-

×

Cryptocurrency Investing Master Class with Stone River eLearning

1 × $6.00

Cryptocurrency Investing Master Class with Stone River eLearning

1 × $6.00 -

×

Carolyn Boroden Package

1 × $15.00

Carolyn Boroden Package

1 × $15.00 -

×

Evolutionary Decision Trees for Stock Index Options and Futures Arbitrage by S.Markose, E.Tsang,H.Er

1 × $6.00

Evolutionary Decision Trees for Stock Index Options and Futures Arbitrage by S.Markose, E.Tsang,H.Er

1 × $6.00 -

×

Quantifiable Edges Swing Trading Course with Quantifiable Edges

1 × $15.00

Quantifiable Edges Swing Trading Course with Quantifiable Edges

1 × $15.00 -

×

Limitless FX Academy Course

1 × $5.00

Limitless FX Academy Course

1 × $5.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Foundation of Successful Trading - 2 DVDs and Bonus Gann Time Factor 2 DVDs

1 × $31.00

Foundation of Successful Trading - 2 DVDs and Bonus Gann Time Factor 2 DVDs

1 × $31.00 -

×

Profitable Patterns for Stock Trading with Larry Pesavento

1 × $6.00

Profitable Patterns for Stock Trading with Larry Pesavento

1 × $6.00 -

×

How You Can Be Right While the Crowd Loses with Jack Bernstein

1 × $6.00

How You Can Be Right While the Crowd Loses with Jack Bernstein

1 × $6.00 -

×

CFA Pro Level 1 2004 CD - Scheweser

1 × $6.00

CFA Pro Level 1 2004 CD - Scheweser

1 × $6.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

AG Trading Journal with Ace Gazette

1 × $6.00

AG Trading Journal with Ace Gazette

1 × $6.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

Advent Forex Course with Cecil Robles

1 × $6.00

Advent Forex Course with Cecil Robles

1 × $6.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

FuturesTrader71 - webinar series (4 webinars)

1 × $6.00

FuturesTrader71 - webinar series (4 webinars)

1 × $6.00 -

×

Advanced Trader with Nikos Trading Academy

1 × $5.00

Advanced Trader with Nikos Trading Academy

1 × $5.00 -

×

Seasonal Stock Market Trends: The Definitive Guide to Calendar‐Based Stock Market Trading with Jay Kaeppel

1 × $6.00

Seasonal Stock Market Trends: The Definitive Guide to Calendar‐Based Stock Market Trading with Jay Kaeppel

1 × $6.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

Handbook on the Knowledge Economy with David Rooney

1 × $6.00

Handbook on the Knowledge Economy with David Rooney

1 × $6.00 -

×

Trade from Anywhere

1 × $6.00

Trade from Anywhere

1 × $6.00 -

×

Capital Asset Investment with Anthony F.Herbst

1 × $6.00

Capital Asset Investment with Anthony F.Herbst

1 × $6.00 -

×

ICT Mentorship – 2019

1 × $13.00

ICT Mentorship – 2019

1 × $13.00 -

×

Traders Forge with Ryan Litchfield

1 × $6.00

Traders Forge with Ryan Litchfield

1 × $6.00 -

×

A Game Plan for Investing in the 21st Century with Thomas J.Dorsey

1 × $6.00

A Game Plan for Investing in the 21st Century with Thomas J.Dorsey

1 × $6.00 -

×

Precision Pattern Trading with Daryl Guppy

1 × $6.00

Precision Pattern Trading with Daryl Guppy

1 × $6.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

Gamma Options Boot Camp with Bigtrends

1 × $74.00

Gamma Options Boot Camp with Bigtrends

1 × $74.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

After Hour Trading Made Easy with Joe Duarte & Roland Burke

1 × $6.00

After Hour Trading Made Easy with Joe Duarte & Roland Burke

1 × $6.00 -

×

Rob’s Swing Trading Methods with Rob Hoffman

1 × $39.00

Rob’s Swing Trading Methods with Rob Hoffman

1 × $39.00 -

×

Bear Trap Indicator with Markay Latimer

1 × $5.00

Bear Trap Indicator with Markay Latimer

1 × $5.00 -

×

Increasing Vertical Spread Probabilities with Technical Analysis with Doc Severson

1 × $6.00

Increasing Vertical Spread Probabilities with Technical Analysis with Doc Severson

1 × $6.00 -

×

The Management of Equity Investments with Dimitris Chorafas

1 × $6.00

The Management of Equity Investments with Dimitris Chorafas

1 × $6.00 -

×

Code 6 + 7 Course with Oil Trading Academy

1 × $41.00

Code 6 + 7 Course with Oil Trading Academy

1 × $41.00 -

×

Traders Secret Code Complete Course with Mark McRae

1 × $6.00

Traders Secret Code Complete Course with Mark McRae

1 × $6.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

Advanced Nasdaq Trading Techniques with Alan Rich

1 × $6.00

Advanced Nasdaq Trading Techniques with Alan Rich

1 × $6.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

Andy’s EMini Bar – 40 Min System with Joe Ross

1 × $6.00

Andy’s EMini Bar – 40 Min System with Joe Ross

1 × $6.00 -

×

Original Curriculum with Home Options Trading Course

1 × $6.00

Original Curriculum with Home Options Trading Course

1 × $6.00 -

×

Maximum Lots Trading Course with Joe Wright

1 × $34.00

Maximum Lots Trading Course with Joe Wright

1 × $34.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

Foundations of Technical Analysis (Article) with Andrew W.Lo

1 × $6.00

Foundations of Technical Analysis (Article) with Andrew W.Lo

1 × $6.00 -

×

ICT Charter Complete Course (2019)

1 × $13.00

ICT Charter Complete Course (2019)

1 × $13.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

Right Line Trading IndicatorSuite (May 2015)

1 × $31.00

Right Line Trading IndicatorSuite (May 2015)

1 × $31.00 -

×

Trade Australian Share CFDs with Brian Griffin

1 × $6.00

Trade Australian Share CFDs with Brian Griffin

1 × $6.00 -

×

Long/Short Market Dynamics: Trading Strategies for Today's Markets with Clive Corcoran

1 × $6.00

Long/Short Market Dynamics: Trading Strategies for Today's Markets with Clive Corcoran

1 × $6.00 -

×

Pine Script Mastery Course with Matthew Slabosz

1 × $5.00

Pine Script Mastery Course with Matthew Slabosz

1 × $5.00 -

×

Trading The E-Minis for a Living with Don Miller

1 × $6.00

Trading The E-Minis for a Living with Don Miller

1 × $6.00 -

×

Harnessing Explosive Market Turns - 3 DVD with Jeff Greenblatt

1 × $6.00

Harnessing Explosive Market Turns - 3 DVD with Jeff Greenblatt

1 × $6.00 -

×

The Newly Revised Hal Method of Cyclic Analysis with Walter Bressert

1 × $5.00

The Newly Revised Hal Method of Cyclic Analysis with Walter Bressert

1 × $5.00 -

×

Original Charting 1936 with W.D.Gann

1 × $6.00

Original Charting 1936 with W.D.Gann

1 × $6.00 -

×

TradeSafe Mechanical Trading System, Course, and Coaching

1 × $85.00

TradeSafe Mechanical Trading System, Course, and Coaching

1 × $85.00 -

×

Core Concepts Mastery with DreamsFX

1 × $5.00

Core Concepts Mastery with DreamsFX

1 × $5.00 -

×

Revolutionary Proven 3 Step with NFTs Cracked

1 × $6.00

Revolutionary Proven 3 Step with NFTs Cracked

1 × $6.00 -

×

Secret Income with James Altucher

1 × $62.00

Secret Income with James Altucher

1 × $62.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

Mastering Risk Modeling with Excel by Alastair Day

1 × $6.00

Mastering Risk Modeling with Excel by Alastair Day

1 × $6.00 -

×

Speculating with Futures and Traditional Commodities Part II (Liverpool Group) - Noble DraKoln

1 × $6.00

Speculating with Futures and Traditional Commodities Part II (Liverpool Group) - Noble DraKoln

1 × $6.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

Preparing for the Worst: Incorporating Downside Risk in Stock Market Investments with Hrishikesh Vinod & Derrick Reagle

1 × $6.00

Preparing for the Worst: Incorporating Downside Risk in Stock Market Investments with Hrishikesh Vinod & Derrick Reagle

1 × $6.00 -

×

Royal Exchange Forex with Jan Teslar

1 × $6.00

Royal Exchange Forex with Jan Teslar

1 × $6.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Investing Online with Benton E.Gup

1 × $6.00

Investing Online with Benton E.Gup

1 × $6.00 -

×

Futures & Options from A to Z with Russell Wassendorf

1 × $6.00

Futures & Options from A to Z with Russell Wassendorf

1 × $6.00 -

×

Game Plan of a Winning Trader with Mike Podwojski & Vic Noble

1 × $6.00

Game Plan of a Winning Trader with Mike Podwojski & Vic Noble

1 × $6.00 -

×

Market Maps. High Probability Trading Techniques with Timothy Morge

1 × $6.00

Market Maps. High Probability Trading Techniques with Timothy Morge

1 × $6.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Volatility Position Risk Management with Cynthia Kase

1 × $6.00

Volatility Position Risk Management with Cynthia Kase

1 × $6.00 -

×

Mind Over Markets

1 × $6.00

Mind Over Markets

1 × $6.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

How to Trade a Vertical Market

1 × $93.00

How to Trade a Vertical Market

1 × $93.00 -

×

Volume Profile 2023 (Order Flow Pack) with Trader Dale

1 × $5.00

Volume Profile 2023 (Order Flow Pack) with Trader Dale

1 × $5.00 -

×

Quarterly Theory with Trader Daye

1 × $20.00

Quarterly Theory with Trader Daye

1 × $20.00 -

×

Small and Mighty Association with Ryan Lee

1 × $6.00

Small and Mighty Association with Ryan Lee

1 × $6.00 -

×

Secrets to Short Term Trading with Larry Williams

1 × $6.00

Secrets to Short Term Trading with Larry Williams

1 × $6.00 -

×

All Access Online Trading Course with Steve Luke

1 × $6.00

All Access Online Trading Course with Steve Luke

1 × $6.00 -

×

Advanced Forex Mastery Course with Alpha Forex Global

1 × $5.00

Advanced Forex Mastery Course with Alpha Forex Global

1 × $5.00 -

×

Outsmarting Wall Street (3rd Ed) with Daniel Alan Seiver

1 × $6.00

Outsmarting Wall Street (3rd Ed) with Daniel Alan Seiver

1 × $6.00 -

×

The Practical Application of Fibonacci Analysis to Investment Markets

1 × $6.00

The Practical Application of Fibonacci Analysis to Investment Markets

1 × $6.00 -

×

Orderflows Gems 2-Private Sessions with Mike Valtos

1 × $20.00

Orderflows Gems 2-Private Sessions with Mike Valtos

1 × $20.00 -

×

Passages To Profitability: A Comprehensive Guide To Channel Trading with Professor Jeff Bierman, CMT

1 × $6.00

Passages To Profitability: A Comprehensive Guide To Channel Trading with Professor Jeff Bierman, CMT

1 × $6.00 -

×

WYCKOFF TRADING COURSE (WTC) PART I – ANALYSIS (Fall 2021) with Roman Bogomazov

1 × $209.00

WYCKOFF TRADING COURSE (WTC) PART I – ANALYSIS (Fall 2021) with Roman Bogomazov

1 × $209.00 -

×

Profit Generating System with Brian Williams

1 × $6.00

Profit Generating System with Brian Williams

1 × $6.00 -

×

Concerning The More Certain Fundamentals Of Astrology

1 × $6.00

Concerning The More Certain Fundamentals Of Astrology

1 × $6.00 -

×

Marder Videos Reports 2019-2022 with Kevin Marder

1 × $104.00

Marder Videos Reports 2019-2022 with Kevin Marder

1 × $104.00 -

×

Traders Classroom Collection Volume 1-4 with Jeffrey Kennedy

1 × $15.00

Traders Classroom Collection Volume 1-4 with Jeffrey Kennedy

1 × $15.00 -

×

ActiveBeta Indexes. Capturing Systematic Sources of Active Equity Returns (HTML) with Andrew Lo

1 × $6.00

ActiveBeta Indexes. Capturing Systematic Sources of Active Equity Returns (HTML) with Andrew Lo

1 × $6.00 -

×

Master Fibonacci, Symmetry & Consistent Profitable Trading with Day Trading Zones

1 × $23.00

Master Fibonacci, Symmetry & Consistent Profitable Trading with Day Trading Zones

1 × $23.00 -

×

Hubert Senters’ Squeeze Play Strategy & Tradestation Code with Hubert Senters

1 × $6.00

Hubert Senters’ Squeeze Play Strategy & Tradestation Code with Hubert Senters

1 × $6.00 -

×

Pro Indicator Pack with Trade Confident

1 × $15.00

Pro Indicator Pack with Trade Confident

1 × $15.00 -

×

Starting Out in Futures Trading with Mark Powers

1 × $6.00

Starting Out in Futures Trading with Mark Powers

1 × $6.00 -

×

George Wollsten: Expert Stock and Grain Trader with George Bayer

1 × $6.00

George Wollsten: Expert Stock and Grain Trader with George Bayer

1 × $6.00 -

×

All About Bonds, Bond Mutual Funds & Bond ETFs (3rd Ed.) with Esme Faerber

1 × $6.00

All About Bonds, Bond Mutual Funds & Bond ETFs (3rd Ed.) with Esme Faerber

1 × $6.00 -

×

New York Institute of Finance – Futures. A Personal Seminar

1 × $6.00

New York Institute of Finance – Futures. A Personal Seminar

1 × $6.00 -

×

How To Buy with Justin Mamis

1 × $6.00

How To Buy with Justin Mamis

1 × $6.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00

Protecting your Retirement Account in a Correction with Dan Sheridan – Sheridan Options Mentoring

$297.00 Original price was: $297.00.$31.00Current price is: $31.00.

File Size: 1.59 GB

Delivery Time: 1–12 hours

Media Type: Online Course

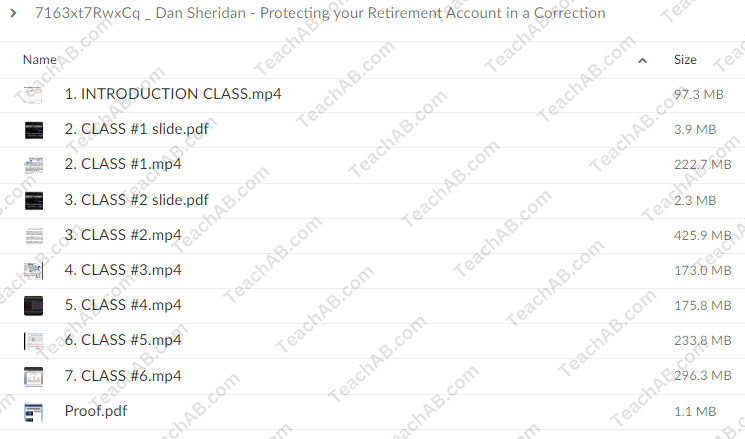

Content Proof: Watch Here!

You may check content proof of “Protecting your Retirement Account in a Correction with Dan Sheridan – Sheridan Options Mentoring” below:

Introduction

Retirement accounts are vital for our future financial security, but they are vulnerable during market corrections. Dan Sheridan of Sheridan Options Mentoring offers strategies to safeguard these accounts. In this article, we’ll explore these strategies, helping you navigate market corrections and protect your retirement savings.

Who is Dan Sheridan?

Background and Expertise

Dan Sheridan is a seasoned options trader with over 30 years of experience. He founded Sheridan Options Mentoring to educate traders on effective options strategies. Dan’s insights are invaluable for both novice and experienced traders.

Sheridan Options Mentoring

Sheridan Options Mentoring offers comprehensive courses and personalized mentoring, focusing on practical options strategies. Their goal is to equip traders with the tools needed to succeed in various market conditions.

Understanding Market Corrections

What is a Market Correction?

A market correction is a decline of 10% or more in the price of a security or index from its recent peak. Corrections are a normal part of market cycles, often caused by economic factors, geopolitical events, or market sentiment shifts.

Impact on Retirement Accounts

During a correction, retirement accounts can suffer significant losses. Protecting these accounts requires proactive strategies to mitigate risks and preserve capital.

Strategies for Protecting Your Retirement Account

Diversification

Spreading Risk

Diversification involves spreading investments across various asset classes to reduce risk. By not putting all your eggs in one basket, you can minimize the impact of a downturn in any single asset class.

Asset Allocation

Proper asset allocation based on your risk tolerance and investment goals can help protect your portfolio. This may include a mix of stocks, bonds, and alternative investments.

Options Strategies

Protective Puts

- What are Protective Puts?: Buying a put option on a stock you own to protect against a decline in its price.

- How to Use Them: Purchase a put option for each stock you want to protect. This strategy acts as an insurance policy, limiting your losses if the stock price falls.

Covered Calls

- What are Covered Calls?: Selling a call option on a stock you own to generate income.

- How to Use Them: Sell a call option at a strike price above the current market price. This provides additional income, which can offset potential losses.

Rebalancing

Maintaining Balance

Rebalancing involves adjusting your portfolio periodically to maintain your desired asset allocation. This helps ensure you’re not overexposed to any single asset class, especially during volatile times.

When to Rebalance

Consider rebalancing at regular intervals, such as quarterly or annually, or when your asset allocation deviates significantly from your target.

Staying Informed

Market Analysis

Stay informed about market trends and economic indicators. Understanding the broader market context can help you make informed decisions about your retirement account.

Education and Mentoring

Engage in continuous learning and consider mentoring from experts like Dan Sheridan. Education can empower you to apply effective strategies and adapt to changing market conditions.

Implementing Dan Sheridan’s Strategies

Step-by-Step Guide

- Assess Your Portfolio:

- Review your current asset allocation and risk exposure.

- Diversify Investments:

- Spread investments across different asset classes to reduce risk.

- Use Protective Puts:

- Buy put options to protect against declines in specific stocks.

- Sell Covered Calls:

- Generate additional income by selling call options on stocks you own.

- Rebalance Regularly:

- Adjust your portfolio to maintain your desired asset allocation.

- Stay Informed:

- Keep up with market trends and continue your education.

Benefits of Dan Sheridan’s Strategies

Risk Mitigation

- Reduce potential losses during market corrections.

- Protect your retirement savings with proven options strategies.

Income Generation

- Generate additional income through covered calls.

- Use this income to offset potential losses or reinvest in your portfolio.

Increased Confidence

- Gain confidence in managing your retirement account.

- Make informed decisions backed by expert strategies.

Common Mistakes to Avoid

Lack of Diversification

- Avoid concentrating investments in a single asset class.

- Ensure a balanced portfolio to spread risk.

Ignoring Rebalancing

- Failing to rebalance can lead to overexposure to certain assets.

- Regularly adjust your portfolio to maintain balance.

Emotional Decisions

- Avoid making impulsive decisions based on market volatility.

- Stick to your strategy and make informed choices.

Conclusion

Protecting your retirement account during market corrections is crucial for long-term financial security. Dan Sheridan’s strategies, including diversification, protective puts, covered calls, and regular rebalancing, offer practical solutions to safeguard your savings. By staying informed and applying these techniques, you can navigate market corrections with confidence and ensure a secure retirement.

Commonly Asked Questions:

- Business Model Innovation: Accept the truth of a legitimate business! Our strategy is organising a group buy in which participants share the costs. We use these cash to acquire popular courses from sale pages and make them available to people with limited financial resources. Despite the authors’ worries, our clients love the cost and accessibility we give.

- The Legal Environment: Yes or No The legality of our activity is ambiguous. While we don’t have specific permission from the course authors to resell the material, there is a technicality at work. The author did not specify any limits on resale when purchasing the course. This legal intricacy is both an opportunity for us and a boon for individuals looking for low-cost access.

- Quality Control: Uncovering the Truth

Getting to the heart of the issue – quality. Purchasing the course straight from the sale page guarantees that all documents and resources are the same as those obtained through traditional channels.

However, we distinguish ourselves by going beyond personal research and resale. It is crucial to note that we are not the official course providers, which means that the following premium services are not included in our package:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not permitted.

- No access to the author’s private membership forum.

- There is no direct email support available from the author or their team.

We operate independently, with the goal of bridging the pricing gap without the extra services provided by official course channels. Your comprehension of our distinct approach is much appreciated.

Be the first to review “Protecting your Retirement Account in a Correction with Dan Sheridan – Sheridan Options Mentoring” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Reviews

There are no reviews yet.