Methodology with John Tirone

1 × $4.00

Classical Technical Analysis as a Powerful Trading Methodology with John Tirone

1 × $4.00 -

×

TheoTrade - Maximum Returns with Infinity Spreads

1 × $23.00

TheoTrade - Maximum Returns with Infinity Spreads

1 × $23.00 -

×

Order Flow Edge – Extreme Edge

1 × $15.00

Order Flow Edge – Extreme Edge

1 × $15.00 -

×

How to Use Spreads to Construct a Trading Roadmap

1 × $6.00

How to Use Spreads to Construct a Trading Roadmap

1 × $6.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Options Trading Course with Consistent Options Income

1 × $5.00

Options Trading Course with Consistent Options Income

1 × $5.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

The Works (Full Educational Course) with Waves 618

1 × $39.00

The Works (Full Educational Course) with Waves 618

1 × $39.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

Investment Valuation

1 × $6.00

Investment Valuation

1 × $6.00 -

×

Option Trading Camp

1 × $15.00

Option Trading Camp

1 × $15.00 -

×

Oil Trading Academy Code 3 Video Course

1 × $6.00

Oil Trading Academy Code 3 Video Course

1 × $6.00 -

×

Perfect Strategy - SPX Daily Options Income with Peter Titus - Marwood Research

1 × $15.00

Perfect Strategy - SPX Daily Options Income with Peter Titus - Marwood Research

1 × $15.00 -

×

Best Trading Strategies Revealed - The Prosperity Trading Course (BTSR)

1 × $78.00

Best Trading Strategies Revealed - The Prosperity Trading Course (BTSR)

1 × $78.00 -

×

The Best of the Professional Traders Journal: Day Trading with Larry Connors

1 × $6.00

The Best of the Professional Traders Journal: Day Trading with Larry Connors

1 × $6.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

Ichimoku 101 Cloud Trading Secrets

1 × $24.00

Ichimoku 101 Cloud Trading Secrets

1 × $24.00 -

×

Evolution Markets FX – TPOT 2.0

1 × $5.00

Evolution Markets FX – TPOT 2.0

1 × $5.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

Astro-Cycles and Speculative Markets with L.J.Jensen

1 × $6.00

Astro-Cycles and Speculative Markets with L.J.Jensen

1 × $6.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

Kaizen On-Demand By Candle Charts

1 × $6.00

Kaizen On-Demand By Candle Charts

1 × $6.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

Comfort Zone Investing: How to Tailor Your Portfolio for High Returns and Peace of Mind with Gillette Edmunds

1 × $6.00

Comfort Zone Investing: How to Tailor Your Portfolio for High Returns and Peace of Mind with Gillette Edmunds

1 × $6.00 -

×

Getting Started in Currency Trading with Michael Duarne Archer, James L.Bickford

1 × $6.00

Getting Started in Currency Trading with Michael Duarne Archer, James L.Bickford

1 × $6.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

The Handbook of Equity Style Management (3rd Ed) with Daniel Coggin & Frank Fabozzi

1 × $6.00

The Handbook of Equity Style Management (3rd Ed) with Daniel Coggin & Frank Fabozzi

1 × $6.00 -

×

Profiting From Forex

1 × $15.00

Profiting From Forex

1 × $15.00 -

×

ZoneTrader Pro v2 (Sep 2013)

1 × $23.00

ZoneTrader Pro v2 (Sep 2013)

1 × $23.00 -

×

ValueSpace. Winning the Battle for Market Leadership with Banwari Mittal, Jagdish N.Sheth

1 × $6.00

ValueSpace. Winning the Battle for Market Leadership with Banwari Mittal, Jagdish N.Sheth

1 × $6.00 -

×

Forex Trading Course 101 & 201

1 × $54.00

Forex Trading Course 101 & 201

1 × $54.00 -

×

Markets 101 Complete Course with Joseph Wang - Central Banking 101

1 × $13.00

Markets 101 Complete Course with Joseph Wang - Central Banking 101

1 × $13.00 -

×

Pips&Profit Trading Course

1 × $13.00

Pips&Profit Trading Course

1 × $13.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

Day Trading the Currency Market: Technical and Fundamental Strategies To Profit from Market Swings with Kathy Lien

1 × $6.00

Day Trading the Currency Market: Technical and Fundamental Strategies To Profit from Market Swings with Kathy Lien

1 × $6.00 -

×

Train & Trade Academy with Omar Agag

1 × $5.00

Train & Trade Academy with Omar Agag

1 × $5.00 -

×

Monthly Mastermind

1 × $6.00

Monthly Mastermind

1 × $6.00 -

×

S&P Reloaded System with Ryan Jones

1 × $4.00

S&P Reloaded System with Ryan Jones

1 × $4.00 -

×

Monster IPO with Trick Trades

1 × $23.00

Monster IPO with Trick Trades

1 × $23.00 -

×

Million Dollar Traders Course with Lex Van Dam

1 × $5.00

Million Dollar Traders Course with Lex Van Dam

1 × $5.00 -

×

Trading Price Action Trading Ranges (Kindle) with Al Brooks

1 × $6.00

Trading Price Action Trading Ranges (Kindle) with Al Brooks

1 × $6.00 -

×

Ron Wagner - Creating a Profitable Trading & Investing Plan + Techniques to Perfect Your Intraday GAP

1 × $6.00

Ron Wagner - Creating a Profitable Trading & Investing Plan + Techniques to Perfect Your Intraday GAP

1 × $6.00 -

×

Advanced Seminar

1 × $31.00

Advanced Seminar

1 × $31.00 -

×

Scanning for Gold with Doug Sutton

1 × $31.00

Scanning for Gold with Doug Sutton

1 × $31.00 -

×

Beginners Guide to Swing Trading Growth Stocks with Brandon Chapman

1 × $5.00

Beginners Guide to Swing Trading Growth Stocks with Brandon Chapman

1 × $5.00 -

×

Intra-Day Trading Techniques CD with Greg Capra

1 × $6.00

Intra-Day Trading Techniques CD with Greg Capra

1 × $6.00 -

×

Adz Trading Academy

1 × $5.00

Adz Trading Academy

1 × $5.00 -

×

FOREX GENERATION MASTER COURSE

1 × $6.00

FOREX GENERATION MASTER COURSE

1 × $6.00 -

×

Bing CPA Bootcamp

1 × $15.00

Bing CPA Bootcamp

1 × $15.00 -

×

FX Goat 4.0 Course

1 × $27.00

FX Goat 4.0 Course

1 × $27.00 -

×

Power Price Action Trading - 8 Weeks Online Training

1 × $6.00

Power Price Action Trading - 8 Weeks Online Training

1 × $6.00 -

×

Netpicks - The Ultimate Trading Machine Complete Set of Courses, TS Indicators & Daily Updates

1 × $6.00

Netpicks - The Ultimate Trading Machine Complete Set of Courses, TS Indicators & Daily Updates

1 × $6.00 -

×

No BS Day Trading Basic Course

1 × $6.00

No BS Day Trading Basic Course

1 × $6.00 -

×

TheVWAP with Zach Hurwitz

1 × $5.00

TheVWAP with Zach Hurwitz

1 × $5.00 -

×

Investing With Giants: Tried and True Stocks That Have Sustained the Test of Time with Linda T.Mead

1 × $6.00

Investing With Giants: Tried and True Stocks That Have Sustained the Test of Time with Linda T.Mead

1 × $6.00 -

×

Inside the Minds Leading Wall Street Investors with Aspatore Books

1 × $6.00

Inside the Minds Leading Wall Street Investors with Aspatore Books

1 × $6.00 -

×

THE NEW SQUEEZE BASIC VERSION: Your Complete System for Timing Explosive Trades with John F. Carter (BASIC VERSION)

1 × $31.00

THE NEW SQUEEZE BASIC VERSION: Your Complete System for Timing Explosive Trades with John F. Carter (BASIC VERSION)

1 × $31.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

High Probability Trading with Marcel Link

1 × $6.00

High Probability Trading with Marcel Link

1 × $6.00 -

×

Trading The Kaltbaum Seven-Step Methodology with Gary Kaltbaum

1 × $4.00

Trading The Kaltbaum Seven-Step Methodology with Gary Kaltbaum

1 × $4.00 -

×

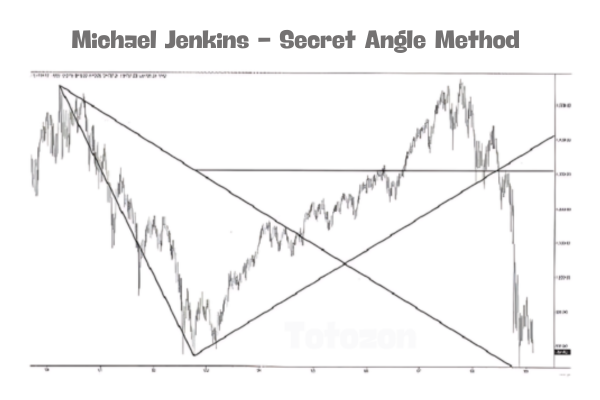

Secret Angle Method with Michael Jenkins

1 × $4.00

Secret Angle Method with Michael Jenkins

1 × $4.00 -

×

Graphs, Application to Speculation with George Cole

1 × $6.00

Graphs, Application to Speculation with George Cole

1 × $6.00 -

×

The Trading Mastermind Forex Workshop 14 CDs with Scott Shubert

1 × $6.00

The Trading Mastermind Forex Workshop 14 CDs with Scott Shubert

1 × $6.00 -

×

War Room Technicals Vol. 3 with Trick Trades

1 × $6.00

War Room Technicals Vol. 3 with Trick Trades

1 × $6.00 -

×

Order Flow Analytics

1 × $54.00

Order Flow Analytics

1 × $54.00 -

×

Winter 2016 Ignite Trading Conference (2016)

1 × $23.00

Winter 2016 Ignite Trading Conference (2016)

1 × $23.00 -

×

Using Fundamental Analysis with Andrew Baxter

1 × $6.00

Using Fundamental Analysis with Andrew Baxter

1 × $6.00 -

×

90 Minute Cycle withThe Algo Trader

1 × $5.00

90 Minute Cycle withThe Algo Trader

1 × $5.00 -

×

The Basics of Swing Trading with Jason Bond

1 × $31.00

The Basics of Swing Trading with Jason Bond

1 × $31.00 -

×

Forex Ulitmatum with Matt Jordan & Patrick Cuthbert

1 × $6.00

Forex Ulitmatum with Matt Jordan & Patrick Cuthbert

1 × $6.00

How to be a Sector Investor with Larry Hungerford & Steve Hungerford

$4.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “How to be a Sector Investor with Larry Hungerford & Steve Hungerford” below:

How to be a Sector Investor with Larry Hungerford & Steve Hungerford

Introduction

Investing can be a complex and daunting task, but focusing on specific sectors can simplify the process and enhance your potential for returns. Larry Hungerford and Steve Hungerford have mastered the art of sector investing, offering valuable insights and strategies. In this article, we will explore how to be a successful sector investor with guidance from these experts.

Understanding Sector Investing

What is Sector Investing?

Sector investing involves allocating your investment portfolio into specific sectors of the economy, such as technology, healthcare, or energy. This strategy aims to capitalize on the growth potential within particular industries.

Benefits of Sector Investing

- Diversification: Spread risk across various sectors.

- Targeted Growth: Focus on high-growth industries.

- Strategic Allocation: Allocate resources based on market trends.

Larry and Steve Hungerford: Pioneers in Sector Investing

Who are Larry and Steve Hungerford?

Larry and Steve Hungerford are renowned investment advisors with decades of experience. They have developed a reputation for their expertise in sector investing, helping clients achieve significant returns.

Their Investment Philosophy

The Hungerfords emphasize a disciplined approach to investing, focusing on thorough research, market analysis, and strategic allocation.

Key Concepts in Sector Investing

1. Identifying Key Sectors

Importance of Sector Analysis

Analyzing various sectors helps identify which industries have the potential for growth. This involves studying economic trends, technological advancements, and consumer behavior.

High-Growth Sectors

- Technology: Rapid innovation and digital transformation.

- Healthcare: Aging population and medical advancements.

- Renewable Energy: Shift towards sustainable energy sources.

2. Analyzing Market Trends

Understanding Market Cycles

Markets move in cycles, and different sectors perform better at different stages. Recognizing these cycles can enhance your investment strategy.

Using Technical Analysis

Technical analysis tools, such as moving averages and trend lines, help identify market trends and make informed decisions.

3. Diversifying Your Portfolio

Why Diversification Matters

Diversification reduces risk by spreading investments across various sectors. This strategy minimizes the impact of poor performance in any single sector.

How to Diversify

- Invest in Multiple Sectors: Allocate funds across various industries.

- Use Sector ETFs: Exchange-traded funds (ETFs) offer a convenient way to diversify.

Developing a Sector Investment Strategy

1. Setting Investment Goals

Define your investment objectives, whether it’s long-term growth, income generation, or capital preservation. Clear goals will guide your sector selection and allocation.

2. Conducting Thorough Research

Research is crucial for identifying promising sectors. Utilize financial reports, industry analyses, and expert opinions to make informed decisions.

3. Creating a Balanced Portfolio

Balance your portfolio by investing in a mix of sectors. Consider factors such as sector growth potential, risk level, and economic conditions.

4. Monitoring and Adjusting

Regularly review your portfolio to ensure it aligns with your investment goals. Adjust your allocations based on market performance and changing economic conditions.

Practical Tips for Sector Investing

1. Stay Informed

Keep up-to-date with market news and trends. Subscribe to financial news outlets, follow industry blogs, and participate in investment forums.

2. Be Patient

Sector investing is a long-term strategy. Be patient and avoid making impulsive decisions based on short-term market fluctuations.

3. Leverage Professional Advice

Consider consulting with financial advisors like Larry and Steve Hungerford to gain expert insights and refine your investment strategy.

4. Use Investment Tools

Utilize online tools and platforms for research, analysis, and portfolio management. These resources can enhance your decision-making process.

Common Mistakes to Avoid

1. Overconcentration

Avoid putting too much of your portfolio into a single sector. This increases risk and can lead to significant losses if that sector underperforms.

2. Ignoring Market Trends

Failing to recognize and adapt to market trends can result in missed opportunities. Stay informed and be prepared to adjust your strategy as needed.

3. Lack of Diversification

Not diversifying your investments can expose you to unnecessary risk. Spread your investments across multiple sectors to mitigate potential losses.

Tools and Resources for Sector Investing

1. Sector ETFs

Sector ETFs provide exposure to specific industries, allowing for easy diversification and targeted investment.

2. Financial News Platforms

Platforms like Bloomberg, Reuters, and CNBC offer real-time news and analysis, keeping you informed about market developments.

3. Investment Research Tools

Tools like Morningstar and Yahoo Finance provide in-depth research and analysis, helping you make informed investment decisions.

Conclusion

Sector investing offers a strategic approach to capitalizing on the growth potential of specific industries. By following the guidance of Larry and Steve Hungerford, you can develop a disciplined investment strategy that leverages market trends and diversification. Remember to stay informed, be patient, and use professional advice to enhance your sector investing success.

FAQs

1. What is sector investing?

Sector investing involves allocating your investment portfolio into specific sectors of the economy to capitalize on growth within particular industries.

2. Who are Larry and Steve Hungerford?

Larry and Steve Hungerford are renowned investment advisors known for their expertise in sector investing.

3. How can I diversify my portfolio in sector investing?

Diversify by investing in multiple sectors and using sector ETFs to spread risk across various industries.

4. Why is diversification important in sector investing?

Diversification reduces risk by minimizing the impact of poor performance in any single sector, enhancing the overall stability of your portfolio.

5. What tools can help with sector investing?

Sector ETFs, financial news platforms, and investment research tools are essential for effective sector investing.

Be the first to review “How to be a Sector Investor with Larry Hungerford & Steve Hungerford” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.