-

×

Theoptionschool - The 6 Secrets of Options Trading

1 × $6.00

Theoptionschool - The 6 Secrets of Options Trading

1 × $6.00 -

×

The New Multi-10x on Steroids Pro Package

1 × $78.00

The New Multi-10x on Steroids Pro Package

1 × $78.00 -

×

Zeus Capital (ZCFX) Full Mentorship Course

1 × $13.00

Zeus Capital (ZCFX) Full Mentorship Course

1 × $13.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

Investing In Fixer-Uppers 2003 with Jay DeCima

1 × $6.00

Investing In Fixer-Uppers 2003 with Jay DeCima

1 × $6.00 -

×

Tradematic Trading Strategy

1 × $31.00

Tradematic Trading Strategy

1 × $31.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

Value Based Power Trading

1 × $6.00

Value Based Power Trading

1 × $6.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

Trendfans & Trendline Breaks with Albert Yang

1 × $6.00

Trendfans & Trendline Breaks with Albert Yang

1 × $6.00 -

×

Wyckoff simplified from Michael Z

1 × $6.00

Wyckoff simplified from Michael Z

1 × $6.00 -

×

The Hedge Fund Edge. Maximum Profit, Minimum Risk. Global Trading Trend Strategies - Mark Boucher

1 × $6.00

The Hedge Fund Edge. Maximum Profit, Minimum Risk. Global Trading Trend Strategies - Mark Boucher

1 × $6.00 -

×

War Room Technicals Volume 2 with Pat Mitchell – Trick Trades

1 × $6.00

War Room Technicals Volume 2 with Pat Mitchell – Trick Trades

1 × $6.00 -

×

Trade Execution with Yuri Shramenko

1 × $6.00

Trade Execution with Yuri Shramenko

1 × $6.00 -

×

Fierce 10 with Mandi Rafsendjani

1 × $5.00

Fierce 10 with Mandi Rafsendjani

1 × $5.00 -

×

WEBINAR series 5 – EXECUTION: A DETAILED PROCESS with FuturesTrader71

1 × $4.00

WEBINAR series 5 – EXECUTION: A DETAILED PROCESS with FuturesTrader71

1 × $4.00 -

×

TheoTrade - Maximum Returns with Infinity Spreads

1 × $23.00

TheoTrade - Maximum Returns with Infinity Spreads

1 × $23.00 -

×

Trading by the Minute - Joe Ross

1 × $6.00

Trading by the Minute - Joe Ross

1 × $6.00 -

×

Wysetrade Forex Masterclass 3.0

1 × $6.00

Wysetrade Forex Masterclass 3.0

1 × $6.00 -

×

The MMXM Traders Course - The MMXM Trader

1 × $5.00

The MMXM Traders Course - The MMXM Trader

1 × $5.00 -

×

Top Futures Day Trading Course DVD

1 × $6.00

Top Futures Day Trading Course DVD

1 × $6.00 -

×

Mission Million Money Management Course

1 × $31.00

Mission Million Money Management Course

1 × $31.00 -

×

Bookmap Masterclass - Profitable Trading with Bookmap By Basics and Execution

1 × $8.00

Bookmap Masterclass - Profitable Trading with Bookmap By Basics and Execution

1 × $8.00 -

×

Core Strategy Program with Ota Courses

1 × $174.00

Core Strategy Program with Ota Courses

1 × $174.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Weekly Iron Condors For Income with Bruce Wayne

1 × $6.00

Weekly Iron Condors For Income with Bruce Wayne

1 × $6.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

Wyckoff Stock Market Institute

1 × $5.00

Wyckoff Stock Market Institute

1 × $5.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Bar Ipro v9.1 for MT4 11XX

1 × $23.00

Bar Ipro v9.1 for MT4 11XX

1 × $23.00 -

×

The Power of Position Sizing Strategies SQN Secrets Revealed with Van Tharp

1 × $5.00

The Power of Position Sizing Strategies SQN Secrets Revealed with Van Tharp

1 × $5.00 -

×

Annual Forecast Reports - Forecast 2023 with Larry Williams

1 × $8.00

Annual Forecast Reports - Forecast 2023 with Larry Williams

1 × $8.00 -

×

Winning System For Trading High-Performance Stocks with Tim Cho

1 × $6.00

Winning System For Trading High-Performance Stocks with Tim Cho

1 × $6.00 -

×

Pristine - Dan Gibby – Market Preparation Trading Gaps & Trading the Open

1 × $6.00

Pristine - Dan Gibby – Market Preparation Trading Gaps & Trading the Open

1 × $6.00 -

×

Monetary Mechanics Course 2024 with The Macro Compass

1 × $139.00

Monetary Mechanics Course 2024 with The Macro Compass

1 × $139.00 -

×

Overnight Profit Strategy PRO with Allison Ostrander

1 × $6.00

Overnight Profit Strategy PRO with Allison Ostrander

1 × $6.00 -

×

Real Trade Examples Volume 1 with Steve Burns

1 × $15.00

Real Trade Examples Volume 1 with Steve Burns

1 × $15.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

Winning Stock Selection Simplified (Vol I, II & III) with Peter Worden

1 × $6.00

Winning Stock Selection Simplified (Vol I, II & III) with Peter Worden

1 × $6.00 -

×

Currency Strategy with Callum Henderson

1 × $6.00

Currency Strategy with Callum Henderson

1 × $6.00 -

×

Trading to Win Course: One Day at Time (2004 ed.) with Bruce Gilmore

1 × $6.00

Trading to Win Course: One Day at Time (2004 ed.) with Bruce Gilmore

1 × $6.00 -

×

9-Day Calendar Deep Dive 2023 with Jay Bailey - Sheridan Options Mentoring

1 × $31.00

9-Day Calendar Deep Dive 2023 with Jay Bailey - Sheridan Options Mentoring

1 × $31.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Trading Price Action Reversals (Kindle) with Al Brooks

1 × $6.00

Trading Price Action Reversals (Kindle) with Al Brooks

1 × $6.00 -

×

Trading Pivot Points with Andrew Peters

1 × $6.00

Trading Pivot Points with Andrew Peters

1 × $6.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Beginner's Guide to Ratio Butterflys Class with Don Kaufman

1 × $6.00

Beginner's Guide to Ratio Butterflys Class with Don Kaufman

1 × $6.00 -

×

Forex Trading using Intermarket Analysis with Louis Mendelsohn

1 × $6.00

Forex Trading using Intermarket Analysis with Louis Mendelsohn

1 × $6.00 -

×

Bond Trading Success

1 × $6.00

Bond Trading Success

1 × $6.00 -

×

XLT - Forex Trading Course

1 × $6.00

XLT - Forex Trading Course

1 × $6.00 -

×

Wyckoff Analysis Series. Module 2. Wyckoff Candle Volume Analysis

1 × $6.00

Wyckoff Analysis Series. Module 2. Wyckoff Candle Volume Analysis

1 × $6.00 -

×

The Decision-Making Process and Forward with Peter Steidlmayer

1 × $4.00

The Decision-Making Process and Forward with Peter Steidlmayer

1 × $4.00 -

×

Volatility and Timing with Jay Kaeppel – The Option Trader’s Guide to Probability

1 × $6.00

Volatility and Timing with Jay Kaeppel – The Option Trader’s Guide to Probability

1 × $6.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

VagaFX Academy Course with VAGAFX

1 × $41.00

VagaFX Academy Course with VAGAFX

1 × $41.00 -

×

8 Successful Iron Condor Methodologies with Dan Sheridan

1 × $23.00

8 Successful Iron Condor Methodologies with Dan Sheridan

1 × $23.00 -

×

Price Action Trading 101 By Steve Burns

1 × $15.00

Price Action Trading 101 By Steve Burns

1 × $15.00 -

×

Intermarket Technical Analysis with John J.Murphy

1 × $6.00

Intermarket Technical Analysis with John J.Murphy

1 × $6.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

Magical Forex Trading System

1 × $6.00

Magical Forex Trading System

1 × $6.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

Astrology At Work & Others

1 × $6.00

Astrology At Work & Others

1 × $6.00 -

×

Price Action Trading Volume 2 with Fractal Flow Pro

1 × $6.00

Price Action Trading Volume 2 with Fractal Flow Pro

1 × $6.00 -

×

Commitments of Traders : Strategies for Tracking the Market and Trading Profitably with Floyd Upperman

1 × $6.00

Commitments of Traders : Strategies for Tracking the Market and Trading Profitably with Floyd Upperman

1 × $6.00 -

×

Insider Signal Exclusive Forex Course - 9 CD with Andy X

1 × $6.00

Insider Signal Exclusive Forex Course - 9 CD with Andy X

1 × $6.00 -

×

Impulse Trading System with Base Camp Trading

1 × $54.00

Impulse Trading System with Base Camp Trading

1 × $54.00 -

×

VSTOPS ProTrader Strategy (Nov 2013)

1 × $6.00

VSTOPS ProTrader Strategy (Nov 2013)

1 × $6.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

Technician’s Guide to Day and Swing Trading with Martin Pring

1 × $6.00

Technician’s Guide to Day and Swing Trading with Martin Pring

1 × $6.00 -

×

Trading to Win (Seminar WorkBook 2003) with Bruce Gilmore

1 × $6.00

Trading to Win (Seminar WorkBook 2003) with Bruce Gilmore

1 × $6.00 -

×

Brian James Sklenka Package

1 × $31.00

Brian James Sklenka Package

1 × $31.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $179.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $179.00 -

×

The A.M. Trader with MarketGauge

1 × $31.00

The A.M. Trader with MarketGauge

1 × $31.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

Forex Nitty Gritty Course with Bill & Greg Poulos

1 × $6.00

Forex Nitty Gritty Course with Bill & Greg Poulos

1 × $6.00 -

×

Cluster Delta with Gova Trading Academy

1 × $5.00

Cluster Delta with Gova Trading Academy

1 × $5.00 -

×

Trading Rules that Work

1 × $6.00

Trading Rules that Work

1 × $6.00 -

×

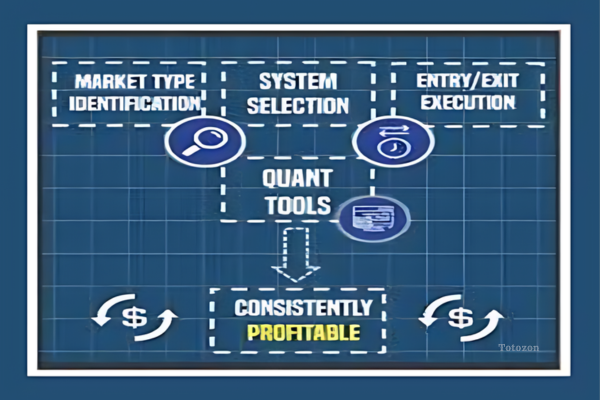

The Profitable Trading System Blueprint with Macro Ops

1 × $6.00

The Profitable Trading System Blueprint with Macro Ops

1 × $6.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Fast Fibonacci for Day Traders

1 × $15.00

Fast Fibonacci for Day Traders

1 × $15.00 -

×

Ultimate Guide Technical Trading

1 × $23.00

Ultimate Guide Technical Trading

1 × $23.00 -

×

Trading Psychology Masterclass with Jared Tendler - TraderLion

1 × $5.00

Trading Psychology Masterclass with Jared Tendler - TraderLion

1 × $5.00 -

×

THE NEW SQUEEZE BASIC VERSION: Your Complete System for Timing Explosive Trades with John F. Carter (BASIC VERSION)

1 × $31.00

THE NEW SQUEEZE BASIC VERSION: Your Complete System for Timing Explosive Trades with John F. Carter (BASIC VERSION)

1 × $31.00 -

×

Limitless Trading Academy with Lorenzo Corrado

1 × $10.00

Limitless Trading Academy with Lorenzo Corrado

1 × $10.00 -

×

A Trader’s Guide To Discipline

1 × $6.00

A Trader’s Guide To Discipline

1 × $6.00 -

×

Trading Options as a Professional: Techniques for Market Makers and Experienced Traders with James Bittman

1 × $6.00

Trading Options as a Professional: Techniques for Market Makers and Experienced Traders with James Bittman

1 × $6.00 -

×

Area 61 with BCFX

1 × $6.00

Area 61 with BCFX

1 × $6.00 -

×

Complete Day Trading : Stock Trading With Technical Analysis

1 × $15.00

Complete Day Trading : Stock Trading With Technical Analysis

1 × $15.00 -

×

Beginner to Intermediate Intensive Q and A with Rob Hoffman

1 × $6.00

Beginner to Intermediate Intensive Q and A with Rob Hoffman

1 × $6.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

Rhythm of the Moon with Jack Gillen

1 × $4.00

Rhythm of the Moon with Jack Gillen

1 × $4.00 -

×

The Rare Writings of W.D Gann

1 × $6.00

The Rare Writings of W.D Gann

1 × $6.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

Trading Freak Academy (Full Course) with JP - Trading Freak

1 × $5.00

Trading Freak Academy (Full Course) with JP - Trading Freak

1 × $5.00 -

×

Swing Trading for a Living (7 Video Cds & WorkBook 2.1 GB)

1 × $6.00

Swing Trading for a Living (7 Video Cds & WorkBook 2.1 GB)

1 × $6.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

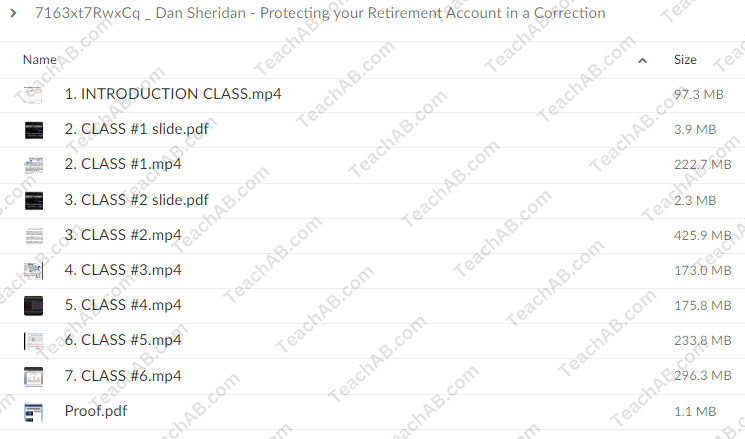

Protecting your Retirement Account in a Correction with Dan Sheridan – Sheridan Options Mentoring

$297.00 Original price was: $297.00.$31.00Current price is: $31.00.

File Size: 1.59 GB

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Protecting your Retirement Account in a Correction with Dan Sheridan – Sheridan Options Mentoring” below:

Introduction

Retirement accounts are vital for our future financial security, but they are vulnerable during market corrections. Dan Sheridan of Sheridan Options Mentoring offers strategies to safeguard these accounts. In this article, we’ll explore these strategies, helping you navigate market corrections and protect your retirement savings.

Who is Dan Sheridan?

Background and Expertise

Dan Sheridan is a seasoned options trader with over 30 years of experience. He founded Sheridan Options Mentoring to educate traders on effective options strategies. Dan’s insights are invaluable for both novice and experienced traders.

Sheridan Options Mentoring

Sheridan Options Mentoring offers comprehensive courses and personalized mentoring, focusing on practical options strategies. Their goal is to equip traders with the tools needed to succeed in various market conditions.

Understanding Market Corrections

What is a Market Correction?

A market correction is a decline of 10% or more in the price of a security or index from its recent peak. Corrections are a normal part of market cycles, often caused by economic factors, geopolitical events, or market sentiment shifts.

Impact on Retirement Accounts

During a correction, retirement accounts can suffer significant losses. Protecting these accounts requires proactive strategies to mitigate risks and preserve capital.

Strategies for Protecting Your Retirement Account

Diversification

Spreading Risk

Diversification involves spreading investments across various asset classes to reduce risk. By not putting all your eggs in one basket, you can minimize the impact of a downturn in any single asset class.

Asset Allocation

Proper asset allocation based on your risk tolerance and investment goals can help protect your portfolio. This may include a mix of stocks, bonds, and alternative investments.

Options Strategies

Protective Puts

- What are Protective Puts?: Buying a put option on a stock you own to protect against a decline in its price.

- How to Use Them: Purchase a put option for each stock you want to protect. This strategy acts as an insurance policy, limiting your losses if the stock price falls.

Covered Calls

- What are Covered Calls?: Selling a call option on a stock you own to generate income.

- How to Use Them: Sell a call option at a strike price above the current market price. This provides additional income, which can offset potential losses.

Rebalancing

Maintaining Balance

Rebalancing involves adjusting your portfolio periodically to maintain your desired asset allocation. This helps ensure you’re not overexposed to any single asset class, especially during volatile times.

When to Rebalance

Consider rebalancing at regular intervals, such as quarterly or annually, or when your asset allocation deviates significantly from your target.

Staying Informed

Market Analysis

Stay informed about market trends and economic indicators. Understanding the broader market context can help you make informed decisions about your retirement account.

Education and Mentoring

Engage in continuous learning and consider mentoring from experts like Dan Sheridan. Education can empower you to apply effective strategies and adapt to changing market conditions.

Implementing Dan Sheridan’s Strategies

Step-by-Step Guide

- Assess Your Portfolio:

- Review your current asset allocation and risk exposure.

- Diversify Investments:

- Spread investments across different asset classes to reduce risk.

- Use Protective Puts:

- Buy put options to protect against declines in specific stocks.

- Sell Covered Calls:

- Generate additional income by selling call options on stocks you own.

- Rebalance Regularly:

- Adjust your portfolio to maintain your desired asset allocation.

- Stay Informed:

- Keep up with market trends and continue your education.

Benefits of Dan Sheridan’s Strategies

Risk Mitigation

- Reduce potential losses during market corrections.

- Protect your retirement savings with proven options strategies.

Income Generation

- Generate additional income through covered calls.

- Use this income to offset potential losses or reinvest in your portfolio.

Increased Confidence

- Gain confidence in managing your retirement account.

- Make informed decisions backed by expert strategies.

Common Mistakes to Avoid

Lack of Diversification

- Avoid concentrating investments in a single asset class.

- Ensure a balanced portfolio to spread risk.

Ignoring Rebalancing

- Failing to rebalance can lead to overexposure to certain assets.

- Regularly adjust your portfolio to maintain balance.

Emotional Decisions

- Avoid making impulsive decisions based on market volatility.

- Stick to your strategy and make informed choices.

Conclusion

Protecting your retirement account during market corrections is crucial for long-term financial security. Dan Sheridan’s strategies, including diversification, protective puts, covered calls, and regular rebalancing, offer practical solutions to safeguard your savings. By staying informed and applying these techniques, you can navigate market corrections with confidence and ensure a secure retirement.

Commonly Asked Questions:

- Business Model Innovation: Accept the truth of a legitimate business! Our strategy is organising a group buy in which participants share the costs. We use these cash to acquire popular courses from sale pages and make them available to people with limited financial resources. Despite the authors’ worries, our clients love the cost and accessibility we give.

- The Legal Environment: Yes or No The legality of our activity is ambiguous. While we don’t have specific permission from the course authors to resell the material, there is a technicality at work. The author did not specify any limits on resale when purchasing the course. This legal intricacy is both an opportunity for us and a boon for individuals looking for low-cost access.

- Quality Control: Uncovering the Truth

Getting to the heart of the issue – quality. Purchasing the course straight from the sale page guarantees that all documents and resources are the same as those obtained through traditional channels.

However, we distinguish ourselves by going beyond personal research and resale. It is crucial to note that we are not the official course providers, which means that the following premium services are not included in our package:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not permitted.

- No access to the author’s private membership forum.

- There is no direct email support available from the author or their team.

We operate independently, with the goal of bridging the pricing gap without the extra services provided by official course channels. Your comprehension of our distinct approach is much appreciated.

Be the first to review “Protecting your Retirement Account in a Correction with Dan Sheridan – Sheridan Options Mentoring” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.