-

×

The Forex Scalper

1 × $5.00

The Forex Scalper

1 × $5.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Technical Analysis of the Currency Market Classic Techniques for Profiting from Market Swings and Trader Sentiment with Boris Schlossberg

1 × $6.00

Technical Analysis of the Currency Market Classic Techniques for Profiting from Market Swings and Trader Sentiment with Boris Schlossberg

1 × $6.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

The FOREX Blueprint with The Swag Academy

1 × $5.00

The FOREX Blueprint with The Swag Academy

1 × $5.00 -

×

Two Options Strategies for Every Investor with Karim Rahemtulla

1 × $6.00

Two Options Strategies for Every Investor with Karim Rahemtulla

1 × $6.00 -

×

TurnSignal Complete 7-6A (Oct 2013)

1 × $6.00

TurnSignal Complete 7-6A (Oct 2013)

1 × $6.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

The Stock Market Course with George Fontanills & Tom Gentile

1 × $6.00

The Stock Market Course with George Fontanills & Tom Gentile

1 × $6.00 -

×

The Forex Trading Academy with Steve Luke

1 × $5.00

The Forex Trading Academy with Steve Luke

1 × $5.00 -

×

Turning Losing Forex Trades into Winners: Proven Techniques to Reverse Your Losses with Gerald E.Greene

1 × $6.00

Turning Losing Forex Trades into Winners: Proven Techniques to Reverse Your Losses with Gerald E.Greene

1 × $6.00 -

×

Insiders guide to Trading Weekly Options with John Carter

1 × $54.00

Insiders guide to Trading Weekly Options with John Carter

1 × $54.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

The Forex Equinox

1 × $54.00

The Forex Equinox

1 × $54.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

Complete Course of Astrology with George Bayer

1 × $6.00

Complete Course of Astrology with George Bayer

1 × $6.00 -

×

The Forex Trading Coach Course

1 × $6.00

The Forex Trading Coach Course

1 × $6.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

ADVANCED Swing Trading Strategy - Forex Trading Stock Trading

1 × $15.00

ADVANCED Swing Trading Strategy - Forex Trading Stock Trading

1 × $15.00 -

×

Ultimate Guide To Swing Trading ETF's

1 × $23.00

Ultimate Guide To Swing Trading ETF's

1 × $23.00 -

×

Dow Jones Secret. Never Lose a Trade with Karl Dittmann

1 × $6.00

Dow Jones Secret. Never Lose a Trade with Karl Dittmann

1 × $6.00 -

×

Winning on the Stock Market with Brian J.Millard

1 × $6.00

Winning on the Stock Market with Brian J.Millard

1 × $6.00 -

×

The Forex Trading Course: A Self-Study Guide To Becoming a Successful Currency Trader with Abe Cofnas

1 × $6.00

The Forex Trading Course: A Self-Study Guide To Becoming a Successful Currency Trader with Abe Cofnas

1 × $6.00 -

×

The ETF Handbook, + website: How to Value and Trade Exchange Traded Funds (1st Edition) with David Abner

1 × $6.00

The ETF Handbook, + website: How to Value and Trade Exchange Traded Funds (1st Edition) with David Abner

1 × $6.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Institutional Scalping and Intraday Trading

1 × $5.00

Institutional Scalping and Intraday Trading

1 × $5.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

Turnaround Trader Formula with Ifan Wei - T3 Live

1 × $23.00

Turnaround Trader Formula with Ifan Wei - T3 Live

1 × $23.00 -

×

Ultimate MT4 Course

1 × $15.00

Ultimate MT4 Course

1 × $15.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

The Encyclopedia Trading Strategies

1 × $6.00

The Encyclopedia Trading Strategies

1 × $6.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

DreamerGG – Mentorship 2023

1 × $5.00

DreamerGG – Mentorship 2023

1 × $5.00 -

×

Ultimate Options Trading Blueprint

1 × $23.00

Ultimate Options Trading Blueprint

1 × $23.00 -

×

The Secret to Extraordinary Wealth in the Options Market - 4 DVDs

1 × $31.00

The Secret to Extraordinary Wealth in the Options Market - 4 DVDs

1 × $31.00 -

×

TTW TradeFinder and Bookmap Course with Trading To Win

1 × $10.00

TTW TradeFinder and Bookmap Course with Trading To Win

1 × $10.00 -

×

TTM Directional Day Filter System for TS

1 × $6.00

TTM Directional Day Filter System for TS

1 × $6.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Trading Options for Dummies with George Fontanills

1 × $6.00

Trading Options for Dummies with George Fontanills

1 × $6.00 -

×

How To Design, Test, Evaluate and Implement Profitable Trading Systems(Manual Only)

1 × $4.00

How To Design, Test, Evaluate and Implement Profitable Trading Systems(Manual Only)

1 × $4.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

The Advanced Technical Analysis Trading Course (New 2019)

1 × $6.00

The Advanced Technical Analysis Trading Course (New 2019)

1 × $6.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

Trading Framework with Retail Capital

1 × $24.00

Trading Framework with Retail Capital

1 × $24.00 -

×

Breadth Internal Indicators - Winning Swing & Position Trading with Greg Capra

1 × $6.00

Breadth Internal Indicators - Winning Swing & Position Trading with Greg Capra

1 × $6.00 -

×

The Secret To Making 7 Figures In A Year with Steven Dux

1 × $31.00

The Secret To Making 7 Figures In A Year with Steven Dux

1 × $31.00 -

×

Turtle Soup Course with ICT Trader Romeo

1 × $5.00

Turtle Soup Course with ICT Trader Romeo

1 × $5.00 -

×

The W.D. Gann Method of Trading with Gerald Marisch

1 × $6.00

The W.D. Gann Method of Trading with Gerald Marisch

1 × $6.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

NQ Full Order Flow Course with Scott Pulcini Trader

1 × $8.00

NQ Full Order Flow Course with Scott Pulcini Trader

1 × $8.00 -

×

Ultimate Scalping Masterclass 4.0 with RockzFX Academy

1 × $6.00

Ultimate Scalping Masterclass 4.0 with RockzFX Academy

1 × $6.00 -

×

The Viper Advanced Program

1 × $13.00

The Viper Advanced Program

1 × $13.00 -

×

The Solar Guidance System with Ruth Miller & Iam Williams

1 × $6.00

The Solar Guidance System with Ruth Miller & Iam Williams

1 × $6.00 -

×

TTM Slingshot

1 × $6.00

TTM Slingshot

1 × $6.00 -

×

TurboVZO Indicator & VZO Signals (PREMIUM)

1 × $54.00

TurboVZO Indicator & VZO Signals (PREMIUM)

1 × $54.00 -

×

Bollinger Band Jackpot with Mark Deaton

1 × $31.00

Bollinger Band Jackpot with Mark Deaton

1 × $31.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

FXCharger

1 × $23.00

FXCharger

1 × $23.00 -

×

Options Trading RD3 Webinar Series

1 × $31.00

Options Trading RD3 Webinar Series

1 × $31.00 -

×

Ultimate Breakout

1 × $54.00

Ultimate Breakout

1 × $54.00 -

×

The Fear Process with Lewis Mocker

1 × $23.00

The Fear Process with Lewis Mocker

1 × $23.00 -

×

Beginner Course + access to Introductory Course

1 × $6.00

Beginner Course + access to Introductory Course

1 × $6.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

Trading the Eclipses

1 × $6.00

Trading the Eclipses

1 × $6.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Unedited Superconference 2010

1 × $15.00

Unedited Superconference 2010

1 × $15.00 -

×

Ultimate Candlestick Training Package and Bonus Candlestick Analysis Technician Seminar

1 × $23.00

Ultimate Candlestick Training Package and Bonus Candlestick Analysis Technician Seminar

1 × $23.00 -

×

The MMXM Trader’s 2nd Course: My Personal Approach

1 × $17.00

The MMXM Trader’s 2nd Course: My Personal Approach

1 × $17.00 -

×

Elliott Wave DNA with Nicola Delic

1 × $31.00

Elliott Wave DNA with Nicola Delic

1 × $31.00 -

×

KvngSolz Fx Mentorship

1 × $27.00

KvngSolz Fx Mentorship

1 × $27.00 -

×

TTM Directional Day Filter Indicator with Value Chart for TS

1 × $6.00

TTM Directional Day Filter Indicator with Value Chart for TS

1 × $6.00 -

×

Ultimate Gann Trading

1 × $15.00

Ultimate Gann Trading

1 × $15.00 -

×

Intra-Day Trading Nasdaq Futures Class with Tony Rago

1 × $6.00

Intra-Day Trading Nasdaq Futures Class with Tony Rago

1 × $6.00 -

×

Jumping Off The Porch with WALLSTREET TRAPPER

1 × $4.00

Jumping Off The Porch with WALLSTREET TRAPPER

1 × $4.00 -

×

Twelve Ways to Survive the Next Twelve Months with Adam Lass

1 × $6.00

Twelve Ways to Survive the Next Twelve Months with Adam Lass

1 × $6.00 -

×

Ultimate Gann Course Coaching Online Classroom 2009 with David Bowden & Aaron Lynch

1 × $23.00

Ultimate Gann Course Coaching Online Classroom 2009 with David Bowden & Aaron Lynch

1 × $23.00 -

×

Intermediate Guide To How Simpler Options Uses ThinkorSwim with Henry Gambell

1 × $15.00

Intermediate Guide To How Simpler Options Uses ThinkorSwim with Henry Gambell

1 × $15.00 -

×

The Situational Order Flow Trading Course with Mike Valtos

1 × $20.00

The Situational Order Flow Trading Course with Mike Valtos

1 × $20.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

The Secret Code of Japanese Candlesticks with Felipe Tudela

1 × $5.00

The Secret Code of Japanese Candlesticks with Felipe Tudela

1 × $5.00 -

×

Using Intermarket Analysis to Make Smarter Traders with Murray Ruggiero

1 × $4.00

Using Intermarket Analysis to Make Smarter Traders with Murray Ruggiero

1 × $4.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

Winning in Options with Elliott Wave + 5 Options Strategies with Todd Gordon

1 × $23.00

Winning in Options with Elliott Wave + 5 Options Strategies with Todd Gordon

1 × $23.00 -

×

The Secrets to Successful Forex Trading 2004

1 × $6.00

The Secrets to Successful Forex Trading 2004

1 × $6.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

The Profit-Taker Breakthrough with Don Abrams

1 × $4.00

The Profit-Taker Breakthrough with Don Abrams

1 × $4.00 -

×

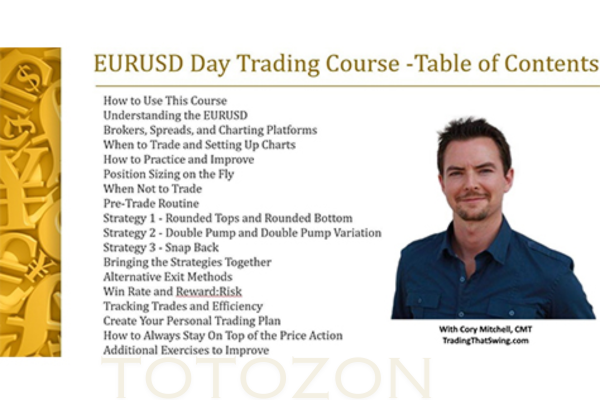

The EURUSD Day Trading Course with Cory Mitchell - Trade That Swing

1 × $15.00

The EURUSD Day Trading Course with Cory Mitchell - Trade That Swing

1 × $15.00 -

×

University Tutorial

1 × $6.00

University Tutorial

1 × $6.00 -

×

Understanding Price Action: practical analysis of the 5-minute time frame with Bob Volman

1 × $5.00

Understanding Price Action: practical analysis of the 5-minute time frame with Bob Volman

1 × $5.00 -

×

Market Geometry Mentoring Sessions with Timothy Morge

1 × $69.00

Market Geometry Mentoring Sessions with Timothy Morge

1 × $69.00 -

×

The Email Academy

1 × $31.00

The Email Academy

1 × $31.00 -

×

TTM Indicators Package for eSignal

1 × $6.00

TTM Indicators Package for eSignal

1 × $6.00 -

×

Time by Degrees Online Coaching 2009 + PDF Workbooks

1 × $54.00

Time by Degrees Online Coaching 2009 + PDF Workbooks

1 × $54.00 -

×

The Ultimate Professional Trader Plus CD Library

1 × $31.00

The Ultimate Professional Trader Plus CD Library

1 × $31.00 -

×

Trend Following Stocks - Complete Breakout System with Joe Marwood

1 × $6.00

Trend Following Stocks - Complete Breakout System with Joe Marwood

1 × $6.00 -

×

Killmex Academy Education Course

1 × $5.00

Killmex Academy Education Course

1 × $5.00 -

×

The Winning Secret

1 × $23.00

The Winning Secret

1 × $23.00 -

×

Unlocking the Profits of the New Swing Chart Method with Dave Reif & Jeff Cooper

1 × $23.00

Unlocking the Profits of the New Swing Chart Method with Dave Reif & Jeff Cooper

1 × $23.00 -

×

Wolfe Waves

1 × $15.00

Wolfe Waves

1 × $15.00 -

×

The Engulfing Trader Video Series 2014 with Timon Weller

1 × $6.00

The Engulfing Trader Video Series 2014 with Timon Weller

1 × $6.00 -

×

Tape Reading - Learn how to read the tape for day trading with Jose Casanova

1 × $15.00

Tape Reading - Learn how to read the tape for day trading with Jose Casanova

1 × $15.00

Hot Trading Investing Strategy: ETF and Futures with QSB Funds

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Hot Trading Investing Strategy: ETF and Futures with QSB Funds

Introduction

In the dynamic world of trading, staying ahead of the curve requires innovative strategies and tools. The QSB Funds offer a comprehensive approach to trading ETFs (Exchange-Traded Funds) and futures, designed to maximize returns while managing risk. This article explores the intricacies of this hot trading strategy, providing insights into its components, benefits, and implementation.

Understanding QSB Funds

What are QSB Funds?

QSB Funds, or Quantitative Strategic Beta Funds, are investment funds that leverage quantitative analysis and strategic beta approaches to optimize trading outcomes. These funds combine traditional investment strategies with modern quantitative techniques.

Key Features

- Quantitative Analysis: Utilizes mathematical models to inform trading decisions.

- Strategic Beta: Focuses on factors such as volatility, momentum, and value.

Who Can Benefit from QSB Funds?

Both individual traders and institutional investors can benefit from QSB Funds, particularly those looking to enhance their portfolios with sophisticated trading strategies.

Individual Traders

- Accessibility: Easy entry into advanced trading strategies.

- Diversification: Broad exposure to various assets and markets.

Institutional Investors

- Scalability: Suitable for large-scale investments.

- Risk Management: Enhanced techniques to manage and mitigate risks.

ETF Trading with QSB Funds

What are ETFs?

ETFs are investment funds traded on stock exchanges, much like stocks. They hold assets such as stocks, commodities, or bonds and typically track an index.

Benefits of ETFs

- Diversification: Invest in a broad range of assets.

- Liquidity: Easy to buy and sell on exchanges.

- Cost-Effective: Lower expense ratios compared to mutual funds.

ETF Trading Strategies

Long-Term Investment

Invest in ETFs for the long term to benefit from market growth.

- Index Funds: Track major market indices.

- Sector ETFs: Focus on specific sectors such as technology or healthcare.

Short-Term Trading

Use ETFs for short-term trading opportunities.

- Leveraged ETFs: Amplify returns on market movements.

- Inverse ETFs: Profit from market declines.

Implementing QSB Funds in ETF Trading

Quantitative Analysis

Use quantitative models to identify trading opportunities.

- Factor Analysis: Analyze factors like momentum and value.

- Backtesting: Test strategies against historical data.

Strategic Beta

Focus on strategic beta approaches to enhance returns.

- Smart Beta: Combine traditional beta with alternative weighting strategies.

- Risk Management: Use strategic beta to manage portfolio risk.

Futures Trading with QSB Funds

What are Futures?

Futures are financial contracts obligating the buyer to purchase an asset, or the seller to sell an asset, at a predetermined future date and price.

Benefits of Futures Trading

- Leverage: Control large positions with relatively small capital.

- Hedging: Protect against price fluctuations in underlying assets.

- Diversification: Access to a wide range of asset classes.

Futures Trading Strategies

Trend Following

Follow market trends to capitalize on price movements.

- Moving Averages: Identify trends using moving average indicators.

- Breakout Strategies: Trade on significant price movements.

Mean Reversion

Trade on the premise that prices will revert to their mean.

- Bollinger Bands: Use Bollinger Bands to identify overbought or oversold conditions.

- Stochastic Oscillator: Determine entry and exit points based on price momentum.

Implementing QSB Funds in Futures Trading

Quantitative Models

Use advanced quantitative models to inform trading decisions.

- Algorithmic Trading: Automate trades based on predefined criteria.

- Statistical Arbitrage: Exploit price inefficiencies between correlated assets.

Strategic Beta in Futures

Apply strategic beta approaches to manage futures trading.

- Volatility Targeting: Adjust exposure based on market volatility.

- Factor Investing: Focus on factors like value, momentum, and carry.

Risk Management in QSB Funds

Diversification

Spread investments across various assets to reduce risk.

- Asset Allocation: Allocate funds across stocks, bonds, and commodities.

- Geographical Diversification: Invest in different regions to mitigate regional risks.

Position Sizing

Determine the appropriate size for each trade to manage risk.

- Fixed Fractional: Risk a set percentage of the portfolio per trade.

- Volatility-Based: Adjust position size based on asset volatility.

Stop-Loss Orders

Implement stop-loss orders to limit potential losses.

- Fixed Stops: Set a predetermined price level to exit a trade.

- Trailing Stops: Adjust stop levels as the market moves in your favor.

Psychological Aspects of Trading

Discipline

Maintain discipline to adhere to your trading plan.

- Trading Plan: Develop and stick to a well-defined trading plan.

- Emotional Control: Avoid making impulsive decisions based on emotions.

Patience

Be patient and wait for the right trading opportunities.

- Market Analysis: Conduct thorough market analysis before trading.

- Long-Term Perspective: Focus on long-term goals rather than short-term gains.

Benefits of QSB Funds

Enhanced Returns

QSB Funds aim to provide enhanced returns through advanced strategies.

- Quantitative Techniques: Use mathematical models to identify opportunities.

- Strategic Beta: Focus on factors that drive returns.

Risk Management

QSB Funds incorporate sophisticated risk management techniques.

- Diversification: Spread risk across various assets.

- Hedging: Protect against adverse market movements.

Accessibility

QSB Funds provide access to advanced trading strategies for all investors.

- Educational Resources: Learn about advanced strategies through educational materials.

- User-Friendly Platforms: Access QSB Funds through intuitive trading platforms.

Conclusion

The QSB Funds offer a robust and sophisticated approach to trading ETFs and futures. By leveraging quantitative analysis and strategic beta approaches, these funds provide enhanced returns and effective risk management. Whether you are an individual trader or an institutional investor, QSB Funds can help you navigate the complexities of the financial markets with confidence.

Commonly Asked Questions:

- Business Model Innovation: Accept the truth of a legitimate business! Our strategy is organising a group buy in which participants share the costs. We use these cash to acquire popular courses from sale pages and make them available to people with limited financial resources. Despite the authors’ worries, our clients love the cost and accessibility we give.

- The Legal Environment: Yes or No The legality of our activity is ambiguous. While we don’t have specific permission from the course authors to resell the material, there is a technicality at work. The author did not specify any limits on resale when purchasing the course. This legal intricacy is both an opportunity for us and a boon for individuals looking for low-cost access.

- Quality Control: Uncovering the Truth

Getting to the heart of the issue – quality. Purchasing the course straight from the sale page guarantees that all documents and resources are the same as those obtained through traditional channels.

However, we distinguish ourselves by going beyond personal research and resale. It is crucial to note that we are not the official course providers, which means that the following premium services are not included in our package:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not permitted.

- No access to the author’s private membership forum.

- There is no direct email support available from the author or their team.

We operate independently, with the goal of bridging the pricing gap without the extra services provided by official course channels. Your comprehension of our distinct approach is much appreciated.

Be the first to review “Hot Trading Investing Strategy: ETF and Futures with QSB Funds” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.