-

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

How To Day-Trade Micro Eminis with Dr. Stoxx

1 × $5.00

How To Day-Trade Micro Eminis with Dr. Stoxx

1 × $5.00 -

×

Momentum Signals Training Course with Fulcum Trader

1 × $5.00

Momentum Signals Training Course with Fulcum Trader

1 × $5.00 -

×

Market Trader Forecasting Modeling Course

1 × $6.00

Market Trader Forecasting Modeling Course

1 × $6.00 -

×

Footprint Deep Dive

1 × $15.00

Footprint Deep Dive

1 × $15.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

Elite Trend Trader with Frank Bunn

1 × $23.00

Elite Trend Trader with Frank Bunn

1 × $23.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

Millionaire Traders with Kathy Lien & Boris Schlossberg

1 × $6.00

Millionaire Traders with Kathy Lien & Boris Schlossberg

1 × $6.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

Pit Bull with Martin Schwartz

1 × $6.00

Pit Bull with Martin Schwartz

1 × $6.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

The SPX 35-40 Day Delta Neutral Unbalanced Butterfly with Sheridan Options Mentoring

1 × $15.00

The SPX 35-40 Day Delta Neutral Unbalanced Butterfly with Sheridan Options Mentoring

1 × $15.00 -

×

TLM Virtual Trading Summit 2021 with TradeLikeMike

1 × $6.00

TLM Virtual Trading Summit 2021 with TradeLikeMike

1 × $6.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Option Trading Camp

1 × $15.00

Option Trading Camp

1 × $15.00 -

×

![The Art of Trading Covered Writes [1 video (AVI)] image](https://www.totozon.com/wp-content/uploads/2024/07/A-trader-analyzing-earnings-reports-on-a-computer-screen.png) Learn To Trade Earnings with Dan Sheridan

1 × $23.00

Learn To Trade Earnings with Dan Sheridan

1 × $23.00 -

×

Intra-Day Trading Tactics with Greg Capra

1 × $6.00

Intra-Day Trading Tactics with Greg Capra

1 × $6.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

Nasdaq Trading Strategies Book with French Trader

1 × $6.00

Nasdaq Trading Strategies Book with French Trader

1 × $6.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

Ez-Forex Trading System 4.2 with Beau Diamond

1 × $6.00

Ez-Forex Trading System 4.2 with Beau Diamond

1 × $6.00 -

×

Million Dollar Traders Course with Lex Van Dam

1 × $5.00

Million Dollar Traders Course with Lex Van Dam

1 × $5.00 -

×

Oliver Velez - Core, Swing, Guerrilla, Momentum Trading, Micro Trading Tactics

1 × $23.00

Oliver Velez - Core, Swing, Guerrilla, Momentum Trading, Micro Trading Tactics

1 × $23.00 -

×

FXS Analytics Training and Q&A Access with FXS Analytics

1 × $6.00

FXS Analytics Training and Q&A Access with FXS Analytics

1 × $6.00 -

×

Into The Abbys with Black Rabbit

1 × $18.00

Into The Abbys with Black Rabbit

1 × $18.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Maximizing Profits with Weekly Options with Optionpit

1 × $15.00

Maximizing Profits with Weekly Options with Optionpit

1 × $15.00 -

×

FX At One Glance - Ichimoku First Glance Video Course

1 × $23.00

FX At One Glance - Ichimoku First Glance Video Course

1 × $23.00 -

×

Jimdandym Ql4 Courses

1 × $15.00

Jimdandym Ql4 Courses

1 × $15.00 -

×

Floor Trader Tools 8.2 with Roy Kelly

1 × $6.00

Floor Trader Tools 8.2 with Roy Kelly

1 × $6.00 -

×

JJ Dream Team Workshop Training Full Course

1 × $55.00

JJ Dream Team Workshop Training Full Course

1 × $55.00 -

×

Strategy Class + Indicators

1 × $31.00

Strategy Class + Indicators

1 × $31.00 -

×

Mesa & Trading Market Cycles (1st Edition) with John Ehlers & Perry Kaufman

1 × $6.00

Mesa & Trading Market Cycles (1st Edition) with John Ehlers & Perry Kaufman

1 × $6.00 -

×

Don Fishback ODDS The Key to 95 Winners

1 × $6.00

Don Fishback ODDS The Key to 95 Winners

1 × $6.00 -

×

Options, Futures & Other Derivatives . Solutions Manual

1 × $6.00

Options, Futures & Other Derivatives . Solutions Manual

1 × $6.00 -

×

Beginner's Guide to Ratio Butterflys Class with Don Kaufman

1 × $6.00

Beginner's Guide to Ratio Butterflys Class with Don Kaufman

1 × $6.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

James Dalton Mind Over Markets Expanded Intensive Series 2018

1 × $6.00

James Dalton Mind Over Markets Expanded Intensive Series 2018

1 × $6.00 -

×

Street Smarts & TS Code with Larry Connors & Linda Bradford Rashcke

1 × $6.00

Street Smarts & TS Code with Larry Connors & Linda Bradford Rashcke

1 × $6.00 -

×

Greatest Trading Tools

1 × $6.00

Greatest Trading Tools

1 × $6.00 -

×

Elliott Wave Simplified with Clif Droke

1 × $6.00

Elliott Wave Simplified with Clif Droke

1 × $6.00 -

×

Inner Circle Trader ICT Mentorship 2021 with Michael Huddleston

1 × $5.00

Inner Circle Trader ICT Mentorship 2021 with Michael Huddleston

1 × $5.00 -

×

The Art of Trading Covered Writes [1 video (AVI)]

1 × $15.00

The Art of Trading Covered Writes [1 video (AVI)]

1 × $15.00 -

×

Winning the Losers Game with Charles Ellis

1 × $6.00

Winning the Losers Game with Charles Ellis

1 × $6.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Professional Trader Training Course (Complete)

1 × $23.00

Professional Trader Training Course (Complete)

1 × $23.00 -

×

Conquering Stock Market Hype with Allan Campbell

1 × $6.00

Conquering Stock Market Hype with Allan Campbell

1 × $6.00 -

×

Pinpoint Profit Method Class

1 × $31.00

Pinpoint Profit Method Class

1 × $31.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

Falcon FX Pro

1 × $31.00

Falcon FX Pro

1 × $31.00 -

×

FX Cartel Online Course

1 × $31.00

FX Cartel Online Course

1 × $31.00 -

×

Lee Gettess’s Package

1 × $6.00

Lee Gettess’s Package

1 × $6.00 -

×

Options University - 3rd Anual Forex Superconference

1 × $3.00

Options University - 3rd Anual Forex Superconference

1 × $3.00 -

×

How Charts Can Help You in the Stock Market with William Jiller

1 × $6.00

How Charts Can Help You in the Stock Market with William Jiller

1 × $6.00 -

×

Philadelphia Seminar Replay & PDF Study Guide with ASFX Day Trading

1 × $31.00

Philadelphia Seminar Replay & PDF Study Guide with ASFX Day Trading

1 × $31.00 -

×

Security Analysis Sixth Edition, Foreword by Warren Buffett with Benjamin Graham, David Dodd

1 × $6.00

Security Analysis Sixth Edition, Foreword by Warren Buffett with Benjamin Graham, David Dodd

1 × $6.00 -

×

Online Forex University Course

1 × $10.00

Online Forex University Course

1 × $10.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

Mastering The ICO: Spotting Needles In A Haystack with Alphashark

1 × $39.00

Mastering The ICO: Spotting Needles In A Haystack with Alphashark

1 × $39.00 -

×

NoBSFX Trading Workshop with Jaime Johnson

1 × $23.00

NoBSFX Trading Workshop with Jaime Johnson

1 × $23.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

Market Maker’s Method Dec 2010 (PDF, MT4 Indicators, Video 600 MB)

1 × $6.00

Market Maker’s Method Dec 2010 (PDF, MT4 Indicators, Video 600 MB)

1 × $6.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

Andrew Keene's Most Confident Trade Yet

1 × $54.00

Andrew Keene's Most Confident Trade Yet

1 × $54.00 -

×

Pro Online Trader. Trade Like a Pro (Video 1.30 GB)

1 × $6.00

Pro Online Trader. Trade Like a Pro (Video 1.30 GB)

1 × $6.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

Quantifiable Edges VIX Trading Course with Amibroker Code - Quantifiable Edges

1 × $15.00

Quantifiable Edges VIX Trading Course with Amibroker Code - Quantifiable Edges

1 × $15.00 -

×

Master Class: Income Trading with Option Pit

1 × $101.00

Master Class: Income Trading with Option Pit

1 × $101.00 -

×

ZoneTrader Pro v2 (Sep 2013)

1 × $23.00

ZoneTrader Pro v2 (Sep 2013)

1 × $23.00 -

×

Indian Time Cycles and Market Forecasting with Barry William Rosen

1 × $7.00

Indian Time Cycles and Market Forecasting with Barry William Rosen

1 × $7.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Learn to Trade Forex and Stocks – From Beginner to Advanced

1 × $6.00

Learn to Trade Forex and Stocks – From Beginner to Advanced

1 × $6.00 -

×

Evolved Traders with Riley Coleman

1 × $5.00

Evolved Traders with Riley Coleman

1 × $5.00 -

×

ICinDER V2 Cycle Analysis and TrendGuide Pack and Bloodhound Ultimate (May 2015)

1 × $31.00

ICinDER V2 Cycle Analysis and TrendGuide Pack and Bloodhound Ultimate (May 2015)

1 × $31.00 -

×

Intermarket Analysis with John Murphy

1 × $6.00

Intermarket Analysis with John Murphy

1 × $6.00 -

×

IBD Advanced Buying Strategies Home Study Program

1 × $10.00

IBD Advanced Buying Strategies Home Study Program

1 × $10.00 -

×

Carter FX 2.0 with CFX University

1 × $5.00

Carter FX 2.0 with CFX University

1 × $5.00 -

×

Markets 101 Complete Course with Joseph Wang - Central Banking 101

1 × $13.00

Markets 101 Complete Course with Joseph Wang - Central Banking 101

1 × $13.00 -

×

Hedge Funds: Insights in Performance Measurement, Risk Analysis, and Portfolio Allocation (1st Edition) - Greg Gregoriou, Georges Hübner, Nicolas Papageorgiou & Fabrice Rouah

1 × $6.00

Hedge Funds: Insights in Performance Measurement, Risk Analysis, and Portfolio Allocation (1st Edition) - Greg Gregoriou, Georges Hübner, Nicolas Papageorgiou & Fabrice Rouah

1 × $6.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

InterMarket Analysis (Ed.2004) with John J.Murphy

1 × $6.00

InterMarket Analysis (Ed.2004) with John J.Murphy

1 × $6.00 -

×

Hedged Strategy Series in Volatile Markets All 4 with Dan Sheridan

1 × $15.00

Hedged Strategy Series in Volatile Markets All 4 with Dan Sheridan

1 × $15.00 -

×

Intro to Options Trading with Real Life Trading

1 × $13.00

Intro to Options Trading with Real Life Trading

1 × $13.00 -

×

Main Online Course with MadCharts

1 × $5.00

Main Online Course with MadCharts

1 × $5.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

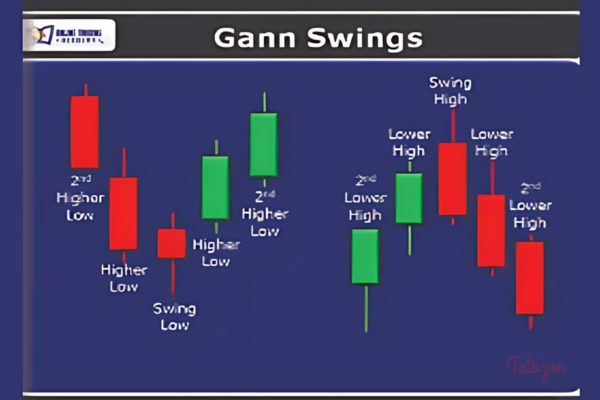

Terry Ashman’s Gann Swings Swing Trading Course (HotTrader Tutorial)

1 × $6.00

Terry Ashman’s Gann Swings Swing Trading Course (HotTrader Tutorial)

1 × $6.00 -

×

Wyckoff Stock Market Institute

1 × $5.00

Wyckoff Stock Market Institute

1 × $5.00 -

×

Radioactive Trading Mastery Course

1 × $6.00

Radioactive Trading Mastery Course

1 × $6.00 -

×

Module 4 Elliot Wave and Identify Wave Count

1 × $31.00

Module 4 Elliot Wave and Identify Wave Count

1 × $31.00 -

×

Galactic Trader Seminar

1 × $15.00

Galactic Trader Seminar

1 × $15.00 -

×

ETFMax

1 × $31.00

ETFMax

1 × $31.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

Fundamentals of Algorithmic Trading

1 × $23.00

Fundamentals of Algorithmic Trading

1 × $23.00 -

×

Day Trading and Swing Trading Strategies For Stocks By Mohsen Hassan

1 × $6.00

Day Trading and Swing Trading Strategies For Stocks By Mohsen Hassan

1 × $6.00 -

×

Dan Sheridan Delta Force

1 × $6.00

Dan Sheridan Delta Force

1 × $6.00 -

×

New Market Timing Techniques

1 × $6.00

New Market Timing Techniques

1 × $6.00 -

×

Getting Started in Options with Michael Thomsett

1 × $6.00

Getting Started in Options with Michael Thomsett

1 × $6.00 -

×

Gold Nuggets for Stock and Commodity Traders with George Bayer

1 × $6.00

Gold Nuggets for Stock and Commodity Traders with George Bayer

1 × $6.00 -

×

Geomagnetic Storms & Stock Markets (Article) with Anna Krivelyova, C.Robotti

1 × $6.00

Geomagnetic Storms & Stock Markets (Article) with Anna Krivelyova, C.Robotti

1 × $6.00 -

×

Forex Mentor - FX Winning Strategies

1 × $15.00

Forex Mentor - FX Winning Strategies

1 × $15.00

A Process for Prudential Institutional Investment with Bancroft, Caldwell, McSweeny

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “A Process for Prudential Institutional Investment with Bancroft, Caldwell, McSweeny” below:

A Process for Prudential Institutional Investment with Bancroft, Caldwell, McSweeny

Introduction

Navigating the complexities of institutional investment requires a disciplined approach to manage risks and optimize returns effectively. The framework developed by Bancroft, Caldwell, and McSweeny offers a comprehensive process for prudential investment, ensuring that institutions can meet their fiduciary responsibilities while seeking growth.

Understanding Prudential Investment

Prudential investment involves strategies that emphasize safety, soundness, and the prudent management of assets, essential for institutional investors responsible for managing substantial portfolios.

The Role of Institutional Investors

Institutional investors, such as pension funds, insurance companies, and endowments, play a critical role in the financial markets, managing large pools of money that support retirement benefits, insurance policies, and educational programs.

Who are Bancroft, Caldwell, and McSweeny?

Bancroft, Caldwell, and McSweeny are esteemed financial experts known for their strategic insights into institutional investments, offering models that prioritize risk management and compliance within regulatory frameworks.

Key Principles of the Investment Process

Asset Allocation

Asset allocation is a fundamental component, involving the distribution of assets across various categories to balance risk and return.

Diversification Strategies

Diversification is crucial to mitigating risk, ensuring that the investment portfolio is spread across different asset classes to avoid concentration in any single area.

Risk Management

Effective risk management involves identifying, analyzing, and addressing potential risks to the portfolio to preserve capital and maintain stability.

Implementing the Investment Process

Step-by-Step Approach

A structured step-by-step approach helps institutions implement the investment strategies effectively, starting from thorough market research to final execution.

Investment Policy Development

Developing a robust investment policy is critical. This policy sets the guidelines for the types of investments allowed, the risk tolerance levels, and the strategic objectives of the institution.

Regular Monitoring and Reassessment

Continuous monitoring of the investment portfolio and regular reassessment of investment strategies are essential to adapt to changing market conditions and ensure alignment with the institution’s goals.

Tools and Techniques for Effective Investment

Analytical Tools

Utilizing advanced analytical tools can provide deep insights into market trends, asset performance, and potential risks, aiding in informed decision-making.

Portfolio Analytics

Portfolio analytics help in assessing the performance of the investment portfolio against benchmarks and strategic targets.

Compliance and Regulatory Adherence

Ensuring compliance with relevant laws and regulations is paramount for institutional investors to avoid legal repercussions and maintain trust.

Challenges in Institutional Investment

Market Volatility

Handling market volatility is one of the major challenges. Strategies to navigate these waters include dynamic asset allocation and hedging techniques.

Regulatory Changes

Staying abreast of regulatory changes and adapting investment strategies accordingly is crucial for compliance and performance.

Technological Advancements

Embracing technological advancements can enhance analytical capabilities, but it also requires staying updated with tech trends that impact financial markets.

Case Studies and Success Stories

Learning from Successful Investments

Analyzing successful investment strategies employed by leading institutions can provide practical insights and actionable lessons.

Addressing Failures

Understanding past investment failures is equally important to identify what went wrong and how similar mistakes can be avoided in the future.

Best Practices in Institutional Investment

Compiling best practices from experienced investors can help in crafting more effective investment strategies.

Conclusion

The investment framework by Bancroft, Caldwell, and McSweeny offers a robust foundation for prudential institutional investment. By adopting their disciplined approach, institutional investors can navigate the complexities of the financial markets with confidence, ensuring both compliance and performance.

Frequently Asked Questions:

- What is prudential institutional investment?

Prudential institutional investment refers to the practice of managing large-scale investment portfolios in a manner that emphasizes risk management, regulatory compliance, and sound financial principles. - Why is asset allocation important in institutional investments?

Asset allocation helps in balancing risk and return, which is crucial for achieving the long-term financial objectives of institutional portfolios. - How often should institutional investments be reassessed?

Institutional investments should be reassessed regularly, at least annually, or as market conditions and institutional goals evolve. - What tools are essential for effective institutional investment management?

Advanced analytical tools, portfolio management software, and compliance tracking systems are essential for effective management. - What are the best practices for managing institutional investments during market volatility?

Best practices include maintaining a diversified portfolio, employing hedging strategies, and continuously monitoring market conditions to make informed adjustments.

Be the first to review “A Process for Prudential Institutional Investment with Bancroft, Caldwell, McSweeny” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.