-

×

Quick Scalp Trader (Unlocked)

1 × $31.00

Quick Scalp Trader (Unlocked)

1 × $31.00 -

×

Complete Trading Bundle with AAA Quants

1 × $27.00

Complete Trading Bundle with AAA Quants

1 × $27.00 -

×

FX GOAT CURRENCIES COURSE 2.0

1 × $13.00

FX GOAT CURRENCIES COURSE 2.0

1 × $13.00 -

×

The Online Investing Book with Harry Domash

1 × $6.00

The Online Investing Book with Harry Domash

1 × $6.00 -

×

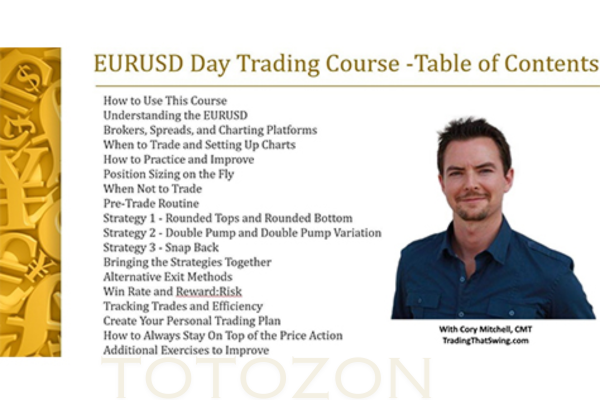

The EURUSD Day Trading Course with Cory Mitchell - Trade That Swing

1 × $15.00

The EURUSD Day Trading Course with Cory Mitchell - Trade That Swing

1 × $15.00 -

×

TRADER SMILE MANAGEMENT TRAINING COURSE

1 × $31.00

TRADER SMILE MANAGEMENT TRAINING COURSE

1 × $31.00 -

×

Momentum Explained. Vol.1

1 × $6.00

Momentum Explained. Vol.1

1 × $6.00 -

×

The Finessee_fx Enigma Course + PD Array Matrix with Pipsey Hussle

1 × $13.00

The Finessee_fx Enigma Course + PD Array Matrix with Pipsey Hussle

1 × $13.00 -

×

Cloud9Nine Trading Course

1 × $5.00

Cloud9Nine Trading Course

1 × $5.00 -

×

Street Smarts & TS Code with Larry Connors & Linda Bradford Rashcke

1 × $6.00

Street Smarts & TS Code with Larry Connors & Linda Bradford Rashcke

1 × $6.00 -

×

Toast FX Course

1 × $5.00

Toast FX Course

1 × $5.00 -

×

Investments (6th Ed.)

1 × $6.00

Investments (6th Ed.)

1 × $6.00 -

×

Tradeciety Online Forex Trading MasterClass

1 × $5.00

Tradeciety Online Forex Trading MasterClass

1 × $5.00 -

×

Hot Trading Investing Strategy: ETF and Futures with QSB Funds

1 × $6.00

Hot Trading Investing Strategy: ETF and Futures with QSB Funds

1 × $6.00 -

×

The Order Flow Edge Trading Course with Michael Valtos

1 × $20.00

The Order Flow Edge Trading Course with Michael Valtos

1 × $20.00 -

×

Trading Indicators for the 21th Century

1 × $15.00

Trading Indicators for the 21th Century

1 × $15.00 -

×

The Ultimate Supply and Demand Course - Anonymous

1 × $31.00

The Ultimate Supply and Demand Course - Anonymous

1 × $31.00 -

×

Dynamic Swing Trader-NETPICKS (Unlocked)

1 × $54.00

Dynamic Swing Trader-NETPICKS (Unlocked)

1 × $54.00 -

×

Trading Psychology - How to Think Like a Professional Trader - 4 DVD

1 × $6.00

Trading Psychology - How to Think Like a Professional Trader - 4 DVD

1 × $6.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

The Smart Income Strategy with Anthony Verner

1 × $171.00

The Smart Income Strategy with Anthony Verner

1 × $171.00 -

×

Maximizing Profits with Weekly Options with Optionpit

1 × $15.00

Maximizing Profits with Weekly Options with Optionpit

1 × $15.00 -

×

The Investor Accelerator Premium Membership

1 × $34.00

The Investor Accelerator Premium Membership

1 × $34.00 -

×

Mindset Trader Day Trading Course with Mafia Trading

1 × $6.00

Mindset Trader Day Trading Course with Mafia Trading

1 × $6.00 -

×

MOJO TOOLBOX with ProTrader Mike

1 × $23.00

MOJO TOOLBOX with ProTrader Mike

1 × $23.00 -

×

The Stock Market Course with George Fontanills & Tom Gentile

1 × $6.00

The Stock Market Course with George Fontanills & Tom Gentile

1 × $6.00 -

×

Trading BIG Moves With Options

1 × $31.00

Trading BIG Moves With Options

1 × $31.00 -

×

Thetimefactor - TRADING WITH PRICE

1 × $15.00

Thetimefactor - TRADING WITH PRICE

1 × $15.00 -

×

TTM Directional Day Filter System for TS

1 × $6.00

TTM Directional Day Filter System for TS

1 × $6.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

Weekly Power Options Strategies

1 × $6.00

Weekly Power Options Strategies

1 × $6.00 -

×

Advanced Seminar

1 × $31.00

Advanced Seminar

1 × $31.00 -

×

The Profit-Taker Breakthrough with Don Abrams

1 × $4.00

The Profit-Taker Breakthrough with Don Abrams

1 × $4.00 -

×

Level 3 - AlgoX Trading Tactics

1 × $31.00

Level 3 - AlgoX Trading Tactics

1 × $31.00 -

×

The First Time Investor: How to Start Safe, Invest Smart and Sleep Well (2nd Edition) with Larry Chambers

1 × $6.00

The First Time Investor: How to Start Safe, Invest Smart and Sleep Well (2nd Edition) with Larry Chambers

1 × $6.00 -

×

Expert Option Trading Course with David Vallieres & Tim Warren

1 × $23.00

Expert Option Trading Course with David Vallieres & Tim Warren

1 × $23.00 -

×

The Email Academy

1 × $31.00

The Email Academy

1 × $31.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

ValueSpace. Winning the Battle for Market Leadership with Banwari Mittal, Jagdish N.Sheth

1 × $6.00

ValueSpace. Winning the Battle for Market Leadership with Banwari Mittal, Jagdish N.Sheth

1 × $6.00 -

×

Bradley F.Cowan (Cycle-Trader.com)

1 × $23.00

Bradley F.Cowan (Cycle-Trader.com)

1 × $23.00 -

×

Breakouts: The Quintessential Approach – Feibel Trading

1 × $31.00

Breakouts: The Quintessential Approach – Feibel Trading

1 × $31.00 -

×

Time Factor Digital Course with William McLaren

1 × $6.00

Time Factor Digital Course with William McLaren

1 × $6.00 -

×

TTM Slingshot

1 × $6.00

TTM Slingshot

1 × $6.00 -

×

Vantagepointtrading - Stock Market Swing Trading Video Course

1 × $15.00

Vantagepointtrading - Stock Market Swing Trading Video Course

1 × $15.00 -

×

Momentum Signals Interactive Training Course 2010-2011

1 × $6.00

Momentum Signals Interactive Training Course 2010-2011

1 × $6.00 -

×

GLOBAL MACRO PRO TRADING COURSE

1 × $31.00

GLOBAL MACRO PRO TRADING COURSE

1 × $31.00 -

×

Ichimoku Traders Academy with Tyler Espitia

1 × $31.00

Ichimoku Traders Academy with Tyler Espitia

1 × $31.00 -

×

Instant Cash With Judgment Liens with Mike Warren

1 × $6.00

Instant Cash With Judgment Liens with Mike Warren

1 × $6.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00

Plunketts Investment & Securities Industry Almanac 2010 with Jack W.Plunkett

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Plunketts Investment & Securities Industry Almanac 2010 with Jack W.Plunkett” below:

Plunkett’s Investment & Securities Industry Almanac 2010 with Jack W. Plunkett

Introduction

In the ever-evolving landscape of finance, “Plunkett’s Investment & Securities Industry Almanac 2010” by Jack W. Plunkett stands as a crucial resource. This comprehensive guide provides an in-depth look into the trends, technologies, and key players of the investment and securities industry as of 2010. Here, we explore the valuable insights and data-rich content of this essential financial compendium.

Overview of Plunkett’s Almanac

What is Plunkett’s Almanac?

Plunkett’s Almanac serves as an annual resource that aggregates critical data and analysis on various industries. The 2010 edition focuses specifically on the investment and securities sector.

Purpose and Utility

The almanac aims to equip investors, financial analysts, and industry professionals with the latest trends, enabling informed decision-making and strategic planning.

Key Features of the 2010 Edition

Industry Trends

Discover the major trends that shaped the investment world in 2010, from global economic shifts to regulatory changes.

Technological Advancements

Learn about the technological innovations that were disrupting the securities industry at that time, such as automated trading systems and blockchain prototypes.

Market Analysis

The almanac provides detailed market analysis, including performance benchmarks of different asset classes and financial instruments.

Tools for Professionals

Statistical Data

Extensive statistical data covering market sizes, growth rates, and industry forecasts are highlighted, offering a quantitative foundation for analysis.

Company Profiles

Detailed profiles of leading companies give insights into their operations, strategic directions, and financial health.

Investment Opportunities

Identifying potential investment opportunities within various segments of the securities industry as presented in the almanac.

Reading Between the Lines

Analyzing Predictions vs. Reality

Explore how the predictions made in the 2010 edition have held up over the years, providing a retrospective analysis.

Lessons Learned

Understanding the cyclical nature of financial markets through the lens of past analyses can provide valuable lessons for today’s investors.

For Academic Use

Educational Insights

The almanac is also a vital resource for academic settings, enhancing curriculum for finance and economic students.

Research Applications

Researchers can utilize the comprehensive data to support studies and papers related to financial markets and economic theories.

Global Impact

Influence on Global Markets

Discussion on how the trends and data from the almanac influence global investment strategies and financial policies.

Case Studies

Incorporate real-world case studies from the almanac to illustrate successful investment strategies and pitfalls.

The Future of Investment Analysis

Predicting Trends

Using historical data from sources like Plunkett’s to forecast future industry movements.

Adapting to Changes

How current professionals can use historical data to adapt to the rapid changes in the investment landscape.

Conclusion

“Plunkett’s Investment & Securities Industry Almanac 2010” provides a treasure trove of information that remains relevant for understanding past market dynamics and their implications on future trends. Jack W. Plunkett’s meticulous compilation serves as both a historical record and a forward-looking tool for anyone involved in the financial sector.

Frequently Asked Questions

- Is the 2010 edition of Plunkett’s Almanac still relevant today?

- Yes, it provides historical context that is crucial for understanding long-term trends and cycles in the investment world.

- Who benefits most from reading this almanac?

- Financial analysts, investors, educators, and students of finance and economics.

- What makes Plunkett’s Almanac stand out from other financial reports?

- Its comprehensive coverage, detailed company profiles, and predictive insights set it apart.

- How can investors use this almanac to improve their strategies?

- By analyzing historical data and trends to better predict and react to future market movements.

- Can this almanac help predict future financial crises?

- While it cannot predict specific events, it helps identify risk factors and trends that may indicate potential crises.

Be the first to review “Plunketts Investment & Securities Industry Almanac 2010 with Jack W.Plunkett” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.