-

×

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00

Ultimate Trading Course with Dodgy's Dungeon

1 × $8.00 -

×

Financial Fortress with TradeSmart University

1 × $6.00

Financial Fortress with TradeSmart University

1 × $6.00 -

×

Futures Commodity Trading with G. Scott Martin

1 × $6.00

Futures Commodity Trading with G. Scott Martin

1 × $6.00 -

×

CarterFX Membership with Duran Carter

1 × $23.00

CarterFX Membership with Duran Carter

1 × $23.00 -

×

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00

The A14 Weekly Option Strategy Workshop with Amy Meissner

1 × $23.00 -

×

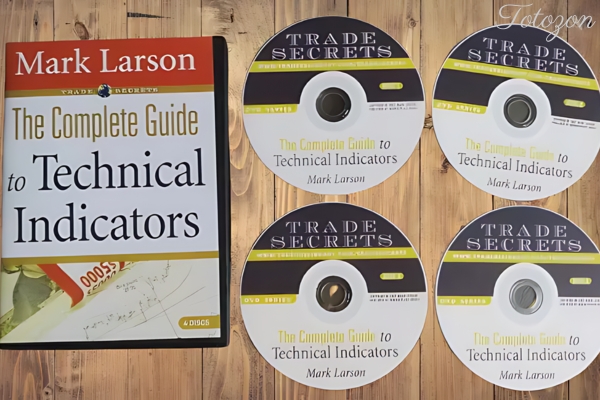

The Complete Guide to Technical Indicators with Mark Larson

1 × $6.00

The Complete Guide to Technical Indicators with Mark Larson

1 × $6.00 -

×

Forex Project Advanced Course with Tyler Crowell

1 × $5.00

Forex Project Advanced Course with Tyler Crowell

1 × $5.00 -

×

The Insider's Guide to 52 Homes in 52 Weeks: Acquire Your Real Estate Fortune Today with Dolf De Roos

1 × $6.00

The Insider's Guide to 52 Homes in 52 Weeks: Acquire Your Real Estate Fortune Today with Dolf De Roos

1 × $6.00 -

×

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00

Essentials in Quantitative Trading QT01 By HangukQuant's

1 × $23.00 -

×

TRADING NFX Course with Andrew NFX

1 × $5.00

TRADING NFX Course with Andrew NFX

1 × $5.00 -

×

How To Become StressFree Trader with Jason Starzec

1 × $4.00

How To Become StressFree Trader with Jason Starzec

1 × $4.00 -

×

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00

Trading Short TermSame Day Trades Sep 2023 with Dan Sheridan & Mark Fenton - Sheridan Options Mentoring

1 × $31.00 -

×

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00

Best of the Best: Collars with Amy Meissner & Scott Ruble

1 × $15.00 -

×

Preparing for the Worst: Incorporating Downside Risk in Stock Market Investments with Hrishikesh Vinod & Derrick Reagle

1 × $6.00

Preparing for the Worst: Incorporating Downside Risk in Stock Market Investments with Hrishikesh Vinod & Derrick Reagle

1 × $6.00 -

×

Simpler Options - Weekly Butterflies for Income

1 × $6.00

Simpler Options - Weekly Butterflies for Income

1 × $6.00 -

×

Successful Stock Speculation (1922) with John James

1 × $6.00

Successful Stock Speculation (1922) with John James

1 × $6.00 -

×

Trading with Price Ladder and Order Flow Strategies with Alex Haywood - Axia Futures

1 × $6.00

Trading with Price Ladder and Order Flow Strategies with Alex Haywood - Axia Futures

1 × $6.00 -

×

FlowRider Trading Course with Boris Schlossberg and Kathy Lien - Bkforex

1 × $15.00

FlowRider Trading Course with Boris Schlossberg and Kathy Lien - Bkforex

1 × $15.00 -

×

Academy of Financial Trading Foundation Trading Programme Webinar

1 × $6.00

Academy of Financial Trading Foundation Trading Programme Webinar

1 × $6.00 -

×

Pattern Picking with Charles Drummond

1 × $6.00

Pattern Picking with Charles Drummond

1 × $6.00 -

×

Masterclass 5.0 with RockzFX

1 × $5.00

Masterclass 5.0 with RockzFX

1 × $5.00 -

×

AI For Traders with Trading Markets

1 × $31.00

AI For Traders with Trading Markets

1 × $31.00 -

×

Slapped by the Invisible Hand: The Panic of 2007 with Gary Gorton

1 × $6.00

Slapped by the Invisible Hand: The Panic of 2007 with Gary Gorton

1 × $6.00 -

×

Euro Fractal Trading System with Cynthia Marcy, Erol Bortucene

1 × $6.00

Euro Fractal Trading System with Cynthia Marcy, Erol Bortucene

1 × $6.00 -

×

T.A.M.E. Home Study Course with Doug Sutton

1 × $6.00

T.A.M.E. Home Study Course with Doug Sutton

1 × $6.00 -

×

How Do You Read Charts? A Guide to Classic Price Pattern Recognition Class with Professor Jeff Bierman

1 × $6.00

How Do You Read Charts? A Guide to Classic Price Pattern Recognition Class with Professor Jeff Bierman

1 × $6.00 -

×

Day Trading For 50 Years PDF with Michael Jenkins

1 × $6.00

Day Trading For 50 Years PDF with Michael Jenkins

1 × $6.00 -

×

Predators & Profits with Martin Howell & John Bogle

1 × $6.00

Predators & Profits with Martin Howell & John Bogle

1 × $6.00 -

×

A Working Man's Forex Position Trading System 2010 with Alan Benefield

1 × $6.00

A Working Man's Forex Position Trading System 2010 with Alan Benefield

1 × $6.00 -

×

Strategy, Value and Risk - The Real Options Approach with Jamie Rogers

1 × $6.00

Strategy, Value and Risk - The Real Options Approach with Jamie Rogers

1 × $6.00 -

×

The Crypto Code with Joel Peterson - Adam Short

1 × $15.00

The Crypto Code with Joel Peterson - Adam Short

1 × $15.00 -

×

The London Close Trade Strategy with Shirley Hudson & Vic Noble

1 × $4.00

The London Close Trade Strategy with Shirley Hudson & Vic Noble

1 × $4.00 -

×

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00

The Naked Eye: Raw Data Analytics with Edgar Torres - Raw Data Analytics

1 × $8.00 -

×

FasTrack Premium with Note Conference

1 × $78.00

FasTrack Premium with Note Conference

1 × $78.00 -

×

The Practical Fractal with Bill Williams

1 × $6.00

The Practical Fractal with Bill Williams

1 × $6.00 -

×

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00

The Best Option Trading Course with David Jaffee - Best Stock Strategy

1 × $15.00 -

×

Trend Trading My Way with Markay Latimer

1 × $15.00

Trend Trading My Way with Markay Latimer

1 × $15.00 -

×

DFX Scalping Strategy Course with Disciplined FX

1 × $23.00

DFX Scalping Strategy Course with Disciplined FX

1 × $23.00 -

×

Empirical Market Microstructure

1 × $6.00

Empirical Market Microstructure

1 × $6.00 -

×

Super Structure Trading Home Study Course

1 × $23.00

Super Structure Trading Home Study Course

1 × $23.00 -

×

An Introduction to Capital Markets with Andrew M.Chisholm

1 × $6.00

An Introduction to Capital Markets with Andrew M.Chisholm

1 × $6.00 -

×

A Comparison of Popular Trading Systems (2nd Ed.) with Lars Kestner

1 × $6.00

A Comparison of Popular Trading Systems (2nd Ed.) with Lars Kestner

1 × $6.00 -

×

Volume Profile 2023 (Elite Pack) with Trader Dale

1 × $5.00

Volume Profile 2023 (Elite Pack) with Trader Dale

1 × $5.00 -

×

Peter Borish Online Trader Program

1 × $15.00

Peter Borish Online Trader Program

1 × $15.00 -

×

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00

The Indices Orderflow Masterclass with The Forex Scalpers

1 × $23.00 -

×

Market Tide indicator with Alphashark

1 × $54.00

Market Tide indicator with Alphashark

1 × $54.00 -

×

HunterFX Video Course with HunterFX

1 × $6.00

HunterFX Video Course with HunterFX

1 × $6.00 -

×

4 Class Bundle

1 × $31.00

4 Class Bundle

1 × $31.00 -

×

Stock Traders Almanac 2008 with Jeffrey Hirsch & Yale Hirsch

1 × $6.00

Stock Traders Almanac 2008 with Jeffrey Hirsch & Yale Hirsch

1 × $6.00 -

×

8 Strategies for Day Trading

1 × $31.00

8 Strategies for Day Trading

1 × $31.00 -

×

5 Day Bootcamp with AWFX AnthonysWorld

1 × $34.00

5 Day Bootcamp with AWFX AnthonysWorld

1 × $34.00 -

×

Options 201: Vertical and Calendar Spread Essentials 5 Part Class with Don Kaufman On Demand Replay

1 × $6.00

Options 201: Vertical and Calendar Spread Essentials 5 Part Class with Don Kaufman On Demand Replay

1 × $6.00 -

×

Team Bull Trading Academy

1 × $5.00

Team Bull Trading Academy

1 × $5.00 -

×

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00

The Orderflows Trade Opportunities Encyclopedia with Michael Valtos

1 × $8.00 -

×

Evolve MasterClass with Irek Piekarski

1 × $13.00

Evolve MasterClass with Irek Piekarski

1 × $13.00 -

×

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00

Algo Trading Masterclass with Ali Casey - StatOasis

1 × $23.00 -

×

Elite Gap Trading with Nick Santiago - InTheMoneyStocks

1 × $93.00

Elite Gap Trading with Nick Santiago - InTheMoneyStocks

1 × $93.00 -

×

Chart Pattern Profits

1 × $6.00

Chart Pattern Profits

1 × $6.00 -

×

Survive and Thrive in Extreme Volatility Class with Don Kaufman

1 × $6.00

Survive and Thrive in Extreme Volatility Class with Don Kaufman

1 × $6.00 -

×

Beat the Market with Edward O.Thorp

1 × $6.00

Beat the Market with Edward O.Thorp

1 × $6.00 -

×

The Amazing Common Sense Guide To Investment Success with John Thomchick

1 × $6.00

The Amazing Common Sense Guide To Investment Success with John Thomchick

1 × $6.00 -

×

30 Trading Classics with 3T Live

1 × $5.00

30 Trading Classics with 3T Live

1 × $5.00 -

×

Inside Strategies for Profiting with Options with Max Ansbacher

1 × $6.00

Inside Strategies for Profiting with Options with Max Ansbacher

1 × $6.00 -

×

Behavior and Performance of Investment Newsletter Analysts (Article) with Alok Kumar

1 × $6.00

Behavior and Performance of Investment Newsletter Analysts (Article) with Alok Kumar

1 × $6.00 -

×

How I Trade the QQQs with Don Miller

1 × $6.00

How I Trade the QQQs with Don Miller

1 × $6.00 -

×

Technical Analysis By JC Parets - Investopedia Academy

1 × $15.00

Technical Analysis By JC Parets - Investopedia Academy

1 × $15.00 -

×

Short Swing Trading v6.0 with David Smith

1 × $6.00

Short Swing Trading v6.0 with David Smith

1 × $6.00 -

×

How to Call the Top in a Stock (To the Penny!) and Earn 9-11% Annualized Cash Yields Doing It with Dan Ferris

1 × $6.00

How to Call the Top in a Stock (To the Penny!) and Earn 9-11% Annualized Cash Yields Doing It with Dan Ferris

1 × $6.00 -

×

The Adventures of the Cycle Hunter. The Cyclist with Craig Bttlc

1 × $6.00

The Adventures of the Cycle Hunter. The Cyclist with Craig Bttlc

1 × $6.00 -

×

Zero to Hero Course with EVO Capital

1 × $13.00

Zero to Hero Course with EVO Capital

1 × $13.00 -

×

Royal Exchange Forex with Jan Teslar

1 × $6.00

Royal Exchange Forex with Jan Teslar

1 × $6.00 -

×

Best of AM Review (Volume 1-3) with Peter Bain

1 × $6.00

Best of AM Review (Volume 1-3) with Peter Bain

1 × $6.00 -

×

The Precision Profit Float Indicator (TS Code & Setups) with Steve Woods

1 × $6.00

The Precision Profit Float Indicator (TS Code & Setups) with Steve Woods

1 × $6.00 -

×

Quantitative Trading Strategies (1st Edition) with Lars Kestner

1 × $6.00

Quantitative Trading Strategies (1st Edition) with Lars Kestner

1 × $6.00 -

×

THE BUNDLE (MAIN COURSE) with Daniel Savage - Forex Savages

1 × $6.00

THE BUNDLE (MAIN COURSE) with Daniel Savage - Forex Savages

1 × $6.00 -

×

Increase Your Net Worth In 2 Hours A Week with Jerremy Newsome - Real Life Trading

1 × $17.00

Increase Your Net Worth In 2 Hours A Week with Jerremy Newsome - Real Life Trading

1 × $17.00 -

×

Flipping Cash Rockstar with Lucas Adamski

1 × $6.00

Flipping Cash Rockstar with Lucas Adamski

1 × $6.00 -

×

Simpler Options - Ultimate Guide to Debit Spreads – Nov 2014

1 × $6.00

Simpler Options - Ultimate Guide to Debit Spreads – Nov 2014

1 × $6.00 -

×

Starter Guide to Investing Stocks, Crypto & Precious Metals with Ryan Hogue

1 × $5.00

Starter Guide to Investing Stocks, Crypto & Precious Metals with Ryan Hogue

1 × $5.00 -

×

Advanced Trading Techniques 2 CDs with Sammy Chua

1 × $6.00

Advanced Trading Techniques 2 CDs with Sammy Chua

1 × $6.00 -

×

Complete Times Course with Afshin Taghechian

1 × $6.00

Complete Times Course with Afshin Taghechian

1 × $6.00 -

×

Order flow self-study training program with iMFtracker

1 × $10.00

Order flow self-study training program with iMFtracker

1 × $10.00 -

×

System Building Masterclass

1 × $31.00

System Building Masterclass

1 × $31.00 -

×

D.A.T.E. Unlock Your Trading DNA Worskshop with Geoff Bysshe

1 × $6.00

D.A.T.E. Unlock Your Trading DNA Worskshop with Geoff Bysshe

1 × $6.00 -

×

Essentials Course & Day Trading Strategies with Bear Bull Traders

1 × $13.00

Essentials Course & Day Trading Strategies with Bear Bull Traders

1 × $13.00 -

×

Masterclass 2.0 with Dave Teaches

1 × $31.00

Masterclass 2.0 with Dave Teaches

1 × $31.00 -

×

Forex Retracement Theory with CopperChips

1 × $6.00

Forex Retracement Theory with CopperChips

1 × $6.00 -

×

David Weis Stock Market Update Nightly Report 2014-2019

1 × $20.00

David Weis Stock Market Update Nightly Report 2014-2019

1 × $20.00 -

×

How to Trade Diagonal Triangles. Superior Risk Reward Trade Setups

1 × $6.00

How to Trade Diagonal Triangles. Superior Risk Reward Trade Setups

1 × $6.00 -

×

PRO COURSE Order Flow Strategy with Gova Trading Academy

1 × $5.00

PRO COURSE Order Flow Strategy with Gova Trading Academy

1 × $5.00 -

×

Floor Trader Tools 8.2 with Roy Kelly

1 × $6.00

Floor Trader Tools 8.2 with Roy Kelly

1 × $6.00 -

×

Trading 3SMA System with Hector DeVille

1 × $6.00

Trading 3SMA System with Hector DeVille

1 × $6.00 -

×

A Complete Course in Option Trading Fundamentals with Joseph Frey

1 × $6.00

A Complete Course in Option Trading Fundamentals with Joseph Frey

1 × $6.00 -

×

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

White Phoenix’s The Smart (Money) Approach to Trading with Jayson Casper

1 × $39.00

Opening Range Breakout Indicator for ThinkorSwim

$6.00

File Size: Coming soon!

Delivery Time: 1–12 hours

Media Type: Online Course

You may check content of “Opening Range Breakout Indicator for ThinkorSwim” below:

In the world of trading, the Opening Range Breakout (ORB) indicator is a powerful tool that can help you identify potential trading opportunities right at the start of the trading day. This article will explore how to use the ORB indicator on the ThinkorSwim platform, providing you with a step-by-step guide to enhance your trading strategy. Let’s get started!

What is the Opening Range Breakout Indicator?

The Opening Range Breakout indicator identifies the high and low prices during the initial minutes of the trading session. Traders use these levels to predict price movements for the rest of the day.

Why Use the ORB Indicator?

- Early Trading Opportunities: Captures the early momentum of the trading day.

- Clear Entry and Exit Points: Provides specific levels to enter or exit trades.

- Versatility: Applicable to various markets and timeframes.

Setting Up the ORB Indicator on ThinkorSwim

Step 1: Open ThinkorSwim

First, open the ThinkorSwim platform and log into your account.

Step 2: Access the Chart

Navigate to the ‘Charts’ tab to start setting up the ORB indicator.

Step 3: Add the ORB Study

- Click on the ‘Studies’ button at the top of the chart.

- Select ‘Edit Studies’ from the dropdown menu.

- In the ‘Edit Studies’ window, type “Opening Range Breakout” in the search bar.

- Select the ORB study and click ‘Add Selected’ to add it to your chart.

Step 4: Configure the ORB Settings

You can customize the ORB settings based on your trading preferences. Common settings include:

- Time Frame: Set the time frame for the opening range (e.g., first 15 minutes).

- Colors: Choose colors for the high and low lines for better visibility.

Using the ORB Indicator in Your Trading Strategy

Identifying Breakouts

The primary use of the ORB indicator is to identify breakouts. Here’s how you can use it:

Bullish Breakout

- Entry Point: When the price breaks above the opening range high.

- Exit Point: Set a profit target or use a trailing stop-loss to protect gains.

Bearish Breakout

- Entry Point: When the price breaks below the opening range low.

- Exit Point: Similar to bullish breakouts, set a profit target or use a trailing stop-loss.

Combining ORB with Other Indicators

For better accuracy, combine the ORB indicator with other technical indicators:

- Moving Averages: Confirm the trend direction.

- Relative Strength Index (RSI): Identify overbought or oversold conditions.

- Volume: Ensure there is sufficient trading volume to support the breakout.

Backtesting the ORB Strategy

Before implementing the ORB strategy with real money, it’s crucial to backtest it. ThinkorSwim provides tools for backtesting:

- Access OnDemand: Use the OnDemand feature to simulate past trading days.

- Apply the ORB Indicator: Set up the ORB indicator and test different settings.

- Analyze Results: Evaluate the performance of your strategy over various market conditions.

Common Mistakes to Avoid

Ignoring Market Conditions

Market conditions can affect the effectiveness of the ORB strategy. Be mindful of:

- Market News: Significant news events can lead to unpredictable price movements.

- Market Trends: Ensure the overall market trend supports your trade direction.

Overtrading

Opening Range Breakout strategies can generate multiple signals in a day. Avoid overtrading by sticking to your trading plan and only taking high-probability trades.

Enhancing Your ORB Strategy

Using Multiple Time Frames

Analyze multiple time frames to get a broader perspective. For example, use a daily chart to understand the long-term trend and a 5-minute chart for precise entries.

Adjusting to Market Volatility

During volatile market conditions, adjust the ORB settings:

- Wider Ranges: Use a longer opening range period to account for higher volatility.

- Tighter Stops: Use tighter stop-losses to manage risk better.

Practical Tips for Using ORB on ThinkorSwim

- Set Alerts: Configure alerts in ThinkorSwim to notify you when the price breaks the opening range high or low.

- Review Trades: Keep a trading journal to review your ORB trades and identify areas for improvement.

- Stay Disciplined: Stick to your trading plan and avoid emotional trading decisions.

Conclusion

The Opening Range Breakout indicator is a valuable tool for traders looking to capitalize on early market movements. By setting it up on ThinkorSwim and integrating it into a well-thought-out trading strategy, you can enhance your trading performance. Remember to backtest your strategy, stay disciplined, and continuously refine your approach based on market conditions.

Frequently Asked Questions:

- Business Model Innovation:

Embrace our legitimate business model! We organize group buys, allowing participants to share costs for popular courses, making them accessible to those with limited financial resources. Our approach ensures affordability and accessibility, despite author concerns. - The Legal Environment:

The legality of our activity is uncertain. While we lack specific permission from course authors, there’s a technicality: authors didn’t impose resale limits upon course purchase. This presents both an opportunity for us and a benefit for individuals seeking low-cost access. - Quality Control:

Unveiling the Truth

Quality is paramount. Purchasing courses directly from sales pages ensures consistency with traditionally obtained materials. However, we’re not official course providers and don’t offer premium services:

- No scheduled coaching calls or sessions with the author.

- No access to the author’s private Facebook group or web portal.

- No entry to the author’s private membership forum.

- Direct email support from the author or their team is unavailable. Operating independently, we aim to bridge the pricing gap without additional services provided by official channels. Your understanding of our unique approach is valued.

Be the first to review “Opening Range Breakout Indicator for ThinkorSwim” Cancel reply

You must be logged in to post a review.

Related products

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Forex Trading

Reviews

There are no reviews yet.