-

×

Precision Pattern Trading with Daryl Guppy

1 × $6.00

Precision Pattern Trading with Daryl Guppy

1 × $6.00 -

×

TradeSafe Mechanical Trading System, Course, and Coaching

1 × $85.00

TradeSafe Mechanical Trading System, Course, and Coaching

1 × $85.00 -

×

Advanced Trading Strategies

1 × $31.00

Advanced Trading Strategies

1 × $31.00 -

×

How To Backtest Bootcamp

1 × $17.00

How To Backtest Bootcamp

1 × $17.00 -

×

Kaizen On-Demand By Candle Charts

1 × $6.00

Kaizen On-Demand By Candle Charts

1 × $6.00 -

×

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00

The Trading Blueprint with Brad Goh - The Trading Geek

1 × $5.00 -

×

The Complete Guide to Option Selling, 2nd 2009 with James Cordier & Michael Gross

1 × $6.00

The Complete Guide to Option Selling, 2nd 2009 with James Cordier & Michael Gross

1 × $6.00 -

×

How to Create Better Trading Opportunities through Hedging with Jon Najarian

1 × $6.00

How to Create Better Trading Opportunities through Hedging with Jon Najarian

1 × $6.00 -

×

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00

W. D Gann 's Square Of 9 Applied To Modern Markets with Sean Avidar - Hexatrade350

1 × $23.00 -

×

Mastering Candlestick Charts II with Greg Capra

1 × $6.00

Mastering Candlestick Charts II with Greg Capra

1 × $6.00 -

×

The Afluent Desktop Currency Trader with Amin Sadak

1 × $6.00

The Afluent Desktop Currency Trader with Amin Sadak

1 × $6.00 -

×

PRO COURSE Order Flow Strategy with Gova Trading Academy

1 × $5.00

PRO COURSE Order Flow Strategy with Gova Trading Academy

1 × $5.00 -

×

Mergers & Acquisitions From A to Z with Andrew J.Sherman

1 × $6.00

Mergers & Acquisitions From A to Z with Andrew J.Sherman

1 × $6.00 -

×

Analysis Of Entry Signals (Technicals) with Joe Marwood

1 × $15.00

Analysis Of Entry Signals (Technicals) with Joe Marwood

1 × $15.00 -

×

Crypto Trading Cyber Security for Bitcoin & Altcoin Holders with Zlatin Georgiev

1 × $5.00

Crypto Trading Cyber Security for Bitcoin & Altcoin Holders with Zlatin Georgiev

1 × $5.00 -

×

Handbook for Enviroment Risk Decision Making with C.Richard Cothern

1 × $6.00

Handbook for Enviroment Risk Decision Making with C.Richard Cothern

1 × $6.00 -

×

A Comprehensive Guide to Intraday Trading Strategies & Setups Class with Jeff Bierman

1 × $6.00

A Comprehensive Guide to Intraday Trading Strategies & Setups Class with Jeff Bierman

1 × $6.00 -

×

FuturesTrader71 - webinar series (4 webinars)

1 × $6.00

FuturesTrader71 - webinar series (4 webinars)

1 × $6.00 -

×

Private Access Pro Webinars 2021-2022 with Trader Lion

1 × $5.00

Private Access Pro Webinars 2021-2022 with Trader Lion

1 × $5.00 -

×

The Python for Traders Masterclass with Mr James

1 × $10.00

The Python for Traders Masterclass with Mr James

1 × $10.00 -

×

The Crash of 1997 (Article) with Hans Hannula

1 × $6.00

The Crash of 1997 (Article) with Hans Hannula

1 × $6.00 -

×

Using Fundamental Analysis with Andrew Baxter

1 × $6.00

Using Fundamental Analysis with Andrew Baxter

1 × $6.00 -

×

Naked Forex: High-Probability Techniques for Trading Without Indicators (2012) with Alex Nekritin & Walter Peters

1 × $6.00

Naked Forex: High-Probability Techniques for Trading Without Indicators (2012) with Alex Nekritin & Walter Peters

1 × $6.00 -

×

The PPS Trading System with Curtis Arnold

1 × $6.00

The PPS Trading System with Curtis Arnold

1 × $6.00 -

×

Random Walk Trading - J.L.Lord - One Strategy for All Markets

1 × $6.00

Random Walk Trading - J.L.Lord - One Strategy for All Markets

1 × $6.00 -

×

Confessions of a Pit Trader 2003 with Rick Burgess

1 × $6.00

Confessions of a Pit Trader 2003 with Rick Burgess

1 × $6.00 -

×

Vertex Investing Course (2023)

1 × $8.00

Vertex Investing Course (2023)

1 × $8.00 -

×

How to Predict and Prepare for a Stock Market Crash with Damon Verial

1 × $6.00

How to Predict and Prepare for a Stock Market Crash with Damon Verial

1 × $6.00 -

×

Increase Your Net Worth In 2 Hours A Week with Jerremy Newsome - Real Life Trading

1 × $17.00

Increase Your Net Worth In 2 Hours A Week with Jerremy Newsome - Real Life Trading

1 × $17.00 -

×

Dan Sheridan Delta Force

1 × $6.00

Dan Sheridan Delta Force

1 × $6.00 -

×

The Random Character of Interest Rates with Joseph Murphy

1 × $6.00

The Random Character of Interest Rates with Joseph Murphy

1 × $6.00 -

×

Day Trading Smart Right From the Start: Trading Essentials for Maximum Results - David Nassar & John Boyer

1 × $6.00

Day Trading Smart Right From the Start: Trading Essentials for Maximum Results - David Nassar & John Boyer

1 × $6.00 -

×

Hedge Funds: Insights in Performance Measurement, Risk Analysis, and Portfolio Allocation (1st Edition) - Greg Gregoriou, Georges Hübner, Nicolas Papageorgiou & Fabrice Rouah

1 × $6.00

Hedge Funds: Insights in Performance Measurement, Risk Analysis, and Portfolio Allocation (1st Edition) - Greg Gregoriou, Georges Hübner, Nicolas Papageorgiou & Fabrice Rouah

1 × $6.00 -

×

A Plan to make $3k Monthly on $25k with Short Term Trades with Dan Sheridan

1 × $23.00

A Plan to make $3k Monthly on $25k with Short Term Trades with Dan Sheridan

1 × $23.00 -

×

Preparing for the Worst: Incorporating Downside Risk in Stock Market Investments with Hrishikesh Vinod & Derrick Reagle

1 × $6.00

Preparing for the Worst: Incorporating Downside Risk in Stock Market Investments with Hrishikesh Vinod & Derrick Reagle

1 × $6.00 -

×

Price Action Trading Manual 2010

1 × $6.00

Price Action Trading Manual 2010

1 × $6.00 -

×

FTMO Academy Course

1 × $5.00

FTMO Academy Course

1 × $5.00 -

×

Technical Analysis Entry & Exit with Andrew Baxter

1 × $6.00

Technical Analysis Entry & Exit with Andrew Baxter

1 × $6.00 -

×

Fractal Based Point Processes with Steven Bradley Lowen & Malvin Carl Teich

1 × $6.00

Fractal Based Point Processes with Steven Bradley Lowen & Malvin Carl Teich

1 × $6.00 -

×

Trading Instruments & Strategies with Andrew Baxter

1 × $6.00

Trading Instruments & Strategies with Andrew Baxter

1 × $6.00 -

×

Apteros Trading Fall Intensive 2021 - Trading Intensive

1 × $54.00

Apteros Trading Fall Intensive 2021 - Trading Intensive

1 × $54.00 -

×

The Pocket Mortgage Guide: 60 of the Most Important Questions and Answers About Your Home Loan with Jack Guttentag

1 × $6.00

The Pocket Mortgage Guide: 60 of the Most Important Questions and Answers About Your Home Loan with Jack Guttentag

1 × $6.00 -

×

Rob’s Swing Trading Methods with Rob Hoffman

1 × $39.00

Rob’s Swing Trading Methods with Rob Hoffman

1 × $39.00 -

×

Handbook of Integral Equations with Andrei D.Polyanin, Alexander V.Manzhirov

1 × $6.00

Handbook of Integral Equations with Andrei D.Polyanin, Alexander V.Manzhirov

1 × $6.00 -

×

FestX Main Online video Course with Clint Fester

1 × $5.00

FestX Main Online video Course with Clint Fester

1 × $5.00 -

×

Equities with Peter Martin

1 × $6.00

Equities with Peter Martin

1 × $6.00 -

×

Forex Trading Plan - Learn How To Set SMART Trading Goals! with Anas Abba & FXMindTrix Academy

1 × $6.00

Forex Trading Plan - Learn How To Set SMART Trading Goals! with Anas Abba & FXMindTrix Academy

1 × $6.00 -

×

A+ Setups Big Caps Options with Jtrader

1 × $6.00

A+ Setups Big Caps Options with Jtrader

1 × $6.00 -

×

Stock Market Rules (2nd Ed.) with Michael Sheimo

1 × $6.00

Stock Market Rules (2nd Ed.) with Michael Sheimo

1 × $6.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

Order Flow With The Power Of Point Of Control Course and The Imbalance

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

Order Flow With The Power Of Point Of Control Course and The Imbalance

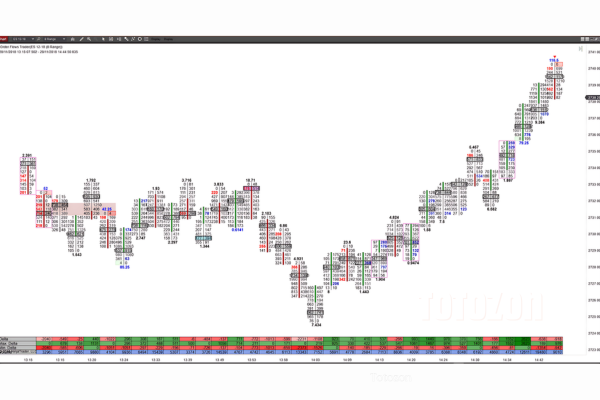

Introduction

Understanding the intricacies of order flow and the power of the point of control (POC) is essential for any serious trader. This article explores the details of these concepts, offering insights into how they can be leveraged for better trading decisions.

What is Order Flow?

Order flow refers to the buying and selling activity in the financial markets. It provides a real-time view of market dynamics, revealing the intentions of traders and the forces driving price movements.

Why Order Flow Matters

- Market Sentiment: Order flow helps us gauge market sentiment by showing the volume and direction of trades.

- Price Movement: It reveals the underlying factors behind price movements, offering a clearer picture than traditional indicators.

The Power of Point of Control (POC)

The point of control is a key concept in market profile analysis. It represents the price level at which the highest volume of trades occurs, indicating the most significant area of interest for traders.

Understanding POC

- Volume Profile: POC is part of the volume profile, which shows the distribution of trading volume across different price levels.

- Significance: The POC is considered a fair price, where supply and demand are balanced.

How to Identify the POC

- Volume Data: Analyze the volume data for the trading session.

- Price Levels: Identify the price level with the highest volume.

- Mark the POC: This is your point of control.

Order Flow and POC in Trading

Combining order flow analysis with the POC provides a powerful toolkit for traders.

Entry and Exit Points

- Entries: Look for high-volume areas near the POC to enter trades.

- Exits: Use the POC to determine optimal exit points, minimizing risk and maximizing profit.

Market Trends

- Trend Confirmation: Confirm trends by analyzing the alignment of order flow with the POC.

- Reversals: Identify potential reversals when price moves significantly away from the POC.

The Imbalance Concept

Imbalance refers to a situation where buying and selling volumes are unequal, often leading to price movements.

Types of Imbalance

- Buy Imbalance: More buying volume than selling, indicating bullish sentiment.

- Sell Imbalance: More selling volume than buying, indicating bearish sentiment.

Detecting Imbalances

- Volume Analysis: Monitor the volume of trades on the bid and ask sides.

- Price Movement: Observe rapid price changes that often accompany imbalances.

Using Imbalances in Trading

Identifying and leveraging imbalances can enhance your trading strategy.

Trade Entries

- Buy Imbalance: Enter long positions during a buy imbalance.

- Sell Imbalance: Enter short positions during a sell imbalance.

Risk Management

- Stop-Loss Placement: Place stop-loss orders at levels where imbalances reverse.

- Profit Targets: Set profit targets based on the continuation of imbalances.

Combining Order Flow, POC, and Imbalance

Holistic Analysis

By combining these concepts, you can develop a comprehensive market view.

- Order Flow: Provides real-time market sentiment.

- POC: Identifies key price levels.

- Imbalance: Highlights potential price movements.

Practical Application

- Analyze Order Flow: Start with a real-time analysis of order flow.

- Identify POC: Determine the POC from the volume profile.

- Detect Imbalances: Look for buy or sell imbalances to inform your trading decisions.

Case Studies

Case Study 1: Stock Trading

A trader identified a strong buy imbalance near the POC of a tech stock, entering a long position that yielded a 15% profit in two days.

Case Study 2: Forex Trading

In the forex market, a trader used order flow and POC to identify a significant sell imbalance in the EUR/USD pair, resulting in a profitable short trade.

Conclusion

Mastering order flow, the power of the point of control, and the concept of imbalance can significantly enhance your trading strategy. By integrating these tools, you can gain deeper market insights and make more informed trading decisions.

Commonly Asked Questions:

- Business Model Innovation: Accept the truth of a legitimate business! Our strategy is organising a group buy in which participants share the costs. We use these cash to acquire popular courses from sale pages and make them available to people with limited financial resources. Despite the authors’ worries, our clients love the cost and accessibility we give.

- The Legal Environment: Yes or No The legality of our activity is ambiguous. While we don’t have specific permission from the course authors to resell the material, there is a technicality at work. The author did not specify any limits on resale when purchasing the course. This legal intricacy is both an opportunity for us and a boon for individuals looking for low-cost access.

- Quality Control: Uncovering the Truth

Getting to the heart of the issue – quality. Purchasing the course straight from the sale page guarantees that all documents and resources are the same as those obtained through traditional channels.

However, we distinguish ourselves by going beyond personal research and resale. It is crucial to note that we are not the official course providers, which means that the following premium services are not included in our package:

- There are no scheduled coaching calls or sessions with the author.

- Access to the author’s private Facebook group or web portal is not permitted.

- No access to the author’s private membership forum.

- There is no direct email support available from the author or their team.

We operate independently, with the goal of bridging the pricing gap without the extra services provided by official course channels. Your comprehension of our distinct approach is much appreciated.

Be the first to review “Order Flow With The Power Of Point Of Control Course and The Imbalance” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Quantamentals – The Next Great Forefront Of Trading and Investing with Trading Markets

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.