-

×

RSD - Alex’s Natural Instinct Method Manifesto

1 × $6.00

RSD - Alex’s Natural Instinct Method Manifesto

1 × $6.00 -

×

Design for Six Sigma with Subir Chowdhury

1 × $6.00

Design for Six Sigma with Subir Chowdhury

1 × $6.00 -

×

Evolution Markets (Full Main Course)

1 × $5.00

Evolution Markets (Full Main Course)

1 × $5.00 -

×

AbleTrend with John Wang & Grace Wang

1 × $6.00

AbleTrend with John Wang & Grace Wang

1 × $6.00 -

×

Footprint Day Trading Blueprint with Futures Flow

1 × $5.00

Footprint Day Trading Blueprint with Futures Flow

1 × $5.00 -

×

Create Your Trade Plan with Yuri Shramenko

1 × $6.00

Create Your Trade Plan with Yuri Shramenko

1 × $6.00 -

×

Trading Options as a Professional: Techniques for Market Makers and Experienced Traders with James Bittman

1 × $6.00

Trading Options as a Professional: Techniques for Market Makers and Experienced Traders with James Bittman

1 × $6.00 -

×

Advanced Fibonacci Trading with Neal Hughes

1 × $6.00

Advanced Fibonacci Trading with Neal Hughes

1 × $6.00 -

×

Buy, Sell or Hold Manage Your Portfolio for Maximum Gain with Michaal Thomsett

1 × $6.00

Buy, Sell or Hold Manage Your Portfolio for Maximum Gain with Michaal Thomsett

1 × $6.00 -

×

Trade with a Day Job USA v2010 with Markets Mastered

1 × $6.00

Trade with a Day Job USA v2010 with Markets Mastered

1 × $6.00 -

×

Trading The Hobbs Triple Crown Strategy with Derrik Hobbs

1 × $6.00

Trading The Hobbs Triple Crown Strategy with Derrik Hobbs

1 × $6.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

Volume Breakout Indicator

1 × $31.00

Volume Breakout Indicator

1 × $31.00 -

×

Scanning For Gold with Doug Sutton

1 × $6.00

Scanning For Gold with Doug Sutton

1 × $6.00 -

×

Developing Profitable Systems from Discretionary to Mechanical with Fred Shutzman

1 × $6.00

Developing Profitable Systems from Discretionary to Mechanical with Fred Shutzman

1 × $6.00 -

×

Artificial Neural Networks Technology with Dave Anderson, George McNeill

1 × $6.00

Artificial Neural Networks Technology with Dave Anderson, George McNeill

1 × $6.00 -

×

Common Sense Commodities with David Duty

1 × $6.00

Common Sense Commodities with David Duty

1 × $6.00 -

×

Using Robert’s Indicators with Rob Hoffman

1 × $6.00

Using Robert’s Indicators with Rob Hoffman

1 × $6.00 -

×

Commitments of Traders : Strategies for Tracking the Market and Trading Profitably with Floyd Upperman

1 × $6.00

Commitments of Traders : Strategies for Tracking the Market and Trading Profitably with Floyd Upperman

1 × $6.00 -

×

Scalping the Forex

1 × $6.00

Scalping the Forex

1 × $6.00 -

×

Trader University Course

1 × $5.00

Trader University Course

1 × $5.00 -

×

Advanced Trading System 2020

1 × $179.00

Advanced Trading System 2020

1 × $179.00 -

×

Inner Circle Trader

1 × $6.00

Inner Circle Trader

1 × $6.00 -

×

3 Day Master Advanced Workshop Seminar (Video & Manuals 8.48 GB)

1 × $6.00

3 Day Master Advanced Workshop Seminar (Video & Manuals 8.48 GB)

1 × $6.00 -

×

Crypto for Starters: All You Need to Know to Start Investing and Trading Cryptocurrency on Binance with Malcolm Yard

1 × $5.00

Crypto for Starters: All You Need to Know to Start Investing and Trading Cryptocurrency on Binance with Malcolm Yard

1 × $5.00 -

×

Tradezilla 2.0

1 × $5.00

Tradezilla 2.0

1 × $5.00 -

×

The Index Trading Course Workbook: Step-by-Step Exercises and Tests to Help You Master The Index Trading Course with George Fontanills & Tom Gentile

1 × $6.00

The Index Trading Course Workbook: Step-by-Step Exercises and Tests to Help You Master The Index Trading Course with George Fontanills & Tom Gentile

1 × $6.00 -

×

ETF Trading Strategies Revealed with David Vomund

1 × $6.00

ETF Trading Strategies Revealed with David Vomund

1 × $6.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Stock Market Rules (2nd Ed.) with Michael Sheimo

1 × $6.00

Stock Market Rules (2nd Ed.) with Michael Sheimo

1 × $6.00 -

×

Trading on the Edge with Guido J.Deboeck

1 × $6.00

Trading on the Edge with Guido J.Deboeck

1 × $6.00 -

×

Traders Seminars – 7 CD

1 × $31.00

Traders Seminars – 7 CD

1 × $31.00 -

×

Technical Analysis for Short-Term Traders

1 × $6.00

Technical Analysis for Short-Term Traders

1 × $6.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

Power Charting - Robert’s Indicator Webinar

1 × $6.00

Power Charting - Robert’s Indicator Webinar

1 × $6.00 -

×

T.A.M.E. Home Study Course with Doug Sutton

1 × $6.00

T.A.M.E. Home Study Course with Doug Sutton

1 × $6.00 -

×

The McClellan Oscillator and Other Tools for with Tom McClellan

1 × $6.00

The McClellan Oscillator and Other Tools for with Tom McClellan

1 × $6.00 -

×

Trading with Oscillators. Pinpointing Market Extremes with Mark Etzkorn

1 × $6.00

Trading with Oscillators. Pinpointing Market Extremes with Mark Etzkorn

1 × $6.00 -

×

Video Bundle - 4d & "Into The Abyss" with Blackrabbitfx

1 × $6.00

Video Bundle - 4d & "Into The Abyss" with Blackrabbitfx

1 × $6.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

Chaos and order in the Capital Markets with Edgar E.Peters

1 × $6.00

Chaos and order in the Capital Markets with Edgar E.Peters

1 × $6.00 -

×

Forex Trading Systems Elearning Course - Busted Breakout System with Van Tharp

1 × $6.00

Forex Trading Systems Elearning Course - Busted Breakout System with Van Tharp

1 × $6.00 -

×

Secret Forex Society Economic Reports (2006-2007) with Felix Homogratus

1 × $6.00

Secret Forex Society Economic Reports (2006-2007) with Felix Homogratus

1 × $6.00 -

×

AstroFibonacci 7.3722 magisociety

1 × $6.00

AstroFibonacci 7.3722 magisociety

1 × $6.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

Advanced Swing Trading with John Crane

1 × $6.00

Advanced Swing Trading with John Crane

1 × $6.00 -

×

Cheat Code Trading System

1 × $13.00

Cheat Code Trading System

1 × $13.00 -

×

The Great Depression with David Burg

1 × $6.00

The Great Depression with David Burg

1 × $6.00 -

×

Tenkei Trading Techniques Programme with Wilson P.Williams

1 × $6.00

Tenkei Trading Techniques Programme with Wilson P.Williams

1 × $6.00 -

×

The 5 Day Momentum Method

1 × $6.00

The 5 Day Momentum Method

1 × $6.00 -

×

The Crash of 1997 (Article) with Hans Hannula

1 × $6.00

The Crash of 1997 (Article) with Hans Hannula

1 × $6.00 -

×

Candlestick Secrets For Profiting In Options

1 × $23.00

Candlestick Secrets For Profiting In Options

1 × $23.00 -

×

Fibonacci Trading: How to Master the Time and Price Advantage with Carolyn Boroden

1 × $6.00

Fibonacci Trading: How to Master the Time and Price Advantage with Carolyn Boroden

1 × $6.00 -

×

Advanced GET 8.0 EOD

1 × $6.00

Advanced GET 8.0 EOD

1 × $6.00 -

×

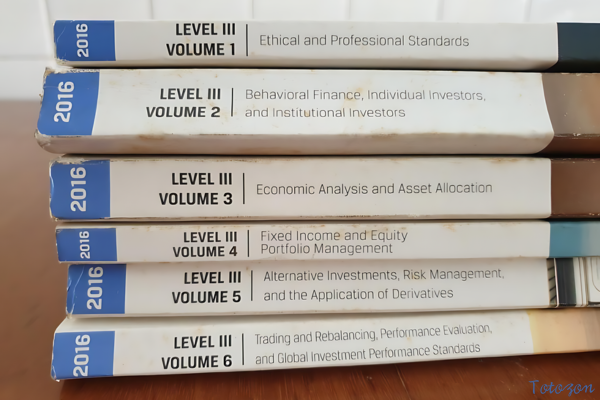

CFA Level 1,2,3 - Study Guides 2006

1 × $6.00

CFA Level 1,2,3 - Study Guides 2006

1 × $6.00 -

×

Trading Indicators for the 21st Century

1 × $6.00

Trading Indicators for the 21st Century

1 × $6.00 -

×

An Introduction to Option Trading Success with James Bittman

1 × $6.00

An Introduction to Option Trading Success with James Bittman

1 × $6.00 -

×

PayTrading with Eric Shawn

1 × $6.00

PayTrading with Eric Shawn

1 × $6.00 -

×

Advanced Trading Course with DovyFX

1 × $5.00

Advanced Trading Course with DovyFX

1 × $5.00 -

×

Advanced Forex Mastery Course with Alpha Forex Global

1 × $5.00

Advanced Forex Mastery Course with Alpha Forex Global

1 × $5.00 -

×

The Market Matrix

1 × $6.00

The Market Matrix

1 × $6.00 -

×

Zap Seminar - Ablesys

1 × $6.00

Zap Seminar - Ablesys

1 × $6.00 -

×

Scalping Strategy Webinar! recorded. BEST WEBINAR

1 × $23.00

Scalping Strategy Webinar! recorded. BEST WEBINAR

1 × $23.00 -

×

ApexFX Pro

1 × $5.00

ApexFX Pro

1 × $5.00 -

×

Connors on Advanced Trading Strategies with Larry Connors

1 × $6.00

Connors on Advanced Trading Strategies with Larry Connors

1 × $6.00 -

×

Trading with MORE Special Set-ups - Recorded Webinar

1 × $15.00

Trading with MORE Special Set-ups - Recorded Webinar

1 × $15.00 -

×

Wyckoff 2.0: Structures, Volume Profile and Order Flow (Trading and Investing Course: Advanced Technical Analysis) by Rubén Villahermosa

1 × $5.00

Wyckoff 2.0: Structures, Volume Profile and Order Flow (Trading and Investing Course: Advanced Technical Analysis) by Rubén Villahermosa

1 × $5.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Bear Market Success Workshop with Base Camp Trading

1 × $15.00

Bear Market Success Workshop with Base Camp Trading

1 × $15.00 -

×

Bootcamp and eBook with Jjwurldin

1 × $24.00

Bootcamp and eBook with Jjwurldin

1 × $24.00 -

×

Myths of the Free Market with Kenneth Friedman

1 × $6.00

Myths of the Free Market with Kenneth Friedman

1 × $6.00 -

×

System Building Masterclass

1 × $31.00

System Building Masterclass

1 × $31.00 -

×

Advanced Course with Dimitri Wallace - Gold Minds Global

1 × $6.00

Advanced Course with Dimitri Wallace - Gold Minds Global

1 × $6.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

Advanced Trading Applications of Candlestick Charting with Gary S.Wagner & Bradley L.Matheny

1 × $6.00

Advanced Trading Applications of Candlestick Charting with Gary S.Wagner & Bradley L.Matheny

1 × $6.00 -

×

Computerized Trading with Mark Jurik

1 × $6.00

Computerized Trading with Mark Jurik

1 × $6.00 -

×

The Future of Investing with Chris Skinner

1 × $6.00

The Future of Investing with Chris Skinner

1 × $6.00 -

×

Dumb Money: Adventures of a Day Trader with Joey Anuff

1 × $6.00

Dumb Money: Adventures of a Day Trader with Joey Anuff

1 × $6.00 -

×

DiNapoli Levels Training Course with Joe DiNapoli & Merrick Okamoto

1 × $6.00

DiNapoli Levels Training Course with Joe DiNapoli & Merrick Okamoto

1 × $6.00 -

×

Day Trading with Volume Profile and Orderflow - Price Action Volume Trader

1 × $6.00

Day Trading with Volume Profile and Orderflow - Price Action Volume Trader

1 × $6.00 -

×

Trading 3SMA System with Hector DeVille

1 × $6.00

Trading 3SMA System with Hector DeVille

1 × $6.00 -

×

BD FX Course with FX Learning

1 × $6.00

BD FX Course with FX Learning

1 × $6.00 -

×

USDX Trading Course with Jared Martinez - MTI

1 × $6.00

USDX Trading Course with Jared Martinez - MTI

1 × $6.00 -

×

CHARTCHAMPIONS Course

1 × $10.00

CHARTCHAMPIONS Course

1 × $10.00 -

×

Pristine Seminar - Guerrilla Trading Tactics with Oliver Velez

1 × $6.00

Pristine Seminar - Guerrilla Trading Tactics with Oliver Velez

1 × $6.00 -

×

Forex Income Engine Course 2008 - 6 CDs + Manual

1 × $6.00

Forex Income Engine Course 2008 - 6 CDs + Manual

1 × $6.00 -

×

7 Figures Forex Course

1 × $15.00

7 Figures Forex Course

1 × $15.00 -

×

T. Harv Eker’s All-Access

1 × $39.00

T. Harv Eker’s All-Access

1 × $39.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

The Best (Public) Trading Methods I’ve Found for Futures & Equities with Perry J.Kaufman

$6.00

File Size: Cooming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “The Best (Public) Trading Methods I’ve Found for Futures & Equities with Perry J.Kaufman” below:

The Best (Public) Trading Methods I’ve Found for Futures & Equities with Perry J.Kaufman

Introduction

In the vast world of financial trading, the quest for effective and reliable trading methods is unending. Among the plethora of strategies, the methods developed by Perry J. Kaufman stand out, particularly for futures and equities. This article delves into some of the best public trading strategies that Kaufman has offered to traders seeking to maximize their potential in these markets.

Understanding Kaufman’s Approach

Who is Perry J. Kaufman?

Perry J. Kaufman is a renowned expert in the trading world, known for his quantitative and algorithmic trading strategies. With a career spanning several decades, Kaufman has contributed significantly to the development of trading systems that adapt to changing market conditions.

The Philosophy Behind Kaufman’s Strategies

Kaufman’s methods are built on the foundation of adaptability and efficiency. His strategies often incorporate dynamic trading algorithms that adjust based on volatility and market trends, making them particularly useful for futures and equities.

Key Trading Methods

Adaptive Moving Averages

One of Kaufman’s most notable contributions is the Adaptive Moving Average (AMA). This technique adjusts more quickly to market data when the price fluctuations are significant and slows down during less volatile periods.

How AMA Works

- Identify the market trend: AMA filters out the market noise by adjusting its sensitivity.

- Application in real trading: Traders use AMA to refine their entry and exit points, enhancing their trading precision.

Kaufman’s Adaptive Moving Convergence Divergence (KAMA)

Building on the concept of adaptive indicators, Kaufman’s version of the MACD—KAMA—is another tool designed to offer better market entries and exits by accounting for price volatility and market noise.

Benefits of KAMA

- Reduces likelihood of false signals: By adapting to volatility, KAMA helps in filtering out less probable trading signals.

- Enhances strategy performance: Traders often combine KAMA with other indicators to improve decision-making.

Efficiency Ratio and Its Application

Kaufman’s Efficiency Ratio (ER) is a key metric used to measure the efficiency of price movement. A high ER suggests a strong trend, while a low ER indicates a choppy, directionless market.

Utilizing ER in Trading

- Strategy formulation: Traders can design strategies that trigger when the ER crosses certain thresholds, indicating a potential start or end of a trend.

Practical Applications of Kaufman’s Methods

Case Studies in Futures Trading

Using Kaufman’s methods, many traders have successfully navigated the futures markets, capitalizing on trends and adjusting to market reversals with greater agility.

Equity Market Strategies

In the equities market, Kaufman’s strategies have aided traders in managing portfolio volatility and improving trade timing based on adaptive indicators.

Advantages of Kaufman’s Trading Methods

- Flexibility in different market conditions

- Improved accuracy in trend detection

- Effective risk management

Challenges and Considerations

While Kaufman’s methods offer numerous benefits, they require a deep understanding of market mechanics and the ability to interpret complex indicators. Traders must also remain vigilant about over-optimization risks.

Conclusion

Perry J. Kaufman’s trading methods provide a robust framework for tackling the complexities of futures and equities markets. By embracing these adaptive strategies, traders can enhance their trading precision and manage risks more effectively.

FAQs

- What is the Adaptive Moving Average (AMA)?

- AMA is an indicator that adjusts its sensitivity based on market volatility to provide clearer trend signals.

- How does Kaufman’s Efficiency Ratio help in trading?

- It measures the efficiency of price movements, helping traders to identify strong trends and filter out market noise.

- Can Kaufman’s methods be applied to day trading?

- Yes, these methods are versatile and can be adapted for different trading styles, including day trading.

- What are the common pitfalls when using adaptive strategies?

- Overfitting and complexity in interpretation are common challenges faced by traders using these strategies.

- Are Kaufman’s strategies suitable for beginners?

- While effective, Kaufman’s methods often require a higher level of market understanding, making them more suitable for intermediate and advanced traders.

Be the first to review “The Best (Public) Trading Methods I’ve Found for Futures & Equities with Perry J.Kaufman” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

Forex Trading

Forex Trading

Reviews

There are no reviews yet.