-

×

Opportunity Investing with Gerald Appel

1 × $6.00

Opportunity Investing with Gerald Appel

1 × $6.00 -

×

Jigsaw Orderflow Training Course with Jigsaw Trading

1 × $6.00

Jigsaw Orderflow Training Course with Jigsaw Trading

1 × $6.00 -

×

Jesse Livermore Trading System with Joe Marwood - Marwood Research

1 × $15.00

Jesse Livermore Trading System with Joe Marwood - Marwood Research

1 × $15.00 -

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

The TradingKey - Mastering Elliott Wave by Rob Roy 2010 + Complete Workbooks with HUBB Financial

1 × $6.00

The TradingKey - Mastering Elliott Wave by Rob Roy 2010 + Complete Workbooks with HUBB Financial

1 × $6.00 -

×

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00

Options Trading & Ultimate MasterClass With Tyrone Abela - FX Evolution

1 × $54.00 -

×

Wyckoff Analysis Series. Module 2. Wyckoff Candle Volume Analysis

1 × $6.00

Wyckoff Analysis Series. Module 2. Wyckoff Candle Volume Analysis

1 × $6.00 -

×

The Telecoms Trade War with Mark Naftel

1 × $6.00

The Telecoms Trade War with Mark Naftel

1 × $6.00 -

×

Volcano Trading with Claytrader

1 × $15.00

Volcano Trading with Claytrader

1 × $15.00 -

×

Tick By Tick By Alphonso Esposito - TradeSmart

1 × $6.00

Tick By Tick By Alphonso Esposito - TradeSmart

1 × $6.00 -

×

The Haller Theory of Stock Market Trends

1 × $6.00

The Haller Theory of Stock Market Trends

1 × $6.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

How To Read The Market Professionally with TradeSmart

1 × $27.00

How To Read The Market Professionally with TradeSmart

1 × $27.00 -

×

Cwesi Forex Trading Bootcamp (Algo Trading)

1 × $13.00

Cwesi Forex Trading Bootcamp (Algo Trading)

1 × $13.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00

Matrix Spread Options Trading Course with Base Camp Trading

1 × $31.00 -

×

Trading System Development 101,102,103

1 × $6.00

Trading System Development 101,102,103

1 × $6.00 -

×

Lessons from the Greatest Stock Traders of all Time with John Boik

1 × $6.00

Lessons from the Greatest Stock Traders of all Time with John Boik

1 × $6.00 -

×

XJO Quant - High Probability Trading Setups on ASX 200 Index

1 × $31.00

XJO Quant - High Probability Trading Setups on ASX 200 Index

1 × $31.00 -

×

Butterfly and Condor Workshop with Aeromir

1 × $15.00

Butterfly and Condor Workshop with Aeromir

1 × $15.00 -

×

BookMap Advanced v6.1

1 × $6.00

BookMap Advanced v6.1

1 × $6.00 -

×

Advanced Forex Patterns with Vic Noble & Darko Ali

1 × $39.00

Advanced Forex Patterns with Vic Noble & Darko Ali

1 × $39.00 -

×

Buy the Fear Sell the Greed

1 × $6.00

Buy the Fear Sell the Greed

1 × $6.00 -

×

The Orderflow Masterclass with PrimeTrading

1 × $17.00

The Orderflow Masterclass with PrimeTrading

1 × $17.00 -

×

New Foundations for Auction Market Trading Course with Tom Alexander

1 × $54.00

New Foundations for Auction Market Trading Course with Tom Alexander

1 × $54.00 -

×

Tradematic Trading Strategy

1 × $31.00

Tradematic Trading Strategy

1 × $31.00 -

×

Trading Weekly Options for Income in 2016 with Dan Sheridan

1 × $23.00

Trading Weekly Options for Income in 2016 with Dan Sheridan

1 × $23.00 -

×

Mastering Trading Stress with Ari Kiev

1 × $6.00

Mastering Trading Stress with Ari Kiev

1 × $6.00 -

×

Winning System For Trading High-Performance Stocks with Tim Cho

1 × $6.00

Winning System For Trading High-Performance Stocks with Tim Cho

1 × $6.00 -

×

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00

Scalp Strategy and Flipping Small Accounts with Opes Trading Group

1 × $5.00 -

×

A Trader’s Guide To Discipline

1 × $6.00

A Trader’s Guide To Discipline

1 × $6.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

Building Wealth In Stock Market with David Novac

1 × $6.00

Building Wealth In Stock Market with David Novac

1 × $6.00 -

×

Vom Einsteiger zum Mastertrader 2.0 with Mehrwert Garantier

1 × $109.00

Vom Einsteiger zum Mastertrader 2.0 with Mehrwert Garantier

1 × $109.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

Breakthrough Strategies for Predicting Any Market: Charting Elliott Wave, Lucas, Fibonacci and Time for Profit - Jeff Greenblatt & Dawn Bolton-Smith

1 × $6.00

Breakthrough Strategies for Predicting Any Market: Charting Elliott Wave, Lucas, Fibonacci and Time for Profit - Jeff Greenblatt & Dawn Bolton-Smith

1 × $6.00 -

×

Timing the Market with Unique Indicators with Sherman McCellan

1 × $6.00

Timing the Market with Unique Indicators with Sherman McCellan

1 × $6.00 -

×

Building Cryptocurrencies with JavaScript By Stone River eLearning

1 × $6.00

Building Cryptocurrencies with JavaScript By Stone River eLearning

1 × $6.00 -

×

Secret Income with James Altucher

1 × $62.00

Secret Income with James Altucher

1 × $62.00 -

×

The Volatility Surface with Jim Gatheral

1 × $6.00

The Volatility Surface with Jim Gatheral

1 × $6.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

Cycle Trends Professional 2.3 Rear Time with Esignal cycletrends.co.za

1 × $6.00

Cycle Trends Professional 2.3 Rear Time with Esignal cycletrends.co.za

1 × $6.00 -

×

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00

TradeCraft: Your Path to Peak Performance Trading By Adam Grimes

1 × $15.00 -

×

Portfolio Management-Earn 12 Hours CE Credits

1 × $85.00

Portfolio Management-Earn 12 Hours CE Credits

1 × $85.00 -

×

Snapbacks CD

1 × $6.00

Snapbacks CD

1 × $6.00 -

×

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00

0 DTE Options Trading Workshop with Aeromir Corporation

1 × $15.00 -

×

Beat the Bear with Jea Yu

1 × $6.00

Beat the Bear with Jea Yu

1 × $6.00 -

×

Weekly Iron Condors For Income with Bruce Wayne

1 × $6.00

Weekly Iron Condors For Income with Bruce Wayne

1 × $6.00 -

×

The Options Trading Body of Knowledge with Michael Thomsett

1 × $6.00

The Options Trading Body of Knowledge with Michael Thomsett

1 × $6.00 -

×

WyseTrade Trading Masterclass Course

1 × $5.00

WyseTrade Trading Masterclass Course

1 × $5.00 -

×

Value Investing Bootcamp with Nick Kraakman

1 × $15.00

Value Investing Bootcamp with Nick Kraakman

1 × $15.00 -

×

The Three Secrets to Trading Momentum Indicators with David Penn

1 × $6.00

The Three Secrets to Trading Momentum Indicators with David Penn

1 × $6.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

TradeGuider VSA Plugin for MetaTrader 4

1 × $6.00

TradeGuider VSA Plugin for MetaTrader 4

1 × $6.00 -

×

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00

Crypto Trading Academy with Cheeky Investor - Aussie Day Trader

1 × $13.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00

The Complete Guide to Multiple Time Frame Analysis & Reading Price Action with Aiman Almansoori

1 × $13.00 -

×

Baby Blue Trading Technique for the E-Minis with Dave Wright

1 × $6.00

Baby Blue Trading Technique for the E-Minis with Dave Wright

1 × $6.00 -

×

Hedge Fund Trading Systems with Trading Tuitions

1 × $5.00

Hedge Fund Trading Systems with Trading Tuitions

1 × $5.00 -

×

Tom Williams Final Mentorship Course

1 × $6.00

Tom Williams Final Mentorship Course

1 × $6.00 -

×

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00

Advanced Spread Trading with Guy Bower - MasterClass Trader

1 × $15.00 -

×

Adz Trading Academy

1 × $5.00

Adz Trading Academy

1 × $5.00 -

×

US indices system with LaMartinatradingFx

1 × $10.00

US indices system with LaMartinatradingFx

1 × $10.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

Tradezilla 2.0

1 × $5.00

Tradezilla 2.0

1 × $5.00 -

×

Advanced Daytrading Seminar with Ken Calhoun

1 × $155.00

Advanced Daytrading Seminar with Ken Calhoun

1 × $155.00 -

×

Volume Profile Formula with Aaron Korbs

1 × $5.00

Volume Profile Formula with Aaron Korbs

1 × $5.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

The Whale Order with The Forex Scalpers

1 × $5.00

The Whale Order with The Forex Scalpers

1 × $5.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

Forecast 2024 Clarification with Larry Williams

1 × $15.00

Forecast 2024 Clarification with Larry Williams

1 × $15.00 -

×

6 Dynamic Trader Real Time and End Of Day

1 × $39.00

6 Dynamic Trader Real Time and End Of Day

1 × $39.00 -

×

BWT Precision 7.0.2.3 (bluewavetrading.com)

1 × $31.00

BWT Precision 7.0.2.3 (bluewavetrading.com)

1 × $31.00 -

×

WondaFX Signature Strategy with WondaFX

1 × $5.00

WondaFX Signature Strategy with WondaFX

1 × $5.00 -

×

Pro Indicator Pack with Trade Confident

1 × $15.00

Pro Indicator Pack with Trade Confident

1 × $15.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

Vaga Academy with VAGAFX

1 × $5.00

Vaga Academy with VAGAFX

1 × $5.00 -

×

Vega Modified Butterfly Class with Jay Bailey - Sheridan Options Mentoring

1 × $31.00

Vega Modified Butterfly Class with Jay Bailey - Sheridan Options Mentoring

1 × $31.00 -

×

Winning Chart Patterns For NASDAQ Traders Version 2 - 1 DVD with Ken Calhoun

1 × $6.00

Winning Chart Patterns For NASDAQ Traders Version 2 - 1 DVD with Ken Calhoun

1 × $6.00 -

×

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00

$20 – 52k 20 pips a day challange with Rafał Zuchowicz - TopMasterTrader

1 × $5.00 -

×

The Risk-Wise Investor: How to Better Understand and Manage Risk with Michael Carpenter

1 × $6.00

The Risk-Wise Investor: How to Better Understand and Manage Risk with Michael Carpenter

1 × $6.00 -

×

W.O.W. Guaranteed Income with Chuck Hughes

1 × $31.00

W.O.W. Guaranteed Income with Chuck Hughes

1 × $31.00 -

×

Astrology & Stock Market Forecasting with Louise McWhirter

1 × $4.00

Astrology & Stock Market Forecasting with Louise McWhirter

1 × $4.00 -

×

Trendfund.com - Scalping, Options, Advanced Options

1 × $4.00

Trendfund.com - Scalping, Options, Advanced Options

1 × $4.00 -

×

Top Futures Day Trading Course DVD

1 × $6.00

Top Futures Day Trading Course DVD

1 × $6.00 -

×

Candlestick Trading Forum Trading Seminar with Stephen W.Bigalow

1 × $4.00

Candlestick Trading Forum Trading Seminar with Stephen W.Bigalow

1 × $4.00 -

×

Options Trading Course with Consistent Options Income

1 × $5.00

Options Trading Course with Consistent Options Income

1 × $5.00 -

×

The New Investment Superstars: 13 Great Investors and Their Strategies for Superior Returns - Lois Peltz

1 × $6.00

The New Investment Superstars: 13 Great Investors and Their Strategies for Superior Returns - Lois Peltz

1 × $6.00 -

×

Anton Kreil - Professional Options Trading Masterclass

1 × $23.00

Anton Kreil - Professional Options Trading Masterclass

1 × $23.00 -

×

Investors Live Textbook Trading DVD

1 × $15.00

Investors Live Textbook Trading DVD

1 × $15.00 -

×

The Nature of Risk with Justin Mamis

1 × $6.00

The Nature of Risk with Justin Mamis

1 × $6.00 -

×

Precise Exits & Entries with Charles LeBeau

1 × $6.00

Precise Exits & Entries with Charles LeBeau

1 × $6.00 -

×

The Triad Formula System with Jason Fielder

1 × $6.00

The Triad Formula System with Jason Fielder

1 × $6.00 -

×

Tick Trader Bundle with Top Trade Tools

1 × $54.00

Tick Trader Bundle with Top Trade Tools

1 × $54.00 -

×

War Room Technicals Vol. 3 with Trick Trades

1 × $6.00

War Room Technicals Vol. 3 with Trick Trades

1 × $6.00 -

×

SQX Mentorship with Tip Toe Hippo

1 × $23.00

SQX Mentorship with Tip Toe Hippo

1 × $23.00 -

×

CFA Level 2 - Examination Book Afternoon Section (1999)

1 × $6.00

CFA Level 2 - Examination Book Afternoon Section (1999)

1 × $6.00 -

×

Unlocking Success in ICT 2022 Mentorship: The Smart Money Guide to The Full ICT Day Trading Model by LumiTraders & Darya Filipenka

1 × $5.00

Unlocking Success in ICT 2022 Mentorship: The Smart Money Guide to The Full ICT Day Trading Model by LumiTraders & Darya Filipenka

1 × $5.00 -

×

The Ultimate Trader Transformation

1 × $62.00

The Ultimate Trader Transformation

1 × $62.00 -

×

Bond Market Course with The Macro Compass

1 × $15.00

Bond Market Course with The Macro Compass

1 × $15.00 -

×

Option Trader Magazine (optionstradermag.com) with Magazine

1 × $6.00

Option Trader Magazine (optionstradermag.com) with Magazine

1 × $6.00 -

×

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00

The Prop Trading Code with Brannigan Barrett - Axia Futures

1 × $23.00 -

×

Raghee’s Winners Circle Course

1 × $6.00

Raghee’s Winners Circle Course

1 × $6.00 -

×

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00

Deep Dive Butterfly Trading Strategy Class with SJG Trades

1 × $41.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

Learn Forex Cash Bomb

1 × $6.00

Learn Forex Cash Bomb

1 × $6.00 -

×

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00

Home Run Options Trading Course with Dave Aquino - Base Camp Trading

1 × $11.00 -

×

Wall Street Stories with Edwin Lefevre

1 × $6.00

Wall Street Stories with Edwin Lefevre

1 × $6.00 -

×

The Ultimate Option Guide When & How to Use Which Strategy for The Best Results with Larry Gaines - Power Cycle Trading

1 × $39.00

The Ultimate Option Guide When & How to Use Which Strategy for The Best Results with Larry Gaines - Power Cycle Trading

1 × $39.00 -

×

Market Structure Masterclass with Braveheart Trading

1 × $5.00

Market Structure Masterclass with Braveheart Trading

1 × $5.00 -

×

WealthFRX Trading Mastery 3.0

1 × $5.00

WealthFRX Trading Mastery 3.0

1 × $5.00 -

×

Jarratt Davis Forex Trading Course

1 × $23.00

Jarratt Davis Forex Trading Course

1 × $23.00 -

×

Techical Analysis with Charles D.Kirkpatrick

1 × $6.00

Techical Analysis with Charles D.Kirkpatrick

1 × $6.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00

Crystal Ball Pack PLUS bonus Live Trade By Pat Mitchell - Trick Trades

1 × $20.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

Charting Made Easy with John J.Murphy

1 × $6.00

Charting Made Easy with John J.Murphy

1 × $6.00 -

×

CFA Level 1,2,3 - Study Guides 2006

1 × $6.00

CFA Level 1,2,3 - Study Guides 2006

1 × $6.00 -

×

Oportunities in Forex Calendar Trading Patterns with Anduril Analytics

1 × $6.00

Oportunities in Forex Calendar Trading Patterns with Anduril Analytics

1 × $6.00 -

×

Alpha Quant Program with Lucas Inglese - Quantreo

1 × $15.00

Alpha Quant Program with Lucas Inglese - Quantreo

1 × $15.00 -

×

Get More Leads Quickly with Brittany Lynch

1 × $6.00

Get More Leads Quickly with Brittany Lynch

1 × $6.00 -

×

Inner Circle Trader ICT Mentorship 2021 with Michael Huddleston

1 × $5.00

Inner Circle Trader ICT Mentorship 2021 with Michael Huddleston

1 × $5.00 -

×

Forex Powerband Dominator

1 × $6.00

Forex Powerband Dominator

1 × $6.00 -

×

Historical Stock Price Data For 8,000+ US Stocks with Joe Marwood

1 × $4.00

Historical Stock Price Data For 8,000+ US Stocks with Joe Marwood

1 × $4.00 -

×

Entries & Exits Strategy with The Chart Guys

1 × $6.00

Entries & Exits Strategy with The Chart Guys

1 × $6.00 -

×

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00

ICT Prodigy Trading Course – $650K in Payouts with Alex Solignani

1 × $15.00 -

×

Forex Strategies Guide for Day and Swing Traders with Cory Mitchell - Vantage Point Trading

1 × $4.00

Forex Strategies Guide for Day and Swing Traders with Cory Mitchell - Vantage Point Trading

1 × $4.00 -

×

Trading on Momentum with Ken Wolff

1 × $6.00

Trading on Momentum with Ken Wolff

1 × $6.00 -

×

London Super Conference 2018

1 × $54.00

London Super Conference 2018

1 × $54.00 -

×

Activedaytrader - 3 Important Ways to Manage Your Options Position

1 × $15.00

Activedaytrader - 3 Important Ways to Manage Your Options Position

1 × $15.00 -

×

Forex Patterns and Probabilities: Trading Strategies for Trending and Range-Bound Markets with Ed Ponsi

1 × $6.00

Forex Patterns and Probabilities: Trading Strategies for Trending and Range-Bound Markets with Ed Ponsi

1 × $6.00 -

×

Full 2 Day Dark Pool And Market Strategy Training

1 × $6.00

Full 2 Day Dark Pool And Market Strategy Training

1 × $6.00 -

×

Astro Cycles with Larry Pesavento

1 × $6.00

Astro Cycles with Larry Pesavento

1 × $6.00 -

×

Objective Evaluation of Indicators with Constance Brown

1 × $6.00

Objective Evaluation of Indicators with Constance Brown

1 × $6.00 -

×

TheoTrade

1 × $31.00

TheoTrade

1 × $31.00 -

×

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00

High Probability Trading Using Elliott Wave And Fibonacci Analysis withVic Patel - Forex Training Group

1 × $10.00 -

×

The Science of Trading with Mark Boucher

1 × $6.00

The Science of Trading with Mark Boucher

1 × $6.00 -

×

Advanced Nuances & Exceptions eCourse with Jim Dalton

1 × $15.00

Advanced Nuances & Exceptions eCourse with Jim Dalton

1 × $15.00 -

×

TheoTrade - Maximum Returns with Infinity Spreads

1 × $23.00

TheoTrade - Maximum Returns with Infinity Spreads

1 × $23.00 -

×

Maximum Returns with Infinity Spreads Class with Don Kaufman

1 × $6.00

Maximum Returns with Infinity Spreads Class with Don Kaufman

1 × $6.00 -

×

Power Price Action Trading - 8 Weeks Online Training

1 × $6.00

Power Price Action Trading - 8 Weeks Online Training

1 × $6.00 -

×

Mastering Level 2 with ClayTrader

1 × $197.00

Mastering Level 2 with ClayTrader

1 × $197.00 -

×

Ichimoku Cloud Trading System Class with Jeff Bierman

1 × $6.00

Ichimoku Cloud Trading System Class with Jeff Bierman

1 × $6.00 -

×

30 Days to Market Mastery: A Step-by-Step Guide to Profitable Trading with Jack Bernstein

1 × $6.00

30 Days to Market Mastery: A Step-by-Step Guide to Profitable Trading with Jack Bernstein

1 × $6.00 -

×

Train & Trade Academy with Omar Agag

1 × $5.00

Train & Trade Academy with Omar Agag

1 × $5.00 -

×

STREAM ALERTS

1 × $6.00

STREAM ALERTS

1 × $6.00 -

×

IBD Advanced Buying Strategies Home Study Program

1 × $10.00

IBD Advanced Buying Strategies Home Study Program

1 × $10.00 -

×

Time Factor Digital Course with William McLaren

1 × $6.00

Time Factor Digital Course with William McLaren

1 × $6.00 -

×

Going Global 2015

1 × $6.00

Going Global 2015

1 × $6.00 -

×

Quantitative Finance & Algorithmic Trading in Python with Holczer Balazs

1 × $4.00

Quantitative Finance & Algorithmic Trading in Python with Holczer Balazs

1 × $4.00 -

×

Alpesh Patel Indicator with Alpesh Patel

1 × $62.00

Alpesh Patel Indicator with Alpesh Patel

1 × $62.00 -

×

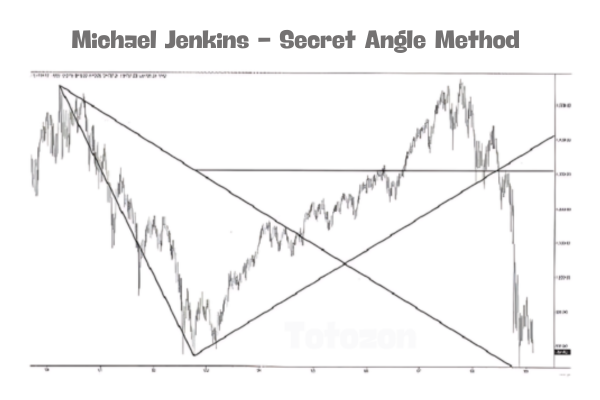

Secret Angle Method with Michael Jenkins

1 × $4.00

Secret Angle Method with Michael Jenkins

1 × $4.00 -

×

CalendarMAX with Hari Swaminathan

1 × $15.00

CalendarMAX with Hari Swaminathan

1 × $15.00 -

×

OptioPit Course 2013 (Gold & Silver Course)

1 × $23.00

OptioPit Course 2013 (Gold & Silver Course)

1 × $23.00 -

×

Forex Trading Made Ez with G.C.Smith

1 × $6.00

Forex Trading Made Ez with G.C.Smith

1 × $6.00 -

×

Options Trading Training – The Blend Dc with Charles Cottle

1 × $4.00

Options Trading Training – The Blend Dc with Charles Cottle

1 × $4.00 -

×

ZR Trading Complete Program (Arabic + French)

1 × $10.00

ZR Trading Complete Program (Arabic + French)

1 × $10.00 -

×

Getting Started in Currency Trading with Michael Duarne Archer, James L.Bickford

1 × $6.00

Getting Started in Currency Trading with Michael Duarne Archer, James L.Bickford

1 × $6.00 -

×

A New Look at Exit Strategies with Charles LeBeau

1 × $6.00

A New Look at Exit Strategies with Charles LeBeau

1 × $6.00 -

×

Chart Pattern Recognition for Metastock with John Murphy

1 × $6.00

Chart Pattern Recognition for Metastock with John Murphy

1 × $6.00 -

×

Day Trade Online (2nd Ed.) with Christopher Farrell

1 × $6.00

Day Trade Online (2nd Ed.) with Christopher Farrell

1 × $6.00 -

×

Kase StatWare 9.7.3

1 × $23.00

Kase StatWare 9.7.3

1 × $23.00 -

×

Video Package

1 × $6.00

Video Package

1 × $6.00 -

×

Active Investment Management: Finding and Harnessing Investment Skill with Charles Jackson

1 × $6.00

Active Investment Management: Finding and Harnessing Investment Skill with Charles Jackson

1 × $6.00 -

×

Stock Speculation (Volume I & II) with Joseph A.Wyler

1 × $4.00

Stock Speculation (Volume I & II) with Joseph A.Wyler

1 × $4.00 -

×

Millionaire Playbook with Jeremy Lefebvre

1 × $62.00

Millionaire Playbook with Jeremy Lefebvre

1 × $62.00 -

×

Options Trading Accelerator with Base Camp Trading

1 × $23.00

Options Trading Accelerator with Base Camp Trading

1 × $23.00 -

×

The Bomb & Bullet Trade Systems 2022 with Guerrilla Trading

1 × $10.00

The Bomb & Bullet Trade Systems 2022 with Guerrilla Trading

1 × $10.00 -

×

Trend Harmony with Murray Ruggiero

1 × $15.00

Trend Harmony with Murray Ruggiero

1 × $15.00 -

×

Electronic Trading "TNT" II How - To Win Trading Stuff with Joe Ross & Mark Cherlin

1 × $6.00

Electronic Trading "TNT" II How - To Win Trading Stuff with Joe Ross & Mark Cherlin

1 × $6.00 -

×

Investments (6th Ed.)

1 × $6.00

Investments (6th Ed.)

1 × $6.00 -

×

Managing Investment Portfolios (3rd Ed.) with John Maginn

1 × $6.00

Managing Investment Portfolios (3rd Ed.) with John Maginn

1 × $6.00 -

×

BCFX 2,0 and 2,5 with Brandon Carter

1 × $5.00

BCFX 2,0 and 2,5 with Brandon Carter

1 × $5.00 -

×

I3T3 Complete Course with All Modules

1 × $10.00

I3T3 Complete Course with All Modules

1 × $10.00 -

×

The First Time Investors Workbook with Joe Jonh Duran & Larry Chambers

1 × $6.00

The First Time Investors Workbook with Joe Jonh Duran & Larry Chambers

1 × $6.00 -

×

Zeus Capital (ZCFX) Full Mentorship Course

1 × $13.00

Zeus Capital (ZCFX) Full Mentorship Course

1 × $13.00 -

×

Evolution Forex Trading

1 × $31.00

Evolution Forex Trading

1 × $31.00 -

×

Stocks with Strauss

1 × $31.00

Stocks with Strauss

1 × $31.00 -

×

Back to the Future – Schabacker’s Principles with Linda Raschke

1 × $6.00

Back to the Future – Schabacker’s Principles with Linda Raschke

1 × $6.00 -

×

Key to Speculation on the New York Stock Exchange

1 × $6.00

Key to Speculation on the New York Stock Exchange

1 × $6.00 -

×

Timing Techniques for Commodity Futures Markets with Colin Alexander

1 × $6.00

Timing Techniques for Commodity Futures Markets with Colin Alexander

1 × $6.00 -

×

Joshua ICT ChartLab 2023

1 × $5.00

Joshua ICT ChartLab 2023

1 × $5.00 -

×

Getting Started With Options with Peter Titus - Marwood Research

1 × $6.00

Getting Started With Options with Peter Titus - Marwood Research

1 × $6.00 -

×

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00

Quantamentals - The Next Great Forefront Of Trading and Investing with Trading Markets

1 × $8.00 -

×

Compass Trading System with Right Line Trading

1 × $39.00

Compass Trading System with Right Line Trading

1 × $39.00 -

×

Trading Floor Training

1 × $6.00

Trading Floor Training

1 × $6.00 -

×

Access All Areas with Marwood Research

1 × $54.00

Access All Areas with Marwood Research

1 × $54.00 -

×

Balance Trader – Market Profile Trading Course

1 × $23.00

Balance Trader – Market Profile Trading Course

1 × $23.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00 -

×

The Multi-Fractal Markets Educational Course with Dylan Forexia

1 × $39.00

The Multi-Fractal Markets Educational Course with Dylan Forexia

1 × $39.00 -

×

Classic Trading Tactics Theory and Practice with Linda Raschke

1 × $13.00

Classic Trading Tactics Theory and Practice with Linda Raschke

1 × $13.00 -

×

Day Trading and Swing Trading the Currency Market with Kathy Lien

1 × $6.00

Day Trading and Swing Trading the Currency Market with Kathy Lien

1 × $6.00 -

×

The Late-Start Investor with John Wasik

1 × $6.00

The Late-Start Investor with John Wasik

1 × $6.00 -

×

Impulse Trading System with Base Camp Trading

1 × $54.00

Impulse Trading System with Base Camp Trading

1 × $54.00 -

×

CMT Association Entire Webinars

1 × $31.00

CMT Association Entire Webinars

1 × $31.00 -

×

The Trading Mastermind Forex Workshop 14 CDs with Scott Shubert

1 × $6.00

The Trading Mastermind Forex Workshop 14 CDs with Scott Shubert

1 × $6.00 -

×

My Trading Strategy with Evolved Traders

1 × $5.00

My Trading Strategy with Evolved Traders

1 × $5.00 -

×

Steidlmayer On Markets. Trading with Market Profile with J.Peter Steidlmayer

1 × $6.00

Steidlmayer On Markets. Trading with Market Profile with J.Peter Steidlmayer

1 × $6.00

Pairs Trading: Quantitative Methods and Analysis with Ganapathy Vidyamurthy

$82.00 Original price was: $82.00.$6.00Current price is: $6.00.

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Content Proof: Watch Here!

You may check content proof of “Pairs Trading: Quantitative Methods and Analysis with Ganapathy Vidyamurthy” below:

Pairs Trading: Quantitative Methods and Analysis with Ganapathy Vidyamurthy

Pairs trading is a market-neutral strategy that involves trading two correlated securities to exploit price discrepancies. Ganapathy Vidyamurthy, a renowned expert in quantitative finance, provides an in-depth analysis of this strategy in his work. In this article, we will explore the fundamentals of pairs trading, the quantitative methods involved, and practical applications based on Vidyamurthy’s insights.

Introduction to Pairs Trading

What is Pairs Trading?

Pairs trading is a statistical arbitrage strategy where two correlated securities are traded simultaneously. Traders buy the undervalued security and sell the overvalued one, aiming to profit from the convergence of their prices.

Who is Ganapathy Vidyamurthy?

Ganapathy Vidyamurthy is a leading expert in quantitative finance, known for his contributions to pairs trading strategies and quantitative analysis. His methodologies provide a robust framework for implementing pairs trading effectively.

Fundamental Concepts of Pairs Trading

1. Market Neutrality

Definition

Pairs trading is market-neutral, meaning it is designed to profit regardless of market direction. This reduces exposure to market risk.

2. Correlation and Cointegration

Correlation

Correlation measures the degree to which two securities move in relation to each other. High correlation is essential for pairs trading.

Cointegration

Cointegration indicates a long-term equilibrium relationship between two securities, suggesting that price deviations are temporary and will revert to the mean.

Quantitative Methods in Pairs Trading

1. Identifying Pairs

Statistical Techniques

Use statistical methods such as Pearson’s correlation coefficient and Johansen’s cointegration test to identify suitable pairs for trading.

2. Spread Calculation

Price Spread

The price spread is the difference between the prices of the two securities. Monitoring the spread helps identify trading opportunities.

Z-Score Calculation

The Z-score measures the number of standard deviations the current spread is from the mean. A high absolute Z-score indicates a potential trading signal.

3. Trading Signals

Entry and Exit Points

Enter a trade when the Z-score exceeds a certain threshold (e.g., ±2). Exit the trade when the spread reverts to the mean.

Stop-Loss and Take-Profit Levels

Set stop-loss and take-profit levels to manage risk and lock in profits.

Implementing Pairs Trading Strategies

1. Data Collection and Analysis

Historical Data

Collect historical price data for the selected pairs. Use this data to analyze correlation and cointegration.

2. Backtesting

Simulating Trades

Backtest the strategy using historical data to evaluate its performance. This helps identify potential issues and refine the strategy.

3. Execution

Automated Trading Systems

Implement the strategy using automated trading systems to execute trades quickly and efficiently.

4. Monitoring and Adjusting

Real-Time Analysis

Continuously monitor the performance of the strategy and make adjustments as needed based on real-time data.

Advantages of Pairs Trading

1. Reduced Market Risk

Hedging

Pairs trading hedges against market risk by taking long and short positions simultaneously.

2. Consistent Returns

Exploiting Inefficiencies

The strategy can generate consistent returns by exploiting temporary price inefficiencies between correlated securities.

Challenges in Pairs Trading

1. Identifying Suitable Pairs

Data-Intensive

Finding pairs that are both highly correlated and cointegrated requires extensive data analysis.

2. Transaction Costs

Impact on Profits

High transaction costs can erode profits, especially for frequent trades. Efficient execution and cost management are crucial.

3. Model Risk

Assumptions and Limitations

Quantitative models rely on historical data and assumptions that may not always hold true in the future.

Case Study: Applying Vidyamurthy’s Methods

1. Selecting Pairs

Example

Consider a pair of stocks from the same industry, such as Coca-Cola and PepsiCo. These companies are likely to be correlated due to their similar business models.

2. Analyzing Data

Statistical Tests

Perform statistical tests to confirm correlation and cointegration. Calculate the spread and Z-score to identify trading signals.

3. Executing Trades

Entry and Exit

Enter trades based on Z-score thresholds and monitor the positions. Exit when the spread reverts to the mean or reaches the stop-loss/take-profit levels.

Risk Management in Pairs Trading

1. Diversification

Multiple Pairs

Trade multiple pairs to diversify risk and reduce the impact of any single pair’s performance.

2. Capital Allocation

Risk Limits

Allocate capital based on risk limits and ensure no single trade can significantly impact the overall portfolio.

3. Regular Review

Performance Evaluation

Regularly review the performance of the strategy and adjust parameters as needed to optimize returns.

Conclusion

Pairs trading, as explained by Ganapathy Vidyamurthy, offers a robust and market-neutral strategy for exploiting price inefficiencies. By understanding and applying quantitative methods, traders can enhance their ability to identify profitable pairs, manage risk, and achieve consistent returns. Continuous monitoring and adaptation are key to maintaining the effectiveness of this strategy in changing market conditions.

FAQs

1. What is pairs trading?

Pairs trading is a market-neutral strategy involving the simultaneous buying and selling of two correlated securities to profit from price discrepancies.

2. How does pairs trading reduce market risk?

Pairs trading reduces market risk by taking both long and short positions, hedging against overall market movements.

3. What are the key quantitative methods in pairs trading?

Key methods include identifying correlated and cointegrated pairs, calculating the spread and Z-score, and backtesting the strategy.

4. Why is cointegration important in pairs trading?

Cointegration indicates a long-term equilibrium relationship between two securities, suggesting that price deviations are temporary and will revert to the mean.

5. What are common challenges in pairs trading?

Challenges include identifying suitable pairs, managing transaction costs, and addressing model risk due to assumptions and data limitations.

Be the first to review “Pairs Trading: Quantitative Methods and Analysis with Ganapathy Vidyamurthy” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.