-

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

2 Day Personal Training Course (Seminar Package) with Martin Pring

1 × $6.00

2 Day Personal Training Course (Seminar Package) with Martin Pring

1 × $6.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

BuySide Global Professional (Jul 2018)

1 × $101.00

BuySide Global Professional (Jul 2018)

1 × $101.00 -

×

Volume Cycles in the stock Market

1 × $6.00

Volume Cycles in the stock Market

1 × $6.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

15 Minutes to Financial Freedom with The Better Traders

1 × $20.00

15 Minutes to Financial Freedom with The Better Traders

1 × $20.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

10 Pips System. The 3rd Candle with Abner Gelin

1 × $6.00

10 Pips System. The 3rd Candle with Abner Gelin

1 × $6.00 -

×

10-Week Stock Trading Program with Stock Market Lab

1 × $6.00

10-Week Stock Trading Program with Stock Market Lab

1 × $6.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

2017 Plan or Get Slaughtered Class with Doc Severson

1 × $6.00

2017 Plan or Get Slaughtered Class with Doc Severson

1 × $6.00 -

×

10 Pips Anytime you Want with Karl Dittmann

1 × $6.00

10 Pips Anytime you Want with Karl Dittmann

1 × $6.00 -

×

12 Strategies for Picking Tops & Bottoms

1 × $23.00

12 Strategies for Picking Tops & Bottoms

1 × $23.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

101 Option Trading Secrets with Kenneth Trester

1 × $6.00

101 Option Trading Secrets with Kenneth Trester

1 × $6.00 -

×

XJO Quant - High Probability Trading Setups on ASX 200 Index

1 × $31.00

XJO Quant - High Probability Trading Setups on ASX 200 Index

1 × $31.00 -

×

(SU281) Complex & Organic Modeling

1 × $85.00

(SU281) Complex & Organic Modeling

1 × $85.00

Risk Management Toolkit with Peter Bain

$6.00

File Size: Cooming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

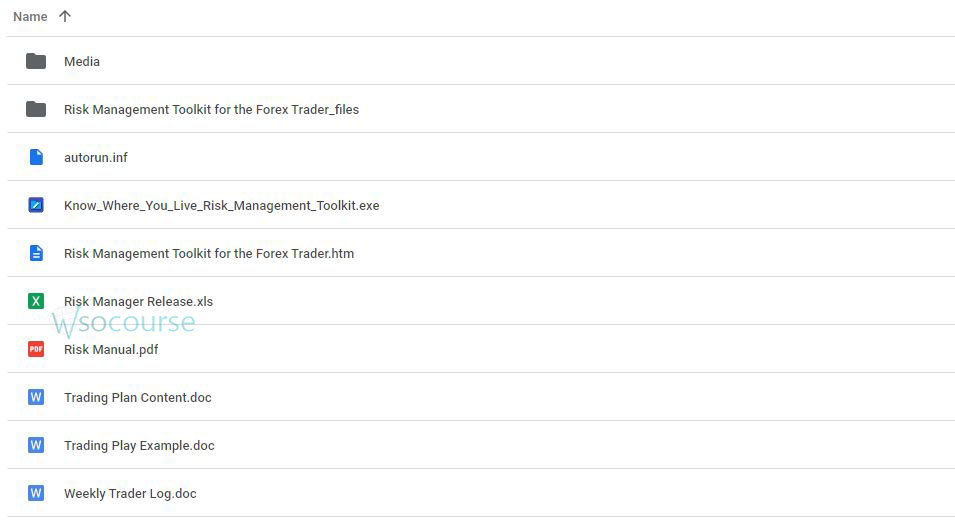

You may check content proof of “Risk Management Toolkit with Peter Bain” below:

Risk Management Toolkit with Peter Bain

Introduction

In the dynamic world of finance, risk management is the cornerstone of sustainable trading and investment strategies. Peter Bain, a renowned financial expert, offers a comprehensive toolkit that empowers traders and investors to minimize risks and maximize returns. Let’s delve into this essential resource.

What is Risk Management?

Risk management involves identifying, assessing, and prioritizing risks followed by coordinated efforts to minimize, monitor, and control the probability or impact of unfortunate events.

Key Components of Risk Management

- Risk Identification

- Risk Assessment

- Risk Mitigation Strategies

Peter Bain’s Risk Management Framework

Peter Bain’s approach to risk management is systematic and comprehensive, ensuring that traders can withstand financial storms and capitalize on opportunities.

Steps in Bain’s Framework

- Establish Risk Tolerance: Determining how much risk is acceptable.

- Develop Risk Strategies: Techniques to mitigate identified risks.

- Implement Risk Controls: Tools and methods to manage risks.

Tools in the Risk Management Toolkit

Bain advocates using specific tools to streamline the risk management process effectively.

Essential Tools

- Risk Calculators: For precise risk assessment.

- Automated Trading Systems: To maintain discipline in trading.

- Stop-Loss Orders: To limit potential losses.

Creating a Risk Management Plan

A well-structured risk management plan is vital for any successful investment strategy.

Components of a Good Plan

- Objective Setting

- Risk Analysis

- Strategy Implementation

Monitoring and Adjusting

Constant monitoring and adjustment of the risk management plan are necessary to align with changing market conditions.

Techniques for Effective Monitoring

- Regular Reviews

- Performance Metrics

- Adjustment Strategies

Behavioral Aspects of Risk Management

Understanding the psychological aspects of risk management can significantly enhance the effectiveness of any strategy.

Psychological Traps to Avoid

- Overconfidence

- Confirmation Bias

The Role of Technology in Risk Management

Technological advancements have revolutionized the way risk management is conducted in the financial sector.

Impact of Technology

- Enhanced Data Analysis

- Improved Accuracy in Risk Assessment

Case Studies: Successful Risk Management

Examining successful case studies can provide practical insights into effective risk management practices.

Examples from the Field

- Case Study 1: Effective use of stop-loss orders.

- Case Study 2: Benefits of automated trading systems.

Conclusion

Peter Bain’s Risk Management Toolkit provides a robust foundation for traders and investors aiming to safeguard their portfolios and enhance their financial outcomes. By embracing these tools and strategies, individuals can navigate the complexities of the financial markets with greater confidence and control.

FAQs

- What is risk management in finance?

- It involves identifying, assessing, and controlling threats to an organization’s capital and earnings.

- What are the key tools in Peter Bain’s risk management toolkit?

- Key tools include risk calculators, automated trading systems, and stop-loss orders.

- How often should a risk management plan be reviewed?

- It should be reviewed regularly, depending on market volatility and investment performance.

- What role does technology play in risk management?

- Technology plays a crucial role in enhancing the accuracy and efficiency of risk assessments and management.

- Can psychological factors affect risk management decisions?

- Yes, psychological factors like overconfidence and bias can significantly impact decision-making in risk management.

Be the first to review “Risk Management Toolkit with Peter Bain” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Reviews

There are no reviews yet.