-

×

Essentials For Amibroker with Matt Radtke - Marwood Research

1 × $15.00

Essentials For Amibroker with Matt Radtke - Marwood Research

1 × $15.00 -

×

Unlearn and Relearn with Market Fluidity

1 × $6.00

Unlearn and Relearn with Market Fluidity

1 × $6.00 -

×

Mathematical Problems in Image Processing with Charles E.Chidume

1 × $6.00

Mathematical Problems in Image Processing with Charles E.Chidume

1 × $6.00 -

×

How I Made One Million Dollars with Larry Williams

1 × $6.00

How I Made One Million Dollars with Larry Williams

1 × $6.00 -

×

Trading Pairs: Capturing Profits and Hedging Risk with Statistical Arbitrage Strategies - Mark Whistler

1 × $6.00

Trading Pairs: Capturing Profits and Hedging Risk with Statistical Arbitrage Strategies - Mark Whistler

1 × $6.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

Train & Trade Academy with Omar Agag

1 × $5.00

Train & Trade Academy with Omar Agag

1 × $5.00 -

×

The Complete Penny Stock Course: Learn How To Generate Profits Consistently By Trading Penny Stocks With Jamil Ben Alluch

1 × $6.00

The Complete Penny Stock Course: Learn How To Generate Profits Consistently By Trading Penny Stocks With Jamil Ben Alluch

1 × $6.00 -

×

ChangeWave Investing 2.0 with Tobin Smith

1 × $6.00

ChangeWave Investing 2.0 with Tobin Smith

1 × $6.00 -

×

The Way to Trade with John Piper

1 × $6.00

The Way to Trade with John Piper

1 × $6.00 -

×

The Ultimate Coach's Corner Forex Video Library with Vic Noble & Darko Ali

1 × $39.00

The Ultimate Coach's Corner Forex Video Library with Vic Noble & Darko Ali

1 × $39.00 -

×

Daryl Guppy Tutorials In Technical Analysis (2000-2001-2003-2004)

1 × $6.00

Daryl Guppy Tutorials In Technical Analysis (2000-2001-2003-2004)

1 × $6.00 -

×

Chart Your Way to Profits (2nd Ed.) with Tim Knight

1 × $6.00

Chart Your Way to Profits (2nd Ed.) with Tim Knight

1 × $6.00 -

×

The Streetsmart Guide to Timing the Stock Market with Colin Alexander

1 × $6.00

The Streetsmart Guide to Timing the Stock Market with Colin Alexander

1 × $6.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

The Ultimate Forex System

1 × $6.00

The Ultimate Forex System

1 × $6.00 -

×

Beat the Bear with Jea Yu

1 × $6.00

Beat the Bear with Jea Yu

1 × $6.00 -

×

Trading Options Using Auction Market Principles with Alexander Trading

1 × $54.00

Trading Options Using Auction Market Principles with Alexander Trading

1 × $54.00 -

×

Vajex Trading Mentorship Program

1 × $13.00

Vajex Trading Mentorship Program

1 × $13.00 -

×

Trading Full Circle the Complete Underground Trader System for Timing with Jea Yu

1 × $6.00

Trading Full Circle the Complete Underground Trader System for Timing with Jea Yu

1 × $6.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

Wave Trading

1 × $23.00

Wave Trading

1 × $23.00 -

×

DayTrading the S&P 500 & TS Code with Afshin Taghechian

1 × $6.00

DayTrading the S&P 500 & TS Code with Afshin Taghechian

1 × $6.00 -

×

WealthFRX Trading Mastery 3.0

1 × $5.00

WealthFRX Trading Mastery 3.0

1 × $5.00 -

×

BookMap Advanced v6.1

1 × $6.00

BookMap Advanced v6.1

1 × $6.00 -

×

Crypto Momentum Trading System with Pollinate Trading

1 × $34.00

Crypto Momentum Trading System with Pollinate Trading

1 × $34.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

Follow the Fed to Investment Success with Douglas Roberts

1 × $6.00

Follow the Fed to Investment Success with Douglas Roberts

1 × $6.00 -

×

Volatility Position Risk Management with Cynthia Kase

1 × $6.00

Volatility Position Risk Management with Cynthia Kase

1 × $6.00 -

×

Build a Professional Trading System using Amibroker with Trading Tuitions - Marwood Research

1 × $23.00

Build a Professional Trading System using Amibroker with Trading Tuitions - Marwood Research

1 × $23.00 -

×

Tradezilla 2.0

1 × $5.00

Tradezilla 2.0

1 × $5.00 -

×

W.D. Gann’s Secret Divergence Method with Hexatrade350

1 × $5.00

W.D. Gann’s Secret Divergence Method with Hexatrade350

1 × $5.00 -

×

VSA Advanced Mentorship Course

1 × $31.00

VSA Advanced Mentorship Course

1 × $31.00 -

×

Volume Analysis – Smart Money

1 × $6.00

Volume Analysis – Smart Money

1 × $6.00 -

×

The Spiral Calendar and Its Effect on Financial Markets and Human Events with Christopher Carolan

1 × $6.00

The Spiral Calendar and Its Effect on Financial Markets and Human Events with Christopher Carolan

1 × $6.00 -

×

Day Trading Academy

1 × $54.00

Day Trading Academy

1 × $54.00 -

×

How to Make 1 Million Per Year Like Larry Williams with Larry Williams

1 × $6.00

How to Make 1 Million Per Year Like Larry Williams with Larry Williams

1 × $6.00 -

×

Neall Concord-Cushing - Secret of Forecasting Using Wave59 Tools (Book I & II)

1 × $6.00

Neall Concord-Cushing - Secret of Forecasting Using Wave59 Tools (Book I & II)

1 × $6.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Bookmap Masterclass with Trading To Win

1 × $6.00

Bookmap Masterclass with Trading To Win

1 × $6.00 -

×

Using Intermarket Analysis to Make Smarter Traders with Murray Ruggiero

1 × $4.00

Using Intermarket Analysis to Make Smarter Traders with Murray Ruggiero

1 × $4.00 -

×

The Guerrilla Online Video Course with Guerrilla Trading

1 × $5.00

The Guerrilla Online Video Course with Guerrilla Trading

1 × $5.00 -

×

The Thirty-Second Jewel in PDF with Constance Brown

1 × $8.00

The Thirty-Second Jewel in PDF with Constance Brown

1 × $8.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

Central Bank Trading Strategies with AXIA Futures

1 × $5.00

Central Bank Trading Strategies with AXIA Futures

1 × $5.00 -

×

Low Timeframe Supply & Demand with RROP

1 × $5.00

Low Timeframe Supply & Demand with RROP

1 × $5.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

Vom Einsteiger zum Mastertrader 2.0 with Mehrwert Garantier

1 × $109.00

Vom Einsteiger zum Mastertrader 2.0 with Mehrwert Garantier

1 × $109.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Newsbeat Bandits Program July 2019

1 × $23.00

Newsbeat Bandits Program July 2019

1 × $23.00 -

×

Weekly Power Options Strategies

1 × $6.00

Weekly Power Options Strategies

1 × $6.00 -

×

W.O.W. Guaranteed Income with Chuck Hughes

1 × $31.00

W.O.W. Guaranteed Income with Chuck Hughes

1 × $31.00 -

×

Tradingology Complete Options Course with David Vallieres

1 × $6.00

Tradingology Complete Options Course with David Vallieres

1 × $6.00 -

×

Options University - 3rd Anual Forex Superconference

1 × $3.00

Options University - 3rd Anual Forex Superconference

1 × $3.00 -

×

ValueSpace. Winning the Battle for Market Leadership with Banwari Mittal, Jagdish N.Sheth

1 × $6.00

ValueSpace. Winning the Battle for Market Leadership with Banwari Mittal, Jagdish N.Sheth

1 × $6.00 -

×

Complete Book Set

1 × $8.00

Complete Book Set

1 × $8.00 -

×

Tom Williams Final Mentorship Course

1 × $6.00

Tom Williams Final Mentorship Course

1 × $6.00 -

×

Ultimate MT4 Course

1 × $15.00

Ultimate MT4 Course

1 × $15.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Top Futures Day Trading Course DVD

1 × $6.00

Top Futures Day Trading Course DVD

1 × $6.00 -

×

Trade Execution & Trade Management with Kam Dhadwar

1 × $6.00

Trade Execution & Trade Management with Kam Dhadwar

1 × $6.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

WYCKOFF TRADING COURSE (WTC) PART I – ANALYSIS (Fall 2021) with Roman Bogomazov

1 × $209.00

WYCKOFF TRADING COURSE (WTC) PART I – ANALYSIS (Fall 2021) with Roman Bogomazov

1 × $209.00 -

×

Building a Better Trader with Glenn Ring

1 × $6.00

Building a Better Trader with Glenn Ring

1 × $6.00 -

×

CFA Level 1,2,3 - Study Guides 2006

1 × $6.00

CFA Level 1,2,3 - Study Guides 2006

1 × $6.00 -

×

Using Long, Medium and Short Term Trends to Forecast Turning Points (Article)

1 × $6.00

Using Long, Medium and Short Term Trends to Forecast Turning Points (Article)

1 × $6.00 -

×

Top 20 VSA Principles & How to Trade Them

1 × $31.00

Top 20 VSA Principles & How to Trade Them

1 × $31.00 -

×

Concerning The More Certain Fundamentals Of Astrology

1 × $6.00

Concerning The More Certain Fundamentals Of Astrology

1 × $6.00 -

×

Edges For Ledges 2 with Trader Dante

1 × $5.00

Edges For Ledges 2 with Trader Dante

1 × $5.00 -

×

TrimTabs Investing with Charles Biderman & David Santschi

1 × $6.00

TrimTabs Investing with Charles Biderman & David Santschi

1 × $6.00 -

×

Darvas Trading WorkBook

1 × $6.00

Darvas Trading WorkBook

1 × $6.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

Module 3 – Short Term Time Frame Trading In The Bund

1 × $6.00

Module 3 – Short Term Time Frame Trading In The Bund

1 × $6.00 -

×

What Products to Watch and Why Class with Don Kaufman

1 × $6.00

What Products to Watch and Why Class with Don Kaufman

1 × $6.00 -

×

Investors Underground - Tandem Trader

1 × $5.00

Investors Underground - Tandem Trader

1 × $5.00 -

×

The Trader Mind Program

1 × $6.00

The Trader Mind Program

1 × $6.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

Futures Day Trading And Order Flow Course with Trade Pro Academy

1 × $15.00

Futures Day Trading And Order Flow Course with Trade Pro Academy

1 × $15.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

The Pocket Mortgage Guide: 60 of the Most Important Questions and Answers About Your Home Loan with Jack Guttentag

1 × $6.00

The Pocket Mortgage Guide: 60 of the Most Important Questions and Answers About Your Home Loan with Jack Guttentag

1 × $6.00 -

×

Trading Non-Farm Payroll Report

1 × $6.00

Trading Non-Farm Payroll Report

1 × $6.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

Video On Demand Pathway with Trade With Profile

1 × $5.00

Video On Demand Pathway with Trade With Profile

1 × $5.00 -

×

Workshop Earnings Powerplay with Base Camp Trading

1 × $17.00

Workshop Earnings Powerplay with Base Camp Trading

1 × $17.00 -

×

Day Trading Futures, Stocks, and Crypto

1 × $5.00

Day Trading Futures, Stocks, and Crypto

1 × $5.00 -

×

Analysis of Equity Investments: Valuation with John Stowe, Thomas Robinson, Jerald Pinto & Dennis McLeavey

1 × $6.00

Analysis of Equity Investments: Valuation with John Stowe, Thomas Robinson, Jerald Pinto & Dennis McLeavey

1 × $6.00 -

×

Trade Chart Patterns Like The Pros with Suri Duddella

1 × $6.00

Trade Chart Patterns Like The Pros with Suri Duddella

1 × $6.00

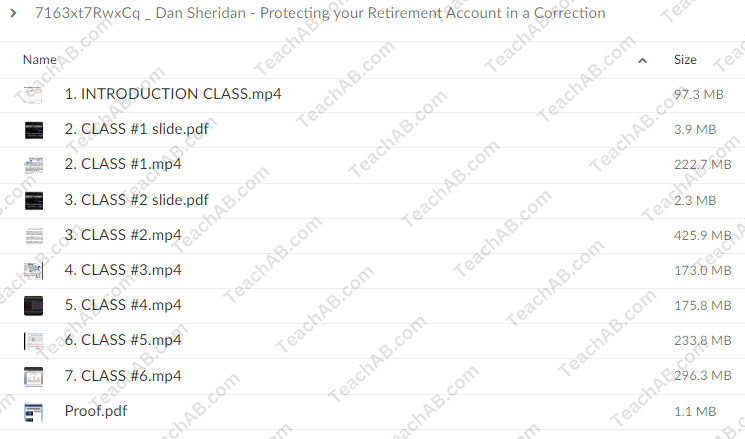

Protecting your Retirement Account in a Correction with Dan Sheridan – Sheridan Options Mentoring

$297.00 Original price was: $297.00.$31.00Current price is: $31.00.

File Size: 1.59 GB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Protecting your Retirement Account in a Correction with Dan Sheridan – Sheridan Options Mentoring” below:

Introduction

Retirement accounts are vital for our future financial security, but they are vulnerable during market corrections. Dan Sheridan of Sheridan Options Mentoring offers strategies to safeguard these accounts. In this article, we’ll explore these strategies, helping you navigate market corrections and protect your retirement savings.

Who is Dan Sheridan?

Background and Expertise

Dan Sheridan is a seasoned options trader with over 30 years of experience. He founded Sheridan Options Mentoring to educate traders on effective options strategies. Dan’s insights are invaluable for both novice and experienced traders.

Sheridan Options Mentoring

Sheridan Options Mentoring offers comprehensive courses and personalized mentoring, focusing on practical options strategies. Their goal is to equip traders with the tools needed to succeed in various market conditions.

Understanding Market Corrections

What is a Market Correction?

A market correction is a decline of 10% or more in the price of a security or index from its recent peak. Corrections are a normal part of market cycles, often caused by economic factors, geopolitical events, or market sentiment shifts.

Impact on Retirement Accounts

During a correction, retirement accounts can suffer significant losses. Protecting these accounts requires proactive strategies to mitigate risks and preserve capital.

Strategies for Protecting Your Retirement Account

Diversification

Spreading Risk

Diversification involves spreading investments across various asset classes to reduce risk. By not putting all your eggs in one basket, you can minimize the impact of a downturn in any single asset class.

Asset Allocation

Proper asset allocation based on your risk tolerance and investment goals can help protect your portfolio. This may include a mix of stocks, bonds, and alternative investments.

Options Strategies

Protective Puts

- What are Protective Puts?: Buying a put option on a stock you own to protect against a decline in its price.

- How to Use Them: Purchase a put option for each stock you want to protect. This strategy acts as an insurance policy, limiting your losses if the stock price falls.

Covered Calls

- What are Covered Calls?: Selling a call option on a stock you own to generate income.

- How to Use Them: Sell a call option at a strike price above the current market price. This provides additional income, which can offset potential losses.

Rebalancing

Maintaining Balance

Rebalancing involves adjusting your portfolio periodically to maintain your desired asset allocation. This helps ensure you’re not overexposed to any single asset class, especially during volatile times.

When to Rebalance

Consider rebalancing at regular intervals, such as quarterly or annually, or when your asset allocation deviates significantly from your target.

Staying Informed

Market Analysis

Stay informed about market trends and economic indicators. Understanding the broader market context can help you make informed decisions about your retirement account.

Education and Mentoring

Engage in continuous learning and consider mentoring from experts like Dan Sheridan. Education can empower you to apply effective strategies and adapt to changing market conditions.

Implementing Dan Sheridan’s Strategies

Step-by-Step Guide

- Assess Your Portfolio:

- Review your current asset allocation and risk exposure.

- Diversify Investments:

- Spread investments across different asset classes to reduce risk.

- Use Protective Puts:

- Buy put options to protect against declines in specific stocks.

- Sell Covered Calls:

- Generate additional income by selling call options on stocks you own.

- Rebalance Regularly:

- Adjust your portfolio to maintain your desired asset allocation.

- Stay Informed:

- Keep up with market trends and continue your education.

Benefits of Dan Sheridan’s Strategies

Risk Mitigation

- Reduce potential losses during market corrections.

- Protect your retirement savings with proven options strategies.

Income Generation

- Generate additional income through covered calls.

- Use this income to offset potential losses or reinvest in your portfolio.

Increased Confidence

- Gain confidence in managing your retirement account.

- Make informed decisions backed by expert strategies.

Common Mistakes to Avoid

Lack of Diversification

- Avoid concentrating investments in a single asset class.

- Ensure a balanced portfolio to spread risk.

Ignoring Rebalancing

- Failing to rebalance can lead to overexposure to certain assets.

- Regularly adjust your portfolio to maintain balance.

Emotional Decisions

- Avoid making impulsive decisions based on market volatility.

- Stick to your strategy and make informed choices.

Conclusion

Protecting your retirement account during market corrections is crucial for long-term financial security. Dan Sheridan’s strategies, including diversification, protective puts, covered calls, and regular rebalancing, offer practical solutions to safeguard your savings. By staying informed and applying these techniques, you can navigate market corrections with confidence and ensure a secure retirement.

Commonly Asked Questions:

- Business Model Innovation: Accept the truth of a legitimate business! Our strategy is organising a group buy in which participants share the costs. We use these cash to acquire popular courses from sale pages and make them available to people with limited financial resources. Despite the authors’ worries, our clients love the cost and accessibility we give.

- The Legal Environment: Yes or No The legality of our activity is ambiguous. While we don’t have specific permission from the course authors to resell the material, there is a technicality at work. The author did not specify any limits on resale when purchasing the course. This legal intricacy is both an opportunity for us and a boon for individuals looking for low-cost access.

- Quality Control: Uncovering the Truth

Getting to the heart of the issue – quality. Purchasing the course straight from the sale page guarantees that all documents and resources are the same as those obtained through traditional channels.

However, we distinguish ourselves by going beyond personal research and resale. It is crucial to note that we are not the official course providers, which means that the following premium services are not included in our package:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not permitted.

- No access to the author’s private membership forum.

- There is no direct email support available from the author or their team.

We operate independently, with the goal of bridging the pricing gap without the extra services provided by official course channels. Your comprehension of our distinct approach is much appreciated.

Be the first to review “Protecting your Retirement Account in a Correction with Dan Sheridan – Sheridan Options Mentoring” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.