-

×

XJO Quant - High Probability Trading Setups on ASX 200 Index

1 × $31.00

XJO Quant - High Probability Trading Setups on ASX 200 Index

1 × $31.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

The Volatility Course + The Volatility Course Workbook with George Fontanills & Tom Gentile

1 × $6.00

The Volatility Course + The Volatility Course Workbook with George Fontanills & Tom Gentile

1 × $6.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

The Chinese Capital Market with Annette Kleinbrod

1 × $6.00

The Chinese Capital Market with Annette Kleinbrod

1 × $6.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

Market Profile Trading Strategies Webinar with Daniel Gramza

1 × $4.00

Market Profile Trading Strategies Webinar with Daniel Gramza

1 × $4.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

US indices system with LaMartinatradingFx

1 × $10.00

US indices system with LaMartinatradingFx

1 × $10.00 -

×

Instant Profits System with Bill Poulos

1 × $6.00

Instant Profits System with Bill Poulos

1 × $6.00 -

×

W.O.W. Guaranteed Income with Chuck Hughes

1 × $31.00

W.O.W. Guaranteed Income with Chuck Hughes

1 × $31.00 -

×

Market Trader Forecasting Modeling Course

1 × $6.00

Market Trader Forecasting Modeling Course

1 × $6.00 -

×

Equity Derivates with Marcus Overhaus, Andrew Ferraris, Thomas Knudsen, Ross Milward, Laurent Nguyen-Ngoc & Gero Schindlmayr

1 × $6.00

Equity Derivates with Marcus Overhaus, Andrew Ferraris, Thomas Knudsen, Ross Milward, Laurent Nguyen-Ngoc & Gero Schindlmayr

1 × $6.00 -

×

The Options Handbook with Bernie Schaeffer

1 × $6.00

The Options Handbook with Bernie Schaeffer

1 × $6.00 -

×

Pairs Trading: Quantitative Methods and Analysis with Ganapathy Vidyamurthy

1 × $6.00

Pairs Trading: Quantitative Methods and Analysis with Ganapathy Vidyamurthy

1 × $6.00 -

×

Intra-Day Trading with Market Internals II with Greg Capra

1 × $6.00

Intra-Day Trading with Market Internals II with Greg Capra

1 × $6.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

The Gold Treasure Map: The Path to Buried Treasure Trading Gold with David Starr & Neil Yeager

1 × $6.00

The Gold Treasure Map: The Path to Buried Treasure Trading Gold with David Starr & Neil Yeager

1 × $6.00 -

×

Aeron V5 Scalper+Grid

1 × $23.00

Aeron V5 Scalper+Grid

1 × $23.00 -

×

Unleash Stock Trading Genius: Money Machine with Talmadge Harper - Harper Healing

1 × $15.00

Unleash Stock Trading Genius: Money Machine with Talmadge Harper - Harper Healing

1 × $15.00 -

×

The Multi-Fractal Markets Educational Course with Dylan Forexia

1 × $39.00

The Multi-Fractal Markets Educational Course with Dylan Forexia

1 × $39.00 -

×

One Week S&P Workshop II with Linda Raschke

1 × $5.00

One Week S&P Workshop II with Linda Raschke

1 × $5.00 -

×

Ultra Blue Forex 2024 with Russ Horn

1 × $17.00

Ultra Blue Forex 2024 with Russ Horn

1 × $17.00 -

×

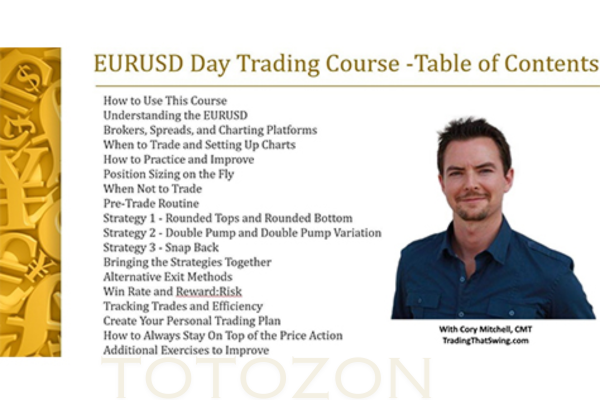

The EURUSD Day Trading Course with Cory Mitchell - Trade That Swing

1 × $15.00

The EURUSD Day Trading Course with Cory Mitchell - Trade That Swing

1 × $15.00 -

×

Winning the Losers Game with Charles Ellis

1 × $6.00

Winning the Losers Game with Charles Ellis

1 × $6.00 -

×

Full Pips & Profit Strategy with Pips & Profits

1 × $18.00

Full Pips & Profit Strategy with Pips & Profits

1 × $18.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Trading Earnings Using Measured-Move Targets with Alphashark

1 × $6.00

Trading Earnings Using Measured-Move Targets with Alphashark

1 × $6.00 -

×

Classic Indicators Back to the Future with Linda Raschke

1 × $4.00

Classic Indicators Back to the Future with Linda Raschke

1 × $4.00 -

×

Intermediate to Advanced Intensive Q and A with Rob Hoffman

1 × $6.00

Intermediate to Advanced Intensive Q and A with Rob Hoffman

1 × $6.00 -

×

War Room Technicals Vol 1 with Trick Traders

1 × $6.00

War Room Technicals Vol 1 with Trick Traders

1 × $6.00 -

×

Valuing Employee Stock Options with Johnathan Mun

1 × $6.00

Valuing Employee Stock Options with Johnathan Mun

1 × $6.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00

The Great Reflation with Anthony Boeckh

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

The Great Reflation with Anthony Boeckh

Introduction

In the intricate world of economic theories and market cycles, Anthony Boeckh’s “The Great Reflation” offers a compelling look at how economies have moved through various phases of inflation and reflation. This guide dives deep into the core concepts presented by Boeckh, exploring how these ideas can be applied in today’s financial landscape.

Understanding Reflation

What is Reflation?

Reflation is an economic scenario where measures are taken to expand a country’s output, aiming to curb the effects of deflation.

Historical Context of Reflation

A brief look at past economic cycles where reflation has played a pivotal role in recovery.

Anthony Boeckh’s Insights

Overview of Boeckh’s Economic Philosophy

Exploring the foundational principles that guide Boeckh’s analysis and predictions.

Key Predictions and Theories

Discussing Boeckh’s major predictions about economic trends and their accuracy over time.

Impact of Reflation on Markets

Effects on the Stock Market

How reflationary measures have historically affected stock markets around the globe.

Reflation and Bond Markets

The relationship between reflation policies and bond market dynamics.

Global Economic Policies and Reflation

Case Studies: USA, EU, and Asia

Examining how different regions have implemented reflationary strategies.

Successes and Failures

Analyzing which policies succeeded and which did not, based on economic outcomes.

The Role of Central Banks

Monetary Policy Tools

A detailed look at the tools used by central banks to induce reflation.

Challenges Faced by Central Banks

Exploring the limitations and challenges central banks encounter in these efforts.

Investment Strategies During Reflation

Equities and Commodities

Strategies for investing in equities and commodities during reflationary periods.

Real Estate and Fixed Income

Guidance on real estate and fixed income investments when reflation is expected.

Predicting Future Economic Cycles

Using Boeckh’s Methods

How to apply Boeckh’s methods to predict and prepare for future economic shifts.

Technological Impact on Economic Trends

Discussing how advances in technology could alter future economic reflation strategies.

Personal Finance in a Reflationary Period

Budgeting and Saving

Tips for personal budgeting and saving during times of economic reflation.

Long-term Financial Planning

How to plan long-term finances considering potential reflationary periods ahead.

Conclusion

“The Great Reflation” by Anthony Boeckh provides invaluable insights into the mechanisms of reflation and its effects on various aspects of the economy. For anyone involved in finance, understanding these concepts is crucial for navigating future markets and making informed investment decisions.

FAQs

- What exactly does reflation mean?

- Reflation is a policy aimed at expanding output and reversing deflation.

- How does reflation affect the stock market?

- Typically, reflation leads to higher stock prices due to increased economic activity.

- Can reflation policies fail?

- Yes, if not properly managed, reflation can lead to overheating of the economy.

- What role do central banks play in reflation?

- Central banks use monetary policy tools to control reflation.

- How should I adjust my investment strategy during reflation?

- Diversify into assets like equities and commodities that benefit from economic growth.

Be the first to review “The Great Reflation with Anthony Boeckh” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Reviews

There are no reviews yet.