-

×

Smashing False Breakouts with Better System Trader

1 × $5.00

Smashing False Breakouts with Better System Trader

1 × $5.00 -

×

Opening Range Breakout Indicator for ThinkorSwim

1 × $6.00

Opening Range Breakout Indicator for ThinkorSwim

1 × $6.00 -

×

Fibonacci Ratios with Pattern Recognition - Larry Pesavento & Steven Shapiro

1 × $6.00

Fibonacci Ratios with Pattern Recognition - Larry Pesavento & Steven Shapiro

1 × $6.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

The New Science of Asset Allocation with Thomas Schneeweis

1 × $6.00

The New Science of Asset Allocation with Thomas Schneeweis

1 × $6.00 -

×

The Astrology of the Old Testament or The Lost World Regained with Karl Anderson

1 × $6.00

The Astrology of the Old Testament or The Lost World Regained with Karl Anderson

1 × $6.00 -

×

Cluster Delta with Gova Trading Academy

1 × $5.00

Cluster Delta with Gova Trading Academy

1 × $5.00 -

×

Beginner Forex Mastery Course with Harrison Uwah - MHU FX Academy

1 × $78.00

Beginner Forex Mastery Course with Harrison Uwah - MHU FX Academy

1 × $78.00 -

×

Market Structure Masterclass with Braveheart Trading

1 × $5.00

Market Structure Masterclass with Braveheart Trading

1 × $5.00 -

×

Boomer Quick Profits Day Trading Course

1 × $23.00

Boomer Quick Profits Day Trading Course

1 × $23.00 -

×

Trading Freak Academy (Full Course) with JP - Trading Freak

1 × $5.00

Trading Freak Academy (Full Course) with JP - Trading Freak

1 × $5.00 -

×

![ACD Method [Video (6 MP4s)] with Mark Fisher](https://www.totozon.com/wp-content/uploads/2024/05/ACD-Method-Video-6-MP4s-with-Mark-Fisher.jpg) ACD Method [Video (6 MP4s)] with Mark Fisher

1 × $6.00

ACD Method [Video (6 MP4s)] with Mark Fisher

1 × $6.00 -

×

Day Trading Futures, Stocks, and Crypto

1 × $5.00

Day Trading Futures, Stocks, and Crypto

1 × $5.00 -

×

Technical Analysis & Options Strategies with K.H.Shaleen

1 × $6.00

Technical Analysis & Options Strategies with K.H.Shaleen

1 × $6.00 -

×

War Room Psychology Vol. 1 with Pat Mitchell – Trick Trades

1 × $23.00

War Room Psychology Vol. 1 with Pat Mitchell – Trick Trades

1 × $23.00 -

×

Analysis Of Entry Signals (Technicals) with Joe Marwood

1 × $15.00

Analysis Of Entry Signals (Technicals) with Joe Marwood

1 × $15.00 -

×

Foundations of Technical Analysis (Article) with Andrew W.Lo

1 × $6.00

Foundations of Technical Analysis (Article) with Andrew W.Lo

1 × $6.00 -

×

Compound Stock Earnings Advanced Charting (Video 1.19 GB)

1 × $15.00

Compound Stock Earnings Advanced Charting (Video 1.19 GB)

1 × $15.00 -

×

A Process for Prudential Institutional Investment with Bancroft, Caldwell, McSweeny

1 × $6.00

A Process for Prudential Institutional Investment with Bancroft, Caldwell, McSweeny

1 × $6.00 -

×

Get to know the VIX Index (aka The Fear Index)

1 × $15.00

Get to know the VIX Index (aka The Fear Index)

1 × $15.00 -

×

Crypto for Starters: All You Need to Know to Start Investing and Trading Cryptocurrency on Binance with Malcolm Yard

1 × $5.00

Crypto for Starters: All You Need to Know to Start Investing and Trading Cryptocurrency on Binance with Malcolm Yard

1 × $5.00 -

×

Artificial Neural Networks Technology with Dave Anderson, George McNeill

1 × $6.00

Artificial Neural Networks Technology with Dave Anderson, George McNeill

1 × $6.00 -

×

An Introduction to Option Trading Success with James Bittman

1 × $6.00

An Introduction to Option Trading Success with James Bittman

1 × $6.00 -

×

Algo Wizard Essentials Course with Srategy Quant

1 × $13.00

Algo Wizard Essentials Course with Srategy Quant

1 × $13.00 -

×

The Logical Trader: Applying a Method to the Madness with Mark Fisher

1 × $6.00

The Logical Trader: Applying a Method to the Madness with Mark Fisher

1 × $6.00 -

×

A- Z Educational Trading Course with InvestiTrade

1 × $39.00

A- Z Educational Trading Course with InvestiTrade

1 × $39.00 -

×

Learn Plan Profit 2.0 with Ricky Gutierrez

1 × $39.00

Learn Plan Profit 2.0 with Ricky Gutierrez

1 × $39.00 -

×

All About Stocks (3rd Ed.) withEsme E.Faerber

1 × $6.00

All About Stocks (3rd Ed.) withEsme E.Faerber

1 × $6.00 -

×

Heiken Ashi 101

1 × $15.00

Heiken Ashi 101

1 × $15.00 -

×

Behavioral Trading with Woody Dorsey

1 × $6.00

Behavioral Trading with Woody Dorsey

1 × $6.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

Short-Term Trading, Long-Term Profits with John Leizman - McGraw-Hill

1 × $6.00

Short-Term Trading, Long-Term Profits with John Leizman - McGraw-Hill

1 × $6.00 -

×

Advanced Trading Strategies with Larry Connors

1 × $6.00

Advanced Trading Strategies with Larry Connors

1 × $6.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

Analysis Of Entry Signals Part Two (Fundamentals) with Joe Marwood

1 × $23.00

Analysis Of Entry Signals Part Two (Fundamentals) with Joe Marwood

1 × $23.00 -

×

Exploring MetaStock Basic with Martin Pring

1 × $6.00

Exploring MetaStock Basic with Martin Pring

1 × $6.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

The Stock Market Trading Secrets of the Late (1940, scaned)

1 × $6.00

The Stock Market Trading Secrets of the Late (1940, scaned)

1 × $6.00 -

×

Applications of Abstract Algebra with Maple - Richard E.Kline, Neil Sigmon, Ernst Stitzinger

1 × $6.00

Applications of Abstract Algebra with Maple - Richard E.Kline, Neil Sigmon, Ernst Stitzinger

1 × $6.00 -

×

Trading by the Book (tradingeducators.com)

1 × $6.00

Trading by the Book (tradingeducators.com)

1 × $6.00 -

×

WD Gann’s Master Time Factor DVD With Miles Wilson Walker

1 × $6.00

WD Gann’s Master Time Factor DVD With Miles Wilson Walker

1 × $6.00 -

×

ShredderFX Compete Courses & Indicators

1 × $6.00

ShredderFX Compete Courses & Indicators

1 × $6.00 -

×

Traders Forge with Ryan Litchfield

1 × $6.00

Traders Forge with Ryan Litchfield

1 × $6.00 -

×

Advanced Pattern Recognition with John Cameron

1 × $23.00

Advanced Pattern Recognition with John Cameron

1 × $23.00 -

×

Activedaytrader - Mastering Technicals

1 × $15.00

Activedaytrader - Mastering Technicals

1 × $15.00 -

×

Trade What You See, Not What You Believe with Larry Pesavento

1 × $6.00

Trade What You See, Not What You Believe with Larry Pesavento

1 × $6.00 -

×

Mining for Golden Trading Opportunities with Jake Bernstein

1 × $8.00

Mining for Golden Trading Opportunities with Jake Bernstein

1 × $8.00 -

×

Sacredscience - Raphael – Book of Fate

1 × $6.00

Sacredscience - Raphael – Book of Fate

1 × $6.00 -

×

CBOT Seminar on Market Profile (101 & 102) with Alex Benjamin

1 × $6.00

CBOT Seminar on Market Profile (101 & 102) with Alex Benjamin

1 × $6.00 -

×

The Gorilla Game (Revised Ed.) with Greoffrey A.Moore & Paul Johnson

1 × $6.00

The Gorilla Game (Revised Ed.) with Greoffrey A.Moore & Paul Johnson

1 × $6.00 -

×

4 Day Trading Bootcamp

1 × $31.00

4 Day Trading Bootcamp

1 × $31.00 -

×

The Stock Selector System with Michael Sheimo

1 × $6.00

The Stock Selector System with Michael Sheimo

1 × $6.00 -

×

Advanced Options Concepts - Probability, Greeks, Simulation

1 × $6.00

Advanced Options Concepts - Probability, Greeks, Simulation

1 × $6.00 -

×

Alexander Elder Package ( Discount 28% )

1 × $31.00

Alexander Elder Package ( Discount 28% )

1 × $31.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

How Do You See Risk? A Guide to Evaluating & Applying Technical Volatility Indicators class with Theotrade

1 × $4.00

How Do You See Risk? A Guide to Evaluating & Applying Technical Volatility Indicators class with Theotrade

1 × $4.00 -

×

Active Investing courses notes with Alan Hull

1 × $6.00

Active Investing courses notes with Alan Hull

1 × $6.00 -

×

Traders Secret Library

1 × $6.00

Traders Secret Library

1 × $6.00 -

×

Complete Best Practices - Weekly Options Income Trading System with Weekly Options Academy

1 × $23.00

Complete Best Practices - Weekly Options Income Trading System with Weekly Options Academy

1 × $23.00 -

×

The Traders Mindset Course (the-traders-mindset.com) with Chris Mathews

1 × $6.00

The Traders Mindset Course (the-traders-mindset.com) with Chris Mathews

1 × $6.00 -

×

Futures & Options from A to Z with Russell Wassendorf

1 × $6.00

Futures & Options from A to Z with Russell Wassendorf

1 × $6.00 -

×

Edge Trading Group with Edge Elite

1 × $6.00

Edge Trading Group with Edge Elite

1 × $6.00 -

×

Bird Watch in Lion Country 2010 Ed with Dirk Du Toit

1 × $6.00

Bird Watch in Lion Country 2010 Ed with Dirk Du Toit

1 × $6.00 -

×

The Methodology Revealed with Nick Santiago & Gareth Soloway - InTheMoneyStocks

1 × $209.00

The Methodology Revealed with Nick Santiago & Gareth Soloway - InTheMoneyStocks

1 × $209.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

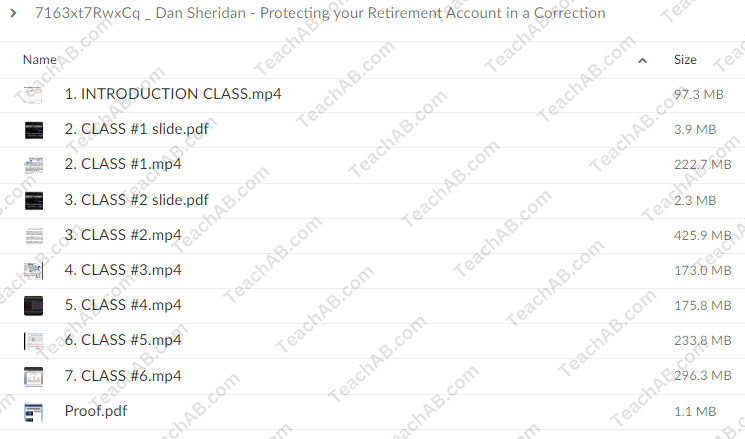

Protecting your Retirement Account in a Correction with Dan Sheridan – Sheridan Options Mentoring

$297.00 Original price was: $297.00.$31.00Current price is: $31.00.

File Size: 1.59 GB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Protecting your Retirement Account in a Correction with Dan Sheridan – Sheridan Options Mentoring” below:

Introduction

Retirement accounts are vital for our future financial security, but they are vulnerable during market corrections. Dan Sheridan of Sheridan Options Mentoring offers strategies to safeguard these accounts. In this article, we’ll explore these strategies, helping you navigate market corrections and protect your retirement savings.

Who is Dan Sheridan?

Background and Expertise

Dan Sheridan is a seasoned options trader with over 30 years of experience. He founded Sheridan Options Mentoring to educate traders on effective options strategies. Dan’s insights are invaluable for both novice and experienced traders.

Sheridan Options Mentoring

Sheridan Options Mentoring offers comprehensive courses and personalized mentoring, focusing on practical options strategies. Their goal is to equip traders with the tools needed to succeed in various market conditions.

Understanding Market Corrections

What is a Market Correction?

A market correction is a decline of 10% or more in the price of a security or index from its recent peak. Corrections are a normal part of market cycles, often caused by economic factors, geopolitical events, or market sentiment shifts.

Impact on Retirement Accounts

During a correction, retirement accounts can suffer significant losses. Protecting these accounts requires proactive strategies to mitigate risks and preserve capital.

Strategies for Protecting Your Retirement Account

Diversification

Spreading Risk

Diversification involves spreading investments across various asset classes to reduce risk. By not putting all your eggs in one basket, you can minimize the impact of a downturn in any single asset class.

Asset Allocation

Proper asset allocation based on your risk tolerance and investment goals can help protect your portfolio. This may include a mix of stocks, bonds, and alternative investments.

Options Strategies

Protective Puts

- What are Protective Puts?: Buying a put option on a stock you own to protect against a decline in its price.

- How to Use Them: Purchase a put option for each stock you want to protect. This strategy acts as an insurance policy, limiting your losses if the stock price falls.

Covered Calls

- What are Covered Calls?: Selling a call option on a stock you own to generate income.

- How to Use Them: Sell a call option at a strike price above the current market price. This provides additional income, which can offset potential losses.

Rebalancing

Maintaining Balance

Rebalancing involves adjusting your portfolio periodically to maintain your desired asset allocation. This helps ensure you’re not overexposed to any single asset class, especially during volatile times.

When to Rebalance

Consider rebalancing at regular intervals, such as quarterly or annually, or when your asset allocation deviates significantly from your target.

Staying Informed

Market Analysis

Stay informed about market trends and economic indicators. Understanding the broader market context can help you make informed decisions about your retirement account.

Education and Mentoring

Engage in continuous learning and consider mentoring from experts like Dan Sheridan. Education can empower you to apply effective strategies and adapt to changing market conditions.

Implementing Dan Sheridan’s Strategies

Step-by-Step Guide

- Assess Your Portfolio:

- Review your current asset allocation and risk exposure.

- Diversify Investments:

- Spread investments across different asset classes to reduce risk.

- Use Protective Puts:

- Buy put options to protect against declines in specific stocks.

- Sell Covered Calls:

- Generate additional income by selling call options on stocks you own.

- Rebalance Regularly:

- Adjust your portfolio to maintain your desired asset allocation.

- Stay Informed:

- Keep up with market trends and continue your education.

Benefits of Dan Sheridan’s Strategies

Risk Mitigation

- Reduce potential losses during market corrections.

- Protect your retirement savings with proven options strategies.

Income Generation

- Generate additional income through covered calls.

- Use this income to offset potential losses or reinvest in your portfolio.

Increased Confidence

- Gain confidence in managing your retirement account.

- Make informed decisions backed by expert strategies.

Common Mistakes to Avoid

Lack of Diversification

- Avoid concentrating investments in a single asset class.

- Ensure a balanced portfolio to spread risk.

Ignoring Rebalancing

- Failing to rebalance can lead to overexposure to certain assets.

- Regularly adjust your portfolio to maintain balance.

Emotional Decisions

- Avoid making impulsive decisions based on market volatility.

- Stick to your strategy and make informed choices.

Conclusion

Protecting your retirement account during market corrections is crucial for long-term financial security. Dan Sheridan’s strategies, including diversification, protective puts, covered calls, and regular rebalancing, offer practical solutions to safeguard your savings. By staying informed and applying these techniques, you can navigate market corrections with confidence and ensure a secure retirement.

Commonly Asked Questions:

- Business Model Innovation: Accept the truth of a legitimate business! Our strategy is organising a group buy in which participants share the costs. We use these cash to acquire popular courses from sale pages and make them available to people with limited financial resources. Despite the authors’ worries, our clients love the cost and accessibility we give.

- The Legal Environment: Yes or No The legality of our activity is ambiguous. While we don’t have specific permission from the course authors to resell the material, there is a technicality at work. The author did not specify any limits on resale when purchasing the course. This legal intricacy is both an opportunity for us and a boon for individuals looking for low-cost access.

- Quality Control: Uncovering the Truth

Getting to the heart of the issue – quality. Purchasing the course straight from the sale page guarantees that all documents and resources are the same as those obtained through traditional channels.

However, we distinguish ourselves by going beyond personal research and resale. It is crucial to note that we are not the official course providers, which means that the following premium services are not included in our package:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not permitted.

- No access to the author’s private membership forum.

- There is no direct email support available from the author or their team.

We operate independently, with the goal of bridging the pricing gap without the extra services provided by official course channels. Your comprehension of our distinct approach is much appreciated.

Be the first to review “Protecting your Retirement Account in a Correction with Dan Sheridan – Sheridan Options Mentoring” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.